- Ethereum has dropped to $1,758, marking its third straight week in decline and its lowest degree since October 2023.

- Spot Ethereum ETFs have misplaced over $513 million in outflows, whereas TRON and layer-2 networks are taking market share from ETH.

- Technical indicators sign extra draw back, with Ethereum probably falling to $1,500 and even $1,000 if promoting strain continues.

Ethereum’s worth has been caught within the pink for 3 consecutive weeks, sliding to $1,758, its lowest degree since October 2023. With over 55% misplaced since its November peak, traders are stepping again, leaving ETH in a weak place.

Why Is Ethereum Falling?

Ethereum’s decline isn’t random—it’s a mix of things weighing it down:

- Spot Ethereum ETFs are bleeding, with outflows exceeding $513 million within the final three weeks, signaling weak Wall Road demand.

- Ethereum is shedding market dominance in key sectors like stablecoin transfers and decentralized exchanges. TRON now leads Tether transactions, whereas layer-2 options like Arbitrum and Base are consuming into its market share.

- ETH’s profitability has taken successful, with simply $210 million in income this yr, lagging behind Uniswap, Solana, Circle, Jito, TRON, and Tether—a stark distinction to its once-dominant place.

On-chain knowledge isn’t wanting nice both. Santiment experiences that each day lively Ethereum addresses have plummeted, dropping from 717,000 earlier this yr to only 293,000 on March 12. Social quantity has additionally declined, reflecting waning retail curiosity.

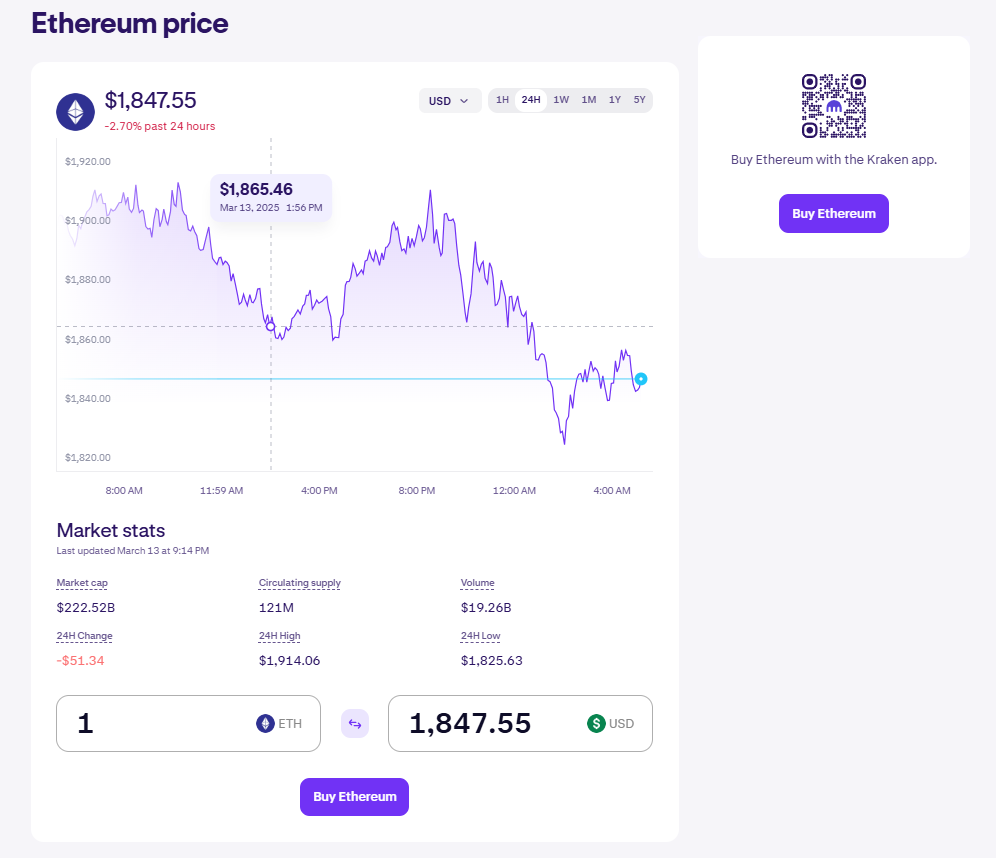

kraken.com

Technical Evaluation: Extra Draw back Forward?

Ethereum’s weekly chart paints a bleak image:

- ETH broke beneath the $2,135 assist degree, confirming a triple-top sample.

- The 50-week shifting common was breached, signaling a robust bearish pattern.

- The Relative Power Index (RSI) is at 33, displaying there’s nonetheless room for extra draw back.

- The Superior Oscillator is beneath zero, including to the bearish momentum.

If the present trajectory holds, ETH might goal $1,500 subsequent, with a possible 45% plunge to $1,000 if promoting strain accelerates. A transfer above $2,500 would invalidate this bearish outlook, however for now, the trail stays downward.