After hitting a peak of $2.99 on February 27, Pi Community is down almost 40% previously two weeks. Technical indicators recommend that PI momentum is stabilizing.

The DMI reveals that purchasing strain has surged previously two days, however the ADX has declined, signaling that the power of the pattern could also be weakening. In the meantime, RSI has spiked from oversold ranges, approaching overbought territory, which might both result in consolidation or a continuation towards key resistance ranges.

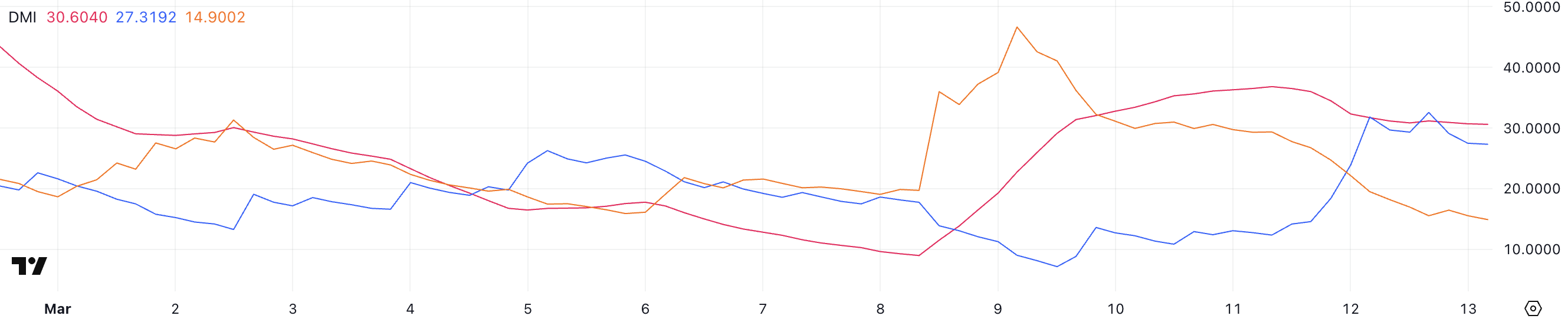

PI Community DMI Reveals Uptrend Is Nonetheless Right here

PI’s DMI chart signifies that the Common Directional Index (ADX) has declined to 30.6 from 36.5 over the previous two days. ADX measures pattern power, with values above 25 usually indicating a powerful pattern, whereas values beneath 20 recommend a weak or consolidating market.

A rising ADX alerts strengthening momentum, whereas a declining ADX suggests a weakening pattern, even when worth motion continues in the identical course.

The present drop in ADX means that whereas PI stays in an uptrend, the momentum behind this motion is softening.

Trying on the Directional Indicators (+DI and -DI), +DI has surged to 27.3 from 12.3 two days in the past however has remained secure since yesterday, whereas -DI has sharply dropped to 14.9 from 29.3. This shift signifies that purchasing strain has considerably elevated over the previous two days, overwhelming prior promoting strain.

Nevertheless, with +DI now secure and ADX declining, the robust shopping for momentum seen earlier could also be fading. This doesn’t essentially imply an instantaneous reversal, nevertheless it suggests the uptrend might gradual or enter a consolidation section until renewed shopping for power pushes the ADX again up.

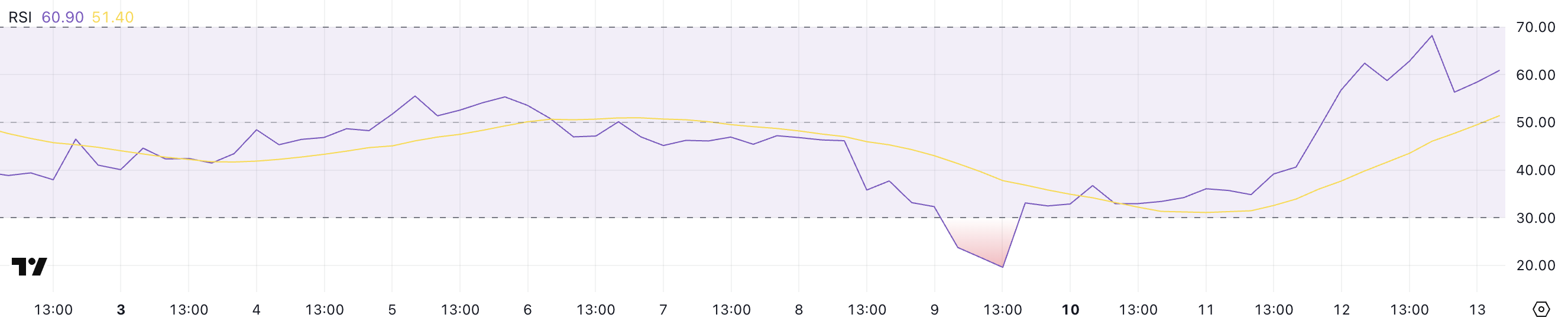

Pi Community RSI Surged In The Final Two Days

PI’s Relative Energy Index (RSI) has climbed sharply to 60.90, up from 34.8 yesterday and 19.5 4 days in the past. RSI is a momentum oscillator that measures the velocity and magnitude of worth actions on a scale from 0 to 100.

Typically, RSI values above 70 point out overbought situations, suggesting potential for a pullback, whereas values beneath 30 sign oversold situations, usually previous a worth restoration.

The speedy rise from deeply oversold ranges to close 61 suggests a powerful shift in momentum, with consumers regaining management.

With PI’s RSI touching 68 earlier and now sitting at 60.90, it’s approaching overbought territory however has not but crossed the vital 70 threshold.

The truth that PI hasn’t surpassed 70 since February 27 means that this stage has traditionally acted as a barrier, doubtlessly triggering profit-taking or a short lived slowdown.

If RSI stabilizes close to its present stage, PI might consolidate earlier than making one other push increased. Nevertheless, if it surges previous 70, it will sign excessive bullish momentum, although that additionally will increase the probability of a short-term correction.

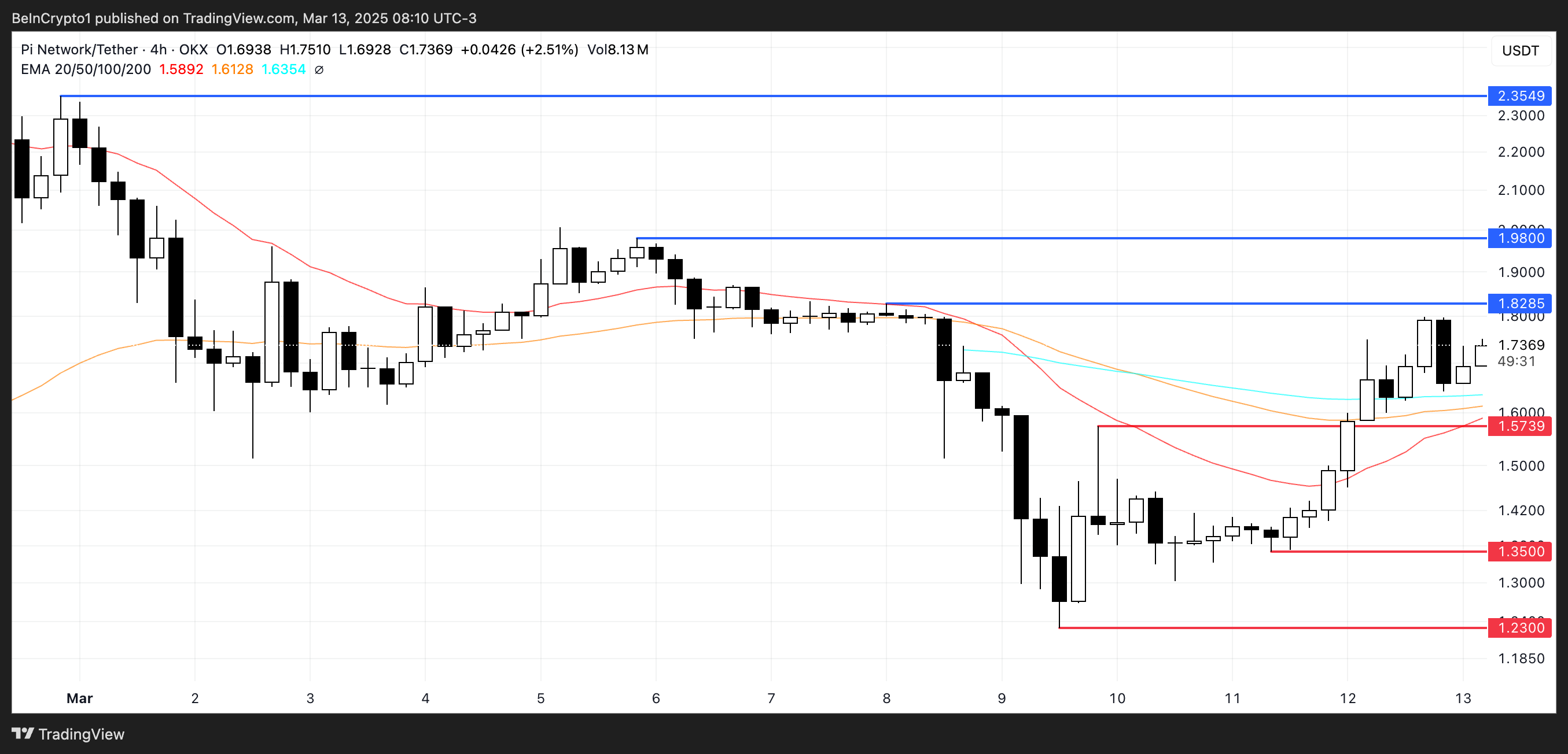

PI Can Reclaim $2.35 Ranges Quickly

PI worth is at the moment buying and selling inside a key vary, going through resistance at $1.82 whereas holding help at $1.57. If the present uptrend persists and consumers handle to push previous $1.82, the following goal could be $1.98.

A break above this stage might open the door for a stronger rally, particularly if PI regains the optimistic momentum seen final month. In that situation, the worth might prolong its climb towards $2.35, reinforcing a extra bullish outlook.

Nevertheless, clearing these ranges would require sustained shopping for strain and a breakout affirmation above $1.82.

On the draw back, if PI’s pattern reverses, it might retest its instant help at $1.57.

Shedding this stage would weaken the bullish construction and expose the worth to additional declines, doubtlessly testing $1.35. If promoting strain intensifies, PI might drop even additional to $1.23, marking a deeper correction.

The power of the help at $1.57 can be essential in figuring out whether or not the present uptrend holds or if PI enters a extra prolonged pullback section.

Disclaimer

In step with the Belief Mission pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.