- XRP’s totally diluted valuation (FDV) has surpassed Ethereum’s, hitting $235 billion, as its DeFi ecosystem beneficial properties traction.

- XRP surged over 300% since Trump’s re-election, fueled by pro-crypto insurance policies and its inclusion within the proposed U.S. Digital Asset Stockpile.

- Ethereum struggles towards rising competitors from Solana, regardless of its Dencun improve slashing transaction charges by 95%.

One thing sudden simply occurred within the crypto world—XRP‘s totally diluted valuation (FDV) has overtaken Ethereum’s. Yep, you learn that proper. In accordance with CoinGecko information from March 14, XRP’s FDV now sits at almost $235 billion, edging previous Ether’s by over $1 billion.

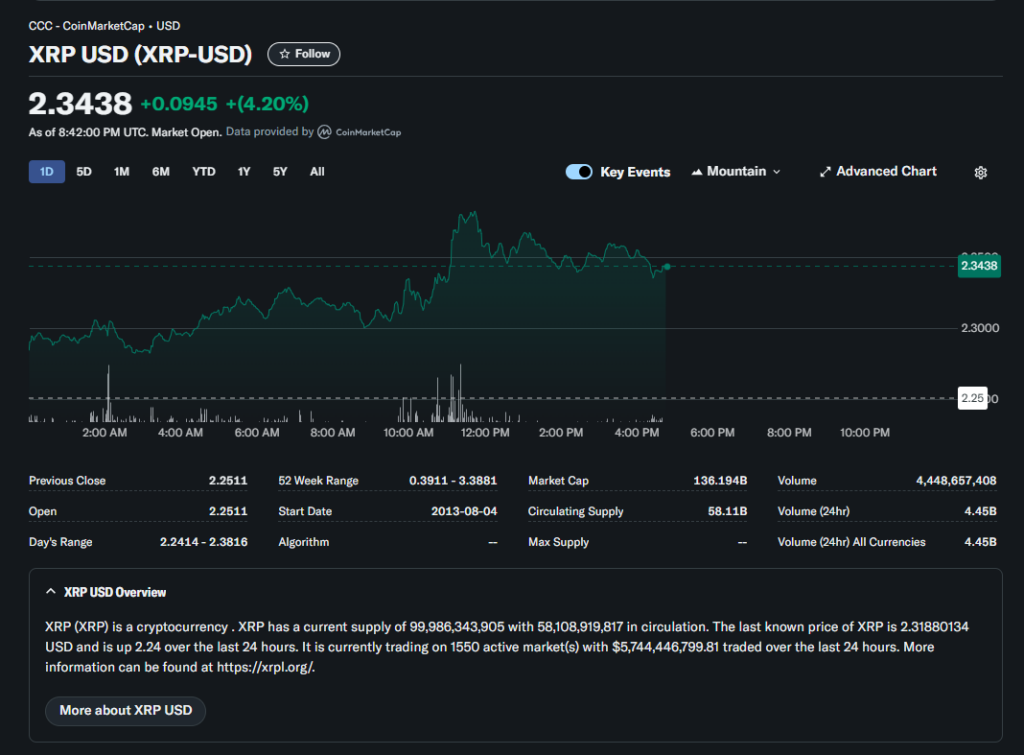

It’s a significant flip in fortunes. XRP Ledger’s DeFi ecosystem has been quietly gaining steam, whereas Ethereum faces rising competitors from rivals like Solana. Even so, Ethereum nonetheless leads in market cap, sitting at $233 billion, in comparison with XRP’s $136 billion.

Why This Issues

FDV measures the full worth of all tokens—circulating or locked. Market cap, however, solely counts what’s actively buying and selling. One huge cause for XRP’s hovering FDV? Ripple Labs nonetheless holds an enormous allocation of XRP, giving the token a deep reservoir of potential liquidity.

The Trump Impact & XRP’s 300% Surge

XRP has been on a wild experience since November 5, the day Donald Trump secured his re-election. Since then, the token has skyrocketed over 300%, hitting $2.30 per XRP.

Why? Effectively, Trump has made it clear he needs the U.S. to be the “world’s crypto capital”—and he’s been appointing crypto-friendly regulators to key positions. That’s been a game-changer, particularly for XRP, which focuses on enterprise adoption.

In February, Ripple unveiled a DeFi roadmap geared toward institutional buyers. In the meantime, its decentralized trade (DEX) has already dealt with over $1 billion in swaps since launching final 12 months.

After which there’s the U.S. Digital Asset Stockpile—a proposed crypto reserve that Trump says will embrace XRP, Solana, and Cardano. In contrast to conventional reserves, this one will solely include property seized from authorized actions—which means no taxpayer {dollars} shall be used to purchase crypto.

finance.yahoo.com

Ethereum Dropping Floor?

Ethereum, however, has been struggling. The Dencun improve, which slashed transaction charges by 95%, was imagined to be an enormous win. However as an alternative, Ethereum has confronted stiff competitors from Solana, whose lightning-fast transactions and memecoin explosion in 2024 helped it seize an enormous share of buying and selling quantity—rivaling Ethereum and its total layer-2 community mixed.

And within the background? The SEC is reportedly winding down its case towards Ripple, simply months after dropping authorized actions towards Coinbase, Kraken, and Uniswap.

XRP’s momentum isn’t slowing down anytime quickly. Is Ethereum in hassle? Perhaps. However one factor’s clear—the crypto panorama is shifting quick.