Senior Bloomberg analyst Mike McGlone is warning traders that Bitcoin (BTC) might crater practically 90% from its present worth because of the circumstances of the gold and inventory markets.

In a brand new thread on the social media platform X, McGlone tells his 66,900 followers that the highest crypto asset by market cap might free fall to simply $10,000 as merchants begin to closely favor gold over it.

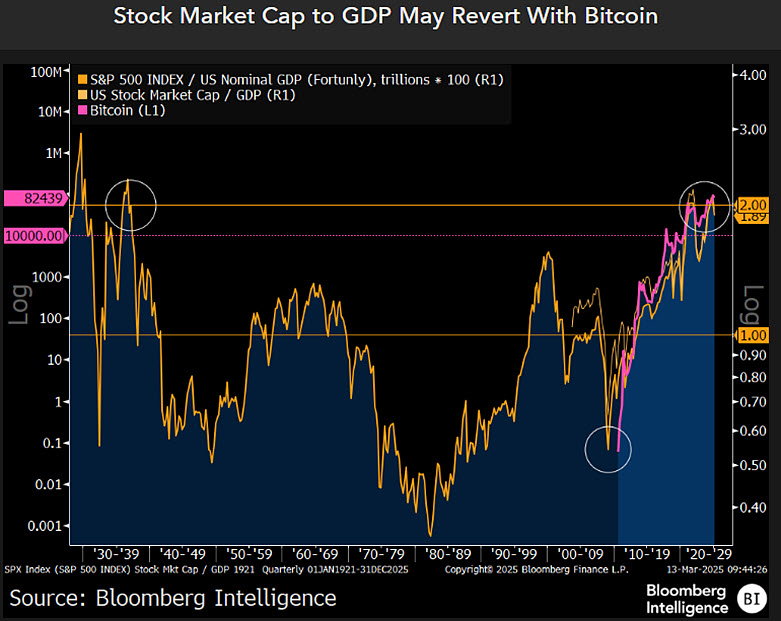

“$100,000 Bitcoin may lose a zero, favoring gold – Bitcoin was born about when the inventory market bottomed in 2009 and has been a pacesetter of one of many biggest risk-asset rallies in historical past, which can recommend what issues.”

In line with McGlone, there’s at present nothing stopping BTC’s downward trajectory, as gold has outperformed the flagship digital asset to date in 2025.

“Bitcoin Again to $10,000? Peak leveraged beta dangers, rising gold. Gold is up about the identical quantity in 2025 to March 13 – about 15% – that Bitcoin is down. However with Bitcoin at about $80,000, what stops these trajectories? A few 6% decline within the S&P 500 might recommend what issues.

The most important exchange-traded fund (ETF) launch in historical past, President Donald Trump’s shift to extremely unstable and speculative cryptos, and reelection might show peak-bubble akin to about 25 years in the past.”

Bitcoin is buying and selling for $84,899 at time of writing, a fractional improve on the day. A drop to McGlone’s degree would symbolize about an 88% drop for the crypto king.

The analyst goes on to notice that traders’ shifting their urge for food from BTC to gold is clear when ETF knowledge.

“Bitcoin/Gold cross could have peaked, with implications – after 4 years of outflows, gold ETFs have turned decisively to inflows in 2025, which can sign a shift in danger appetites.”

Comply with us on X, Fb and Telegram

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Verify Value Motion

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl aren’t funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual danger, and any losses it’s possible you’ll incur are your duty. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please notice that The Every day Hodl participates in internet affiliate marketing.

Featured Picture: Shutterstock/Jorm S