Bitcoin (BTC) continues to expertise large promoting stress as international commerce warfare fears and macroeconomic uncertainty gasoline market-wide worry. The worth is holding above the crucial $80K stage however stays caught under $85K, failing to ascertain a transparent short-term course. With traders hesitant to take main positions, BTC is in a fragile state, the place each bulls and bears are ready for the subsequent main transfer.

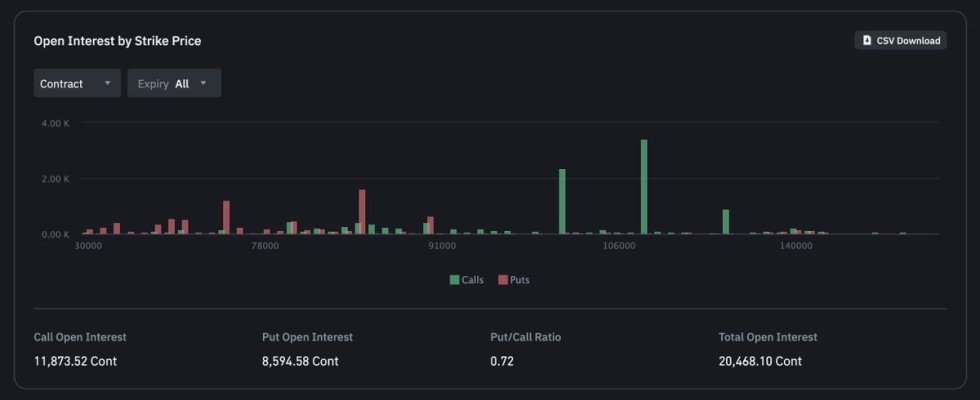

Regardless of the present uncertainty, key market metrics reveal a reasonably bullish sentiment within the Bitcoin choices market. In keeping with latest information, there’s a better focus of contracts and buying and selling volumes in name choices, indicating that some merchants are positioning for potential upside.

The subsequent few buying and selling periods will probably be essential, as Bitcoin should both reclaim key resistance ranges to verify a restoration or threat additional draw back stress if sellers proceed to dominate. With the choices market hinting at potential upside, BTC’s worth motion stays unsure, however merchants are carefully monitoring key help and resistance zones.

Bitcoin Market Indicators Recommend A Potential Rebound

Bitcoin has dropped practically 20% for the reason that begin of the month, with bears sustaining management and pushing costs decrease. The general pattern stays bearish, and except bulls step in to reclaim key ranges, the downtrend may proceed. Nevertheless, some analysts imagine that BTC may very well be gearing up for an enormous restoration as soon as it stabilizes above $80K and reclaims the $90K mark.

Regardless of short-term weak spot, Bitcoin’s long-term fundamentals stay sturdy. Institutional adoption continues to develop, and US President Donald Trump’s plan to ascertain a Strategic Bitcoin Reserve may function a serious catalyst for future worth actions. If demand will increase and confidence returns, BTC may even see a big push towards new highs.

High analyst Axel Adler shared insights on X within the derivatives market, revealing that the Bitcoin choices market at present reveals a reasonably bullish sentiment. There’s a better focus of contracts and buying and selling volumes in name choices, suggesting that some merchants are betting on a possible rebound. Nevertheless, giant put possibility positions within the $75,000–$85,000 vary point out that traders are additionally hedging towards additional draw back dangers.

This hedging exercise alerts uncertainty and the potential for top volatility, making BTC’s subsequent transfer extremely unpredictable. The approaching weeks will probably be essential, as Bitcoin should both reclaim larger ranges to verify a restoration or threat additional declines if promoting stress continues. Merchants are carefully monitoring worth motion, ready for a decisive breakout in both course.

Bulls Struggle To Reclaim Key Ranges

Bitcoin is at present buying and selling at $84,000, making an attempt to carry above the 200-day transferring common (MA) round this stage. Bulls must regain momentum shortly and push BTC above the 200-day exponential transferring common (EMA) at $85,500 to ascertain a basis for a possible restoration.

Nevertheless, market sentiment stays unsure, and bears are protecting stress on BTC. If bulls fail to reclaim the $85K stage, Bitcoin may face renewed promoting stress, resulting in a possible drop under the crucial $80K mark. This may additional prolong the present downtrend, rising the chance of deeper corrections.

For BTC to verify a restoration, it should break previous the $90K mark, a key psychological and technical resistance. Reclaiming this stage would sign renewed purchaser confidence and will set the stage for a stronger rally. Nevertheless, failure to carry present help may result in elevated volatility and additional draw back dangers.

With Bitcoin hovering at essential ranges, the subsequent few buying and selling periods will probably be crucial in figuring out whether or not BTC can stabilize and regain misplaced floor or if the downtrend will proceed towards decrease help zones.

Featured picture from DALL-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.