|

Rumored Shenzhen celeb memecoin manufacturing facility

A mysterious memecoin manufacturing facility in Shenzhen is rumored to be behind a wave of memecoin scams, allegedly launching over a dozen tokens a month. Brazilian soccer legend Ronaldinho Gaúcho has been swept into the controversy on Chinese language social media.

On March 3, Ronaldinho introduced the launch of his personal memecoin on BNB Chain. Inside hours, it skyrocketed to a peak market cap of $30 million, solely to come back crashing all the way down to round $3.7 million, in response to CoinGecko knowledge.

A now-banned X consumer, @R10coin_, claimed to have struck a $6 million cope with Ronaldinho to advertise their token, paying him $3 million upfront. Nevertheless, the X consumer then claimed Ronaldinho had allegedly signed one other token deal and that the footballer’s X account had been bought to a Shenzhen-based agency.

The unnamed Shenzhen agency is rumored to function like a full-scale rip-off operation, aggressively advertising and marketing celebrity-backed tokens to lure traders, pumping the worth, after which cashing out earlier than disappearing. These unverified accusations, whereas speculative, have ignited discussions throughout Chinese language crypto communities concerning the presence of organized memecoin factories designed solely to rug unsuspecting traders.

A authorized professional from Man Kun Regulation Agency weighed in on the matter by means of a WeChat put up on March 4. The lawyer said that if such “token factories” actually exist, they’d represent outright fraud and a textbook instance of a rug pull. In accordance with the lawyer, the advertising and marketing relies fully on deception — utilizing well-known names to create hype, taking part in into folks’s fantasies of in a single day wealth, and in the end profiting off synthetic value manipulation fairly than creating a real blockchain mission.

Regardless of all these allegations, the mission itself has not been deserted, although its worth has largely evaporated. On March 6, the Ronaldinho memecoin staff introduced that the token could be increasing to the Solana blockchain, doubling down on its future plans fairly than distancing itself from the token. In the meantime, the X account that raised accusations in opposition to Ronaldinho and the supposed Shenzhen manufacturing facility, @R10coin_, has been banned from the platform for violating website insurance policies.

Not all HK-listed Bitcoin patrons are hodling

One other Hong Kong-listed firm has been shopping for Bitcoin — however don’t get too excited. Yuxing Infotech Funding Holdings (HKEX: 8005) quietly collected hundreds of thousands in BTC within the second half of 2024, solely to start promoting simply months later.

In accordance with disclosures filed with the Hong Kong Inventory Trade, Yuxing bought 78.2 Bitcoin between July 25, 2024, and Dec. 31, 2024, at a median value of $80,960 per BTC, amounting to a complete of $6.3 million. However by early 2025, the agency had already began lowering its holdings. Between Jan. 22 and March 5, Yuxing bought 50 BTC at a median value of $89,194 per coin, producing $4.5 million. The corporate additionally offloaded 3.3 million USDT for $3.3 million.

Yuxing has not outlined a long-term technique concerning Bitcoin. Whereas the agency allotted capital into BTC in 2024, it opted to cut back its holdings inside months, suggesting it might view Bitcoin as a short-term funding fairly than a treasury asset. The gross sales at $89,194 per BTC point out Yuxing could have turned a revenue, although the corporate didn’t present particulars.

Yuxing is just not an outlier amongst Asian corporations. In December 2024, Chinese language selfie app Meitu liquidated its total Bitcoin and Ethereum holdings, securing roughly $80 million in earnings after three years of accumulation.

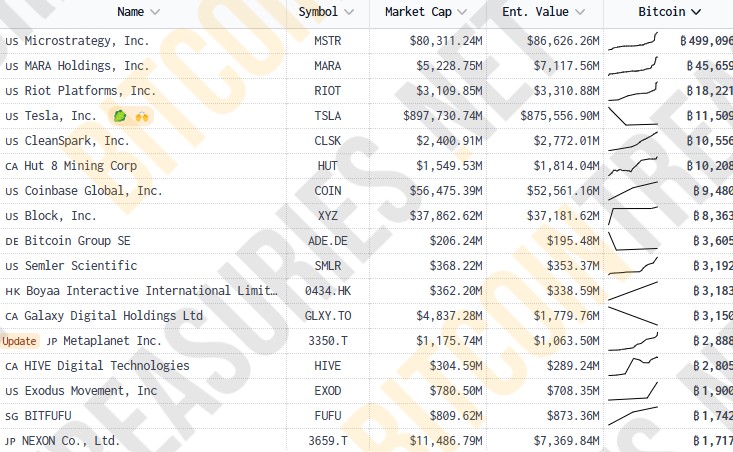

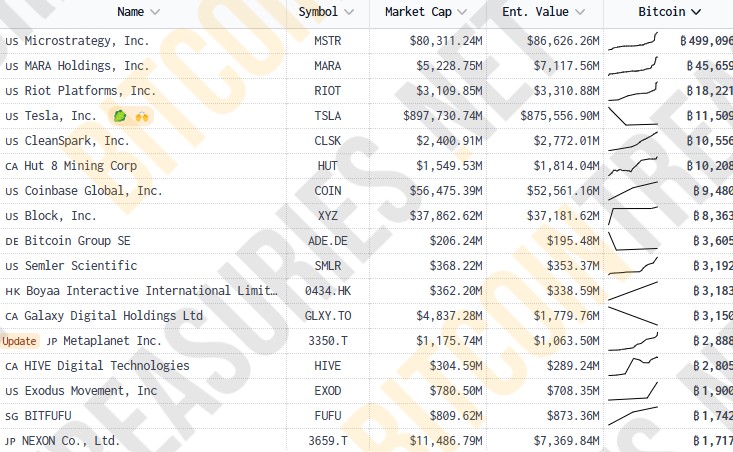

Meitu was as soon as known as the “MicroStrategy of Asia”, being one of many first corporations to undertake the aggressive Bitcoin accumulation technique popularized by Technique and its CEO Michael Saylor. That title has since shifted to Japanese funding agency Metaplanet, which is now closing in on Hong Kong-listed Boyaa Interactive, Asia’s largest public Bitcoin holder with 3,183 BTC.

On March 5, 2025, Metaplanet elevated its holdings to 2,888 BTC after buying one other 497 Bitcoin.

Learn additionally

Options

What do crypto market makers truly do? Liquidity, or manipulation

Options

Earlier than NFTs: Surging curiosity in pre-CryptoPunk collectibles

Telegram in crosshairs in Singapore as crypto and AI crimes surge

Singapore is elevating considerations over Telegram’s position in scams, with Minister of State for Dwelling Affairs Solar Xueling warning that the messaging platform’s emphasis on consumer anonymity has made it engaging to scams and different felony actions. Authorities are monitoring the platform carefully after the variety of scams linked to Telegram practically doubled in 2024.

“One platform we’re particularly involved about is Telegram, which has lengthy prioritized and even prided itself in, the anonymity that it offers its customers. This anonymity is exploited by scammers and different criminals,” Solar mentioned in a speech on March 4.

Rip-off ways are additionally evolving. With tighter safety measures in place for banking transactions, fraudsters have more and more shifted to cryptocurrency, the place funds are tougher to trace and recuperate. Crypto-related scams accounted for practically 1 / 4 of all rip-off losses in Singapore in 2024, up from lower than 10% the earlier yr. The only largest rip-off of the yr — totaling $125 million — was a malware-enabled assault on a sufferer’s cryptocurrency pockets. Whereas Singapore has licensed some digital cost token service suppliers, Solar famous that many international crypto exchanges and pockets suppliers stay unregulated and past the attain of native legislation enforcement.

Authorities are additionally warning concerning the rise of AI-driven scams, which have made fraud harder to detect.

“Gone are the times once we might simply spot a rip-off name or e mail, by means of heavy international accents or dangerous English. At the moment, scammers use AI and details about us on-line, amongst different capabilities, to make themselves extra plausible and evade straightforward detection,” Solar mentioned.

Scammers now use AI-generated voices and data from social media to create extra convincing deception ways. Singapore has responded by deploying AI-powered rip-off detection instruments, such because the Rip-off Analytics and Tactical Intervention System, to determine and disrupt fraudulent web sites and accounts extra effectively.

The federal government is assessing whether or not additional measures are wanted to handle scams on Telegram. Solar mentioned authorities will discover extra actions and will contemplate “legislative levers” if obligatory. The federal government has already labored with platforms similar to Meta and Carousell, which launched enhanced id verification measures that led to a major drop in e-commerce scams.

Learn additionally

Options

Inside South Korea’s wild plan to dominate the metaverse

Options

Change into a Bali crypto digital nomad like me: Right here’s how

Japan warms as much as stablecoins

SBI VC Commerce is making ready to turn out to be the primary Japanese monetary platform to supply USDC stablecoin transactions, following the completion of an preliminary regulatory registration, as Japan regularly relaxes its stance towards stablecoins.

On March 4, SBI VC Commerce introduced it had accomplished the preliminary part of registration for stablecoin buying and selling, receiving approval from the Kanto Regional Monetary Bureau’s Tokyo workplace. This registration permits SBI VC Commerce to begin providing USDC transactions to pick out customers from March 12, with plans for broader public availability shortly afterward.

The transfer follows Japan’s current easing of stablecoin laws. In 2023, Japan reportedly lifted a ban that had restricted foreign-issued stablecoins. In February 2025, Japan’s Monetary Providers Company (FSA) permitted suggestions by a working group to additional calm down laws round stablecoin use, signaling the federal government’s rising help for stablecoins as instruments for monetary innovation and environment friendly transactions.

SBI VC Commerce, a subsidiary of monetary big SBI Holdings, has a longstanding presence within the crypto market, notably by means of its collaborations with corporations like Ripple.

Subscribe

Essentially the most partaking reads in blockchain. Delivered as soon as a

week.

Yohan Yun

Yohan Yun is a multimedia journalist masking blockchain since 2017. He has contributed to crypto media outlet Forkast as an editor and has lined Asian tech tales as an assistant reporter for Bloomberg BNA and Forbes. He spends his free time cooking, and experimenting with new recipes.