The Bitcoin and crypto markets suffered extreme value downturns at the start of the week, with the premier cryptocurrency falling to a low of $76,500. Curiously, the digital belongings market was not alone within the distress, as the US equities market additionally misplaced a good portion of its worth to kick off the week.

A number of consultants have weighed in on this widespread market downturn triggered by the financial uncertainty, as United States President Donald Trump continues to roll out commerce tariffs at will. Outstanding crypto pundit Burak Kesmeci is among the newest to touch upon this situation, predicting which market will get well first.

BTC And ETH Exhibit Excessive Correlation With US Inventory Market

In a March 15 submit on the X platform, Kesmeci defined why it’s virtually unattainable for Bitcoin and different cryptocurrencies to get well earlier than the US conventional markets. The reasoning behind the skilled’s assertion relies on the excessive correlation between cryptocurrency and the US inventory market.

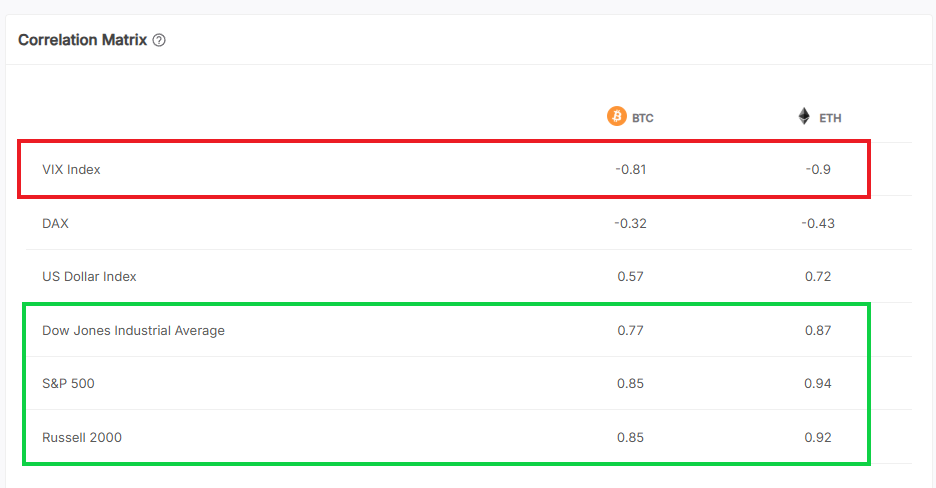

Proving this direct relationship, Kesmeci revealed Bitcoin’s and Ethereum’s correlation with the S&P 500 index (considered the very best gauge of US equities market efficiency) stands at 0.85 and 0.95, respectively. As highlighted within the chart beneath, the 2 largest cryptocurrencies additionally exhibit a excessive correlation with different US inventory market indices, together with the Dow Jones Industrial (DJI) Common and Russell 2000.

Supply: @burak_kesmeci/X

Based on Kesmeci, this development means that buyers view digital belongings, particularly Bitcoin and Ethereum, in an analogous gentle as shares in the US. This explains why the crypto market experiences profound promoting stress at any time when Trump broadcasts new commerce tariffs.

Contrarily, an reverse development might be seen with gold, which has reached a brand new excessive in latest days. Kesmeci famous that the VIX (concern) index is strongly negatively correlated with Bitcoin, which explains why the flagship cryptocurrency is falling as the previous is rising.

Lastly, the analyst revealed that the DJI and S&P 500 indices are beneath the 200-day easy shifting common (used for long-term development monitoring) for the primary time since October 2023. Based on Kesmeci, these US inventory market indices would wish to maneuver above the SMA200 once more earlier than the crypto market would get well.

Bitcoin Value At A Look

As of this writing, the value of Bitcoin stands at round $84,050, reflecting a 0.3% enhance previously 24 hours. Based on information from CoinGecko, the market chief is down by greater than 2% previously week.

The value of BTC hovering round $84,000 on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our group of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.