|

It was after clawing again “six figures” from a decentralized finance (DeFi) rip-off undertaking in 2021 that New York-based lawyer and Navy veteran Max Burwick realized he may tackle crypto’s greatest grifters and win.

“It modified the best way I checked out every thing,” Burwick tells Journal. He’s at present suing Solana-based memecoin manufacturing facility Pump.enjoyable and the creators of the Hawk Tuah (HAWK) token, amongst many others.

“Two issues occurred to me at that second that have been important. One was I understood the twin nature of what folks fake to be in crypto. And I additionally understood the ability that you can have as a lawyer.”

In January, Burwick filed a class-action swimsuit towards Pump.enjoyable — a platform that permits anybody to create their very own memecoin, which was flooding the crypto house with 40,000 additional tokens daily till issues began to tail off following the current Libra (LIBRA) token rip-off.

Nevertheless, the formidable lawsuit has garnered intense backlash on social media, primarily as a result of it makes an attempt to color each memecoin listed by Pump.enjoyable as an unregistered safety.

If that argument is profitable, the case may theoretically spell catastrophe for the $64 billion memecoin market, and in consequence, Burwick has copped large warmth over it. Trolls are making memecoins along with his picture, sending “messages” to his workplace, and lots of extra have accused him of launching a token on the very platform he’s suing.

A current assertion from the Securities and Alternate Fee complicates the case nevertheless. In late February, the company’s Division of Company Finance mentioned that it doesn’t view memecoins as securities and that they’re extra akin to collectibles. Nevertheless, a footnote clarifies that is merely the division’s view and never the SEC’s, and it prompted a dissenting assertion from SEC Commissioner Caroline Crenshaw on the identical day.

Rug pulled? Good

Burwick’s regulation agency solely makes cash if it wins a lawsuit or if it’s in a position to safe an out-of-court settlement, that means it must create a continuing stream of litigation to maintain the engine operating.

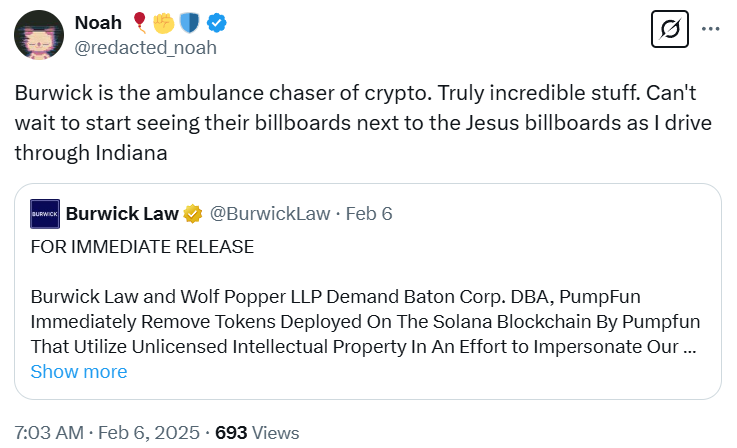

As a consequence of this, Helium Basis head of protocol engineering, Noah Prince and lots of others have slammed Burwick as an “ambulance chaser of crypto” — a time period that references attorneys who attempt to drum up work by persuading somebody who’s been in an accident to assert compensation.

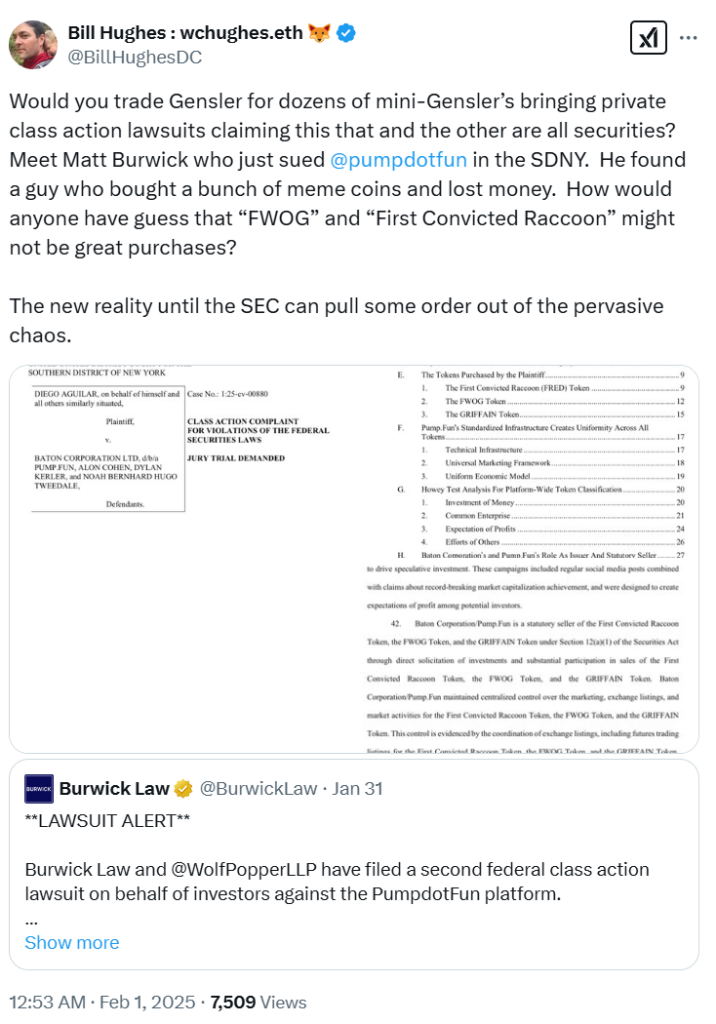

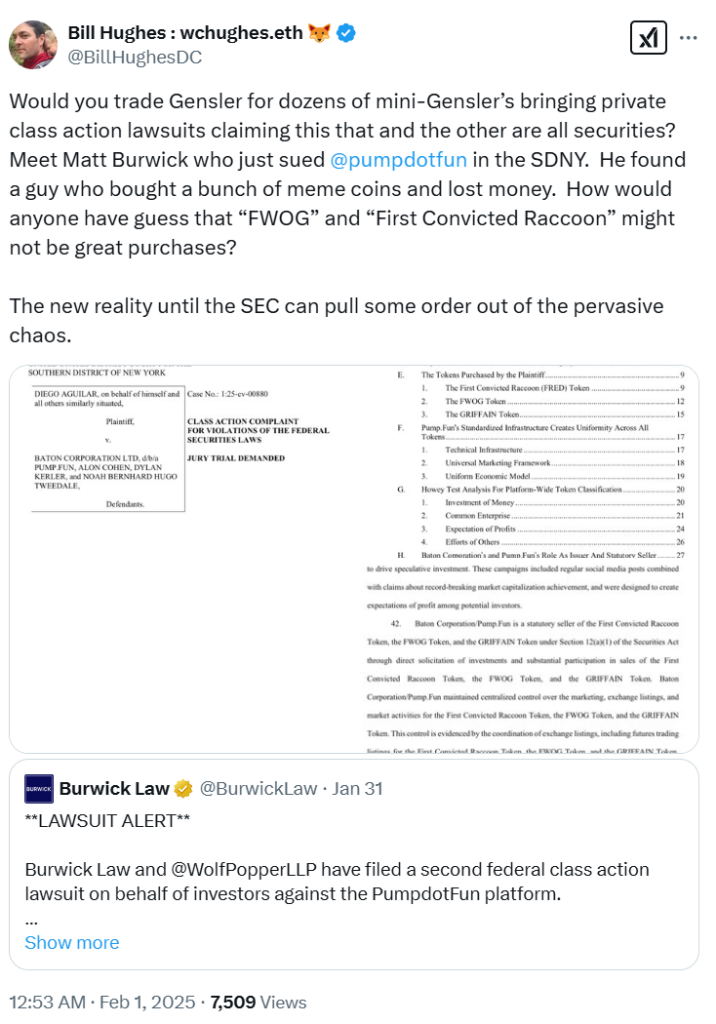

Invoice Hughes, a lawyer at Consensys, requested his followers whether or not they would slightly have SEC Chair Gary Gensler or dozens of “mini-Genslers” (like Burwick) bringing lawsuits claiming “this that and the opposite” are all securities.

Burwick says some have even known as him an “Ivy League swimsuit” chasing {dollars} — and that’s removed from actuality.

“We had felt lots of people had a misunderstanding of who I used to be and actually what the agency was about,” Burwick tells Journal about why he launched a 15-minute video known as “Meet Max Burwick” on X in February.

“I’m a human being. I’m approachable. You understand, this isn’t some far-out lawsuit with some unnamed individual in some metal constructing someplace. That is actuality.”

There was a time when Burwick may barely learn

Burwick says he couldn’t be farther from an “Ivy League swimsuit.” In reality, he barely made it out of highschool.

“I actually struggled studying,” mentioned Burwick, laughing awkwardly. “I used to be so anxious round phrases that I actually didn’t discover ways to learn correctly till I used to be within the Navy.”

Burwick joined the US Navy on the tender age of 18 and says, “I genuinely did educate myself the way to learn.”

5 years later, the 23-year-old Burwick completed up his navy tour as a rescue swimmer and electronics weapons specialist. He labored as a private coach for a CrossFit health club in New York Metropolis and was making an attempt out for a particular navy unit on the identical time.

However these plans have been dashed when Burwick severely injured his again. That’s when he determined to review regulation and took a liking to math and software program engineering.

Now 41, Burwick has been operating his personal observe for round three years.

In current months, he’s focused the creators of Haliey Welch’s Hawk Tuah (HAWK) memecoin, which launched in December to hit a $490 million market cap earlier than dumping 91% inside simply three hours.

He’s trying to characterize traders who’ve misplaced cash on Argentina’s $4 billion lately failed Libra (LIBRA) token, which was “shared” by Argentine President Javier Milei and dropped 85% inside 4 hours of its controversial launch.

Learn additionally

Options

No matter occurred to EOS? Group shoots for unlikely comeback

Options

ZK-rollups are ‘the endgame’ for scaling blockchains: Polygon Miden founder

Burwick advised Journal he was anticipating to file one other 15 to twenty circumstances inside the subsequent two months — however the large query for a lot of is whether or not his Pump.enjoyable lawsuit goes to get anyplace.

Does the Pump.enjoyable case have legs?

In a Jan. 16 X put up, Burwick mentioned that memecoins exemplified on Pump.enjoyable characterize “the last word evolution of multilevel advertising and marketing scams” and are nothing greater than autos for monetary exploitation.

“This isn’t crypto innovation—it’s a repackaged Ponzi scheme.” he wrote on-line, earlier than submitting the lawsuit on Jan. 30.

Gabriel Shapiro, a Silicon Valley-based lawyer and former basic counsel of Delphi Labs, mentioned in a Jan. 17 put up the lawsuit could have legs.

He mentioned that whereas prior to now, memecoins have been assumed to not be lined by US securities legal guidelines, “it’s clear they modified his cycle as professionalized groups/operations fashioned round them and set a part of the market expectations.”

“This doesn’t imply they positively are lined by the securities legal guidelines nevertheless it’s positioned them extra prone to it than was thought-about beforehand.”

Burwick’s class motion alleges that Pump.enjoyable’s core perform is to work alongside influencers to co-issue unregistered securities, claiming the platform has made practically half a billion {dollars} in charges whereas knowingly helping the creation of tokens that exploit hate speech, violence and exploitation to generate consideration and buying and selling quantity.

It’s suing Pump.enjoyable’s founders, the Baton Company, for compensatory damages with the quantity decided at trial.

Shapiro mentioned on X the doc was “thoughtfully drafted,” although he was “unsure how far it’s going to get,” given the “frequent enterprise” prong of the Howey check and the truth that the memecoins undergo an automatic market maker.

One other drawback with Burwick’s lawsuit is the SEC’s Division of Company Finance’s Feb. 27 assertion asserting that it views memecoins as collectibles and thus “don’t contain the supply and sale of securities underneath the federal securities legal guidelines.”

“As such, individuals who take part within the supply and sale of meme cash don’t have to register their transactions with the Fee,” the SEC division mentioned.

This was promptly argued by SEC Commissioner Crenshaw, who mentioned memecoins may fulfill the Howey check’s situation of benefiting from the managerial efforts of others as a result of coordination between developer groups and promoters.

However whereas the lawsuit seems like an assault on all memecoins — Burwick says this isn’t the case in any respect.

“Memecoins are superior. Memecoins aren’t inherently the issue […] There are quite a lot of actually cool issues you can do.”

The issue, Burwick says, is when there’s a secondary marketplace for these tokens, which operates at “warp pace.”

Burwick mentioned he was wanting ahead to memecoins which can be built-in into leisure experiences corresponding to live shows, which may work like an NFT.

Learn additionally

Options

Off The Grid’s success reveals ‘invisible’ blockchain is the successful play

Options

Boston nurse fired for nudes on OnlyFans launches crypto porn app

DOGSHIT2 controversy

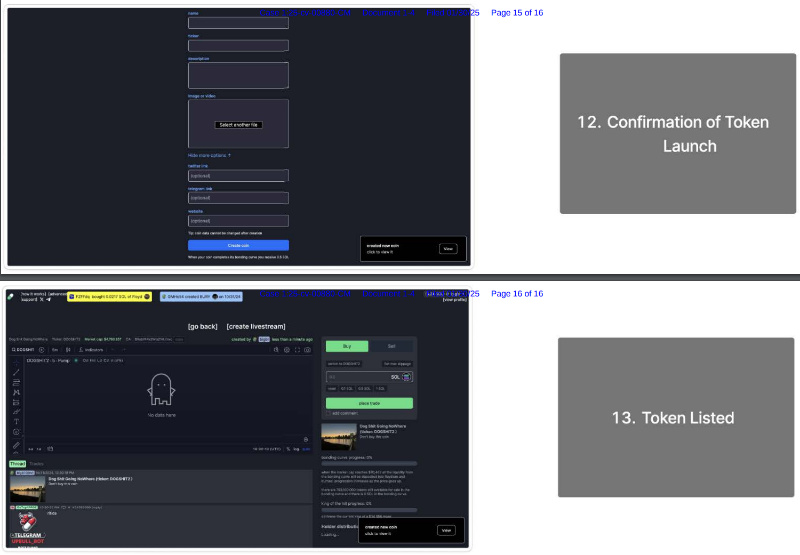

One of many greatest distractions of the Pump.enjoyable lawsuit comes from DOGSHIT2, a memecoin that some imagine Burwick sarcastically launched on the very platform he’s making an attempt to sue.

DOGSHIT2 first appeared on Pump.enjoyable on Nov. 1, 2024, however didn’t start buying and selling till greater than two months in a while Jan. 17, 2025. Critics accuse Burwick of being answerable for launching and itemizing the token on Pump.enjoyable — which, at one level, had a market cap of $23 million.

The purported smoking gun comes from a courtroom exhibit accompanying the class-action lawsuit which reveals the method of itemizing DOGSHIT2 from “join pockets” all the best way to “token listed.”

However Burwick has denied creating or launching the token. That mentioned, he understands why folks don’t appear to love him very a lot for it.

“I’ll say this. I believe it’s a particularly reasonable place the best way folks really feel about it… I get it. I actually get it.”

Subscribe

Essentially the most participating reads in blockchain. Delivered as soon as a

week.

Felix Ng

Felix Ng first started writing concerning the blockchain business by way of the lens of a playing business journalist and editor in 2015. He has since moved into overlaying the blockchain house full-time. He’s most taken with progressive blockchain know-how aimed toward fixing real-world challenges.