|

Su Zhu and Kyle Davies’ newest insolvency drama

OX.FUN, a memecoin alternate that emerged from the remnants of Open Change (OPNX), discovered itself on the middle of insolvency rumors this week after freezing $1 million in person deposits.

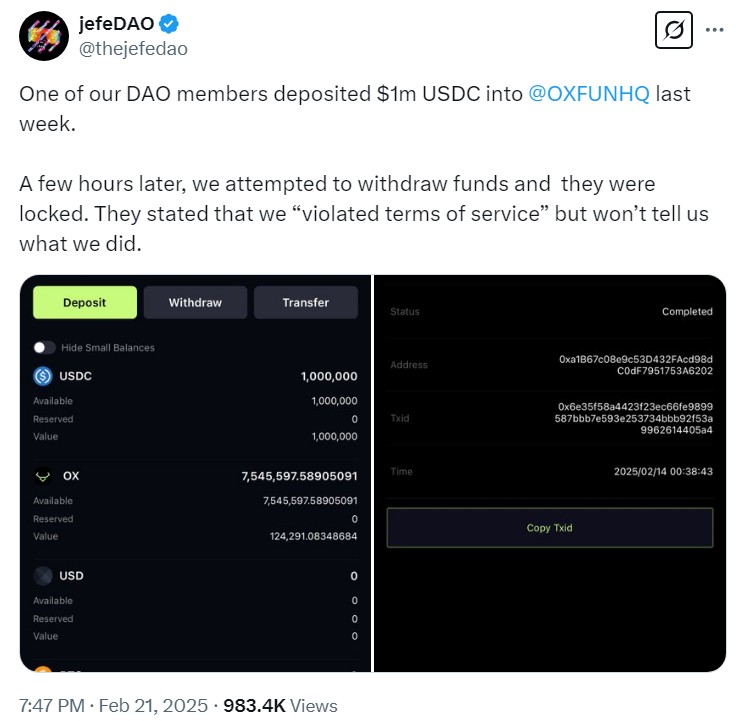

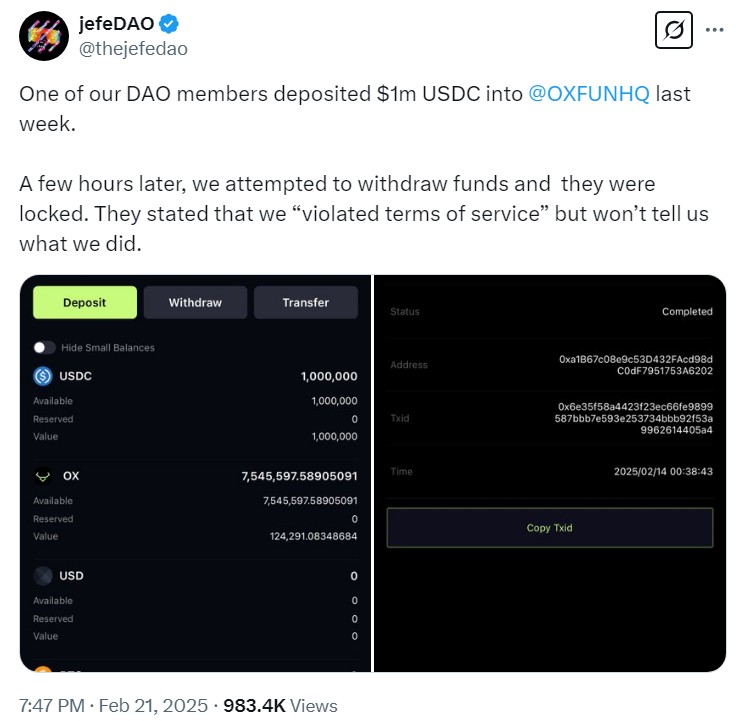

The controversy erupted on Feb. 21, when X person JefeDAO claimed on X that one among its members had deposited $1 million in USDC into OX.FUN, solely to search out the funds locked moments later. Based on JefeDAO, the platform accused the person of violating its phrases of service.

Nicolas Bayle, OX.FUN’s founder, pushed again in opposition to the allegations, stating that the person had tried to take advantage of the platform. OX.FUN claimed the person engaged in “market manipulation” to earn $120,000 in OX tokens, prompting the freeze. The alternate added that an settlement had been reached with JefeDAO, the account was reinstated and the unique deposit could be refunded.

The incident triggered scrutiny of OX.FUN’s monetary well being, with Coinbase govt Conor Grogan noting that many of the alternate’s holdings seemed to be in its personal tokens, a possible purple flag for liquidity considerations. The state of affairs worsened as OX tokens misplaced vital worth amid the controversy, fueling hypothesis in regards to the platform’s solvency.

OX.FUN dismissed the considerations, stating that tracked wallets didn’t replicate the complete scope of the platform’s reserves. An OX.FUN workforce member instructed Journal in a Telegram message that each one person funds are backed 1:1 and mentioned the alternate will launch a transparency dashboard “within the coming days.”

Including to the scrutiny is OX.FUN’s ties to Kyle Davies and Su Zhu, the co-founders of the collapsed Singapore hedge fund Three Arrows Capital. The agency, as soon as one of many largest within the crypto area, imploded in 2022 after making aggressive, leveraged bets that unraveled throughout the market downturn, leaving collectors billions of {dollars} in debt. After its collapse, Davies and Zhu launched OPNX, a buying and selling platform for chapter claims, which was later shut down and changed by OX.FUN, the place Davies and Zhu formally function advisers.

Bybit declares warfare in opposition to North Korean hackers

Bybit suffered the biggest exploit in historical past on Feb. 21 by dropping over $1.4 billion to North Korean hackers.

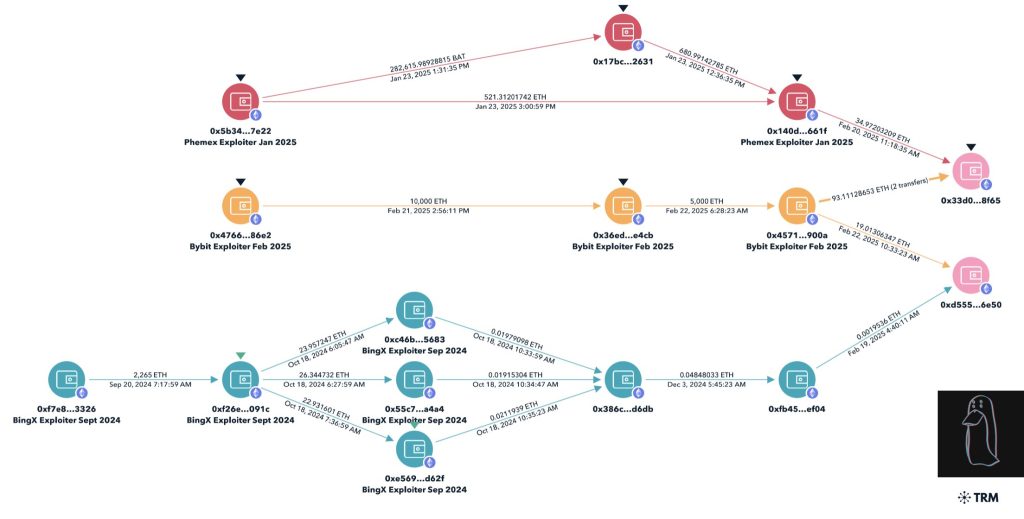

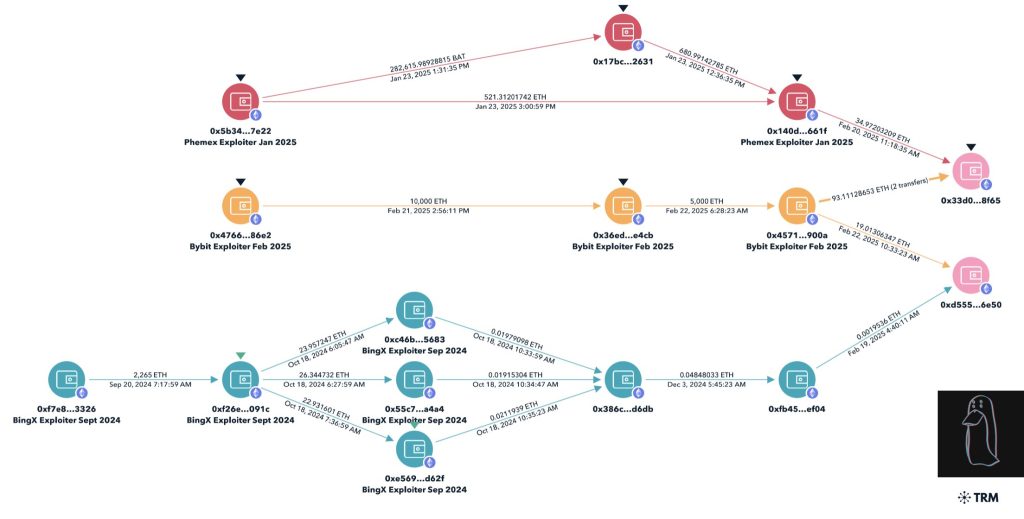

Crypto detective ZachXBT was the primary to formally and publicly determine the hackers, claiming a bounty set by Arkham for offering conclusive proof of their identification. He did so by linking a typical handle used within the Bybit exploit to earlier hacks in opposition to Asia-based exchanges BingX and Phemex, each of which have additionally been attributed to the Lazarus Group. The Federal Bureau of Investigation later confirmed that the assault was carried out by Lazarus.

Bybit misplaced 401,000 Ether within the exploit, and the hackers rapidly distributed the funds throughout a number of wallets, in the end leading to over 11,000 recognized wallets, based on investigators at Elliptic.

A trait of North Korean hackers, except for splitting funds into numerous wallets, is changing them into native property like Ether earlier than swapping them for Bitcoin. Crosschain swapping platform THORChain, which permits direct asset swaps equivalent to Ether to Bitcoin, noticed an enormous improve in swap quantity, surpassing $1 billion in lower than 48 hours from Feb. 26.

After dropping its funds to North Korea, Bybit introduced a warfare in opposition to the hermit kingdom’s cyber unit and has obtained industry-wide assist from companions and rivals in tracing and freezing funds.

Nonetheless, eXch, a no-Know-Your-Buyer swap alternate, has refused to freeze the illicit funds tied to the Bybit exploit. EXch denies laundering funds for North Korea.

Learn additionally

Columns

We tracked down the unique Bitcoin Lambo man

Options

Authorized points encompass the FBI’s creation of pretend crypto tokens

South Korea’s largest alternate banned from accepting new customers

South Korean regulators have dealt a crushing blow to the nation’s largest cryptocurrency alternate, Upbit, imposing a three-month enterprise suspension and govt dismissals.

On Feb. 25, the Monetary Intelligence Unit introduced disciplinary measures in opposition to Upbit and its executives for breaching the Act on Reporting and Utilizing Specified Monetary Transaction Info.

The sanctions successfully freeze Upbit’s capacity to course of cryptocurrency deposits and withdrawals for brand spanking new prospects for 3 months. 9 executives had been disciplined, together with CEO Lee Seok-woo, who acquired a proper warning, and the corporate’s compliance officer, who was fired outright — marking the primary time a compliance officer at a South Korean crypto alternate has been ousted by regulators.

Authorities accused Upbit of flouting repeated warnings to interact in roughly 45,000 transactions with unregistered abroad exchanges. Regulators additionally discovered failures in buyer verification, permitting unchecked trades regardless of strict monetary compliance necessities.

Regardless of overseeing these violations, Seok-woo acquired solely a slap on the wrist, with regulators citing his position as a supervisor somewhat than a direct participant in misconduct.

Whereas the penalties are among the many harshest ever levied in opposition to a South Korean crypto agency, Upbit downplayed their significance, insisting that buying and selling companies, fiat deposits and crypto exchanges will stay unaffected.

Talking to native reporters, Upbit mentioned the alternate is weighing all choices, together with authorized avenues, to problem the sanctions.

Learn additionally

Options

Right here’s preserve your crypto protected

Options

Physician Who materializes in Web3: Tony Pearce’s journey in time and area

Vietnam rejects sandbox proposal for crypto funds

Vietnam’s Ministry of Finance (MoF) has rejected a proposal to introduce crypto transactions within the nation’s upcoming monetary facilities, citing considerations over monetary safety and regulatory gaps, the state media Hanoi Instances reported.

The choice is a setback for efforts to place Ho Chi Minh Metropolis and Danang as fintech hubs, as the federal government stays cautious in regards to the dangers related to cryptocurrencies and digital property, which stay unregulated in Vietnam.

Vietnam’s Ministry of Planning and Funding proposed the launch of a regulatory sandbox permitting digital transactions within the nation’s new monetary facilities, set to start on July 1, 2026.

Nonetheless, the MoF has opposed the timeline, stating that with no authorized framework governing digital property, such transactions pose vital dangers. Officers reportedly confused that legal guidelines masking issuance, buying and selling, service licensing and cybersecurity have to be in place earlier than permitting digital property into Vietnam’s monetary system.

The ministry urged different regulatory companies, together with the State Financial institution of Vietnam, to weigh in on the matter, because the potential use of digital currencies for funds falls beneath the central financial institution’s jurisdiction.

The MoF has additionally really useful that the federal government take direct management over any pilot program and take away the July 1, 2026 begin date from the proposal.

Subscribe

Essentially the most participating reads in blockchain. Delivered as soon as a

week.

Yohan Yun

Yohan Yun is a multimedia journalist masking blockchain since 2017. He has contributed to crypto media outlet Forkast as an editor and has coated Asian tech tales as an assistant reporter for Bloomberg BNA and Forbes. He spends his free time cooking, and experimenting with new recipes.

Learn additionally

Hodler’s Digest

Putin offers Snowden citizenship, Interpol elicits assist in Do Kwon search and FTX US buys Voyager: Hodler’s Digest, Sept. 25-Oct. 1

Editorial Workers

6 min

October 1, 2022

The very best (and worst) quotes, adoption and regulation highlights, main cash, predictions and rather more — one week on Cointelegraph in a single hyperlink!

Learn extra

Hodler’s Digest

US SEC investigates Binance’s ICO, metaverse crypto property up 400% YoY, and STEPN faces DDoS assaults: Hodler’s Digest, June 5-11

Editorial Workers

6 min

June 11, 2022

The very best (and worst) quotes, adoption and regulation highlights, main cash, predictions and rather more — one week on Cointelegraph in a single hyperlink!

Learn extra