The CME opened futures buying and selling on Solana immediately, with FalconX making the primary block commerce. This growth may present liquidity and institutional legitimacy, even probably serving to the case for a Solana ETF.

When the SEC underneath Gary Gensler was contemplating Bitcoin and Ethereum ETFs, CME futures helped decide approval. Now that Solana has this stamp of approval, too, it may enhance its probabilities with the Fee.

CME Presents Solana Futures Contracts

In January, the CME hinted it’d launch SOL and XRP futures however rapidly clarified that no official resolution had occurred. Now, nevertheless, the CME debuted Solana futures, and FalconX made the primary commerce:

“FalconX is proud to execute the primary block commerce in CME SOL futures with StoneX. This extremely anticipated launch marks a historic second for the Solana ecosystem, permitting institutional traders to handle threat and worth publicity on a regulated venue,” Josh Barkhordar, Head of US Gross sales at FalconX, stated in a press launch.

The CME is just not the primary market to supply Solana futures, as Coinbase started providing them in February after looking for CFTC approval.

Nevertheless, the CME is far greater. It is extremely a lot a pillar of the US TradFi ecosystem, with effectively over $100 billion in complete belongings. As Matthew Sigel, VanEck’s Head of Digital Belongings Analysis, famous, this may very well be crucial for a Solana ETF.

The Solana ETF just lately suffered a number of setbacks; the SEC delayed a number of functions, prompting sizable outflows from Solana spot buying and selling.

Specialists have beforehand famous {that a} sizable futures buying and selling market helped persuade the SEC to approve ETFs for Bitcoin and Ethereum. The CME’s new Solana futures market may serve the same operate.

Apart from that, the CME’s Solana futures market gives a number of important benefits. First, it gives a way of institutional legitimacy, which can encourage institutional funding.

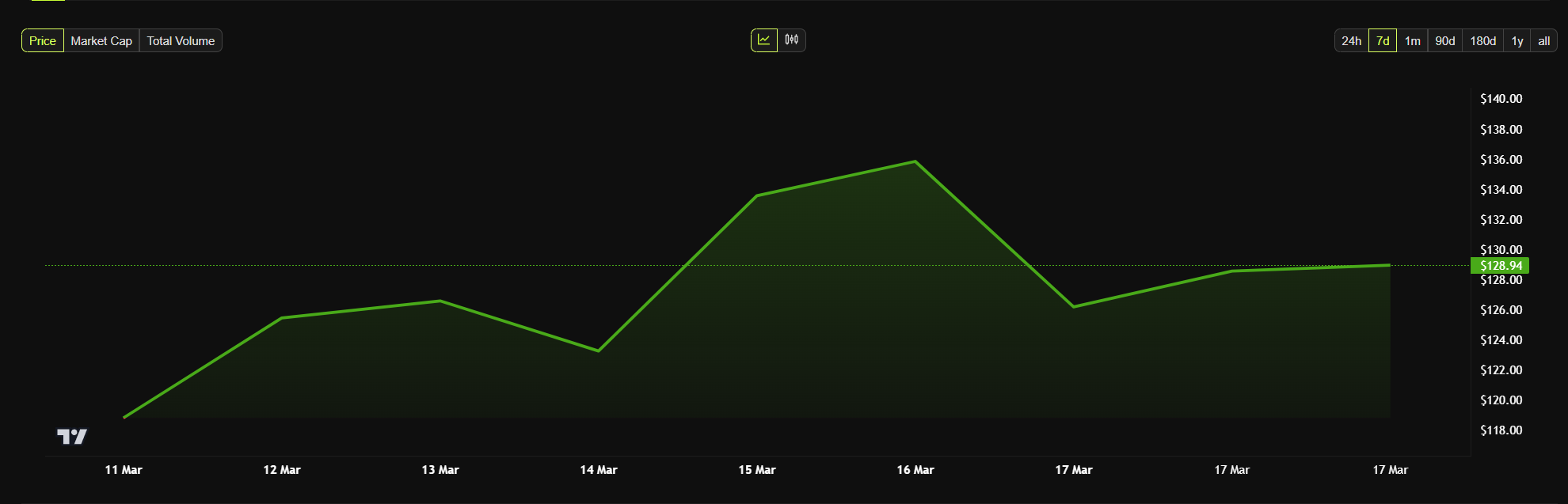

Moreover, it can vastly improve liquidity out there. This might have a big impact on Solana’s future market habits, nevertheless it hasn’t modified SOL’s worth within the quick time period.

Even when the brand new futures buying and selling didn’t instantly bump Solana’s worth, that’s very comprehensible. A growth like it will hopefully arrange future successes, however that doesn’t at all times translate to a short-term worth bump.

If it encourages liquidity, institutional funding, or perhaps a Solana ETF, then the CME may find yourself creating some very bullish outcomes.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.