Information exhibits Bitcoin has not too long ago seen a rise in futures buying and selling quantity, breaking away from the likes of Ethereum (ETH) and Solana (SOL).

Bitcoin Futures Quantity Has Rebounded Lately

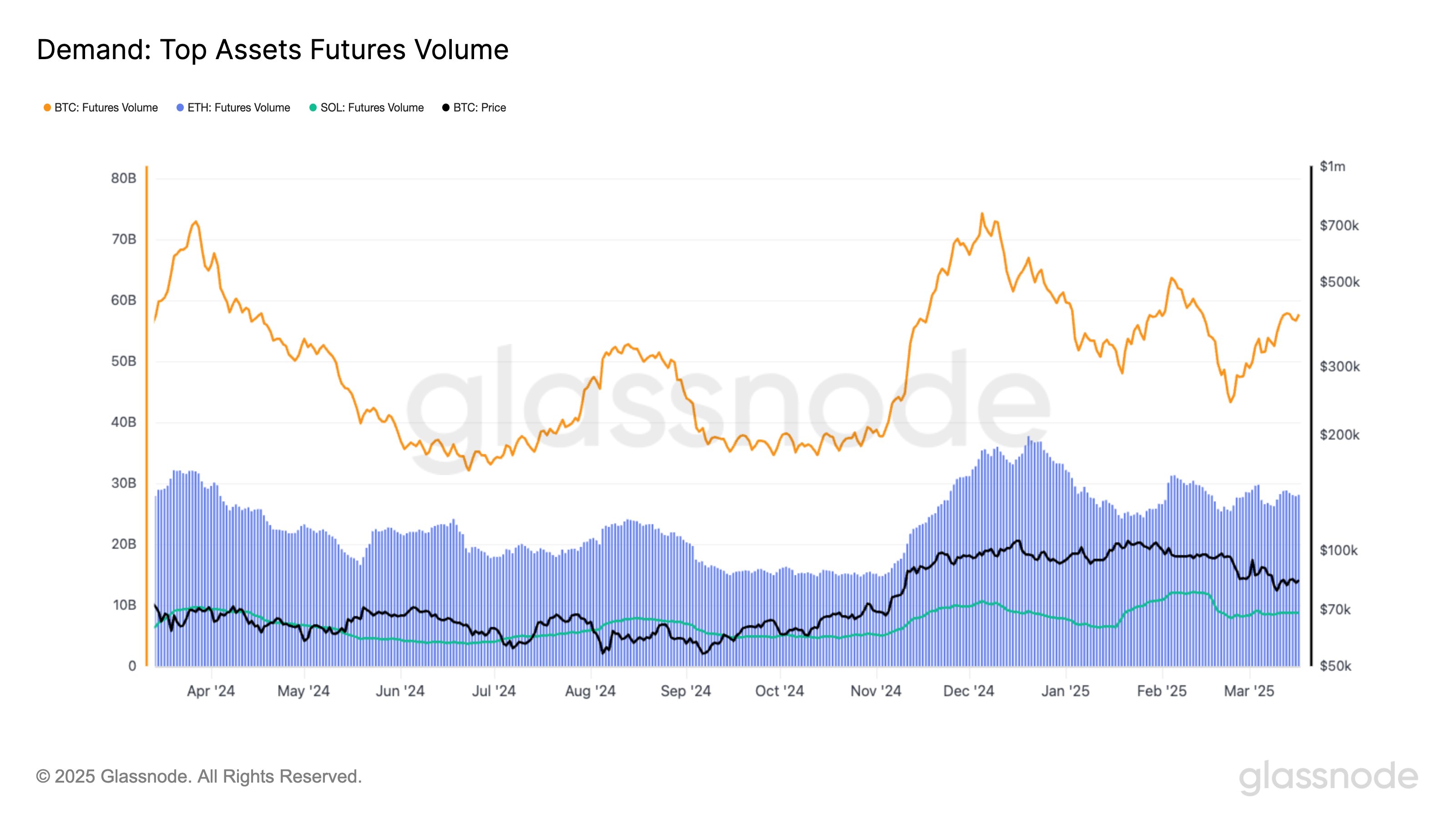

In a brand new submit on X, the on-chain analytics agency Glassnode has talked the most recent development within the futures buying and selling quantity for Bitcoin and two different high cryptocurrencies.

The “futures buying and selling quantity” right here refers to an indicator that retains observe of the overall quantity of a given cryptocurrency that’s turning into concerned in futures-related trades on the centralized derivatives exchanges.

First, here’s a chart that places deal with the futures buying and selling quantity of Bitcoin:

Seems like the worth of the metric has been on the rise for BTC in latest days | Supply: Glassnode on X

As displayed within the above graph, the BTC futures buying and selling quantity noticed a decline final month, however its worth has not too long ago discovered a rebound. At its low, the indicator approached the $40 billion mark, however it has since climbed to $57 billion.

“Bitcoin Futures quantity began the 12 months at $60B, peaked at $63B YTD, and now sits at $57B – 32% greater since Feb 23 however nonetheless beneath December’s $74B peak,” notes the analytics agency.

Whereas the primary cryptocurrency has registered a rise within the metric not too long ago, the identical hasn’t been true for Ethereum and Solana. From the chart, it’s obvious that the indicator has been transferring comparatively flat for these two property.

The development within the ETH futures buying and selling quantity over the previous 12 months | Supply: Glassnode on X

The Ethereum futures quantity measured round $32 billion at first of the 12 months and at present it sits at $28 billion, which isn’t that massive of a distinction. Equally, the indicator kicked off the 12 months at $7 billion for Solana and it’s now at $8.7 billion, as soon as once more a comparatively small change.

The worth of the metric has additionally been transferring sideways for SOL | Supply: Glassnode on X

The futures buying and selling quantity serves as a glance into how the speculative curiosity round a cryptocurrency is like. The latest development would indicate Bitcoin has been attracting the eye from the traders whereas altcoins stay stale.

In another information, the market intelligence platform IntoTheBlock has revealed in an X submit how the Bitcoin long-term holders have began to extend their provide not too long ago.

The analytics agency defines “long-term holders” because the traders who’ve been holding onto their cash since multiple 12 months in the past, with out having transferred or offered them even as soon as.

The BTC HODLers have simply seen a turnaround of their provide | Supply: IntoTheBlock on X

In line with IntoTheBlock, the long-term holders usually accumulate throughout bear markets, so this newest shift could possibly be an indication that sentiment is altering in direction of a bearish one. The analytics agency additionally notes, nevertheless, “remember that this isn’t at all times a dependable sign: i.e. in mid-2021, comparable accumulation didn’t result in a protracted downturn.”

BTC Value

On the time of writing, Bitcoin is floating round $81,800, down greater than 3% during the last 24 hours.

The value of the coin seems to have retraced its restoration | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, IntoTheBlock.com, Glassnode.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.