The chief government of a outstanding analytics agency is immediately turning bearish on Bitcoin, saying BTC has hit a significant cycle prime.

CryptoQuant CEO Ki Younger Ju tells his 417,200 followers on the social media platform X that on-chain knowledge means that Bitcoin is not going to print new highs for at the very least half a yr.

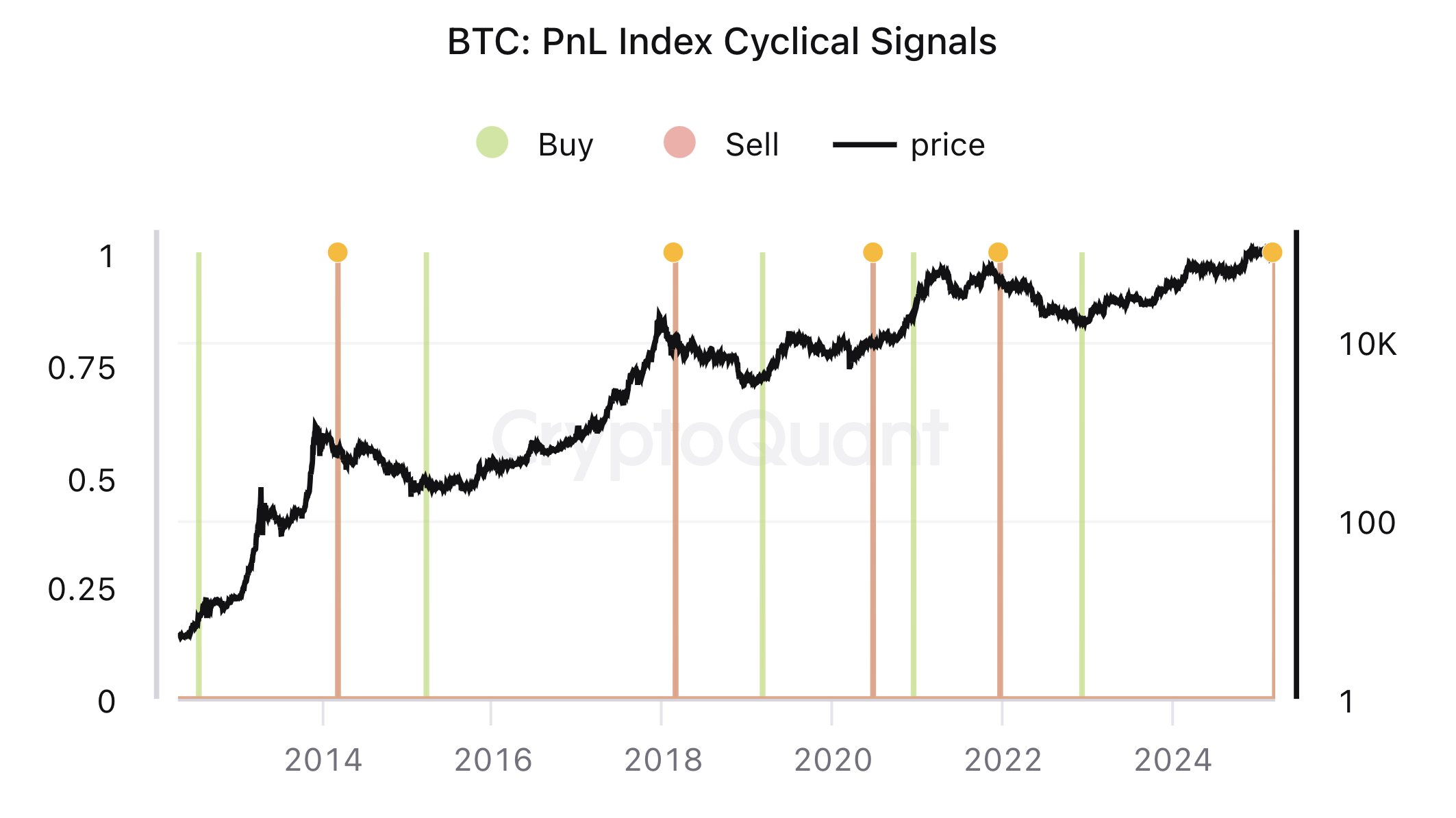

The analytics agency government says Bitcoin’s revenue and loss (PnL) Index Cyclical Indicators, an analytical software that aggregates a number of on-chain metrics to determine cycle tops and bottoms, simply flashed a sign that doubtlessly marks the tip of BTC’s bull market.

“Bitcoin bull cycle is over, anticipating six to 12 months of bearish or sideways worth motion.”

He additionally says that Bitcoin’s 365-day shifting common is beginning to roll over, one other sign that Bitcoin could also be able to enter bear territory.

“Each on-chain metric alerts a bear market. With contemporary liquidity drying up, new whales are promoting Bitcoin at decrease costs…

This alert applies PCA (Principal Element Evaluation) to on-chain indicators like MVRV (market worth to realized worth), SOPR (spent output revenue ratio) and NUPL (web unrealized revenue/loss) to compute a 365-day shifting common. This sign identifies inflection factors the place the development of the one-year shifting common adjustments…

I double-checked the information – it’s correct.”

MVRV is a metric designed to find out whether or not a crypto is overvalued or undervalued by evaluating its present worth (market cap) to the typical worth at which all cash had been final moved (realized cap). SOPR is a metric that tracks whether or not holders of a coin are unloading at a revenue or loss to pinpoint worth reversal areas.

In the meantime, NUPL is a sign used to evaluate the general revenue or loss standing of a coin’s buyers to look into common market sentiment.

In response to Ki Younger Ju, the on-chain alerts counsel that Bitcoin is “coming into a bear market.”

“Realized cap-based indicators present an absence of latest liquidity. Large quantity round 100,000 did not push the worth larger, and ETF (exchange-traded fund) inflows have been adverse for 3 consecutive weeks.”

At time of writing, Bitcoin is value $83,157.

Comply with us on X, Fb and Telegram

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Examine Value Motion

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl should not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal threat, and any losses you could incur are your accountability. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Each day Hodl an funding advisor. Please notice that The Each day Hodl participates in internet affiliate marketing.

Generated Picture: Midjourney