Bitcoin (BTC) is displaying indicators of a possible turnaround regardless of latest volatility, as key on-chain indicators and institutional flows level to enhancing sentiment. The Mayer A number of stays beneath 1, hinting at undervaluation.

In the meantime, institutional confidence seems to be returning, with BlackRock’s latest 2,660 BTC buy marking the most important influx into its Bitcoin ETF in six weeks. Because the market stabilizes and adapts to macroeconomic pressures, Bitcoin’s path to new highs is starting to take form.

BTC Mayer A number of Is Nonetheless Under 1

Bitcoin’s Mayer A number of is at present sitting at 0.98, barely above its latest low of 0.94 recorded on March 10.

This studying means that Bitcoin continues to be undervalued relative to its historic norms, because it continues to commerce beneath its 200-day transferring common.

The indicator has been hovering beneath the 1.0 mark for a lot of the latest consolidation interval, elevating questions on when BTC would possibly regain sufficient momentum to push towards new highs.

The Mayer A number of measures the ratio of Bitcoin’s present worth to its 200-day transferring common, offering insights into whether or not the asset is overextended or undervalued.

Traditionally, values beneath 0.8 are inclined to sign that Bitcoin is closely discounted and may very well be in a long-term accumulation zone, whereas ranges above 2.4 typically point out overheated, euphoric situations.

With the present studying at 0.98, Bitcoin is approaching a neutral-to-bullish threshold.

The final time the Mayer A number of dipped to 0.84, Bitcoin rapidly rallied from $54,000 to $65,000 in simply two weeks. It later stabilized between 1.2 and 1.4 earlier than finally surging previous $100,000 for the primary time.

Whereas historical past doesn’t at all times repeat, this present setup may very well be an early signal that Bitcoin is constructing the muse for its subsequent main leg greater.

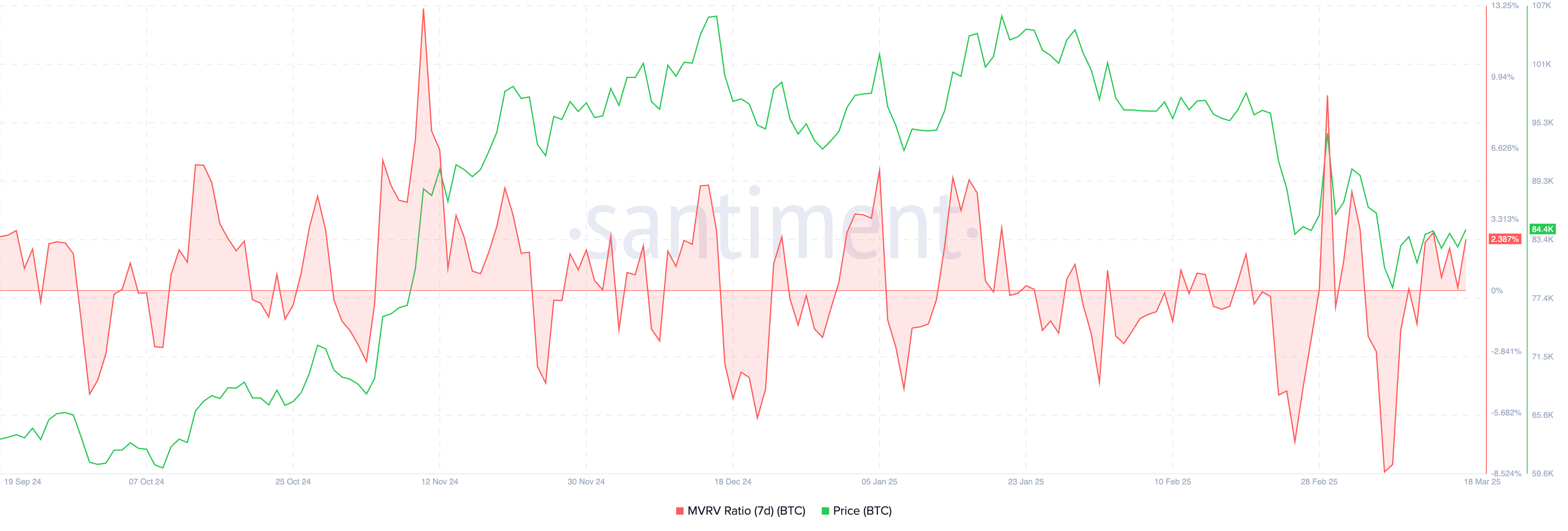

Bitcoin MVRV Brings An Vital Threshold

Bitcoin’s 7-day MVRV (Market Worth to Realized Worth) ratio has climbed to 2.38%, recovering from a latest low of -8.44% on March 8.

This rebound alerts that short-term holders are starting to see modest earnings, however historic patterns recommend that stronger worth momentum normally follows as soon as the 7D MVRV crosses above the 5% mark.

At its present degree, BTC nonetheless seems to be in a transition section. Sentiment is shifting, but it surely hasn’t totally flipped right into a bullish breakout state of affairs.

The 7D MVRV measures the ratio between Bitcoin’s market worth and the typical worth paid by short-term holders (sometimes those that acquired BTC within the final 7 days). When the ratio is unfavourable, it signifies these holders are underwater, whereas constructive readings indicate they’re sitting on earnings.

Traditionally, BTC tends to realize upward momentum when the 7D MVRV strikes past +5%, because it suggests confidence amongst short-term contributors is returning. On condition that BTC continues to be beneath this threshold, it might want additional accumulation or consolidation earlier than it will probably convincingly push towards creating new highs.

If the ratio continues to climb and surpass 5%, that might set off renewed bullish exercise and a possible breakout towards recent all-time highs.

Will Bitcoin (BTC) Create New Highs Quickly?

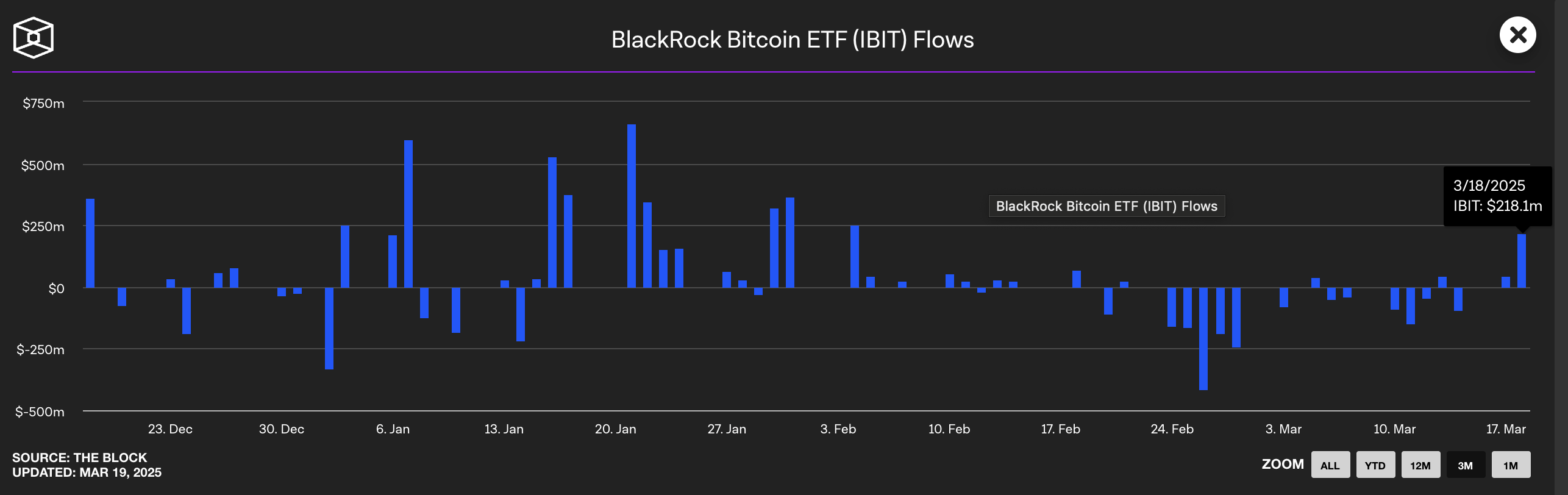

Regardless of Bitcoin’s 11.4% decline over the previous 30 days, institutional bullish sentiment seems to be again, with BlackRock signaling renewed confidence in BTC.

The world’s largest asset supervisor just lately added 2,660 Bitcoin to its iShares Bitcoin Belief (IBIT), marking the most important influx into the fund up to now six weeks.

This important purchase comes after a interval of uncertainty in IBIT flows since early February, suggesting that establishments are as soon as once more positioning for potential upside as market situations evolve.

BlackRock’s newest purchase may sign a broader shift in sentiment as huge gamers overlook short-term volatility and refocus on Bitcoin’s long-term worth.

Institutional curiosity is choosing up once more whereas the market slowly adapts to macro pressures like Trump’s proposed tariffs.

Regardless of the lingering uncertainty, Bitcoin worth setup for brand new highs is rising stronger as confidence returns. If macro situations stabilize, Bitcoin may very well be prepared for an additional push greater quickly.

Disclaimer

Consistent with the Belief Undertaking pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.