A carefully adopted crypto analyst says that Bitcoin (BTC) and Ethereum (ETH) might have reached a neighborhood market backside.

In a brand new submit, crypto dealer Rekt Capital tells his 542,600 followers on the social media platform X that the Relative Power Index (RSI) – a momentum indicator used to point overbought or oversold circumstances – is flashing bullishness for Bitcoin whereas on the verge of breaking by a descending trendline.

“Can the day by day RSI break its downtrend courting to November 2024?”

The analyst additionally says that Bitcoin might quickly rally to fill a CME hole with an higher sure value of $87,000.

A CME hole is the distinction between the Friday closing value of Bitcoin and the Monday opening value on the Chicago Mercantile Trade. Merchants look ahead to gaps as these value variations are likely to get crammed.

“Bitcoin continues to efficiently retest the CME Hole as assist (orange field, $78,000-$80,700). Extra, BTC has been doing so at the next low (black). If this continues BTC will quickly be capable of fully fill the $82,245-$87,000 CME Hole above (orange circle).”

Bitcoin is buying and selling for $84,611 at time of writing, up 3.8% within the final 24 hours.

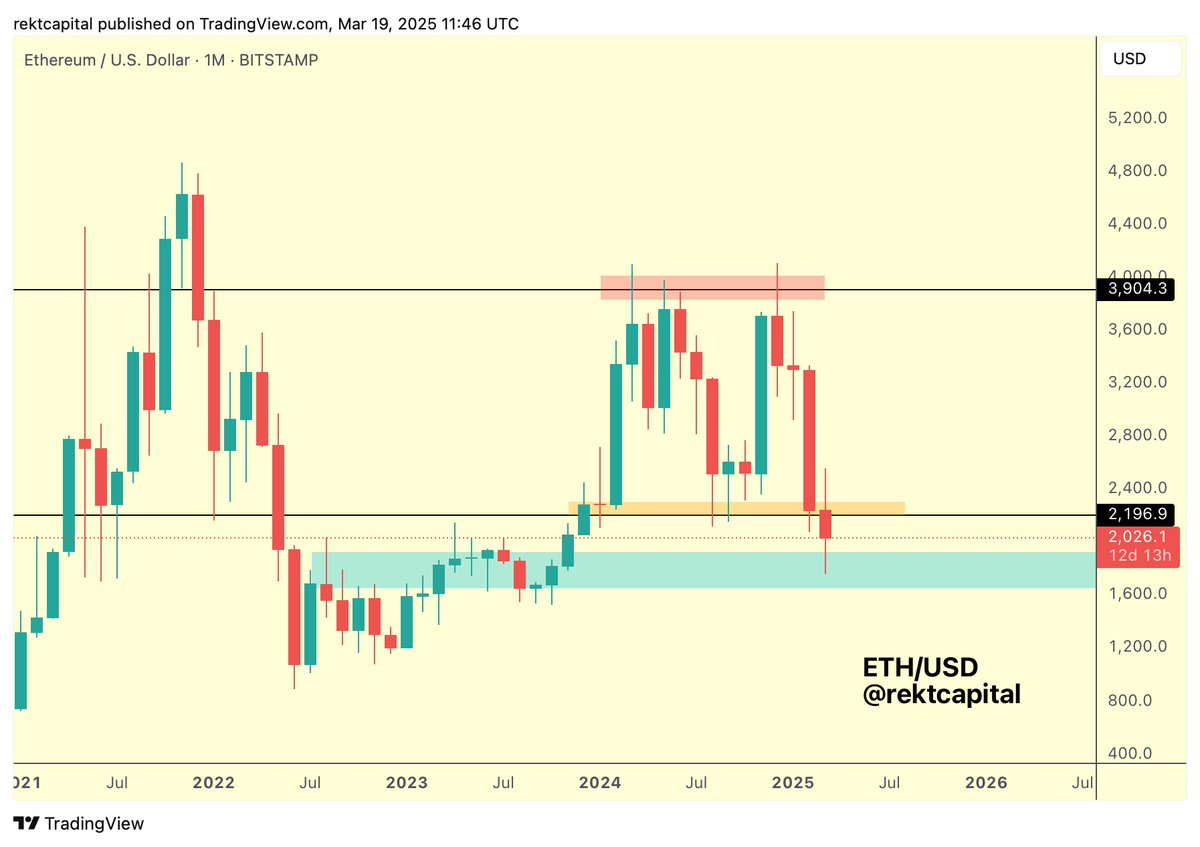

Ethereum, the analyst says ETH could also be getting into a big uptrend after declining right into a value assist that has traditionally sparked rallies.

“Ethereum has dropped into this historic demand space (gentle blue). If the value can generate a powerful sufficient response right here, then ETH will be capable of reclaim the $2,196-$3,900 macro vary (black). If ETH does this earlier than the March month-to-month shut, then this complete sub-$2,200 draw back would find yourself as a draw back wick.”

ETH is buying and selling for $2,048 at time of writing, up 8.9% within the final 24 hours.

Comply with us on X, Fb and Telegram

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Examine Worth Motion

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl usually are not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual danger, and any losses you could incur are your duty. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please observe that The Every day Hodl participates in affiliate internet marketing.

Generated Picture: Midjourney