Bitcoin was as soon as thought-about the dominant foreign money in illicit transactions. Nevertheless, it’s now being changed by privacy-focused cryptocurrencies like Monero (XMR), Zcash (ZEC), Sprint, and stablecoins.

The first purpose for Bitcoin’s decline in unlawful actions is its transparency.

Causes for the Shift from Bitcoin to Privateness Cash

Bitcoin (BTC) as soon as dominated illicit actions on the Darkish Net, comparable to Nucleus Market or Brian’s Membership. The report from TRM Labs indicated that Bitcoin accounted for 97% of the entire cryptocurrency quantity related to unlawful actions in 2016.

Nevertheless, by 2022, this determine had dropped sharply to only 19%, indicating a major shift towards different cryptocurrencies.

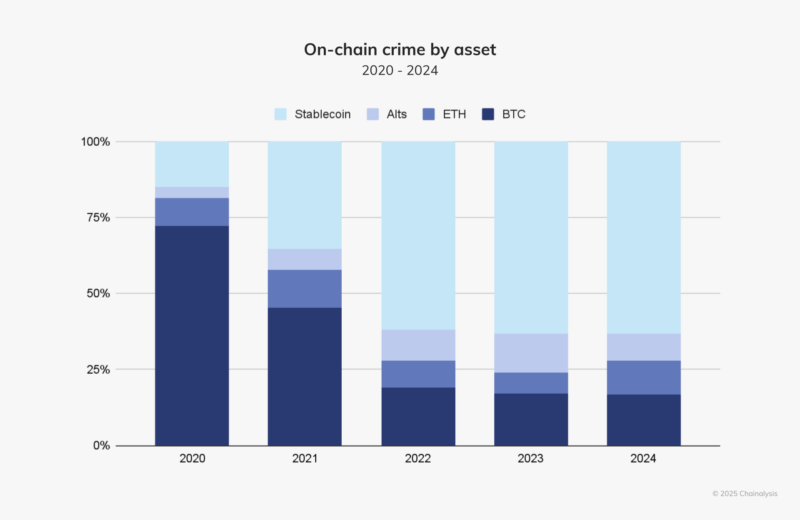

In keeping with the TRM Labs’ report, unlawful cryptocurrency actions involving Bitcoin will drop to only 12% by 2024. Tron (TRX) holds the highest place with 58%. In one other report from Chainalysis, stablecoins now account for almost all of whole illicit transaction quantity at 63%. Using Bitcoin in unlawful actions additionally recorded a major decline.

White Home Market, one of many largest Darkish Net marketplaces, stopped accepting Bitcoin and completely used Monero (XMR) for transactions in 2020.

“The Bitcoin workaround was alleged to be there simply to assist with transition to XMR and as we’re involved, it’s performed, subsequently we at the moment are Monero solely, simply as deliberate,” said White Home Market.

Elliptic researchers uncovered $11 billion in illicit trades utilizing USDT on Cambodia’s Huione Assure market in July 2024. Japanese regulation enforcement tracked Monero, marking the nation’s first arrest linked to Monero transaction evaluation.

The choice was pushed by Bitcoin’s limitations, notably its blockchain transparency. This transfer mirrored a strategic shift in Darkish Net markets and highlighted the rise of privateness cash like Monero, that are designed to offer enhanced anonymity.

The Reputation of Privateness Cash on the Darkish Net

The decline of Bitcoin in unlawful actions just isn’t coincidental however reasonably stems from its inherent limitations. Initially, Bitcoin’s blockchain is a public ledger. When mixed with extra knowledge comparable to IP addresses or change data, each transaction might be tracked.

This transparency has enabled regulation enforcement businesses just like the FBI to make use of blockchain analytics instruments from Chainalysis and Elliptic to dismantle main Darkish Net markets. Examples embrace the Silk Street shutdown in 2013, AlphaBay in 2017, Hydra in 2022, and Incognito Market in 2024.

Moreover, Bitcoin faces technical challenges, together with excessive transaction charges and sluggish affirmation instances. In distinction, privateness cash like Monero, Zcash, and Sprint leverage superior applied sciences to make sure excessive ranges of anonymity, making transaction monitoring extraordinarily tough. The Analysis from ScienceDirect means that privateness cash are carefully linked to Darkish Net site visitors, additional rising their reputation in illicit markets.

The Two Sides of the Shift to Privateness Cash

On the optimistic facet, Bitcoin’s declining function in unlawful actions could enhance its repute as a reliable monetary software. This might result in wider acceptance and entice extra customers and traders.

Nevertheless, the shift from Bitcoin to privateness cash and stablecoins has made it more difficult for regulation enforcement businesses to trace and forestall unlawful transactions. Regardless of superior blockchain analytics instruments that may detect transaction trails via mixers and tumblers, coping with Monero and different privateness cash stays a major problem.

International regulators are more and more scrutinizing privateness cash and stablecoins. Some nations have outright banned privateness cash, whereas stablecoins are subjected to stricter oversight.

The transition from Bitcoin to privateness cash and stablecoins on the Darkish Net is a transparent pattern, pushed by the rising demand for anonymity and effectivity in illicit transactions. Whereas Bitcoin nonetheless performs a job in sure crypto-related crimes, its transparency makes it much less engaging to the Darkish Net.

In the meantime, Monero, Zcash, Sprint, and stablecoins have turn out to be the popular decisions because of their enhanced safety and privateness. This pattern poses vital challenges for regulation enforcement businesses whereas driving developments in blockchain analytics instruments.

Nevertheless, it additionally raises issues about utilizing cryptocurrencies in unlawful actions, necessitating a steadiness between technological innovation and regulatory oversight to make sure transparency and safety within the digital monetary ecosystem.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.