Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Open curiosity in Bitcoin buying and selling is an important metric to evaluate the market’s present sentiment on the digital asset, together with potential worth actions.

In principle, a rise in Bitcoin’s open curiosity suggests liquidity, which might additionally assist an ongoing worth pattern.

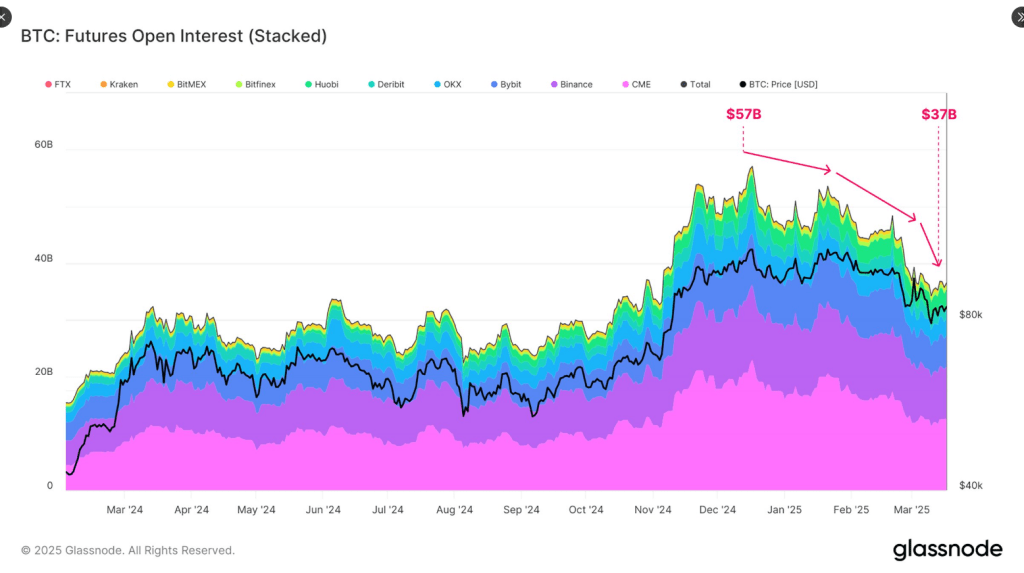

Based on the most recent Glassnode information, Bitcoin’s OI has dipped from $57 billion to $37 billion, or a lack of 35%, for the reason that world’s high digital asset hit its all-time excessive.

Associated Studying

Curiously, Bitcoin hit an all-time excessive of $108,786 on January twentieth, the day United States President Donald Trump was inaugurated for a second time period.

Bitcoin is buying and selling between $83k and $86k, down greater than 22% from its peak, on the time of writing.

Bitcoin Open Curiosity And Its Potential Influence On Value

Buyers and holders use the open curiosity metric to evaluate the sentiment and potential market efficiency of the asset.

A digital asset with a falling open curiosity implies that merchants and buyers are closing their positions because of uncertainties or insecurity or are transferring away from leveraged buying and selling.

Futures open curiosity has dropped from $57B to $37B (-35%) since #Bitcoin’s ATH, signaling diminished hypothesis and hedging exercise. This decline mirrors the contraction seen in on-chain liquidity, pointing to broader risk-off conduct. pic.twitter.com/XPbXiHXlRS

— glassnode (@glassnode) March 20, 2025

In Glassnode’s evaluation, the drop in Bitcoin’s OI displays a broader pattern of reducing on-chain actions and liquidities, the place buyers have much less confidence within the asset.

Bitcoin’s present standing suggests that almost all buyers are actually taking a look at short-term trades for fast positive aspects on the expense of long-term positions.

There’s A Shifting In Positions – Glassnode

Based on Glassnode, merchants and buyers are actually within the cash-and-carry commerce, with a weakening of lengthy positions. It provides that the CME futures closures and ETF outflows mirror a shift in buyers’ technique and likewise add to the promoting stress.

Additionally, the supply of ETFs, which have much less liquidity than futures, could impression the alpha crypto’s short-term market volatility.

Knowledge Highlights Scorching Provide Metric

Glassnode additionally highlighted the asset’s Scorching Provide metric. That is one other essential metric that tracks the Bitcoin holdings at one week or much less.

Based on the identical Twitter/X thread, the numbers have dropped from 5.9% of the full BTC in circulation to 2.8%, reflecting a drop of greater than 50% within the final three months.

The decline within the sizzling provide means that fewer new Bitcoins are traded out there, lowering the asset’s liquidity.

Associated Studying

Glassnode additional painted a depressing image for Bitcoin by explaining that trade inflows have dropped from 58,600 Bitcoins every day to 26,900 Bitcoins, a 54% lower.

This Bitcoin pattern suggests weaker demand since fewer property are transferring to crypto exchanges.

Featured picture from Olhar Digital, chart from TradingView