Constancy’s director of worldwide macro, Jurrien Timmer, is updating his outlook on markets following an across-the-board correction in equities.

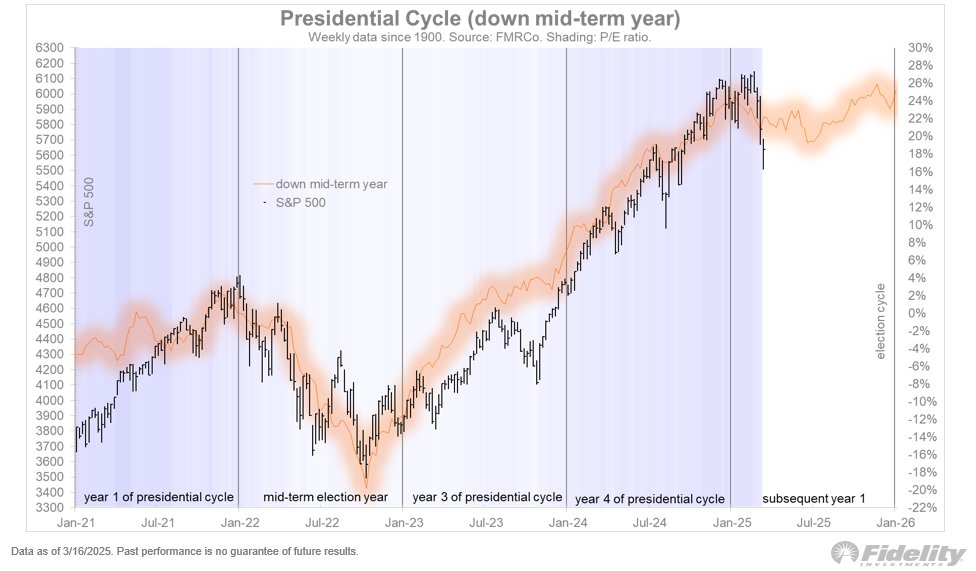

In a publish on the social media platform X, Timmer shares along with his 194,000 followers a chart depicting a mean of the S&P 500’s returns throughout the particular years of presidential phrases.

Timmer’s chart means that the S&P 500 is kind of following the historic common of earlier presidential cycles and that its present drawdown may conclude someplace round July of this yr.

“Whereas I wouldn’t put an excessive amount of weight on this indicator, the iteration of the Presidential cycle by which the mid-term yr (2022) is down, continues to play out properly. We are actually in ‘yr 5’ (if that makes any sense), and that yr has been down on common for the primary six months. It suggests a modest however multi-month corrective interval.”

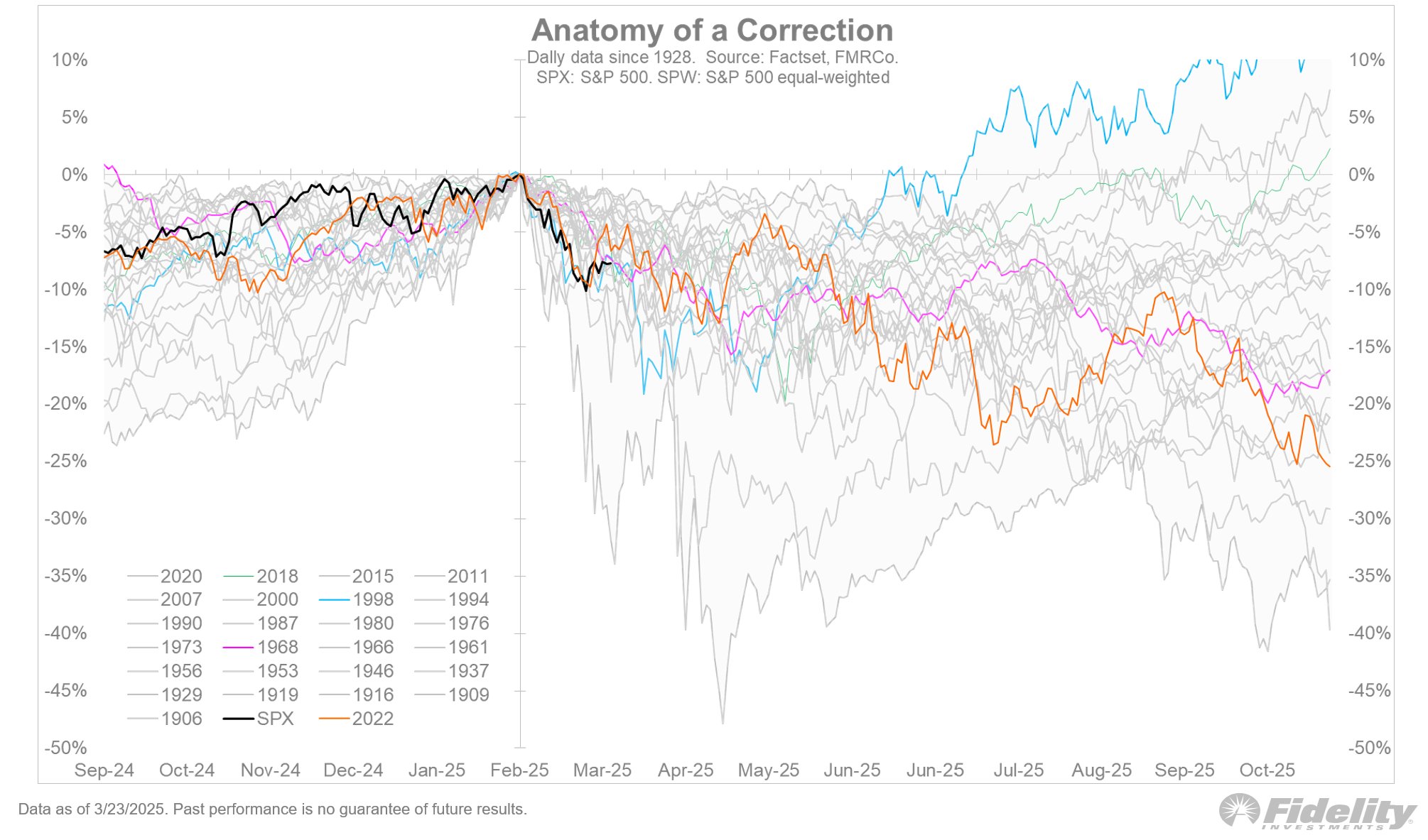

Zooming in, Timmer shares a chart monitoring 26 completely different corrections within the S&P 500 all the best way again to 1906. Taking a look at each correction, Timmer says the present market dip appears harking back to 2018, implying that the S&P 500 may backside out across the 4,900 stage.

“Final week’s reprieve from the tape bombs (which have change into such a characteristic in 2025) allowed the markets to catch their breath. For now, we stay in 10% correction territory whereas we wonder if the following 10% will likely be up or down.

The chart under exhibits all corrections and bear markets since 1900. This one feels a bit like late 2018, which was a 20% correction purely pushed by a number of compression.”

Comply with us on X, Fb and Telegram

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Examine Value Motion

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl will not be funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal danger, and any losses it’s possible you’ll incur are your accountability. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Day by day Hodl an funding advisor. Please be aware that The Day by day Hodl participates in online marketing.

Featured Picture: Shutterstock/TadashiArt/Natalia Siiatovskaia