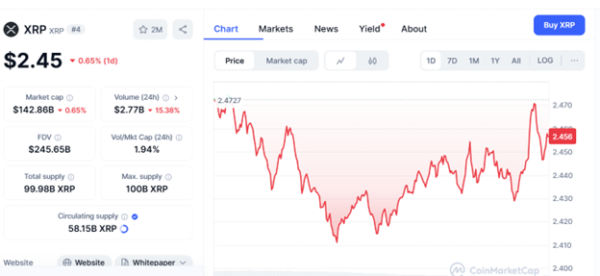

XRP is seeing a slight pullback, buying and selling at $2.45 on the time of writing, down 0.65% over the past 24 hours. This pullback comes after XRP not too long ago peaked at $2.466 earlier that day on March 25, 2025. The market cap stands at $142.868 billion. Nevertheless, XRP has seen a drop of 15.38% within the 24-hour buying and selling quantity, which stands at $2.778 billion. All through this transfer down, XRP continues to draw the eye of merchants. The circulating provide is roughly 58.15 billion, and the entire provide is 99.988 billion.

Total, this means that there’s room for progress ought to demand intensify. Moreover, XRP has a totally diluted market cap of $245.658 billion, indicating the substantial market cap of this token. Can XRP get better from this pullback, or is it for the more severe forward within the days to come back?

supply:coinmarketcap

Technical Setup

Based on analyst Vlad on coinmarketcap, a attainable breakout above $2.45 is supported with an inverted head and shoulders sample. The patterns would goal $2.60 or $3.00 market costs. The present market sentiment is bullish with 72.28% lengthy positions and buying and selling quantity elevated by 60.98%. If the value can break above $2.50, it could create a big rally and dealer curiosity.

Supply: TradingView on coinmarketcap

In a latest tweet by CasiTraders on X, XRP is presently forming a decent consolidation on the 4H chart after printing its excessive at $3.40, setting itself up for a breakout. Fibonacci time evaluation and technical evaluation point out the time frames of Time Zone 2 align with the .618 extension, which happens round March thirtieth from the $2.70-$3.80 goal zone. Key dates within the subsequent month are April 8 for a possible $3.80 excessive and April 25 on the macro W3 prime. June twentieth is Time Zone 5, doubtless representing the general excessive for Wave 5. The technicals point out that an explosive breakout is probably going as XRP approaches the apex of its consolidation.

supply:X

Technical Indicators: RSI and MACD Sign Warning?

The RSI is at 52.61, displaying it’s in impartial territory, indicating potential motion both means. The MACD is bearish with a detrimental histogram worth of -0.0240, suggesting that momentum is fading. Merchants could wish to see the MACD crossover the sign line on the upside for a bullish reversal. Additionally, the decline in quantity on the CoinMarketCap chart suggests purchaser curiosity could also be slowly falling, which, if it continues, can speed up the downtrend if promoting picks up.

supply:TradingView

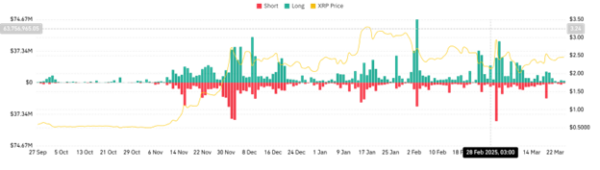

Liquidations: Are Shorts Pulling XRP Down?

Since November 2024, you may see that brief liquidations enhance (crimson bars) when the value takes off, particularly in December 2024 and early March 2025, which signifies that bearish merchants are being squeezed out. Additionally, you will discover that lengthy liquidations are rising (inexperienced bars) as of late February 2025, which corresponded intently with the value declining to the world of $2.45. This means attainable stress on the bulls, and this stress has contributed to the consolidation we have now noticed. If we have now continued lengthy liquidations from the sooner run-up, we would see XRP expertise additional worth declines, notably in the primary assist space round $2.42.

Supply:coinglass

Conclusion: Will XRP Get well?

XRP’s pullback to $2.45 displays a bearish sentiment, primarily influenced by lengthy liquidations and the event of a bearish MACD. No one desires to see this sort of motion when you consider it, however the historic impartial RSI and assist ranges are encouraging. If promoting continues, XRP could check $2.42, whereas breaking $2.46 could provoke a rally in direction of $2.50. Be sure you keep watch over the quantity for affirmation.