Ethereum’s incapacity to ascertain a powerful foothold above $2,000 continues to dampen investor sentiment, inflicting many merchants to maintain their property liquid in case of a possible selloff.

This cautious stance is mirrored in ETH withdrawals from exchanges, which have plunged to a seven-month low.

ETH Alternate Exercise Alerts Rising Bearish Sentiment

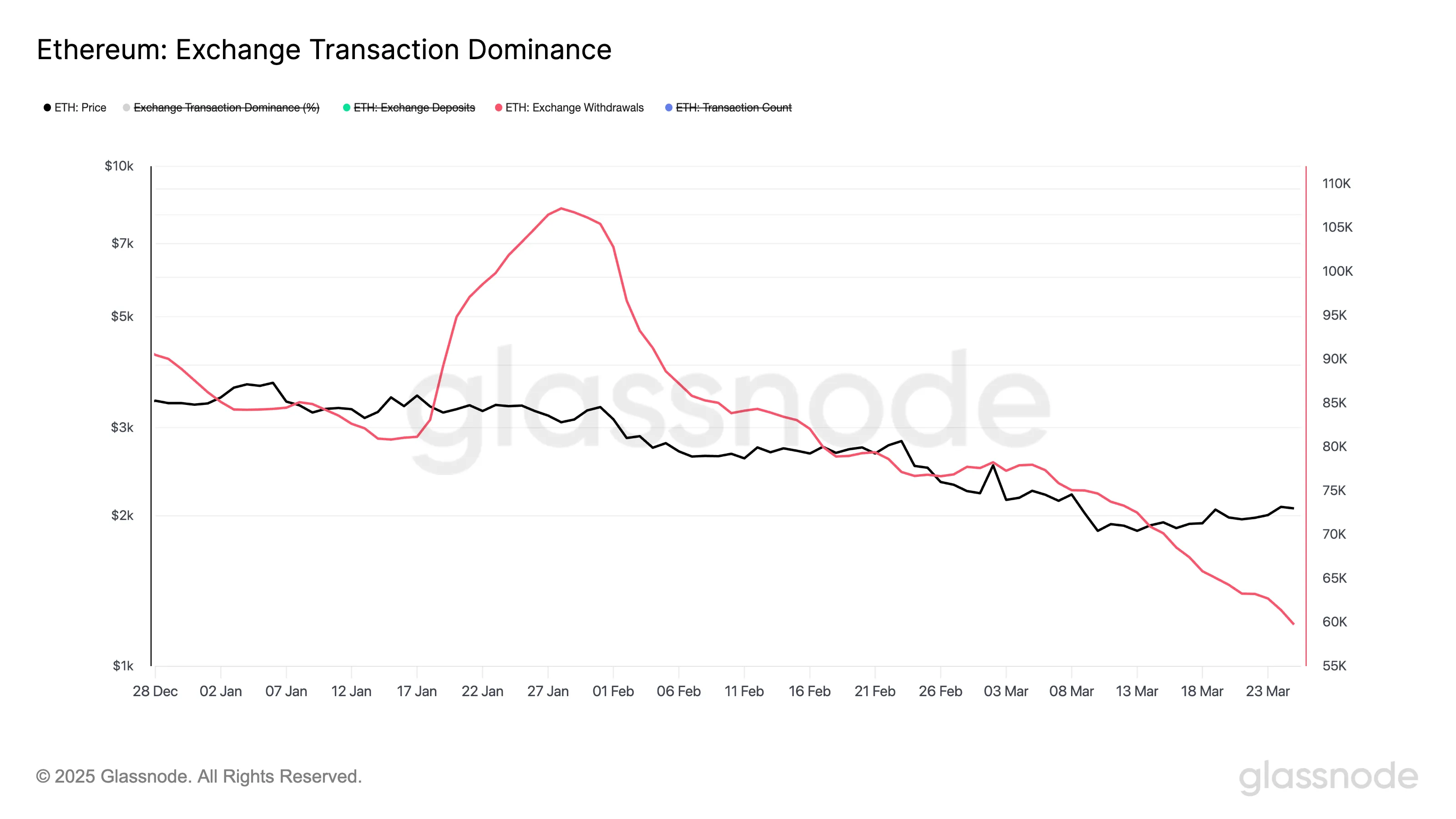

An evaluation of Ethereum’s alternate transaction dominance reveals a major decline in ETH withdrawals since late January. In accordance with Glassnode, ETH’s alternate withdrawal transactions totaled 59,755 cash on Tuesday, marking its lowest single-day rely since August 31.

When ETH withdrawals from exchanges drop, it means fewer buyers are shifting their holdings to personal wallets or chilly storage. This means they don’t seem to be planning to carry the coin long-term. As an alternative, they’re eager on protecting their ETH cash on exchanges; a pattern that alerts a readiness to promote.

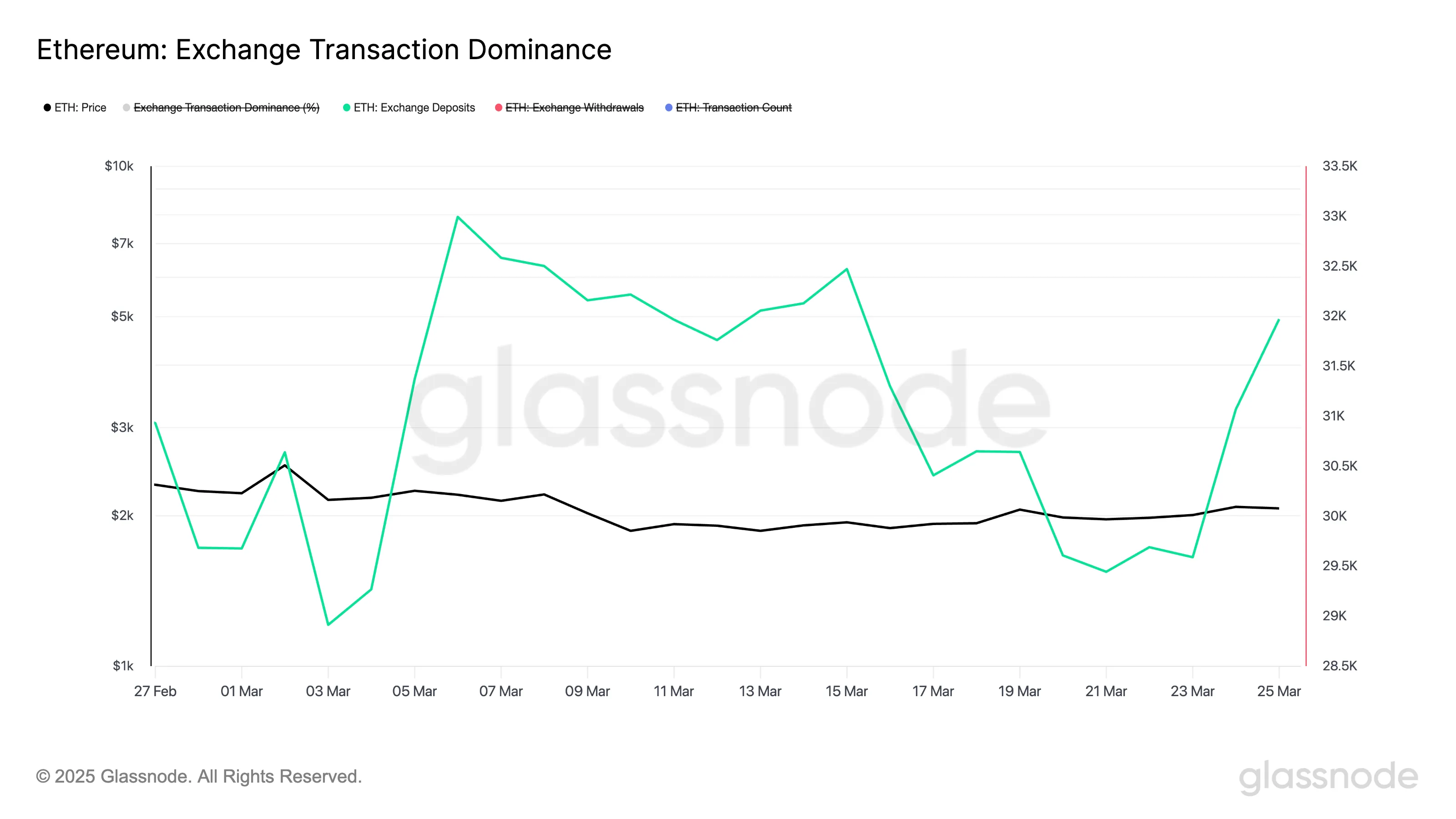

On the identical time, ETH deposits have climbed, confirming the rising promoting stress out there. In accordance with Glassnode, the variety of ETH cash despatched to exchanges has surged by 10% for the reason that starting of March.

When an asset’s alternate deposits spike like this, extra buyers are shifting their holdings onto exchanges, typically in preparation to promote. As bearish sentiment grows weaker, these cash are offered for revenue, placing extra downward stress on ETH’s value.

Will ETH’s Uptrend Maintain? Bulls Face Resistance at $2,148

At press time, ETH is buying and selling at $2,073, marking a 3% achieve over the previous week as a part of the broader market restoration.

On the day by day chart, the main altcoin follows an ascending trendline, signaling sustained value development. If bullish momentum intensifies and alternate withdrawals enhance whereas deposits sluggish, ETH may preserve this pattern and reclaim the $2,148 stage.

Nevertheless, if alternate exercise stays unchanged and promoting stress rises, ETH dangers breaking under the ascending trendline, probably falling to $1,759.

Disclaimer

According to the Belief Challenge pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.