Upbit and its mother or father firm, Dunamu, secured a notable win after the Seoul Administrative Court docket briefly suspended a three-month enterprise restriction imposed by South Korea’s Monetary Intelligence Unit (FIU).

New Upbit customers can proceed depositing and withdrawing crypto belongings till no less than 30 days after the principle lawsuit’s ultimate judgment.

Court docket Suspends Upbit Enterprise Restriction

Native media reported that the choice got here after Dunamu challenged the FIU’s disciplinary motion. Particularly, Upbit’s mother or father firm argued that the penalties had been extreme.

Primarily based on this, the fifth Administrative Division of the Seoul Administrative Court docket, led by Choose Soonyeol Kim, dominated in favor of Dunamu, granting an emergency suspension of the enterprise restriction.

“…the impact will likely be suspended till 30 days from the date of the judgment of the principle lawsuit. This can be a measure to purchase a while for Dunamu,” learn the report.

The FIU’s preliminary penalty was based mostly on allegations that Upbit violated South Korea’s Particular Monetary Transactions Act. The change reportedly allowed transactions with unregistered abroad exchanges with out real-name verification.

Authorities found these infractions throughout an anti-money laundering (AML) audit from August to October final 12 months.

“…We deeply sympathize with the aim of the monetary authorities’ current sanctions, that are geared toward stably establishing the anti-money laundering system and strengthening the authorized compliance system by way of strict self-discipline on digital asset operators,” Upbit responded on the time.

However, the FIU suspended Upbit’s means to course of deposits and withdrawals for brand spanking new customers for 3 months. Authorities reprimanded Upbit’s CEO, Lee Seok-woo, resulting in the dismissal of the corporate’s compliance officer.

Dunamu rapidly responded by submitting a lawsuit to overturn the restriction and requesting a keep of execution. Whereas the suspension was initially set to take impact on March 7, the court docket granted a brief delay to evaluation the case.

With the official suspension in place, Upbit can proceed operations as regular till the ultimate ruling.

This isn’t the primary time Upbit has confronted regulatory challenges. Simply two months in the past, South Korean authorities briefly suspended the change over 700,000 Know-Your-Buyer (KYC) violations.

Upbit was additionally below investigation for alleged antitrust violations six months earlier, with authorities scrutinizing its market practices.

Whereas this ruling provides Upbit some respiratory room, the authorized battle is way from over. The ultimate verdict in the principle lawsuit will decide whether or not the FIU’s sanctions had been justified or an overreach.

This ruling is pivotal for Upbit, South Korea’s largest crypto change. The South Korean authorities lately ordered Google to dam 17 international cryptocurrency exchanges that did not adjust to native rules. With these rivals successfully shut out, Upbit is in a main place to strengthen its market presence and entice extra customers.

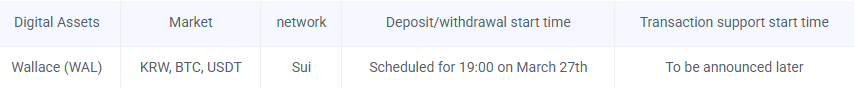

In a separate improvement, Upbit introduced the launch of Wallace (WAL) buying and selling pairs, citing the Korean received (KRW), Bitcoin (BTC), and USDT stablecoin.

WAL token ties to the Walrus protocol, which focuses on decentralized storage for blockchain information. Walrus, developed by the Sui (SUI) group at Mysten Labs, lately secured $140 million in funding, with its mainnet launch coinciding with Upbit’s announcement on March 27.

South Korea’s crypto market is influential, and Upbit’s itemizing may enhance WAL’s visibility. Nonetheless, previous listings like ORCA and BONK present such features typically fade rapidly.

Disclaimer

In adherence to the Belief Undertaking tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.