The crypto market has developed past macroeconomics — it now has ties to politics. When you have doubts, take a look at the costs of belongings like Solana (SOL) since Donald Trump emerged because the winner of the US presidential elections. For example, Solana all-time excessive, which was 40% away some weeks again, now solely wants a 15% hike to clip a brand new peak.

Nonetheless, that’s not the one factor taking place with the altcoin. On this evaluation, BeInCrypto reveals what else is happening and what may very well be subsequent for SOL’s worth.

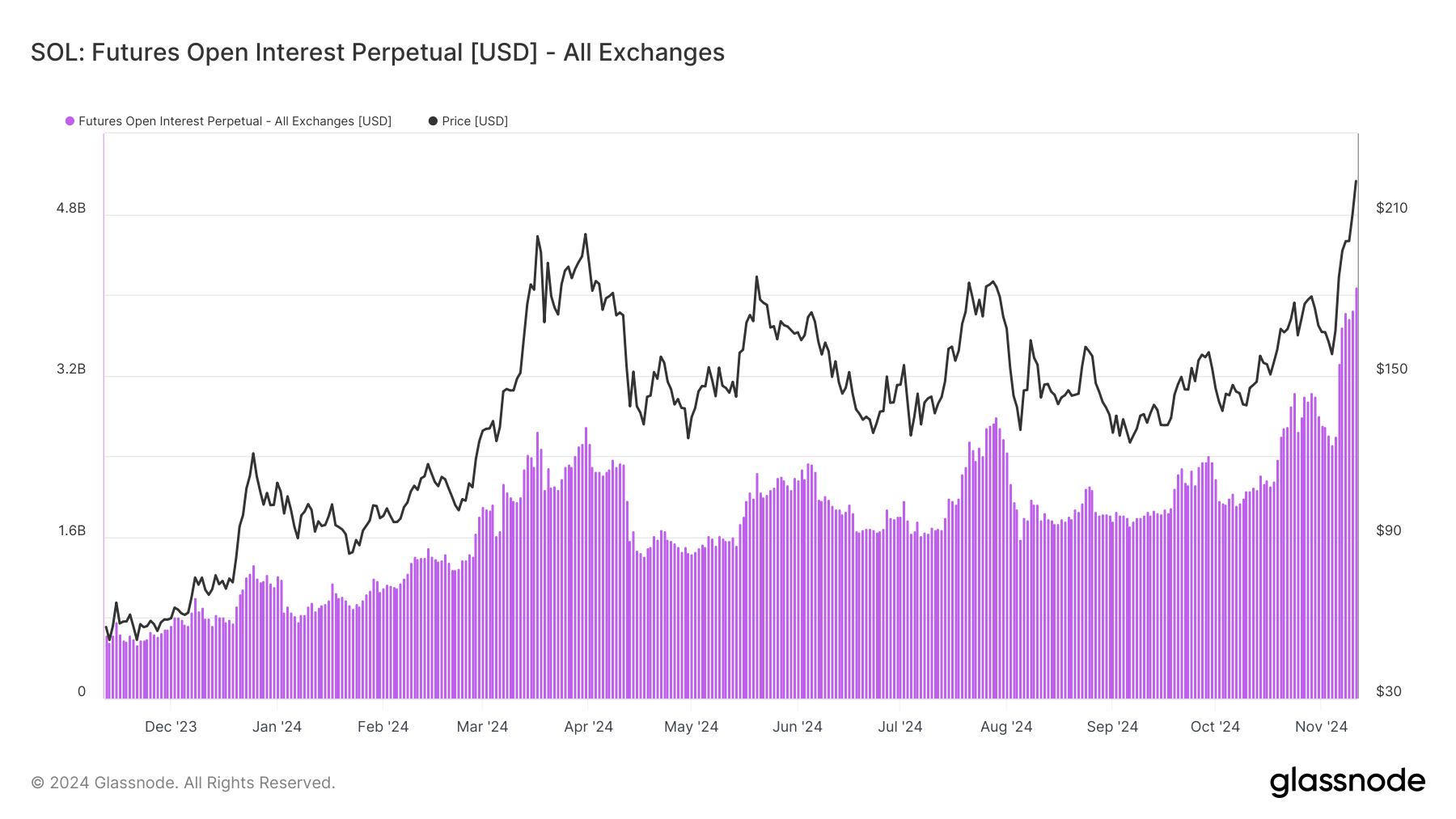

Solana Open Curiosity Hits File Excessive

Solana’s all-time excessive of $260 occurred in November 2021. In March this 12 months, the altcoin tried to surpass that degree however encountered rejection, resulting in a double-digit drawdown.

Nonetheless, issues have modified since final week, as SOL’s worth has elevated by 37% within the final seven days. This hike has introduced it nearer to its all-time excessive, and it now wants a 15% improve to retest the area. However that’s not the one factor.

In response to Glassnode, SOL Open Curiosity has hit a file excessive of $4 billion. OI, because the metric is usually referred to as, is the sum of the worth of all open contracts out there.

Rising open curiosity signifies new capital getting into the market and suggests an increase in speculative exercise. Conversely, reducing open curiosity suggests cash is flowing out. Subsequently, the current hike in Solana’s OI means that, with new cash flowing into the cryptocurrency’s contracts, the worth may go increased.

The Sharpe ratio is one other metric suggesting that Solana’s all-time excessive might turn out to be a actuality within the quick time period. For context, the Sharpe ratio measures an asset’s risk-adjusted return.

Moreover, the upper the Sharpe ratio, the higher the returns relative to the quantity of danger taken. However, if the ratio is unfavourable, it implies that the potential rewards won’t be well worth the danger.

Based mostly on Messari’s knowledge, the Sharpe ratio for SOL has risen to 0.48. This notable improve suggests that purchasing SOL at its present market worth might yield robust returns for traders trying to accumulate.

SOL Value Prediction: Larger than $260 Quickly

On the day by day chart, SOL’s worth encountered resistance at $222.26. Nonetheless, the Chaikin Cash Move (CMF) means that this impediment won’t cease the altcoin from persevering with its rally.

The CMF is an oscillator that measures shopping for and promoting strain, giving a rating between -100 and +100. Constructive values point out an uptrend, whereas unfavourable values recommend a downtrend. A CMF studying close to zero indicators balanced shopping for and promoting strain.

As of this writing, the indicator’s studying is 0.23, suggesting that Solana is experiencing a surge in shopping for strain. With help at $186.58, a brand new Solana all-time excessive may very well be shut, and the worth might rally past $260.

Nonetheless, if promoting strain happens, this prediction may be invalidated. In that state of affairs, SOL’s worth may drop to $157.89.

Disclaimer

In keeping with the Belief Undertaking tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.