Onyxcoin (XCN) has been underneath heavy promoting strain, dropping greater than 11% within the final seven days and over 30% prior to now month. A number of indicators now mirror this sustained weak point, with momentum and pattern indicators leaning decisively bearish.

The RSI is nearing oversold ranges, whereas the ADX reveals the downtrend is gaining energy. Until consumers step in quickly, XCN might face deeper losses earlier than any significant restoration try takes form.

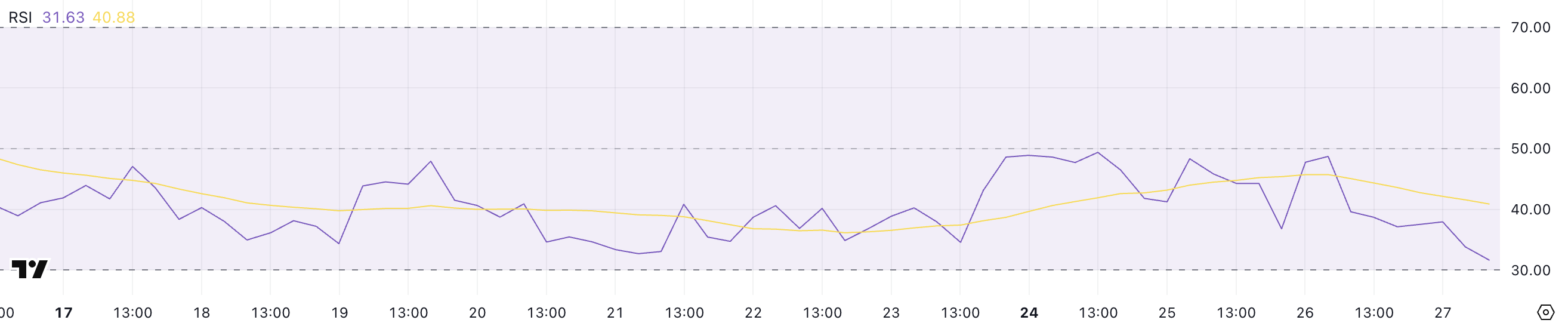

Onyxcoin RSI Is Virtually Reaching Oversold Ranges

Onyxcoin’s Relative Energy Index (RSI) has dropped sharply to 31.63, down from 48.72 only a day earlier. This important decline brings it nearer to the oversold threshold and highlights the rising bearish momentum.

The RSI has now remained beneath the impartial 50 mark for the previous 12 consecutive days, signaling that bearish sentiment has been dominant all through this era.

This ongoing weak point means that sellers proceed to regulate the market, and the newest drop might point out a deepening of the present downtrend.

The RSI is a momentum oscillator that measures the velocity and alter of value actions on a scale from 0 to 100. Readings above 70 usually recommend an asset is overbought and could also be due for a correction, whereas values beneath 30 point out oversold situations that would result in a possible rebound.

XCN’s present RSI of 31.63 places it simply above oversold territory, which suggests a bounce is feasible—however removed from assured. If bearish strain persists and the RSI dips beneath 30, it might sign panic promoting or capitulation.

Then again, a fast restoration in RSI above 40 might trace at fading promoting strain and the early indicators of a pattern reversal.

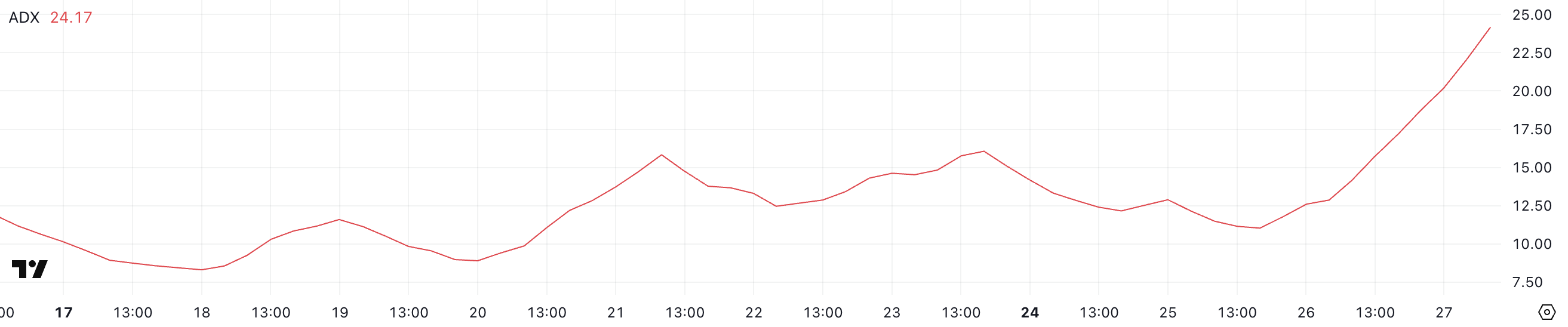

XCN ADX Exhibits The Downtrend Is Getting Stronger

Onyxcoin Common Directional Index (ADX) has surged to 24.17, up from 12.86 only a day in the past, signaling a fast enhance in pattern energy.

The ADX measures the depth of a pattern, no matter its route, and this sharp rise means that the present downtrend is gaining traction.

With XCN’s value already shifting decrease, the strengthening ADX reinforces the concept bears are firmly in management, and the downward momentum might proceed within the close to time period.

The ADX operates on a scale from 0 to 100, with readings beneath 20 usually indicating a weak or non-existent pattern. Values between 20 and 25 level to a pattern that could be beginning to construct, whereas something above 25 indicators a powerful, established pattern.

XCN’s present ADX at 24.17 is correct on the sting of this vital threshold, suggesting that the downtrend is transitioning from early-stage to doubtlessly stronger territory.

If the ADX continues rising above 25 whereas the worth stays in decline, it could affirm that sellers are driving a extra highly effective transfer decrease, and any bullish reversal try might face robust resistance.

Onyxcoin Correction Might Proceed

Onyxcoin EMA strains are at present aligned in a bearish formation, suggesting that the downtrend might persist within the brief time period.

If the bearish momentum continues, XCN might retest the help stage at $0.0083, a vital zone that beforehand acted as a flooring.

A breakdown beneath this stage would probably expose the token to additional draw back, doubtlessly inflicting it to fall to $0.0051, its lowest value since January 17.

The present EMA construction highlights weakening bullish strain and rising vulnerability to further promoting.

Nevertheless, there’s nonetheless a path to restoration if Onyxcoin can regain the robust momentum it confirmed on the finish of January, when it was one of the crucial talked-about altcoins out there.

A reversal might take XCN again to check the resistance at $0.014, and a profitable breakout above that may sign renewed bullish energy.

If consumers push additional, value targets at $0.020 and even $0.026 will develop into related—ranges not seen since mid-February.

Disclaimer

In step with the Belief Venture pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.