Right this moment, roughly $14.21 billion price of Bitcoin (BTC) and Ethereum (ETH) choices are on account of expire.

Market watchers are significantly attentive to this occasion as a result of it has the potential to affect short-term tendencies by means of the quantity of contracts and their notional worth.

$14.21 Billion Bitcoin and Ethereum Choices Expiring

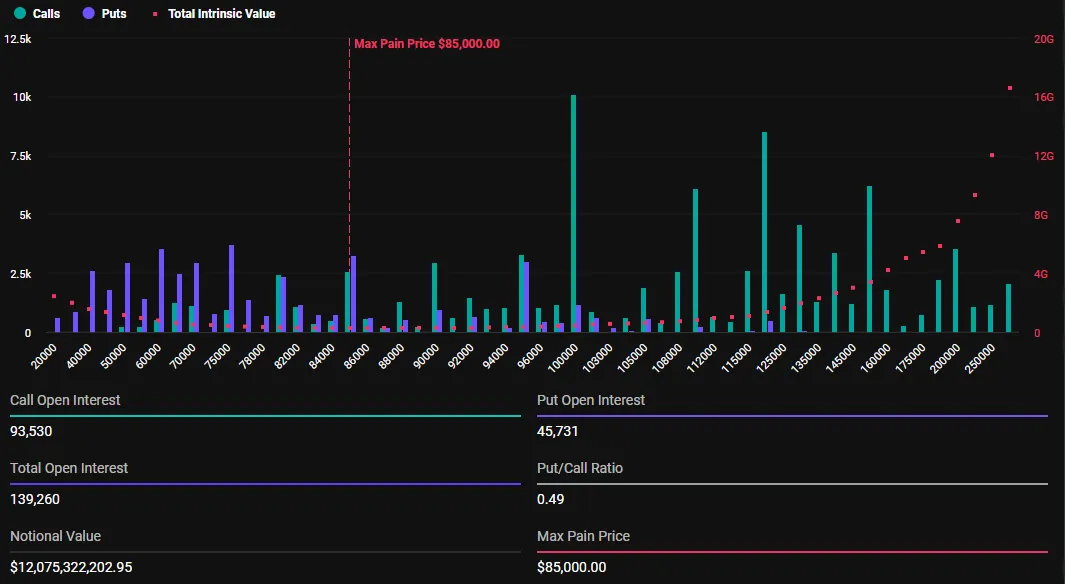

The notional worth of at the moment’s expiring BTC choices is $12.075 billion. In line with Deribit’s knowledge, these 139,260 expiring Bitcoin choices have a put-to-call ratio of 0.49. This ratio suggests a prevalence of buy choices (calls) over gross sales choices (places).

The info additionally reveals that the utmost ache level for these expiring choices is $85,000. The utmost ache level is the value at which the asset will trigger the best variety of holders’ monetary losses.

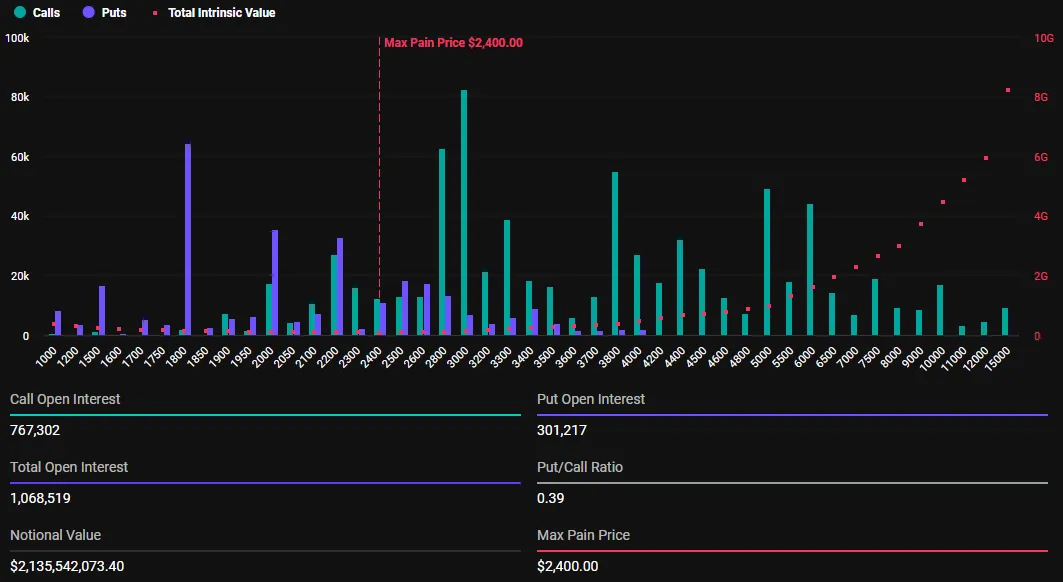

Along with Bitcoin choices, 1,068,519 Ethereum choices contracts are set to run out at the moment. These expiring choices have a notional worth of $2.135 billion, a put-to-call ratio of 0.39, and a most ache level of $2,400.

The variety of at the moment’s expiring Bitcoin and Ethereum choices is considerably increased than final week. BeInCrypto reported that final week’s expired BTC and ETH choices have been 21,596 and 133,447 contracts, respectively. In the identical tone, that they had notional values of $1.826 billion and $264.46 million, respectively.

This notable distinction comes as this week’s expiring choices are for the month and the quarter, with this being the final Friday of March. Deribit choices expiry occurs on Fridays as a result of it aligns with conventional monetary (TradFi) market practices and offers a constant schedule for merchants.

In lots of world markets, together with equities and derivatives, expiration dates for choices contracts are generally set for the top of the buying and selling week—typically Friday—to standardize timing and facilitate settlement processes.

Deribit adopted this conference to take care of familiarity for merchants transitioning from TradFi to crypto markets and to make sure liquidity and market exercise peak at a predictable time.

“Tomorrow is not only any Friday; it’s one of many greatest expiries of the 12 months. Over $14 billion in BTC and ETH choices are set to run out at 08:00 UTC. How do you suppose Q1 will wrap?” Deribit posed in a Thursday submit.

Implied Volatility Heading Into Quarterly Choices Expiry

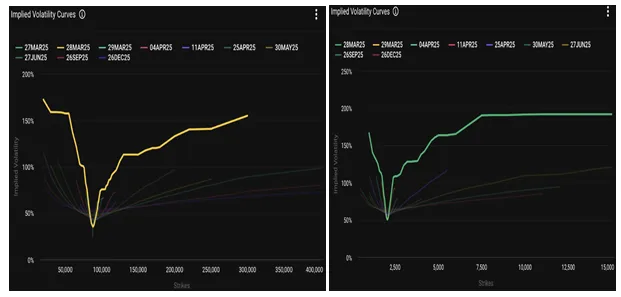

Certainly, at the moment’s choices expiry concludes the primary quarter (Q1) in choices expirations. As this occurs, analysts at Deribit, a cryptocurrency derivatives trade, observe the implied volatility (IV) curves for BTC and ETH, exhibiting market expectations of worth swings.

Particularly, Bitcoin’s curve signifies a powerful bias towards increased costs (upside skew) as calls are priced a lot increased than places. Alternatively, Ethereum’s flatter volatility curve suggests much less directional bias however nonetheless displays elevated volatility. This hints at anticipated worth motion across the expiry date of the $14.21 choices.

“Chart 1 – $BTC: BTC exhibiting some severe upside skew, calls priced method increased. Chart 2 – $ETH: ETH’s curve is flatter, however quantity continues to be elevated throughout the board. Each markets sign anticipation of motion into or post-expiry,” Deribit famous.

This means that each Bitcoin and Ethereum markets anticipate motion into or post-expiry. Elsewhere, analysts at Greeks.stay make clear present market sentiment, citing a cautiously bearish outlook dominating traders’ perspective for Bitcoin.

Particularly, they recommend that the majority merchants anticipate a retest of lower cost ranges round $84,000–$85,000. Bitcoin buying and selling for $85,960 as of this writing signifies a possible downward transfer within the brief time period.

Nevertheless, some merchants observe that Bitcoin is caught in a decent, range-bound buying and selling sample, implying restricted volatility until a breakout happens. Towards this backdrop, Greeks.stay highlights key technical ranges.

“Key resistance ranges being watched are 88,400 the place important passive promoting was noticed, and potential help at 77,000 which one dealer known as the particular backside,” the analysts wrote.

Greeks.stay analysts additionally observe that Implied Volatility is below stress because of the quarterly supply, noting important deviations within the IV Mark. This means alternatives for merchants to use these fluctuations by means of guide or automated methods.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nevertheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.