Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Ethereum and Bitcoin went by way of very completely different trajectories within the first quarter of 2025, and the divergence couldn’t be extra apparent. In accordance with information from on-chain analytics agency IntoTheBlock, Ethereum underperformed considerably, dropping practically 50% in worth over the previous three months.

Associated Studying

Bitcoin, although additionally correcting, noticed a smaller decline beneath 15%. This displays a broader pattern within the crypto market the place inflows and curiosity went towards Bitcoin and some altcoins, leaving Ethereum struggling to regain momentum.

Ethereum’s Underperformance Vs. Bitcoin In Q1

Bitcoin started Q1 on a notably bullish trajectory as a consequence of growing institutional curiosity and powerful inflows into Spot Bitcoin ETFs, a mixture which pushed the worth to a brand new all-time excessive of $108,786 on January 20. This worth marked the height of a gradual upward motion that has positioned Bitcoin firmly within the highlight since October 2023.

Nevertheless, a pronounced downtrend adopted this peak, significantly in March, when the Bitcoin worth dipped beneath $80,000 for the primary time since November 2024. An already struggling Ethereum worth fared a lot worse and broke beneath a powerful assist of $1,900.

Bitcoin has proven resilience since this break, bouncing again above $83,000 and even just lately touching $87,000. However, Ethereum continues to commerce beneath $1,900 and is now vulnerable to dropping $1,800 and breaking beneath.

In accordance with information from Cryptorank, Ethereum closed Q1 2025 with a forty five.3% lower from its quarterly open. This marks the second-worst Q1 efficiency for Ethereum, behind a 47.5% decline in Q1 2018. Bitcoin, alternatively, ended Q1 2025 with an 11.7% lower from its opening worth.

Picture From X: IntoTheBlock

Ethereum Worth Course: $1,800 On Crosshairs With Cautious Bullishness

Ethereum’s decline has been amplified by a visual drop in buying and selling curiosity and inflows even in Spot Ethereum ETFs. Many of the consideration has been on Bitcoin, with Solana, Dogecoin, and XRP taking probably the most important share of curiosity within the altcoin market.

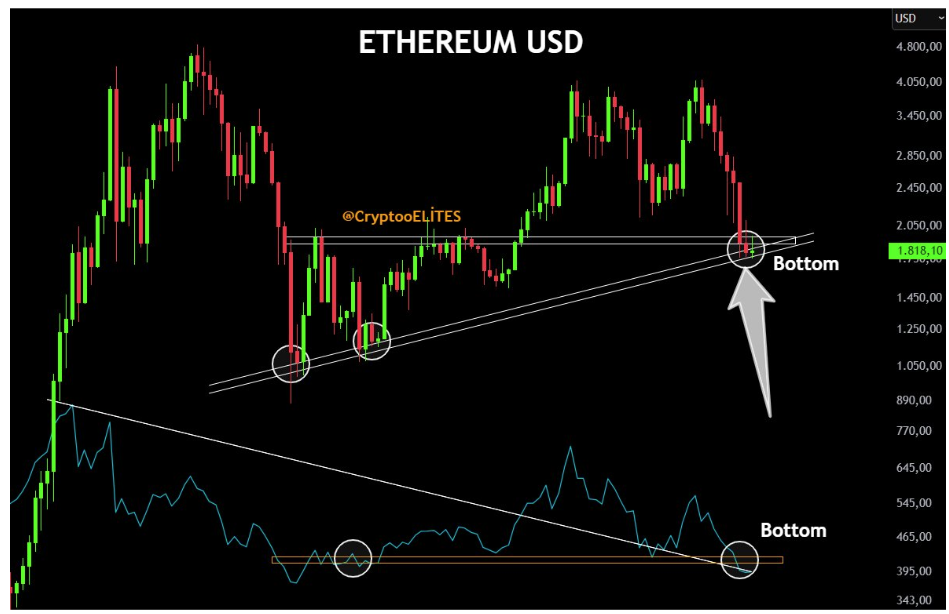

Nonetheless, many crypto analysts are nonetheless bullish on Ethereum and are on the outlook of a bounce as it’s now nearing a backside round $1,800. In accordance with a crypto analyst (@CryptoELlTES ) on social media platform X, Ethereum at $1,800 is the underside.

This outlook relies on this stage, which acted as resistance within the 2022 bear market and is predicted to flip to grow to be assist. One other analyst (Crypto Fella) famous that a reversal at this level “could be superb for alts,” suggesting a attainable broader market restoration for altcoins if Ethereum finds strong footing right here.

Picture From X: @CryptoELlTES

Associated Studying

On the time of writing, Ethereum is buying and selling at $1,803, down by $0.18% and 1.9% up to now 24 hours and 7 days, respectively.

Featured picture from Pexels, chart from TradingView