Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

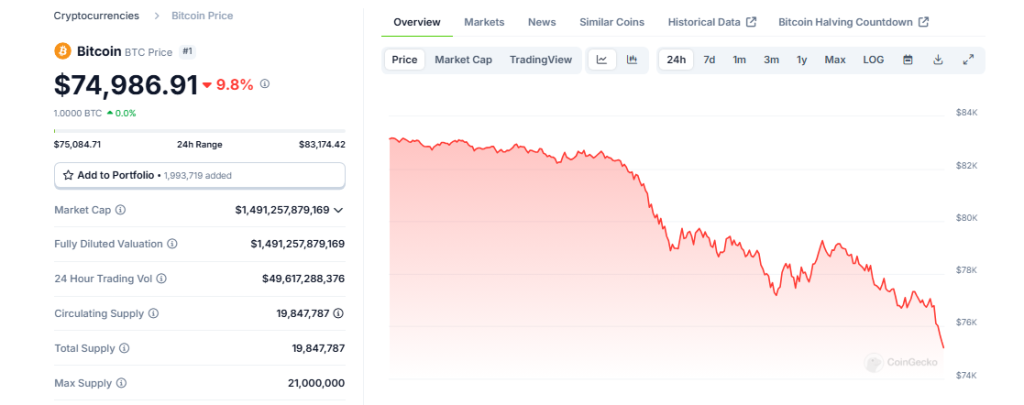

Bitcoin costs fell under $75,000 on Monday, April 7, the bottom since mid-March as traders reacted to US-China commerce relations tensions escalating. The digital foreign money shed about 6% in 24 hours, CoinMarketCap knowledge revealed, as a part of a broader sell-off throughout each crypto and conventional markets.

Associated Studying

US-China Commerce Warfare Triggers Market Panic

The sharp decline comes after US President Donald Trump’s latest imposition of tariff hikes and countermeasures by Beijing. The commerce tensions despatched shockwaves by way of world markets, with Wall Avenue struggling its worst fall because the COVID-19 pandemic. On Friday, April 4, the S&P 500 dropped 6%, the Dow Jones Industrial Common fell 5.5%, and the tech-heavy Nasdaq Composite fell 5.8%.

Market commentator Charles Gasparino cautioned on Twitter that “Monday is shaping as much as be the last word ache day,” and that traders ought to put together for additional promoting stress as markets open this week. That forecast appears to be coming to fruition as Bitcoin is buying and selling between $74,000 and $75,000, far decrease than final week’s ranges.

Breaking: One main market analyst simply advised me “Monday is shaping as much as be the last word ache day.” One other: “Some very nice buys on the market notably in financials.” As they are saying disagreement makes a market! Story creating

— Charles Gasparino (@CGasparino) April 6, 2025

Ethereum And Altcoins Hit More durable Than Bitcoin

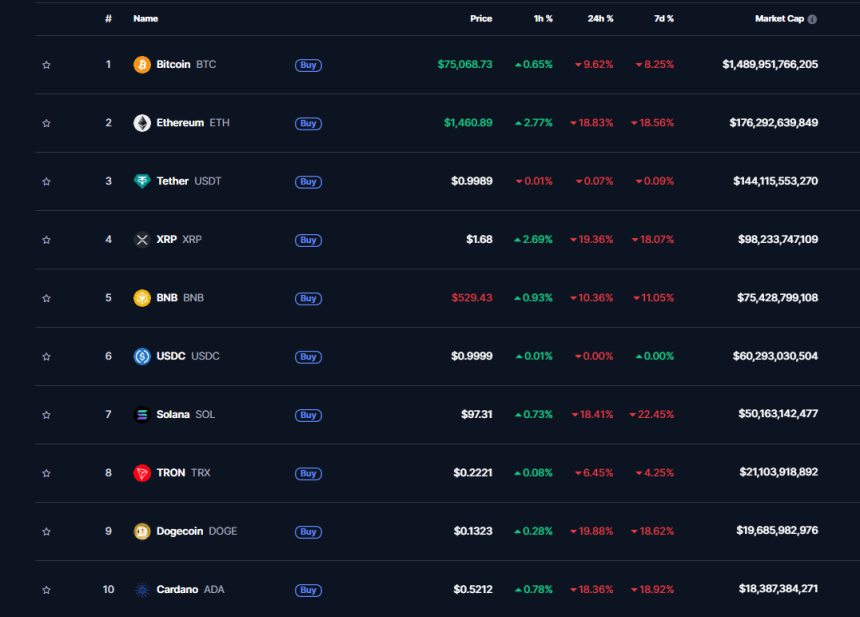

As Bitcoin misplaced closely, different cryptocurrencies plunged even deeper. Ethereum, which is the second-largest cryptocurrency, by market cap, misplaced 13% – greater than double the share drop of Bitcoin. Different well-known altcoins fell arduous as nicely, with SOL and DOGE dropping greater than 10% in in the future. ADA went down by 10.40%, whereas XRP and BNB misplaced 7% and 6%, respectively.

The worldwide cryptocurrency market capitalization is presently at $2.62 trillion as nearly all of prime cash fail to seek out help. Even with the worth decline, Bitcoin’s 24-hour buying and selling quantity jumped to $26 billion – an 80% rise over the previous 24 hours – indicating robust ranges of market exercise throughout the sell-off.

Buyers Flip To Authorities Crypto Reserves For Potential Reduction

There’s a attainable silver lining in market chaos. In keeping with Edul Patel, CEO and co-founder at Mudrex, US authorities companies will disclose their crypto property in the present day. “An enormous affirmation might result in a aid rally,” Patel mentioned.

Associated Studying

Market sentiment stays weak with the Concern and Greed Index inching in direction of what specialists time period “Excessive Concern.” This indicator implies that panicked promoting has been controlling latest market traits as an alternative of sound funding alternative.

In keeping with market observers’ reviews, Bitcoin now has a vital technical take a look at. “Bitcoin should retake the $80,000 stage or it can retest its prior all-time excessive round $74,000,” Patel additional added. This prior all-time excessive, beforehand hailed as a milestone, is now a attainable help stage that merchants want will cease additional value declines.

Featured picture from Gemini Imagen, chart from TradingView