Over the weekend, the cryptocurrency market took a pointy dive, with main belongings struggling important losses. Whereas the downturn has raised considerations, some crypto consultants imagine it might current a possibility for potential future features.

This outlook comes amid widespread fears a couple of potential world recession and escalating commerce wars.

Will the Market Crash Result in a New Class of Crypto Millionaires? Consultants Weigh In

BeInCrypto reported a dramatic plunge within the cryptocurrency market as we speak. The entire market capitalization dropped by $216 billion throughout the previous 24 hours. Bitcoin (BTC) additionally noticed a big decline, falling under the $75,000 mark.

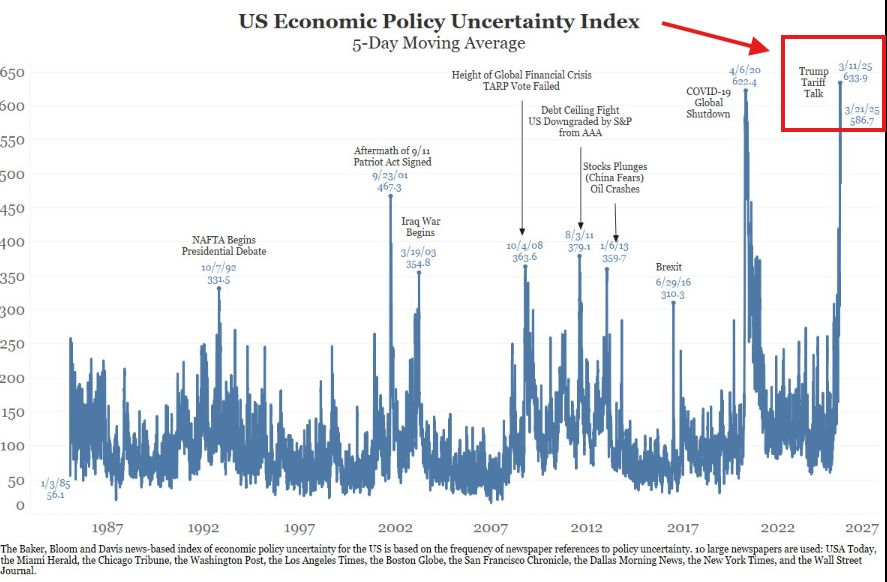

Amidst this, an analyst highlighted that the US Financial Coverage Uncertainty Index has reached an unprecedented excessive. For context, this index measures the extent of uncertainty within the US economic system associated to coverage adjustments.

It combines newspaper mentions of financial uncertainty with knowledge on tax coverage and funds deficits. The next index worth signifies larger uncertainty, which may affect market volatility, investor habits, and financial decision-making.

Notably, it has surpassed ranges seen through the 2008 monetary disaster and the 2020 COVID-19 market crash.

“The market has by no means been extra unsure than it’s proper now. It’s worse than each the nice monetary disaster & the covid crash,” he posted.

The analyst said that trillions of {dollars} have been pulled from the inventory market. Nonetheless, he expressed optimism that a lot of this capital will discover its approach into Bitcoin, presenting a possible alternative for the cryptocurrency.

In the meantime, one other analyst addressed considerations a couple of potential repeat of the 2008 monetary disaster. He famous that such an occasion is very unlikely within the present market. As an alternative, he forecasted a restoration akin to the fast rebound following the 2020 crash.

“Present market crash is trying loads like March 2020. Again then, it was a generational entry level for crypto, and the few who stayed affected person walked away with hundreds of thousands,” he wrote.

Drawing parallels to the 2020 market downturn, he identified that the present market is probably going midway via its correction part. The analyst additionally emphasised that after the 2020 crash, central banks responded by slashing rates of interest and injecting large liquidity into the economic system.

This surge in liquidity performed an important function in pushing shares and danger belongings to new report highs within the subsequent yr.

“If we’re mirroring the 2020 worth motion, which I imagine is probably going, you’ll encounter generational alternatives in crypto. Be affected person and begin paying shut consideration, subsequent weeks and months will probably be decisive. Purchase worry, however don’t rush into it, chances are high it’s nonetheless early,” the analyst defined.

Nonetheless, he careworn that a number of uncertainties stay, together with the length and influence of tariffs, different nations’ responses, and whether or not Bitcoin can decouple from the S&P 500 as a recession hedge.

This angle aligns with one other knowledgeable, who recommended that the current turmoil might pave the best way for a brand new era of crypto millionaires to emerge.

“Keep in mind the COVID crash in 2020. BTC was $3,850, ETH was $100, XRP was at $0.11. And all these initiatives went on to create millionaires over the following few years!” he claimed.

As markets grapple with unprecedented uncertainty, the approaching months will probably decide whether or not this era marks a turning level for a brand new wave of wealth creation or a deeper financial downturn.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.