Binance Analysis printed its report on Trump’s tariffs and the way they may affect the crypto market. It famous that the riskiest investments suffered essentially the most, whereas RWAs and exchanges suffered the least.

Moreover, the perceived threat related to Bitcoin elevated, because of its new correlation with inventory markets. Solely 3% of its polled traders thought of it their most popular asset class within the occasion of a commerce battle.

Binance Analysis Analyzes Tariffs

Binance Analysis, a subsidiary of the world’s largest crypto alternate, has been closely exploring trade developments in 2025. Most lately, it reported vital gaps in newest crypto airdrops and distribution fashions.

As we speak, Binance Analysis produced its latest report, which considerations US tariffs.

President Trump’s proposed tariffs are notably related to Binance, as they’ve had an outsized affect on the crypto market. The report notes that these would be the US’ most stringent tariffs for the reason that Nineteen Thirties, driving fears of stagflation and a world commerce battle.

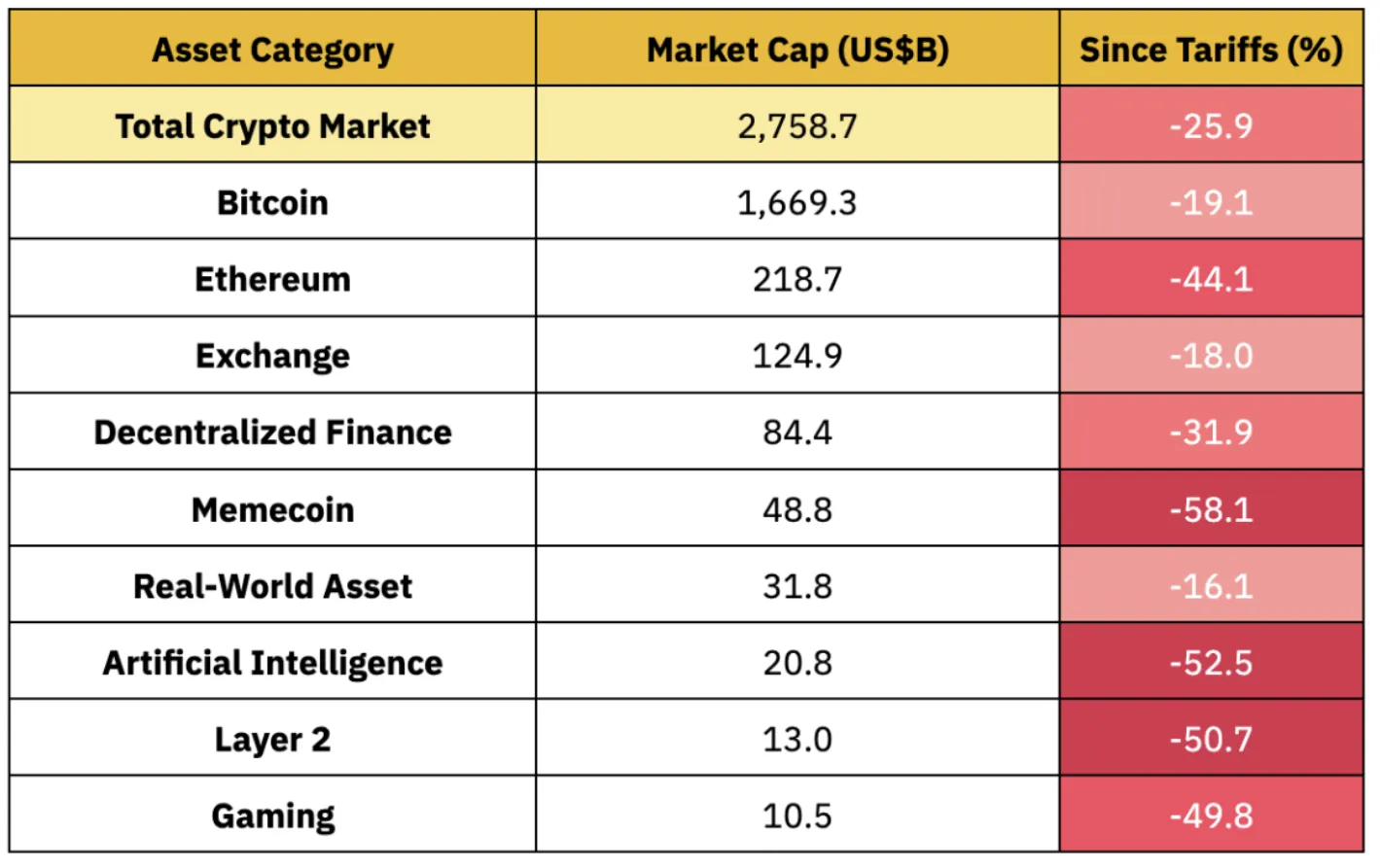

Binance Analysis analyzed completely different crypto-related belongings to find out their dangers:

The claims are backed up by right now’s market strikes. For instance, Ethereum fell to March 2023 ranges, whereas MANTRA’s OM token rose after it introduced a significant RWA fund.

Apparently, RWAs are the crypto market sector that faces the bottom dangers from tariffs. The report notes that essentially the most susceptible sectors are these perceived because the riskiest, comparable to meme cash and AI.

Each the AI tokens and meme cash sectors have dropped greater than 50% for the reason that tariff bulletins, whereas RWA tokens have misplaced solely 16%. Alternate-based tokens solely dipped by 18%.

Binance Analysis additional claims that solely 3% of FMS traders view Bitcoin as their most popular asset class within the occasion of a commerce battle. Though one of the well-liked narratives about Bitcoin is that it may hedge towards inflation, this new correlation could affect that attribute.

“Macroeconomic elements — notably commerce coverage and charge expectations — are more and more driving crypto market habits, quickly eclipsing underlying demand dynamics. Whether or not this correlation construction persists can be key to understanding Bitcoin’s longer-term positioning and diversification worth,” Binance Analysis claimed.

In the end, the report recognized numerous elements that might significantly affect the crypto market. A number of of the opposite elements embrace commerce battle escalation, rising inflation, Federal Reserve coverage, and crypto-specific developments.

“The chance-off response to the reciprocal tariff announcement has seen the S&P 500 lose over $5 trillion in two buying and selling days. Over the previous 44 buying and selling classes, the US inventory market has misplaced over $11 trillion, a determine that accounts for about 38% of your entire nation’s GDP. Trump’s tariff insurance policies have intensified recession fears, with JP Morgan elevating the percentages to 60%,” Fakhul Miah, the Managing Director GoMining Institutional advised BeInCrypto.

Total, the important thing takeaway is that many variables are in play proper now, however it’s nonetheless very doable to select a secure possibility regardless of this chaos. Blockchain tasks pushed by utility and long-term improvement appear to be the most secure possibility within the present risky ecosystem.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.