- TRX and XRP keep sturdy: Over 80% of Tron and Ripple holders stay in revenue, making them a number of the most resilient belongings regardless of latest market dips.

- ETH and SOL wrestle laborious: Ethereum and Solana have seen steep profitability drops, with solely 44.9% and 31.6% of holders in revenue, respectively, signaling deep losses.

- Bitcoin, TON, and DOGE hover within the center: Bitcoin and Toncoin keep strong profitability, whereas Dogecoin is on the sting, with simply 50.8% of its provide nonetheless within the inexperienced.

So, whereas the crypto markets are nonetheless driving out the aftershocks of latest turmoil, on-chain information from Glassnode simply dropped an attention-grabbing nugget: some tokens are holding up method higher than others with regards to profitability.

Let’s break it down—as a result of the numbers are kinda wild.

TRX & XRP: Holders Nonetheless Laughing (Kinda)

On the high of the heap? Tron (TRX). Yup, by some means nonetheless holding sturdy with 84.6% of its provide sitting in revenue. That’s solely a 5.6-point dip year-to-date. Not too shabby.

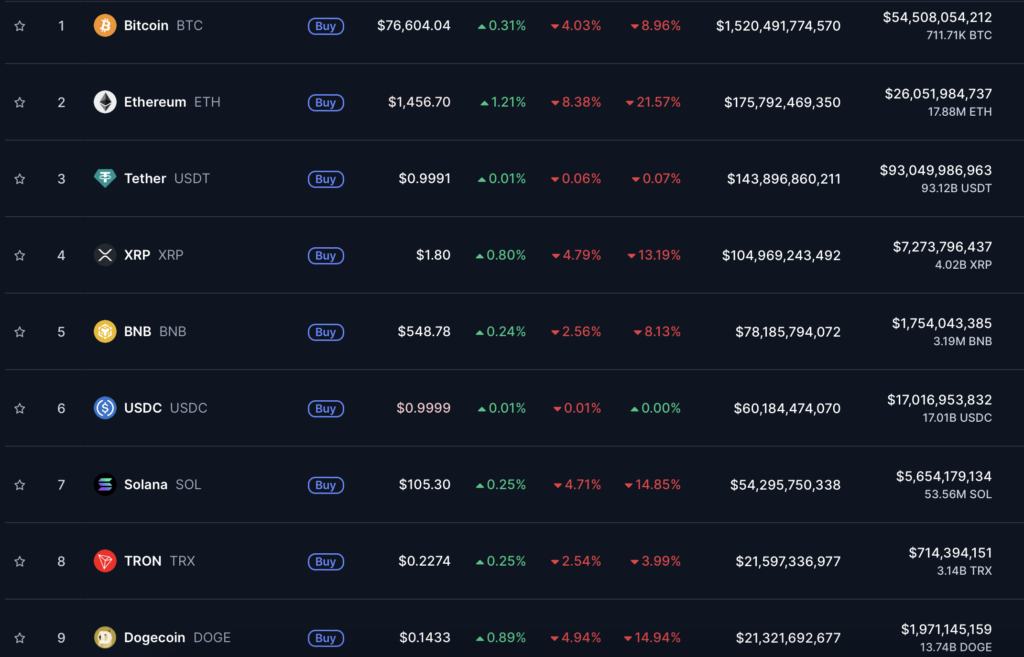

TRX is buying and selling round $0.2349, up 4% prior to now 24 hours. It simply pushed above its 20-day EMA at $0.2334, which normally indicators constructive short-term momentum. And hey, it’s nonetheless not far off from its all-time excessive of $0.44, hit simply 4 months in the past.

Proper behind it’s XRP, with 81.6% of its provide in revenue. Certain, it’s down 10.4 factors YTD, however that’s nonetheless strong in comparison with the broader massacre. XRP is hovering close to $1.87 after a pleasant 7.28% pop.

The catch? It must reclaim $2 after which break above resistance at $2.13 if it desires to make an actual transfer increased. Nonetheless, not a nasty spot to be.

ETH & SOL: Yikes. Simply… Yikes.

Ethereum (ETH), not so fortunate. Solely 44.9% of ETH holders are nonetheless in revenue—a drop of just about 40 proportion factors for the reason that 12 months started.

Even after a gentle 5% rebound prior to now day, ETH remains to be down practically 30% for the month and sitting over 50% underits all-time excessive of $4,878. And let’s not overlook—it hasn’t made a brand new excessive this cycle. Not as soon as.

Oh, and simply so as to add just a little drama, a dormant whale—an Ethereum OG, apparently—simply moved 2,000 ETH ($3.11 million) to Kraken after seven years of sitting on it. Make of that what you’ll.

Solana (SOL)? Even rougher. Solely 31.6% of SOL’s provide is worthwhile proper now, down practically 47 factors YTD. Regardless of a pleasant little bounce to $107 (up 7.7% in the present day), it’s nonetheless dealing with robust resistance on the $122 zone. Loads of holders nonetheless very a lot underwater.

The In-Between Crew: BTC, TON, ONDO & DOGE

Not the whole lot’s black or white, although. Some main cash are hanging out someplace within the center.

Bitcoin (BTC), for instance, nonetheless has 76.8% of its provide in revenue—even after slipping practically 12 factors YTD. It briefly popped above $80K (because of some faux information about Trump delaying tariffs), however has since pulled again to round $78,923.

Toncoin (TON) and Ondo (ONDO) are each holding up pretty nicely, with 76.7% and 74.3% of their provides in revenue, respectively. TON’s buying and selling round $3.11, and ONDO simply bounced 6.7% in the present day to $0.7478.

Dogecoin (DOGE), in the meantime, is straddling the road. Proper now, 50.8% of its provide is worthwhile, down 32.3 factors this 12 months. It’s buying and selling at about $0.1504 after an honest 7.5% bounce.

However right here’s the twist: some analysts suppose DOGE could be headed for a breakdown to $0.06 if it fails to carry this momentum. That might be a steep drop, clearly—however with meme cash, nothing’s ever actually off the desk.