Welcome to the US Morning Briefing—your important rundown of a very powerful developments in crypto for the day forward.

Seize a espresso to see the place Bitcoin could also be headed subsequent, forward of at this time’s launch of the Federal Reserve’s March FOMC assembly, how world commerce tensions are rippling via crypto markets, why recession fears are climbing, and what Wall Avenue and Washington are doing behind the scenes. We’ve additionally received ETF flows, mining dangers, whale habits, and the chart that’s received everybody speaking.

FOMC, Commerce Tensions, and Bitcoin: Key Market Ranges to Watch

With world markets on edge forward of at this time’s 2 p.m. ET launch of the FOMC minutes, merchants shall be carefully waiting for indicators of potential emergency price cuts in Q2, updates on US commerce negotiations, and any alerts that would trace at easing monetary situations.

In the meantime, geopolitical danger is intensifying because the Russia-Ukraine battle takes a brand new flip with stories of captured Chinese language POWs, elevating fears of a broader battle.

Amid this backdrop, Bitcoin continues to check vital help ranges, and analysts are parsing technical alerts to foretell what may occur subsequent.

BRN Analyst Darren Chu, talking solely to BeInCrypto US Morning Briefing, shared an in-depth view of the present macro and crypto ecosystem forward of at this time’s launch of US FOMC assembly minutes from March:

“Dangerous property try to mount a brief overlaying rebound within the Wednesday Asia afternoon (going into the London open) forward of at this time’s extremely anticipated FOMC at 2pm EST. Anticipation is rising for an emergency Fed price lower together with optimistic developments over US buying and selling companions coming to an settlement with the Trump administration on lifting their tariffs and commerce limitations.

US earnings releasing this week in the meantime are taking part in second fiddle to the worldwide macro, geopolitical backdrop, with the Russia-Ukraine battle additional sophisticated by yesterday’s revelation that Chinese language POWs have been captured (which suggests a possible widening of the battle versus a hopes for a ceasefire and peace treaty this 12 months).

Returning to tariffs, China’s countermeasures in response to the US’ escalation have weighed on market sentiment, with expectations rising for a foreign money battle as depreciation pressures weigh on the Yuan, which may lead different Asian regional exporters to following go well with in weakening their currencies.”

On Bitcoin’s value motion, Chu highlighted vital ranges and potential situations following the FOMC:

“By shortly after the FOMC, to the aid of bulls or these taking part in a short-term bounce, BTCUSD ought to be approaching tentative help across the 38.2% Fib retrace of the large December 2022 to January 2025 bull market coinciding roughly with the highs of March and June 2024.

Whatever the quick overlaying which will start within the subsequent day or so, BTCUSD seems to wish to slide additional to an uptrend help connecting the October 2023, August 2024 and September 2024 lows (on the weekly chart) by Could someday.

A base, conservative situation by 12 months finish is for BTCUSD to check the 50% Fib retrace of the late 2022–early 2025 bull market (coinciding roughly with the peaks of April and November 2021).

There’s a medium to low chance for now of testing throughout the identical interval, the 61.8% Fib at simply above the 2024 low of psychologically key 50,000 entire determine degree.”

In keeping with Chu, Odds are rising for a short-term useless cat bounce—a short rebound in a bigger downtrend—to start out at this time at 2 pm EST with the FOMC minutes or later this week with CPI, PPI, and sentiment knowledge.

This bounce may align with a Fibonacci retracement, the place costs briefly transfer as much as key ranges (e.g., 38.2%, 50%, 61.8%) earlier than persevering with the downtrend.

“BTCUSD is now nearing the 61.8% Fib retrace of final August to February’s Bull Market extension, which it may slide to within the day or so following the FOMC.” Chu advised BeInCrypto.

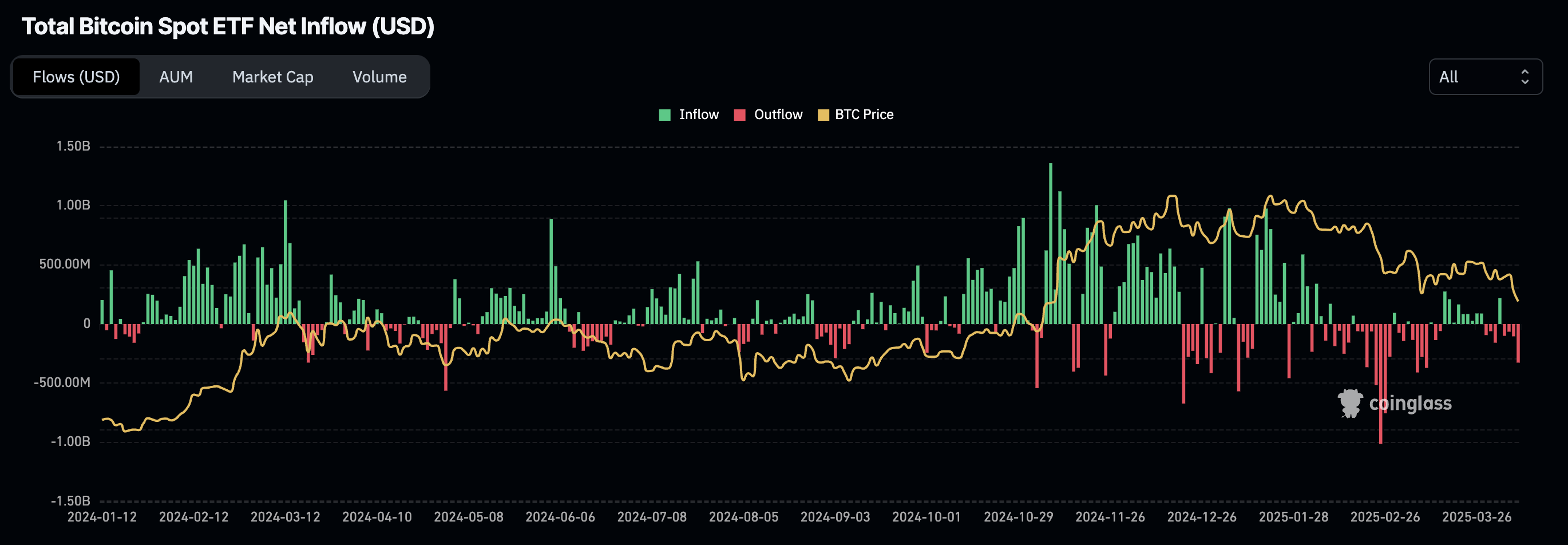

Crypto Chart of the Day

Bitcoin Spot ETFs had the largest day by day outflows ($326 million) since March 11.

Byte-Sized Alpha

– Goldman Sachs now sees a forty five% likelihood of a US recession in 2025 however is doubling down on Bitcoin, holding $1.5 billion by way of ETFs.

– Analyst Ben Sigman says rising commerce battle tensions may gasoline Bitcoin’s development as traders flip to scarce, inflation-hedging property exterior conventional monetary methods.

– As tariffs rattle world markets, crypto whales break up—some dumping property amid panic, others quietly shopping for in anticipation of a rebound.

– Analysts warn the Fed could also be quietly injecting liquidity as RRP balances plunge, elevating fears of stealth QE amid rising commerce tensions and a $500 billion Bitcoin market hit.

– Bitcoin ETFs confronted $326 million in outflows—the most important since March—as institutional traders pulled again, led by BlackRock’s $252 million exit and rising demand for bearish put choices.

– Trump’s new tariffs threaten US Bitcoin mining dominance by driving up gear prices, doubtlessly shrinking America’s 36% share of the worldwide hashrate.

Crypto shares tumbled as Trump’s 104% China tariffs kicked in, triggering $300 million in liquidations, however rising Bitcoin lengthy positions trace at hopes for a rebound.

– The US DOJ will not pursue crypto exchanges and wallets for person actions, sparking debate over decreased oversight and potential dangers of enabling illicit exercise.

Disclaimer

In keeping with the Belief Venture tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.