A broadly adopted crypto analyst is figuring out the place Bitcoin (BTC) could discover a backside amid market turmoil brought on by US President Donald Trump’s tariffs.

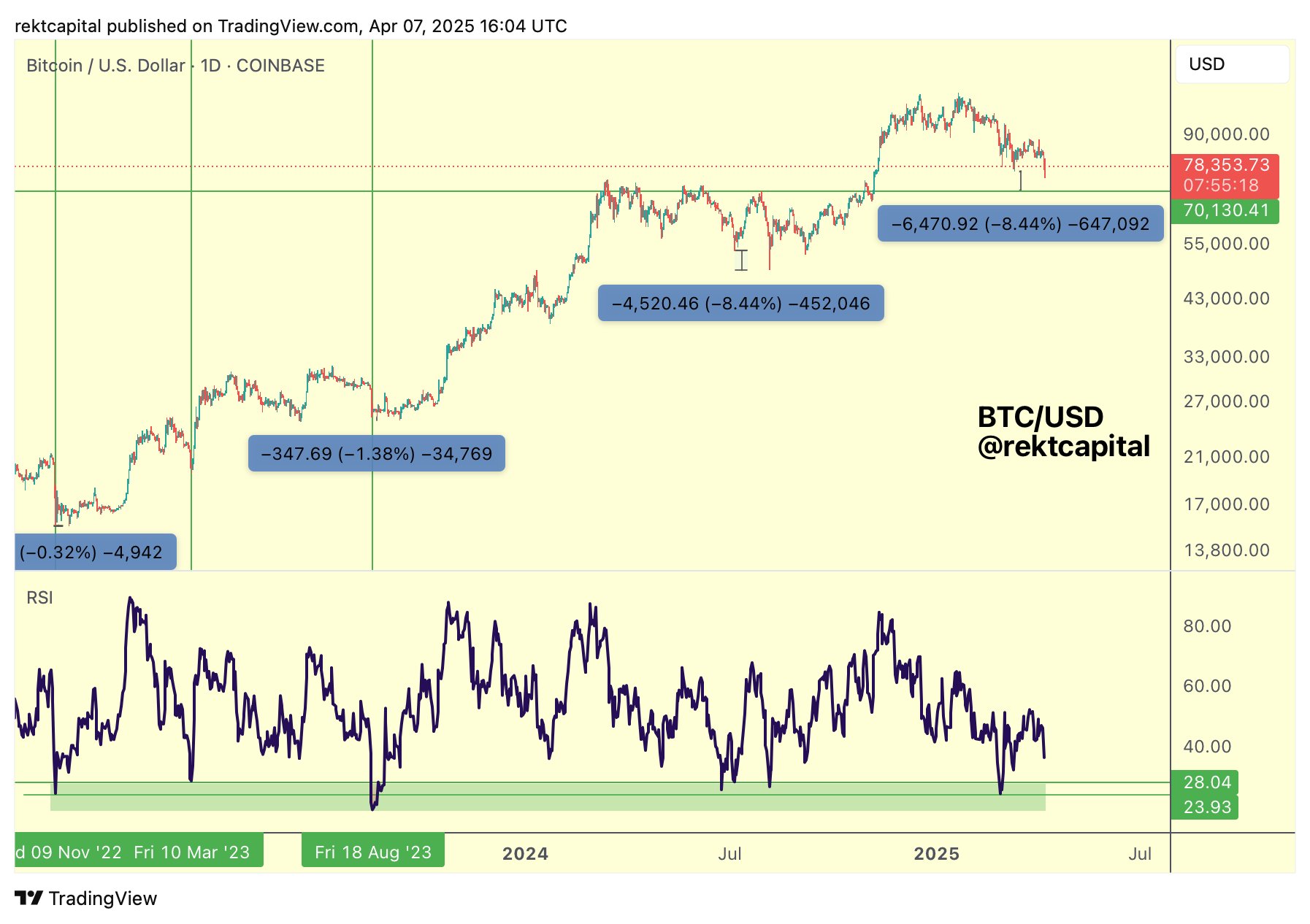

Crypto strategist Rekt Capital tells his 542,6000 followers on the social media platform X that the Relative Power Index (RSI) – a technical indicator that alerts when an asset’s momentum is because of reverse course – suggests Bitcoin could maintain $70,000 as assist.

Says Rekt,

“Every time Bitcoin’s Each day RSI crashed into the sub-28 RSI ranges that wouldn’t essentially mark out the value backside. In truth, traditionally, the precise value backside can be -0.32% to -8.44% decrease than the value when the RSI first bottomed. Bitcoin is presently forming its second low -2.79% beneath the primary low. A repeat of -8.44% beneath the primary low would see value backside at ~$70,000.”

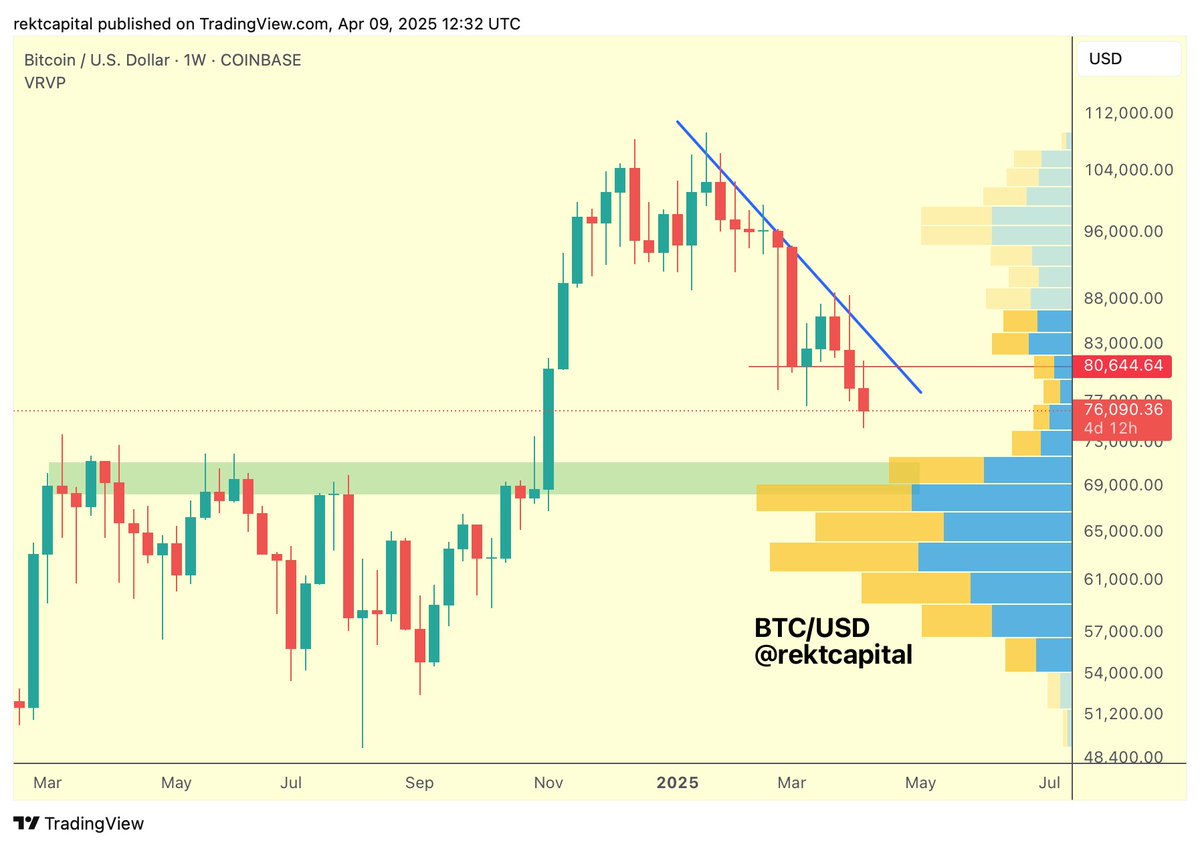

The analyst additionally says that the primary indicators of a potential bullish reversal for Bitcoin can be when the flagship crypto asset breaks and holds resistance at $78,550.

“Bitcoin has didn’t retest the purple $78,550 March lows and it’s potential these lows could determine as new resistance sooner or later. For value to undertake bullish bias, it will must reclaim these lows as assist to then problem the downtrend (inexperienced).”

The analyst additionally notes that Bitcoin has entered a buying and selling quantity hole on the weekly chart round $70,000, additional suggesting that BTC must retest that stage.

“Bitcoin is experiencing draw back continuation after upside wicking into the early March weekly lows (purple). Having confirmed this purple stage as new resistance, BTC is now dropping into the $71,000-$83,000 quantity hole to fill this market inefficiency.”

Bitcoin is buying and selling for $77,500 at time of writing, down 1% within the final 24 hours.

Comply with us on X, Fb and Telegram

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Test Worth Motion

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl aren’t funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal threat, and any losses you might incur are your accountability. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Each day Hodl an funding advisor. Please notice that The Each day Hodl participates in internet affiliate marketing.

Generated Picture: Midjourney