- ETH’s value tapped its realized value, elevating hopes of a possible backside.

- Weak demand for spot ETH ETFs and flat community development may derail such an final result

Ethereum’s [ETH] value is within the information after it tagged a key stage that flagged earlier long-term market bottoms, elevating hopes of potential reversal for the altcoin.

In keeping with CryptoQuant analyst Kriptolik, ETH dropped beneath its ‘realized value,’ the common value foundation for many consumers. This stage typically marks a possible market shift. The analyst claimed,

“These durations have persistently been adopted by robust recoveries — making them strategic accumulation factors for long-term buyers.”

Supply: CryptoQuant

The hooked up chart additionally revealed that the realized value noticed market rebounds in 2018-2020.

Nonetheless, the extent may additionally act as a resistance within the brief time period when ETH’s value drops beneath it. In such a case, the analyst warned {that a} hike in panic promoting of ETH could possibly be seemingly within the close to time period.

What’s subsequent for ETH?

Even so, U.S shares and crypto, together with ETH, have reacted like risk-on property to Trump tariff updates. As such, a possible backside could possibly be accelerated solely via a constructive macro shift.

In reality, even institutional buyers exited the altcoin for six consecutive weeks, as proven by the constant outflows from U.S spot ETH ETFs.

Supply: Soso Worth

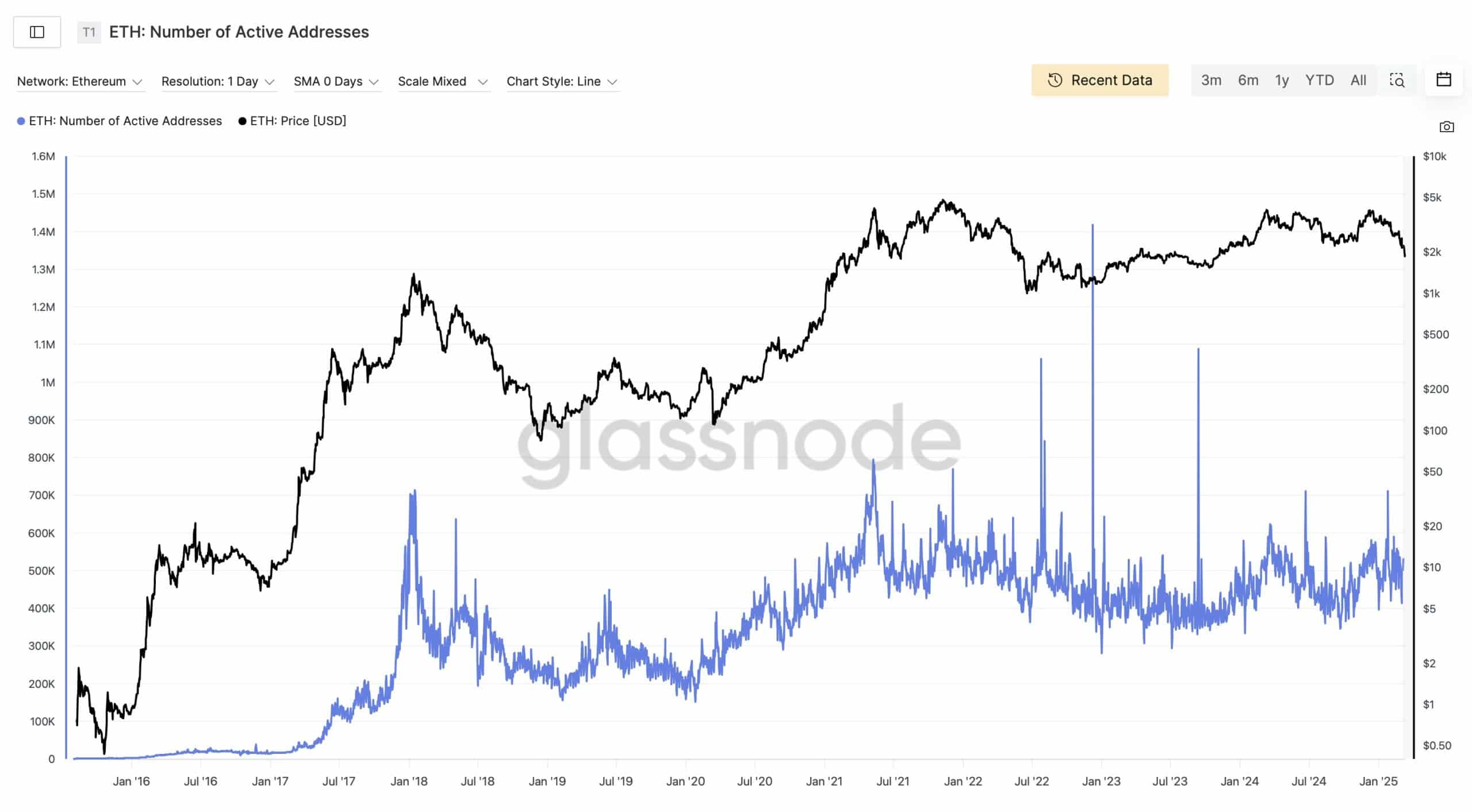

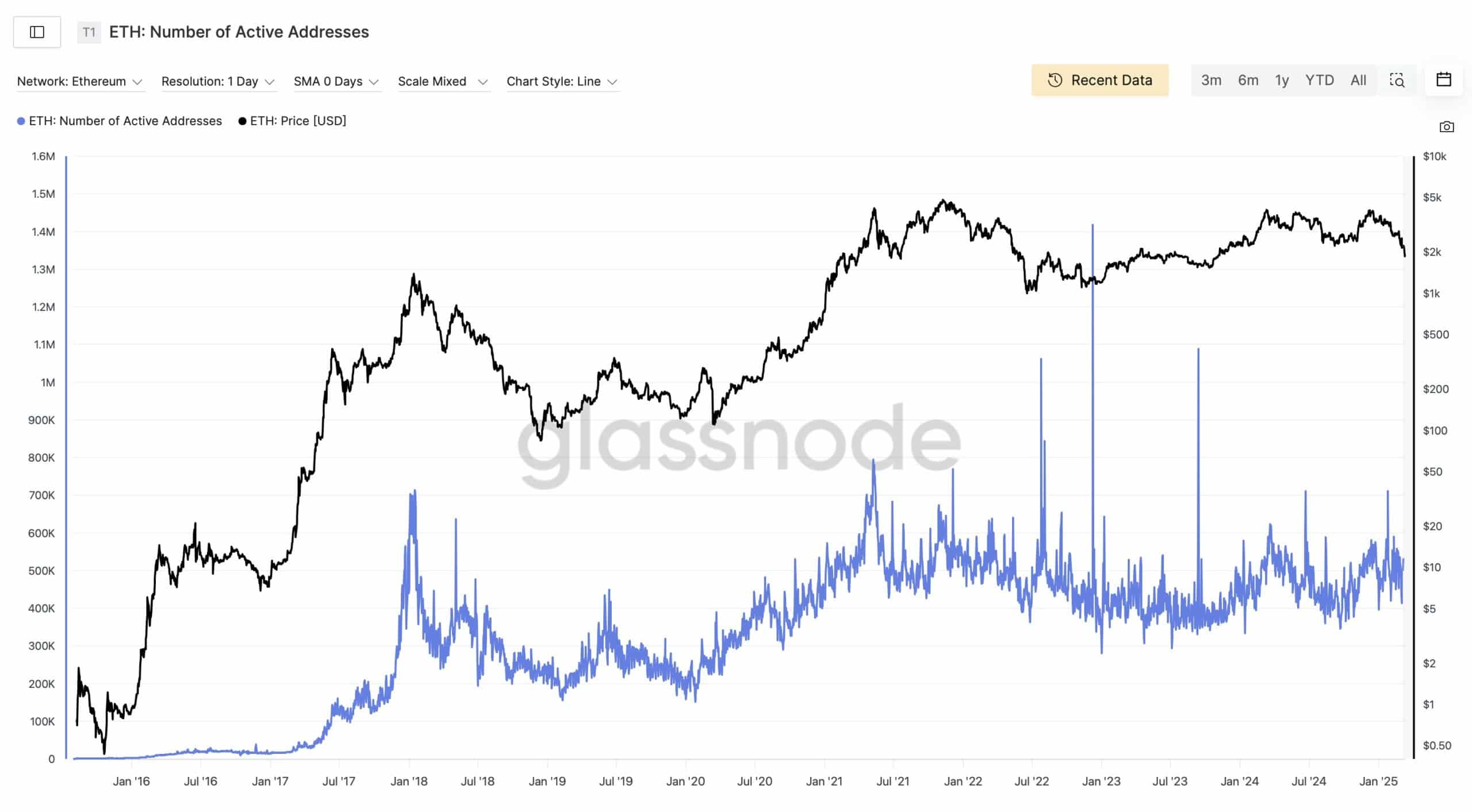

One other cautious information level, in response to analyst Stacy Muur, is stagnant energetic customers. She famous that Ethereum energetic addresses have been flat for 4 years.

Though some critics have argued that customers migrated to L2s, stagnant community development may cap ETH’s restoration prospects.

Supply: Glassnode

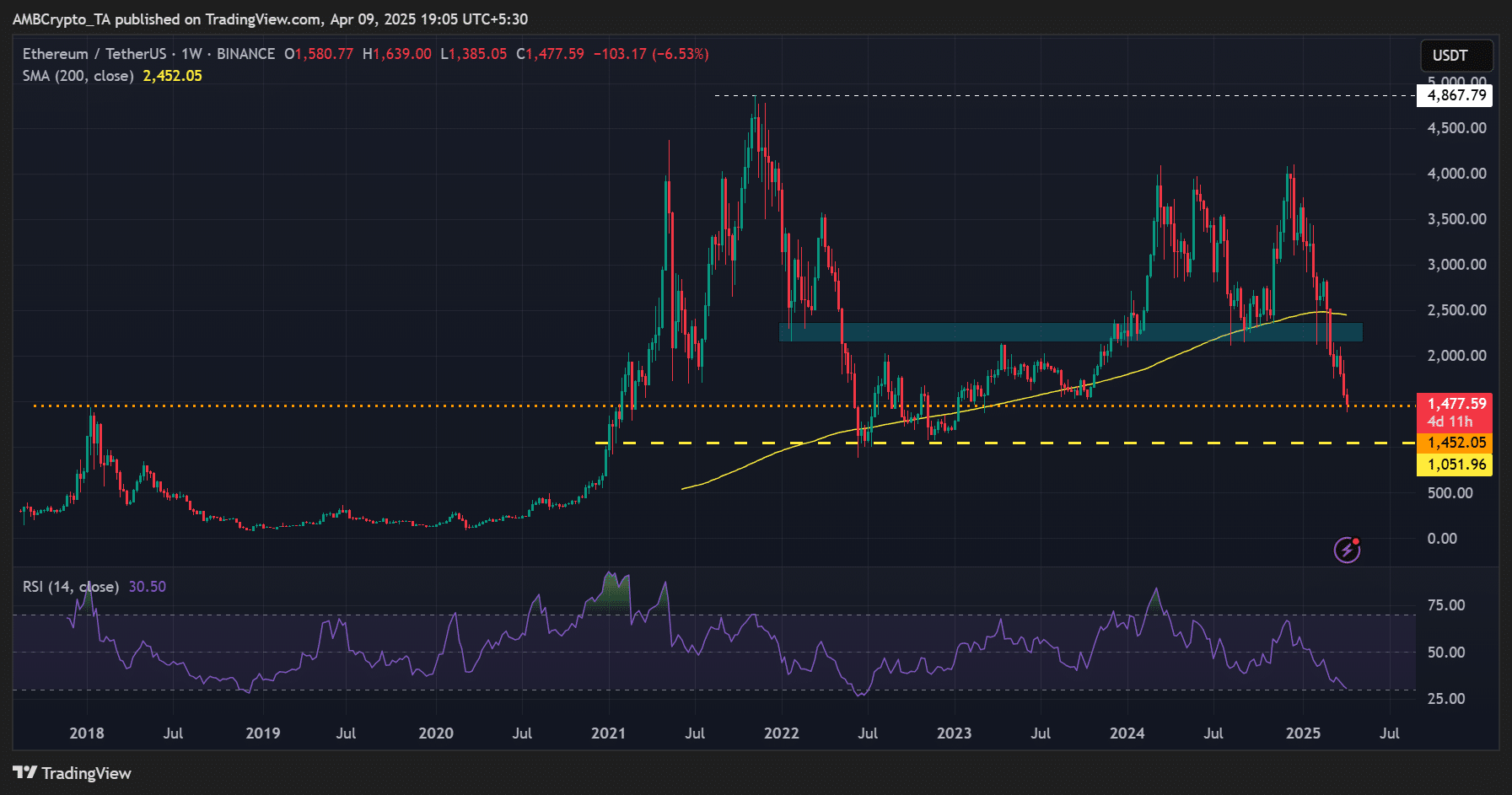

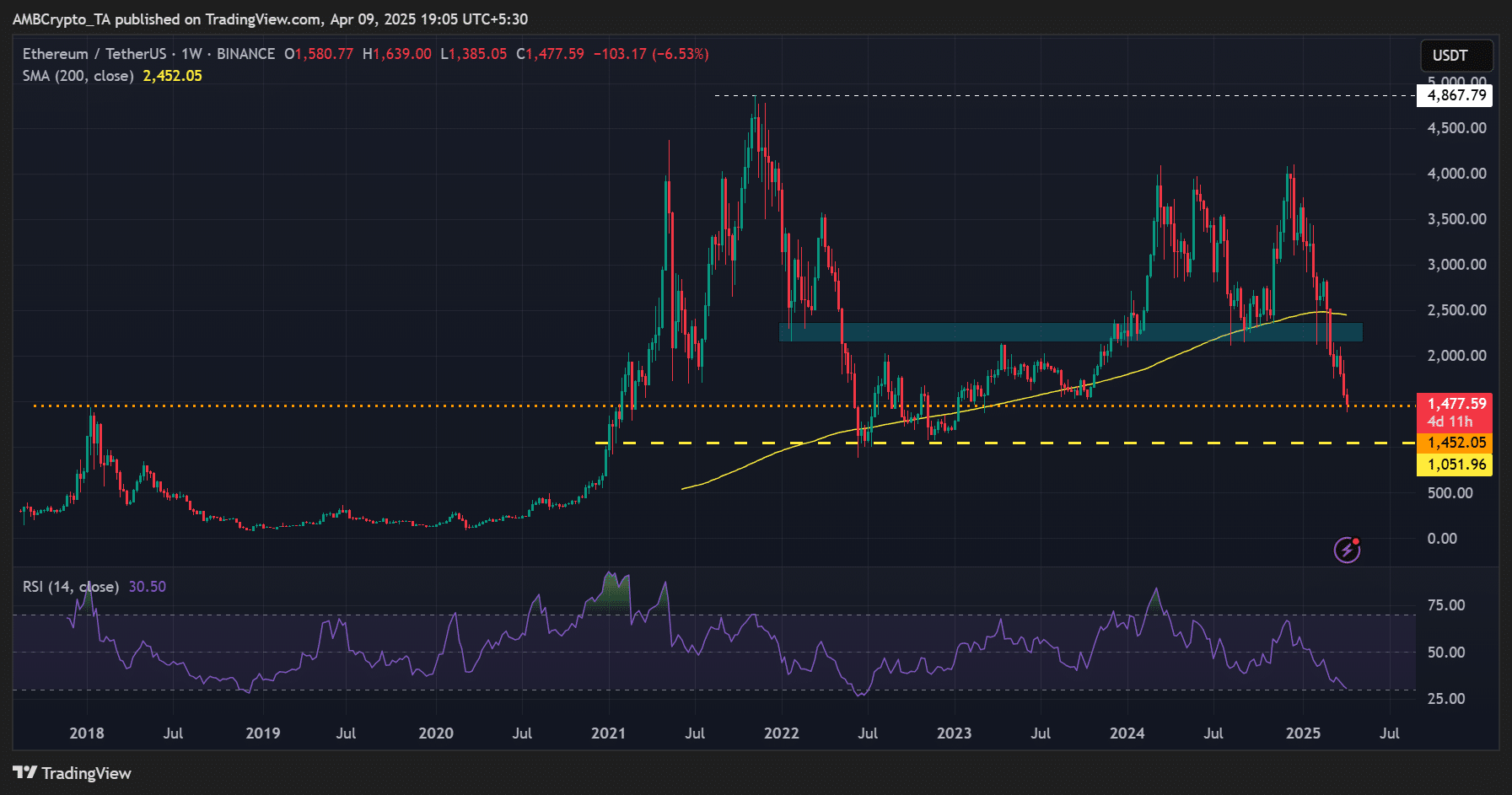

From a value chart perspective, ETH dropped to a two-year low beneath $1.5k. In reality, it was down 64% from its press time cycle peak of $4k.

With ongoing macro uncertainty, an prolonged decline to $1k can’t be overruled within the brief time period.

Supply: ETH/USDT, TradingView

Merely put, the altcoin hit a pivotal level, particularly when tracked from a realized value perspective.

Nonetheless, the macro entrance at present dominates market course and will delay a possible ETH rebound if the uncertainty persists within the brief time period. Apart from, as revealed by a 7-week streak of ETH ETF outflows, the weak demand didn’t paint a powerful restoration outlook.