- SEC greenlighted choice buying and selling for BlackRock, Constancy, and Bitwise spot ETH ETFs.

- The company may approve staking on the merchandise as quickly as Could or August, famous a Bloomberg analyst.

The U.S. Securities and Trade Fee (SEC) has accredited choices buying and selling for spot Ethereum [ETH] ETFs. The company greenlighted choices buying and selling for BlackRock’s ETHA, Bitwise’s BITW, and Constancy’s FETH.

Based on Nate Geraci of ETF Retailer, the replace may appeal to extra ETH investments. He famous,

“SEC has accredited choices buying and selling on spot eth ETFs…Like with BTC ETFs, anticipate to see a bunch of recent launches from issuers.Coated name technique ETH ETFs, buffer ETH ETFs, and so forth.”

Assessing ETH value influence

Regardless of the optimistic replace, nevertheless, Bloomberg analyst James Seyffart acknowledged that the result was ‘100% anticipated’ as a result of it was the deadline for the SEC choice. Merely put, ETH had priced within the consequence.

However he added that staking on the merchandise might be accredited by early Could or August, regardless of their October deadline.

“Its potential they might be accredited for staking early, however the ultimate deadline is on the finish of October.”

Most specialists anticipated staking approval to influence ETH demand and worth extra, particularly from institutional buyers in search of the additional 3% annual yield.

In actual fact, some analysts believed that the dearth of staking was partly accountable for spot ETH ETF’s lukewarm efficiency in comparison with BTC ETFs.

Since their debut, the merchandise have logged $2.3B in cumulative inflows. Nevertheless, spot BTC ETFs recorded $35B in whole inflows — that’s 17x time outperformance by BTC ETFs.

That stated, ETH jumped +10% from $1400 to $1600 on the ninth of April. This adopted President Donald Trump’s 90-day pause on numerous tariffs. Therefore, the choices’ approval wasn’t a key catalyst for the worth upswing.

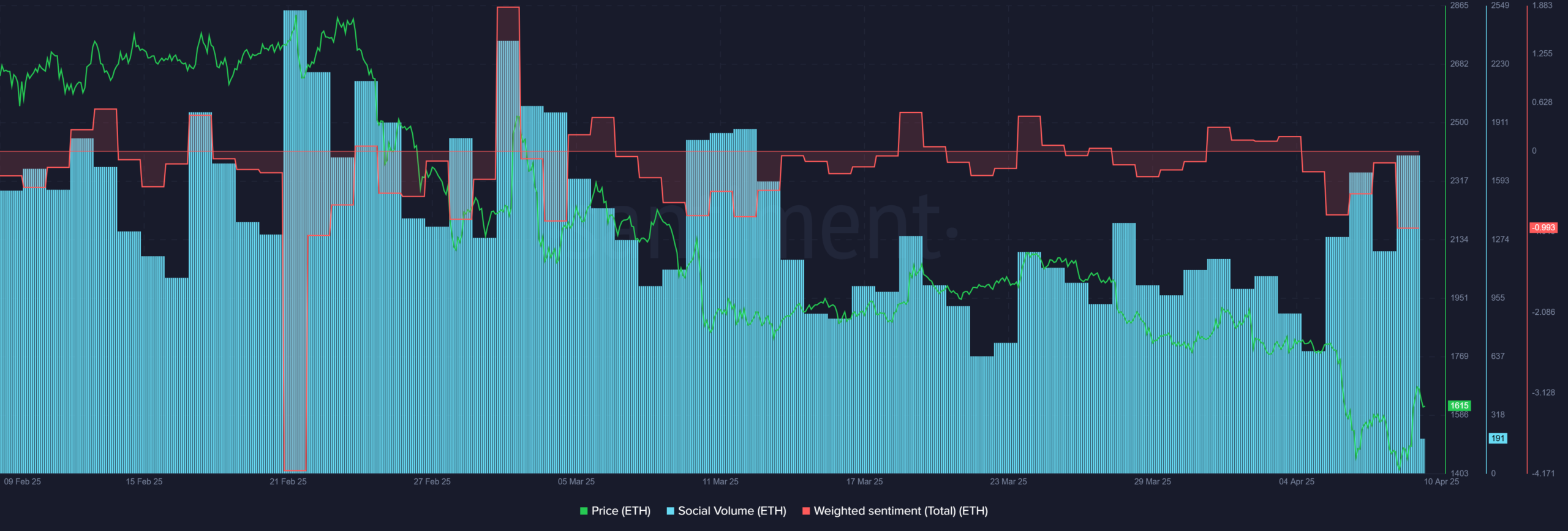

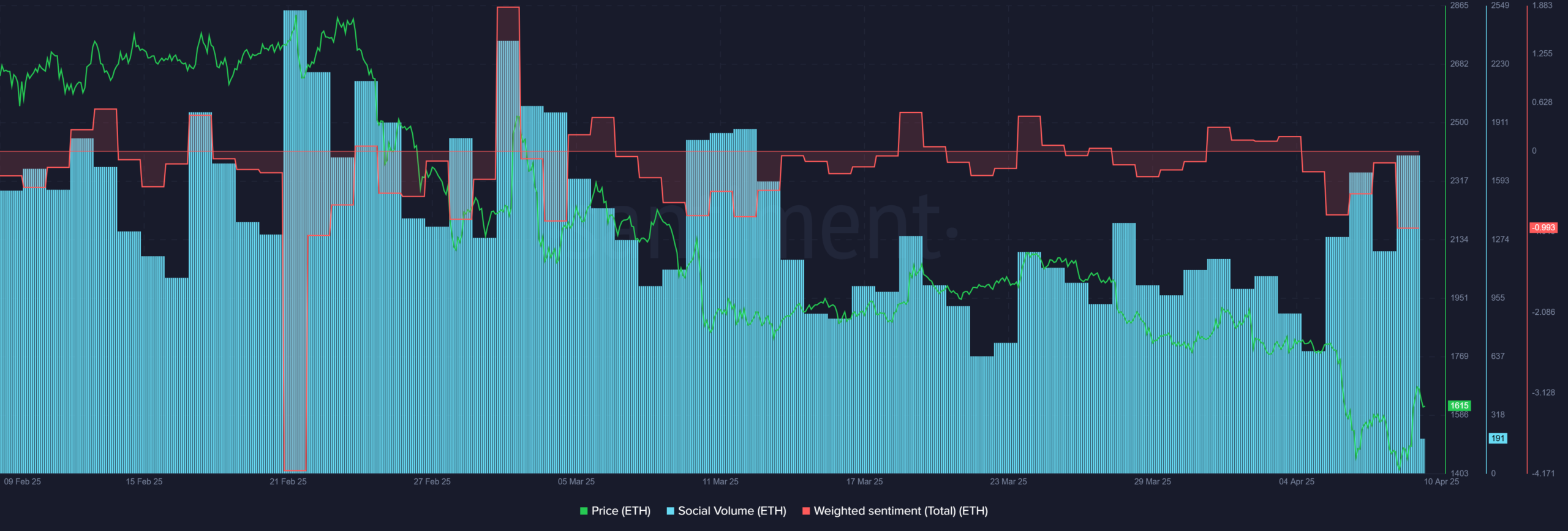

Even so, there was a notable spike in market curiosity for the altcoin, as revealed by the brand new excessive in April’s Social Quantity.

Supply: Santiment

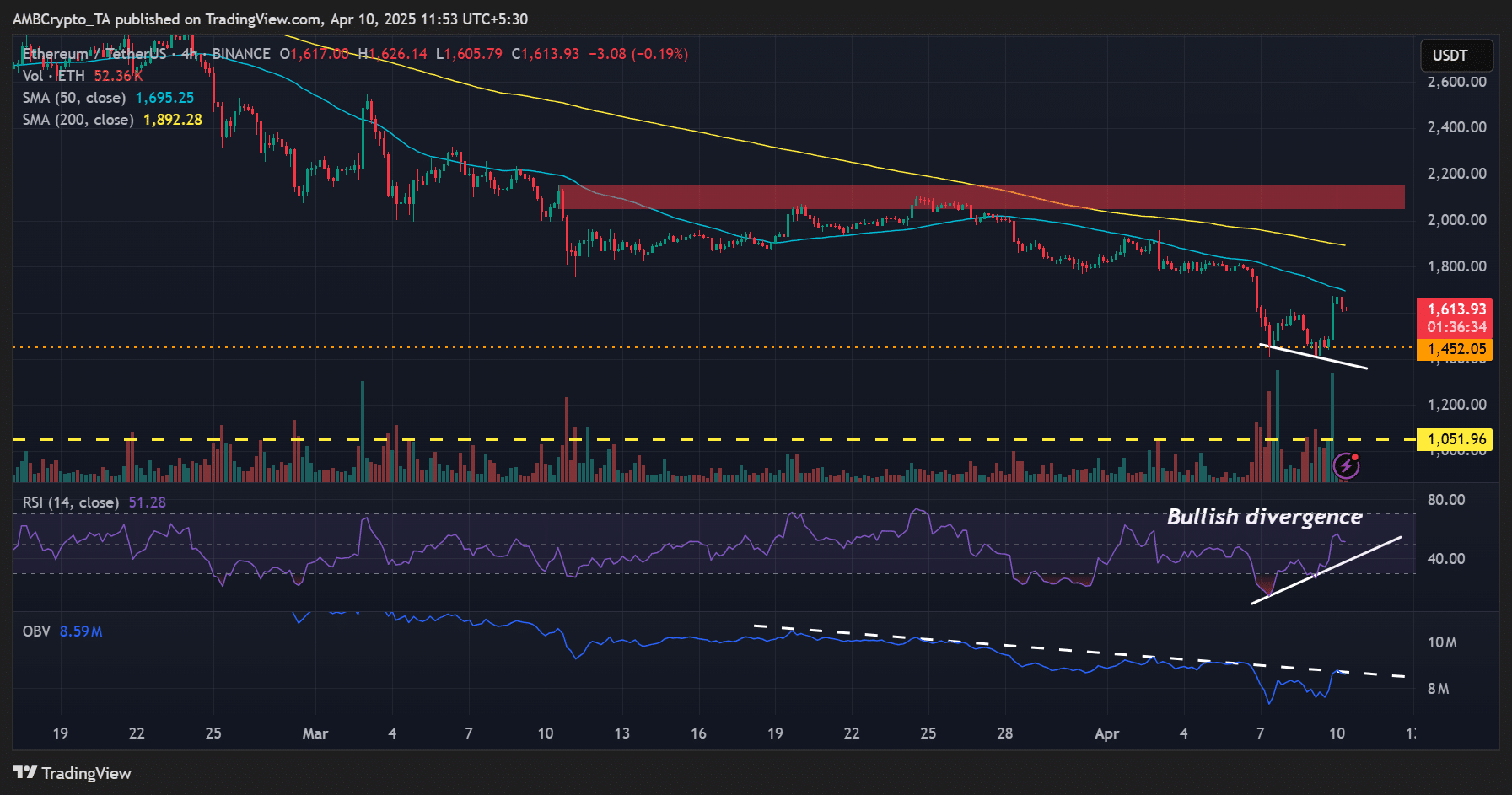

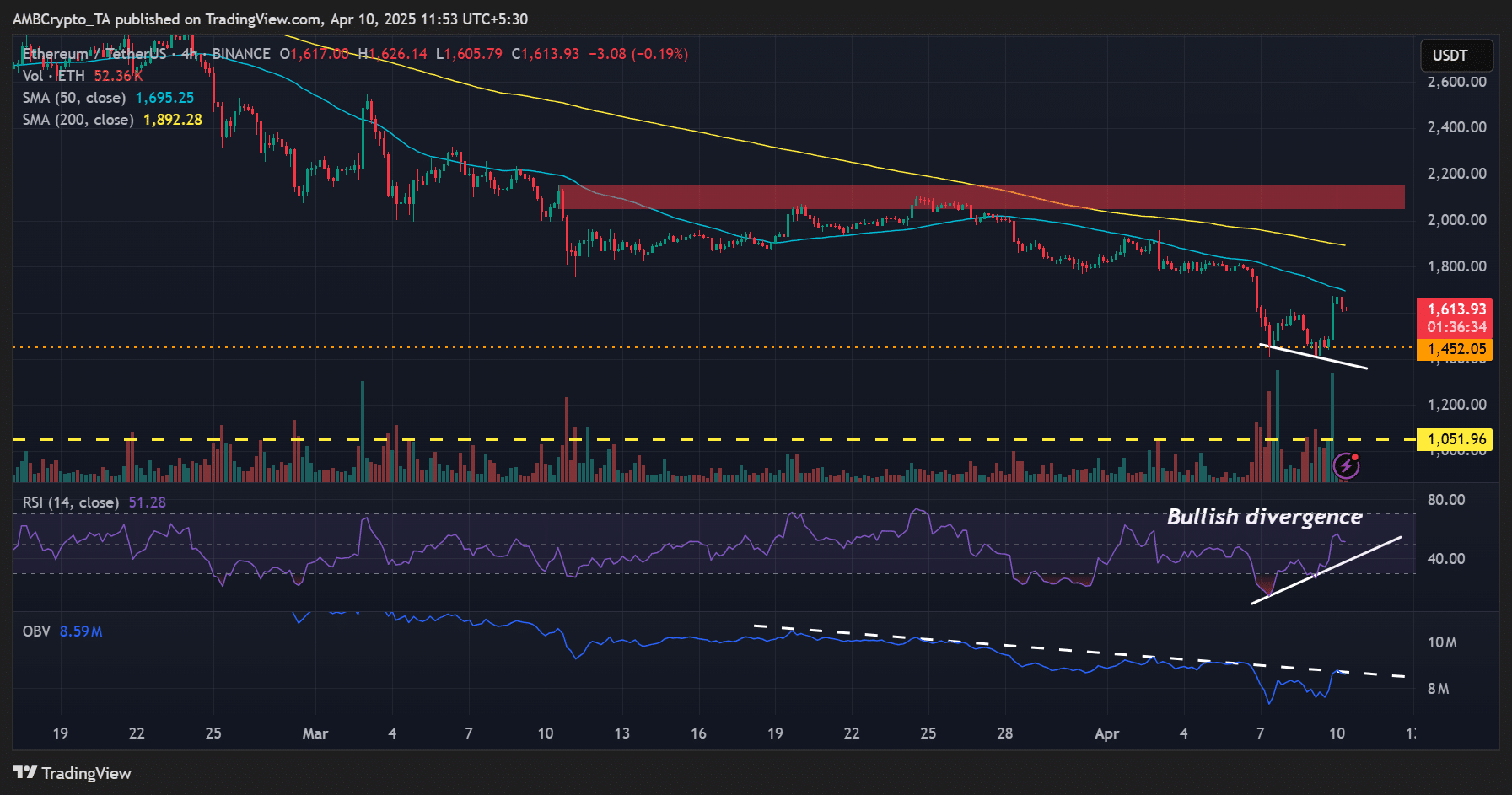

However the sentiment was nonetheless destructive to drive a sustainable restoration for ETH. On the 4-hour value chart, ETH had a bullish RSI divergence, which may sign {that a} seemingly restoration was in sight.

Nevertheless, the momentum may solely be confirmed if the On Steadiness Quantity (OBV) cleared the overhead hurdle (trendline resistance).

Supply: ETH/USDT, TradingView

In conclusion, ETH value may stall close to 50EMA ($1600) within the quick time period, prefer it did prior to now few days.

Nevertheless, a decisive transfer and improved buying and selling quantity above the hurdle may push it increased. However the long-term restoration would possibly hinge on a optimistic macro shift and sure ETH ETF staking approval.