- U.S. shares plunged Thursday after the White Home revealed China tariffs had jumped to 145%, sparking investor panic.

- Trump’s 90-day pause on tariffs for many international locations gave temporary aid, however China’s exclusion rattled markets and triggered retaliation.

- Regardless of U.S. losses, world markets in Asia and Europe rallied on hopes of eased commerce tensions and paused EU tariffs.

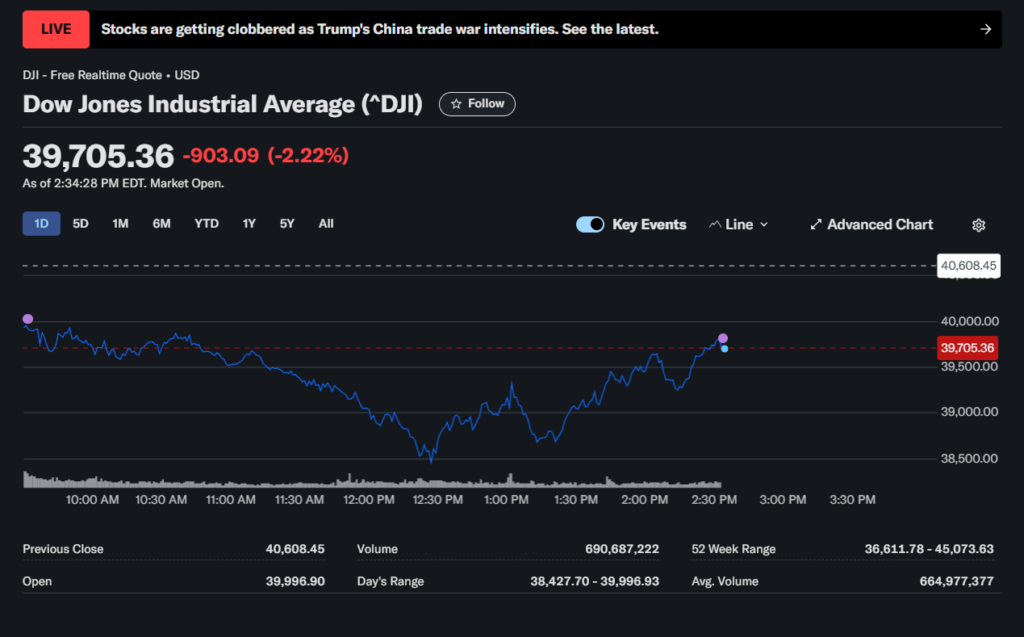

U.S. shares took a pointy nosedive Thursday, erasing practically half of yesterday’s wild rally. Buyers have been left reeling after the White Home revealed tariffs on Chinese language items had really been pushed to a whopping 145%—larger than the 125% most have been bracing for.

That information didn’t sit effectively with Wall Avenue. By mid-afternoon, the Dow Jones tanked 1,790 factors (that’s 4.4%), the S&P 500 misplaced 5.2%, and the Nasdaq crumbled 6.2%.

It wasn’t simply the indexes—big-name shares acquired slammed too. Nike plunged 10% as traders fearful about provide chain disruptions. Tesla dropped 9%, and chipmaker Nvidia fell 8%. In the meantime, just a few stayed afloat—AT&T and Verizon inched up round 0.5%.

The market’s stumble got here simply hours after Trump had tried to chill tensions by hitting pause on a lot of the new tariffs—for everybody besides China. The 90-day suspension helped spark a monster rally Wednesday, however these positive factors didn’t final lengthy.

China, unsurprisingly, fired again. Officers in Beijing accused the U.S. of “weaponizing tariffs,” and even threatened to dam Hollywood movies as a part of its retaliation. International Ministry spokesman Lin Jian referred to as the transfer an act of “egocentric stress.”

A Story of Two Markets

It was a stark distinction from only a day earlier when the Nasdaq posted a file 12.1% single-day surge, and the Dow soared practically 8%—a five-year excessive. However the temper flipped quick as the actual numbers behind the tariff hike trickled out.

Curiously, Asian markets didn’t appear too rattled—no less than not immediately. Japan’s Nikkei closed up 9.1%, South Korea’s Kospi added 6.6%, and Taiwan’s Taiex jumped a whopping 9.3%. Even China’s markets managed positive factors: the Hold Seng rose 2%, the Shanghai Composite ticked up 1.1%, and the Shenzhen Index climbed 2.2%.

In Europe, traders have been driving excessive on information that the EU would pause its retaliation for 90 days, mirroring Trump’s transfer. That despatched the STOXX 600 up greater than 7%, with robust positive factors throughout the board—from London to Madrid.

A Messy Commerce Battle, Far From Over

Trump defended his tariff hike on China in typical vogue—by means of a Fact Social submit, the place he blasted Beijing for exhibiting “an absence of respect.” He insisted the 145% price was mandatory, at the same time as some economists warned the transfer may derail the restoration and spark inflation.

In the meantime, the White Home saved quiet on how lengthy the pause on tariffs for different nations would final—or what occurs when that 90-day clock runs out.

All in all, markets are swinging onerous, traders are nervous, and world commerce relations are trying shakier by the day.