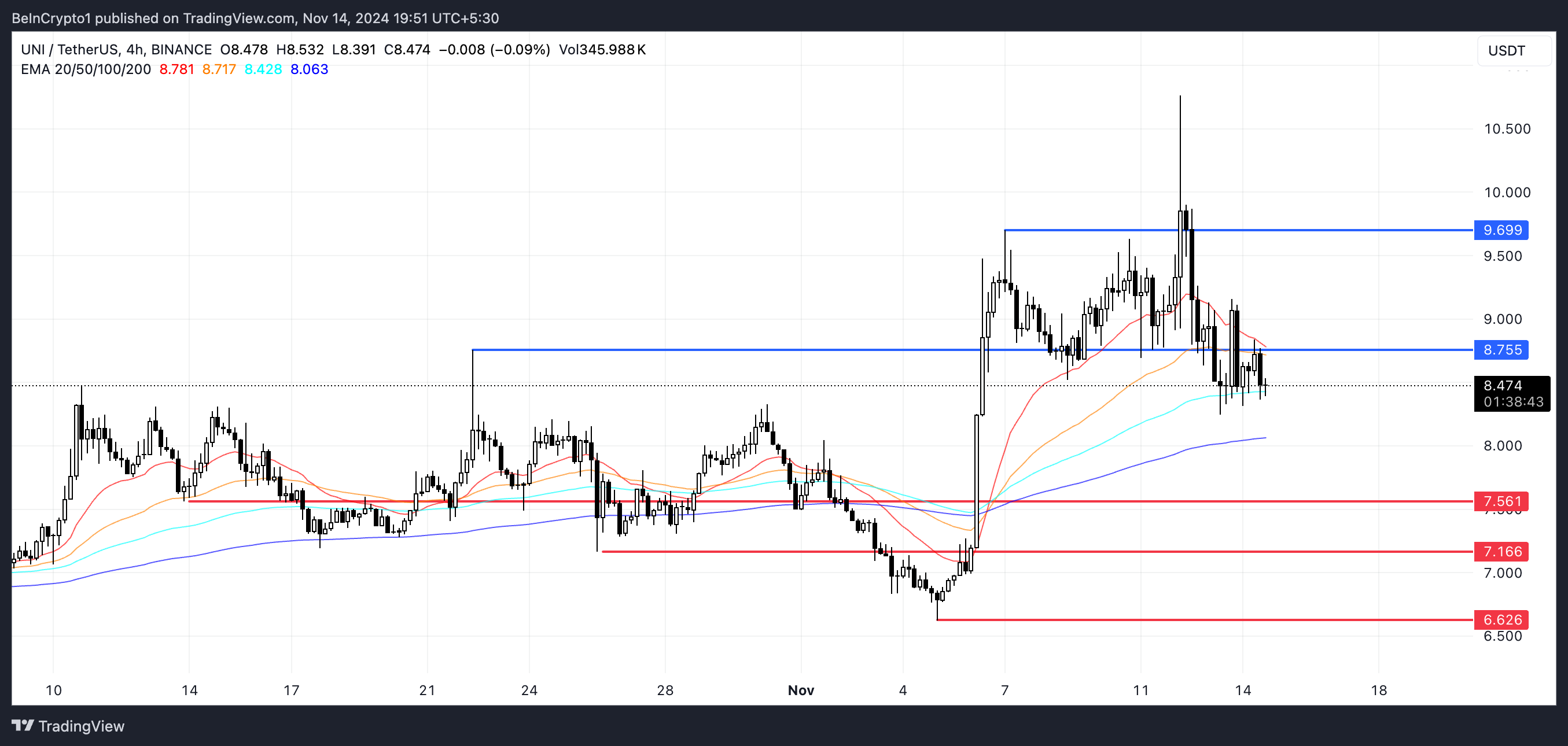

Uniswap (UNI) worth has struggled lately, dropping nearly 5% within the final 24 hours and down 5.24% over the previous week, regardless of Bitcoin’s current surge. The current decline highlights the weak spot in UNI’s momentum, with technical indicators suggesting a cautious outlook.

Though EMA strains nonetheless present a bullish construction, the value slipping beneath short-term EMAs indicators fading shopping for stress. A possible reversal might nonetheless be on the playing cards, however warning is warranted as the present pattern stays susceptible to additional draw back.

UNI RSI Is In The Impartial Zone

On November 7, UNI’s Relative Power Index (RSI) hit 85, pushed by a speedy 50% surge in its worth inside simply 24 hours. Since reaching that top, the RSI has progressively declined and at present sits at 43.32. The RSI is an indicator used to evaluate momentum by measuring the pace and alter of worth actions, serving to establish whether or not an asset is overbought or oversold.

Usually, an RSI above 70 indicators that an asset is perhaps overbought, whereas an RSI beneath 30 signifies doubtlessly oversold situations.

With UNI’s RSI now at 43.32, the indicator means that the current momentum has cooled down significantly. This stage falls within the center vary, reflecting neither an overbought nor an oversold situation however fairly a balanced market sentiment.

It implies that UNI worth might stabilize after the sharp rally, with the potential for both consolidation or a brand new transfer relying on shifts in shopping for or promoting stress.

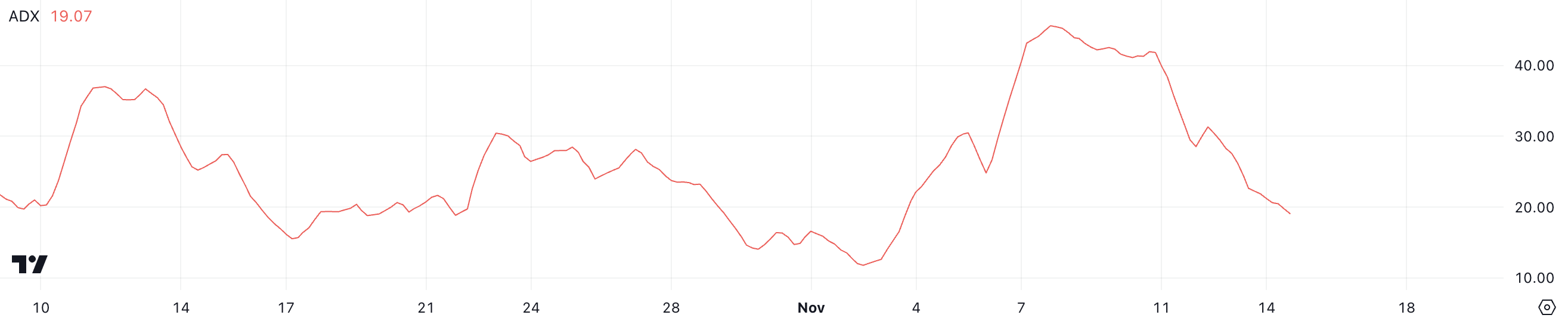

Uniswap ADX Exhibits The Present Development Is Not Robust

UNI’s ADX is at present at 19, down considerably from over 40 only a week in the past. The Common Directional Index (ADX) measures the energy of a pattern with out indicating its course.

Usually, an ADX studying above 25 suggests a powerful pattern, whereas values beneath 20 point out an absence of pattern or weak momentum. The sharp drop from over 40 to 19 indicators that the energy behind UNI’s current pattern has dissipated significantly.

With Uniswap worth presently in a downtrend, an ADX at 19 signifies that the bearish momentum is weak. This means that though the value is declining, the downward stress isn’t significantly sturdy, doubtlessly hinting at a interval of consolidation fairly than an aggressive sell-off.

It might additionally imply that the present pattern would possibly reverse quickly or that market contributors are ready for a clearer course earlier than taking motion.

UNI Value Prediction: Can UNI Go Beneath $7 Subsequent?

UNI’s EMA strains at present show a bullish setting, with the short-term strains positioned above the long-term ones. That signifies beforehand sturdy upward momentum. Nonetheless, the value has now fallen beneath the short-term EMAs, signaling a weakening in shopping for stress.

Furthermore, the short-term strains are trending downward, and in the event that they cross beneath the long-term EMAs, this might type a bearish crossover. Such a crossover usually suggests the beginning of recent, doubtlessly sturdy corrections.

If the bearish crossover happens, UNI worth might check help ranges round $7.5 and $7.1 and doubtlessly fall to $6.6. Nonetheless, as indicated by the present ADX studying, the downtrend is just not significantly sturdy. That leaves room for a doable reversal.

If the pattern shifts to the upside, UNI worth might first problem resistance at $8.7. If this stage is damaged, the subsequent goal could be $9.6, representing a possible 14% worth enhance.

Disclaimer

Consistent with the Belief Challenge tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.