Hedera (HBAR) has recovered over 5% prior to now week. Regardless of some corrections right now, a number of technical indicators flash bullish alerts, suggesting a possible shift in momentum.

The DMI exhibits consumers firmly in management, the Ichimoku Cloud has flipped bullish, and a golden cross seems near forming on the EMA traces. With key resistance ranges approaching, HBAR may very well be gearing up for an prolonged transfer—if the present momentum holds.

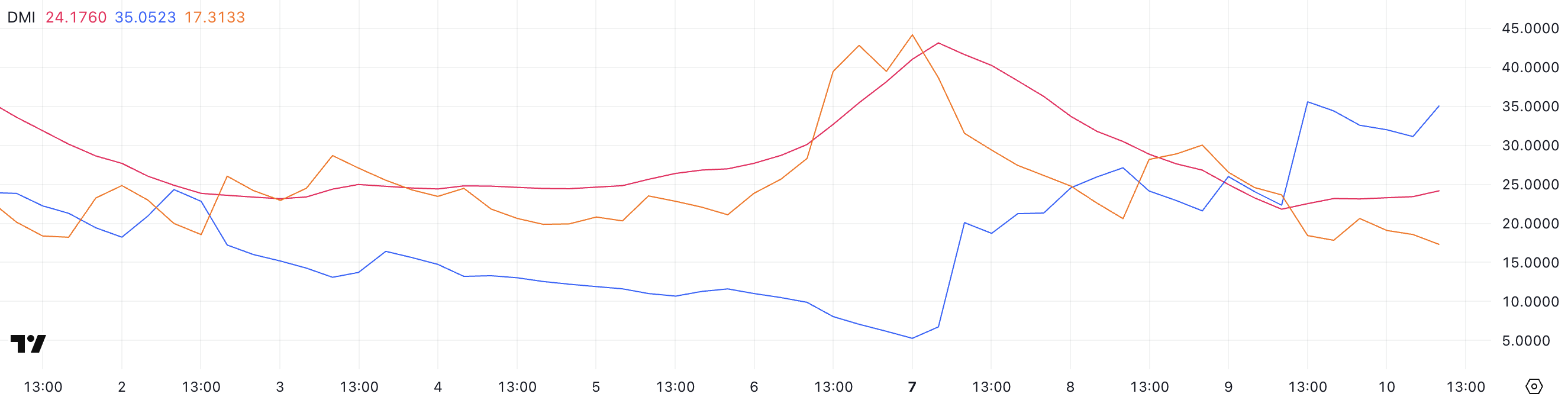

HBAR DMI Exhibits Patrons Are In Full Management

Hedera’s DMI chart is exhibiting indicators of strengthening pattern momentum, with the ADX (Common Directional Index) rising to 24.17 from 21.82 only a day in the past.

The ADX measures the power of a pattern no matter its course. Readings above 25 sometimes point out a powerful pattern, whereas values between 20 and 25 recommend a pattern could also be creating.

With the ADX nearing that threshold, Hedera may very well be making ready for a extra decisive transfer if momentum continues constructing.

Trying on the directional indicators, the +DI has surged to 35.05 from 22.33, whereas the -DI has dropped to 17.31 from 23.65. This widening hole between the bullish and bearish strain alerts a powerful shift in favor of consumers.

If this setup holds, it might point out a creating uptrend for HBAR, particularly if the ADX continues to climb above 25.

The mixture of rising bullish momentum and weakening promoting strain is a optimistic technical sign, suggesting that Hedera could also be gearing up for additional upside within the quick time period.

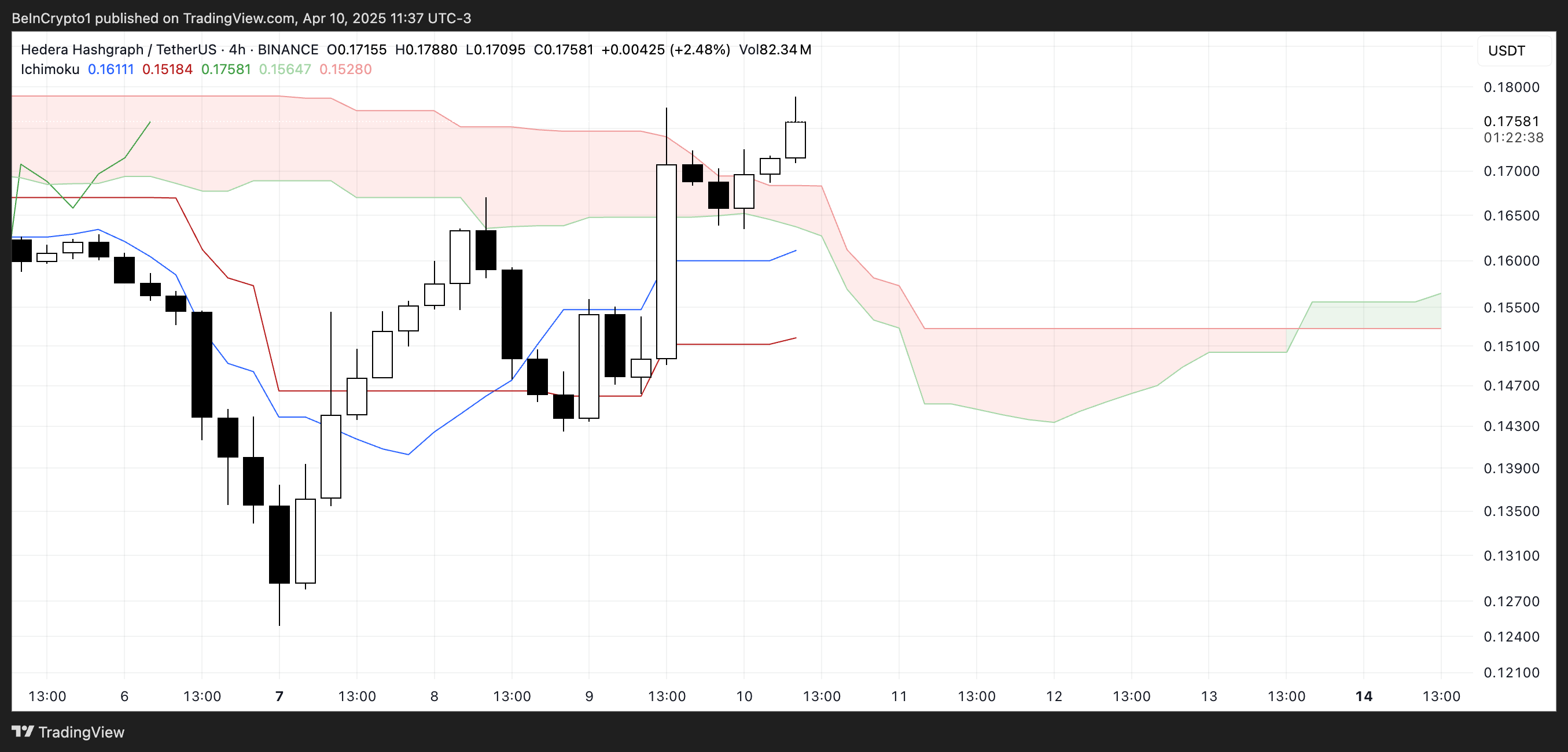

Hedera Ichimoku Cloud Exhibits A Bullish Setup

Hedera’s Ichimoku Cloud chart is flashing a bullish sign. After a powerful transfer upward, value motion broke above the purple cloud (Kumo).

This breakout locations the candles above each the Tenkan-sen (blue line) and the Kijun-sen (purple line), which is mostly seen as an indication of bullish momentum and short-term pattern power.

The cloud forward has additionally began to skinny, suggesting that resistance could also be weakening. If momentum holds, additional upside is extra achievable.

The Chikou Span (lagging inexperienced line) is now positioned above the value candles and the cloud, reinforcing the bullish bias. Nonetheless, with the cloud nonetheless exhibiting a principally flat and slender construction, the present pattern doesn’t but present sturdy continuation alerts.

If the value stays above the cloud and the Tenkan-sen continues to guide above the Kijun-sen, Hedera might maintain this upward trajectory.

However merchants ought to watch carefully for any indicators of a reversal again into or beneath the cloud, which might weaken the bullish setup.

Hedera May Surge Quickly If The Golden Cross Emerges

Hedera’s EMA traces are tightening, signaling a possible breakout. A golden cross—the place short-term EMAs transfer above long-term ones—seems to be forming, which might sometimes point out a bullish pattern reversal.

If confirmed, this setup might push Hedera value towards resistance ranges at $0.18 and $0.20, and if the momentum holds, even greater targets like $0.21 and $0.258 could come into play.

Nonetheless, this bullish situation hinges on a profitable break above the rapid resistance. If HBAR fails to clear the $0.18 degree, it might set off a pullback towards the help at $0.168.

Shedding that help would possible expose Hedera to additional draw back. The following key ranges are $0.153 and presumably beneath $0.13 if promoting strain intensifies.

Disclaimer

In step with the Belief Challenge pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.