An analyst has drawn a provocative comparability between Ethereum and Nokia, a once-dominant tech platform that didn’t adapt shortly sufficient to a altering aggressive market.

The comparability comes amidst the continuing Ethereum versus Solana debate. It goes again years and displays a deeper rigidity between legacy dominance and next-gen efficiency. It considerations which platform is healthier suited to turn out to be the spine of Web3, DeFi, NFTs, and the broader crypto economic system.

Analyst Compares Ethereum to Nokia

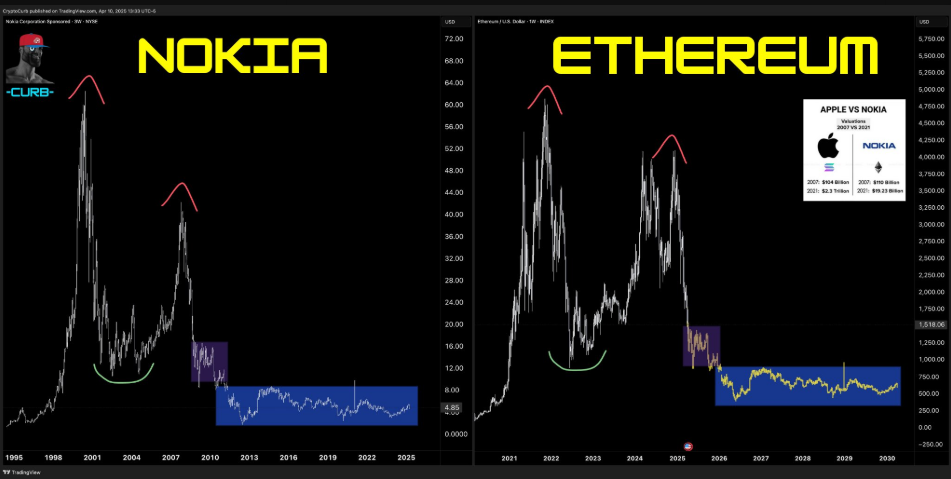

The analyst warns that, like Nokia, Ethereum could possibly be headed for a gradual decline, very like the once-dominant cell phone maker that Apple overtook within the late 2000s.

“Ethereum = Nokia,” analyst Crypto Curb wrote.

The analyst shared two charts: Nokia’s inventory value collapsing from its 2007 peak, and Ethereum’s market cap declining from 2021 highs.

The analogy is rooted in additional than simply market charts. Curb argues that Ethereum’s growing old structure and scalability limitations mirror the downfall of Nokia’s Symbian OS, which couldn’t compete with Apple’s iOS and Google’s Android.

Information on Statista exhibits that by 2013, Nokia’s cell market share had collapsed to three.1% from a peak of 49.4% in 2007.

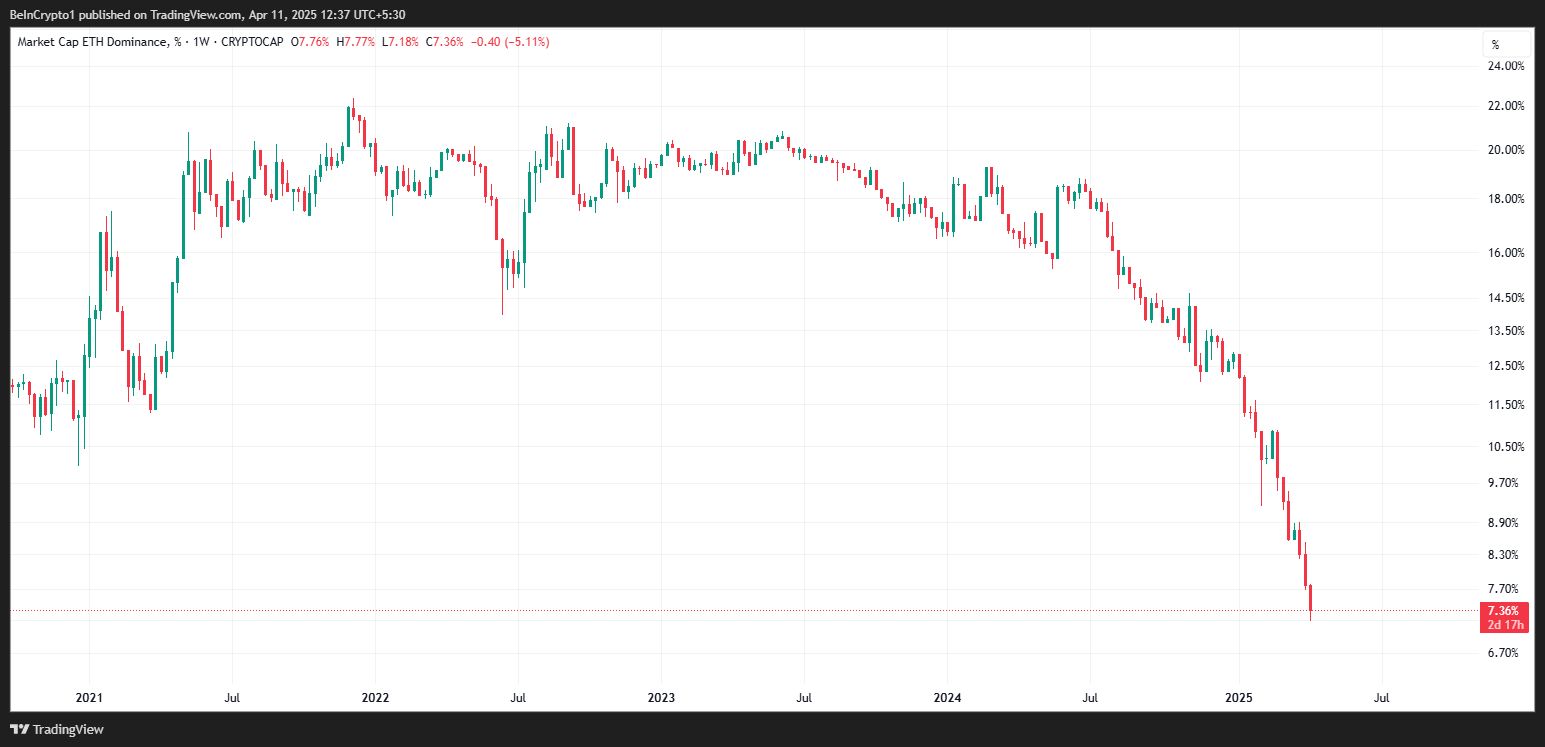

In the meantime, information on TradingView exhibits that Ethereum, which as soon as commanded over 20% of the whole crypto market cap, holds lower than 10% as of this writing.

The put up implies that Ethereum, like Nokia, could also be slowly shedding relevance amid sooner, extra scalable rivals, chief amongst them Solana.

In the meantime, Solana’s rise has been onerous to disregard. Between October 2023 and November 2024, SOL surged from $23 to $264, rising to just about one-third of Ethereum’s market capitalization.

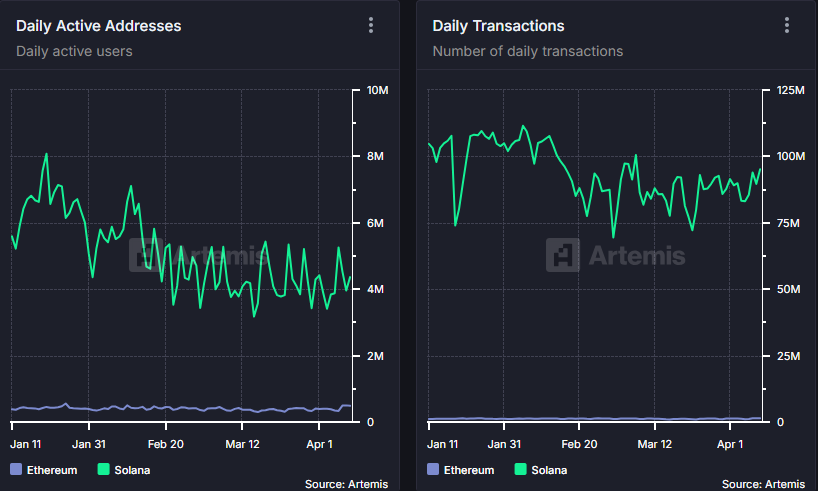

In accordance with on-chain information, Solana now outperforms Ethereum on a number of key metrics. Amongst them are Each day Lively Addresses and Each day Transactions, highlighting its attraction to builders and customers.

The parallels are stark. Apple leapfrogged Nokia with a smoother consumer interface and developer-friendly ecosystem.

Likewise, Solana’s technical benefits, together with greater throughput, decrease charges, and higher consumer expertise (UX), place it as a critical contender to Ethereum’s dominance in decentralized finance (DeFi) and Web3.

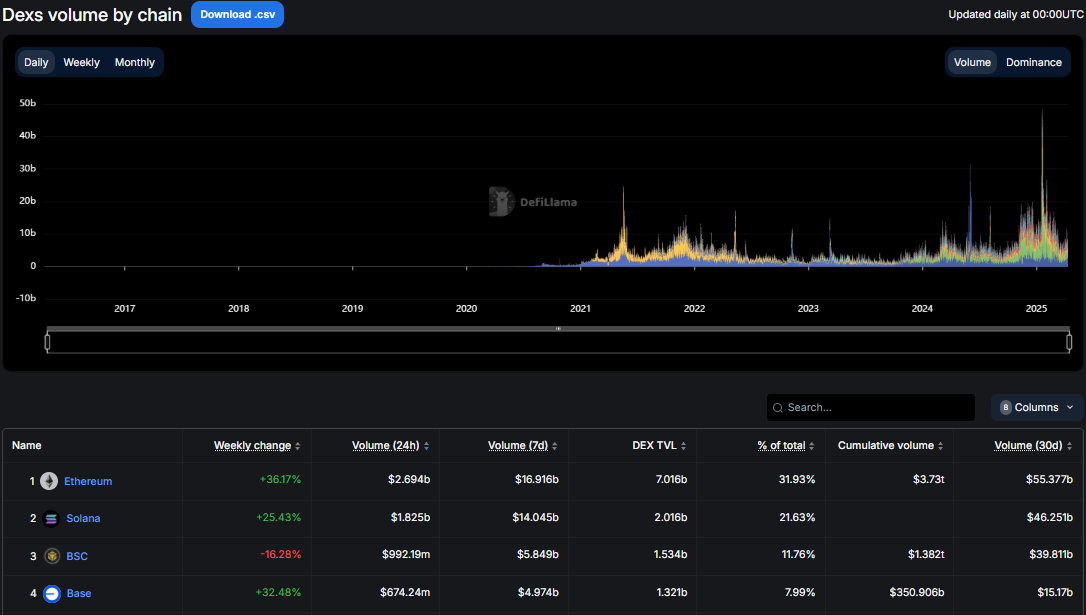

Nonetheless, not everyone seems to be satisfied that Ethereum’s days are numbered. Every week in the past, Ethereum flipped Solana in decentralized change (DEX) buying and selling quantity.

BeInCrypto reported this milestone, which occurred for the primary time in six months. Information on DefiLlama exhibits that Ethereum continues to keep up this lead.

This resurgence in buying and selling exercise suggests Ethereum stays deeply embedded within the crypto ecosystem, significantly amongst refined DeFi customers.

Furthermore, some institutional voices stay cautiously bullish on Ethereum. In March, Franklin Templeton analysts famous that whereas Solana’s DeFi surge is spectacular and will problem Ethereum’s market worth, ETH nonetheless holds key infrastructure benefits.

“Solana nonetheless has a protracted strategy to go earlier than it could actually surpass Ethereum,” an IntoTheBlock analyst instructed BeInCrypto.

Equally, some analysts see the potential for a powerful Ethereum value enhance, citing bullish fundamentals just like the Pectra improve and ETH-staking ETFs (exchange-traded funds).

Nonetheless, Curb’s comparability displays a vital second in Ethereum’s progress. With rivals like Solana racing forward in usability and efficiency, Ethereum should speed up its roadmap lest it turns into overshadowed.

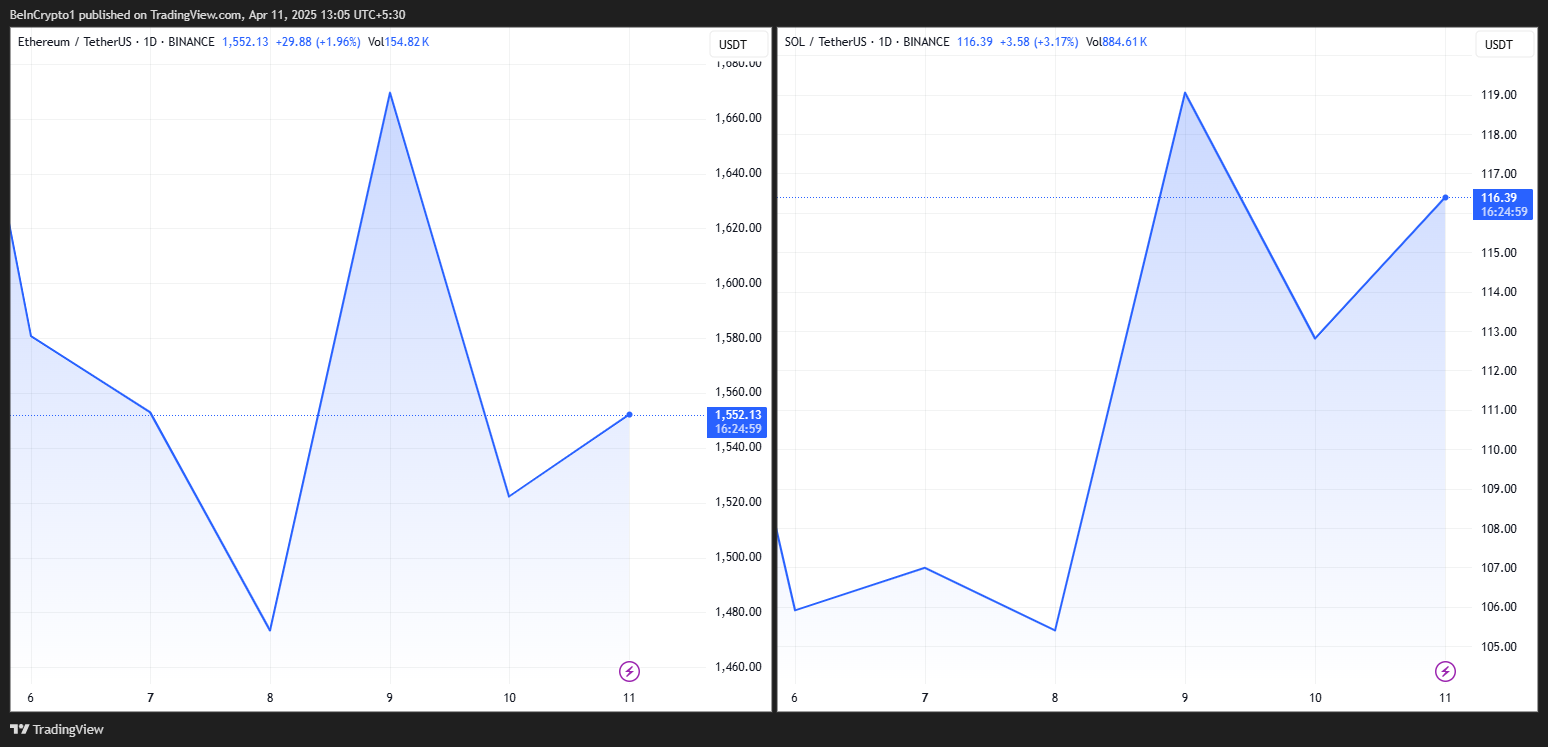

Information exhibits ETH was buying and selling for $1,552 as of this writing, down by over 4% within the final 24 hours. In the meantime, Solana traded for $116.39, recording a modest 1.01% surge over the day.

Disclaimer

In adherence to the Belief Undertaking tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.