A number of crypto-related social media accounts are circulating rumors that the Federal Reserve will lower rates of interest quickly. These focus on an out-of-context quote from Neel Kashkari, President of the Federal Reserve Financial institution of Minneapolis.

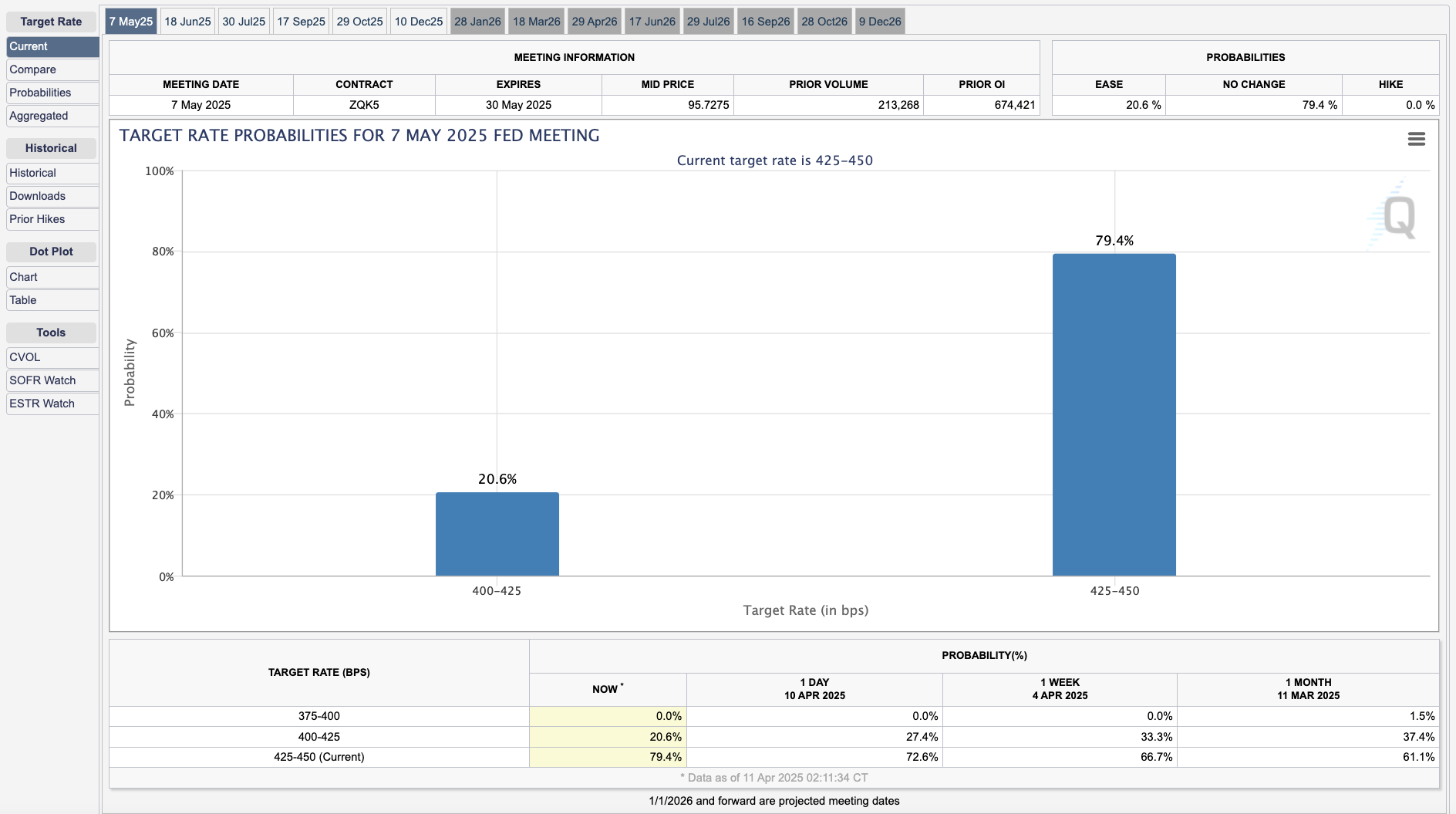

Susan Collins, President of one other regional Fed financial institution, reiterated the low chance of any price cuts. Presently, the CME Group estimates a 20.6% likelihood of them occurring within the subsequent month.

Federal Reserve Price Reduce Rumors Go Wild

As Trump’s tariffs have triggered an enormous quantity of market instability, the crypto house has been determined for a bullish narrative. A recurring hope has been that the Federal Reserve would lower rates of interest, which appears extremely unlikely.

Right this moment, in a CNBC interview, a quote from Neel Kashkari, President of the Federal Reserve Financial institution of Minneapolis, fueled new rumors:

“There are instruments there to offer extra liquidity to the markets on an automated foundation that market individuals can entry, along with the swap traces you talked about for world monetary establishments. These instruments are completely there,” Kashkari claimed.

Quickly after this interview, a number of distinguished crypto accounts started circulating items of this quote out of context. They implied that the Federal Reserve was on the point of reducing rates of interest to stave off potential financial turmoil.

A few of these misguided claims managed to build up 1000’s of views and reposts on the concept the Fed will “print cash.”

Nevertheless, within the full interview, Kashkari clearly acknowledged what he meant by “instruments.” He emphasised that the Fed shouldn’t be involved with world commerce and that its “twin mandate” is to deal with inflation and employment inside the US.

In different phrases, the tariff state of affairs doesn’t change the Federal Reserve’s low likelihood of chopping rates of interest.

After these rumors started circulating, one other higher-up mentioned the Federal Reserve’s instruments relating to rates of interest.

In a subsequent interview with the Monetary Occasions, Susan Collins, President of the Federal Reserve Financial institution of Boston, acknowledged the Fed’s coverage in very direct language:

“We’ve got needed to deploy fairly rapidly, numerous instruments [to address the situation.] We might completely be ready to try this as wanted. The core rate of interest instrument we use for financial coverage is definitely not the one instrument within the toolkit, and possibly not one of the simplest ways to handle challenges of liquidity or market functioning,” Collins claimed.

Each Collins and Kashkari have roughly equal positions, heading one of many 12 Federal Reserve Banks distributed all through the nation. Each tried to obviously talk that the Federal Reserve shouldn’t be contemplating chopping rates of interest right now.

Regardless of this, social media rumors can rapidly get out of hand.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.