Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

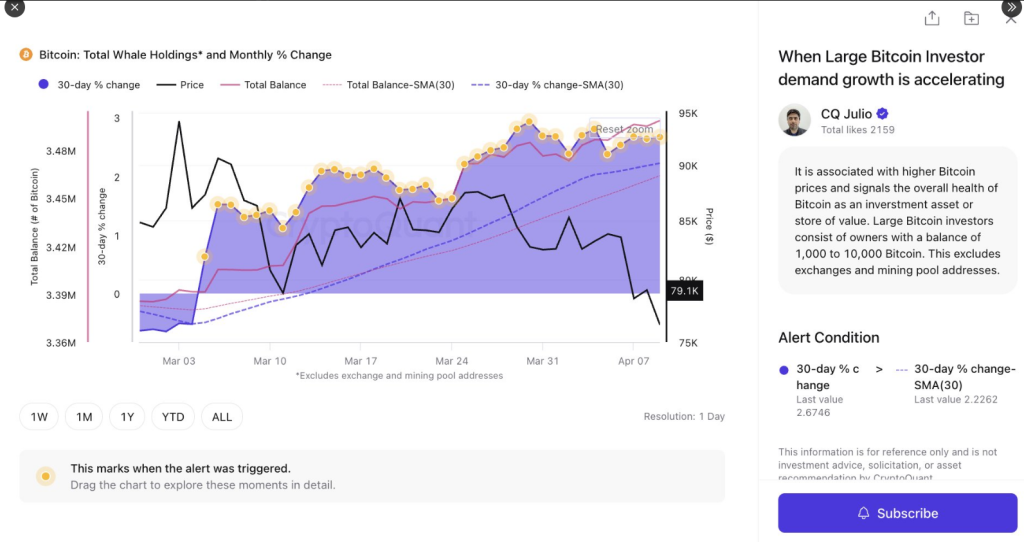

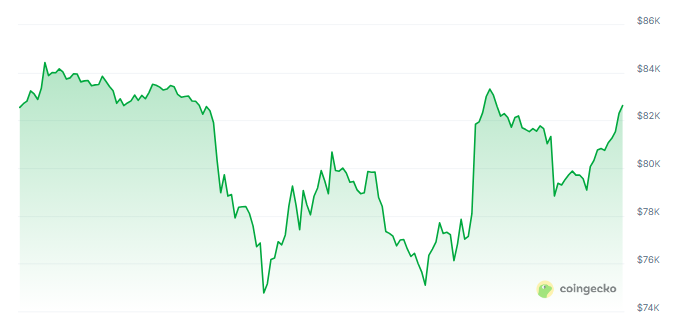

Bitcoin’s value recovered above $82,000 Friday following a decline beneath $75,000 prior to now few days, as traders with giant wallets bought extra of the digital asset. Market developments point out wallets between 1,000 and 10,000 Bitcoin are increasing at a fee greater than the 30-day common, stories CryptoQuant.

Associated Studying

Massive Buyers Show Excessive Confidence In Bitcoin

The rise within the variety of giant crypto holders signifies rising confidence in the way forward for the cryptocurrency. These traders, often not exchanges or mining swimming pools, are vital in sustaining the worth of Bitcoin. Their rising curiosity comes as Bitcoin’s market capitalization hits $1.58 trillion, with dominance over different cryptocurrencies at greater than 60%.

Bitcoin just lately hit $83,400 earlier than correcting barely to settle above $80,000. The rise in these excessive pockets balances is according to Bitcoin’s latest value features, indicating market energy regardless of exterior pressures.

Massive investor demand for Bitcoin is accelerating.

Balances of wallets holding 1K–10K BTC rising quicker than their 30-day common.

Sometimes bullish, indicators sturdy investor confidence. pic.twitter.com/hR5Rumj6A6

— CryptoQuant.com (@cryptoquant_com) April 10, 2025

Analysts Look To Worth Hole Patterns For Future Projections

Some market observers have provided their predictions on what course the highest digital asset might take subsequent. An X (previously Twitter) analyst by the identify of Enzy Bitcoin says that Bitcoin often goes up after the filling up of value gaps. The analyst talked about the most recent hole between $70,000 and $75,000, that Bitcoin might attain $130,000 within the close to future based mostly on historic developments.

Supply: CryptoQuant

One other analyst, BitBull, equated Bitcoin’s stability to latest volatility in US inventory markets. As the standard markets have grappled with volatility, Bitcoin has remained agency above $80,000. Costs beneath $100,000 should still be acceptable entry factors for traders, some specialists say.

BTC Lengthy-Time period Goal Extraordinarily Optimistic

Wanting additional down the highway, different market observers posted a really favorable prognosis for Bitcoin’s future solely just lately, emphasizing the importance of being cognizant of market cycles, notably throughout pricing fluctuations like when in a bear entice.

The analysts’ projection reads as unusually bullish, that maybe Bitcoin might get to a whopping $250,000 price ticket. This imaginative and prescient additionally predicts significant development for main various cryptocurrencies.

Market Cap Hits $1.58 Trillion Whereas Restoration Retains Momentum

The most recent value bounceback of the flagship crypto has taken its mixture market worth to $1.58 trillion when this report was made. This follows its appreciation by over $8,000 from latest lows, demonstrating the aptitude of the cryptocurrency to bounce again rapidly from non permanent declines.

Associated Studying

The market dominance of the cryptocurrency has additionally grown, at the moment standing at over 60% of the full crypto market capitalization. The dominance signifies that Bitcoin is the preferred cryptocurrency and continues to draw traders who want development in addition to a retailer of worth.

Though Bitcoin did not maintain its quick surge to $83,500, sustaining above $81,000 demonstrates resilience within the prevailing market surroundings. The truth that the shopping for continues from whales signifies that such traders imagine costs will proceed rising within the months forward.

Featured picture from BetaNews, chart from TradingView