- A preferred analysts imagine that the altcoin sector is in a ‘purchase’ zone for mid-term traders proper now

- BTC and USDT dominance didn’t fairly align with such a bullish outlook

The altcoin sector recorded a sustained sell-off in early 2025, with high cryptos like Solana [SOL] and Ethereum [ETH] shedding +65% of their values. Nonetheless, which may change quickly after a key indicator flashed a ‘BUY’ sign.

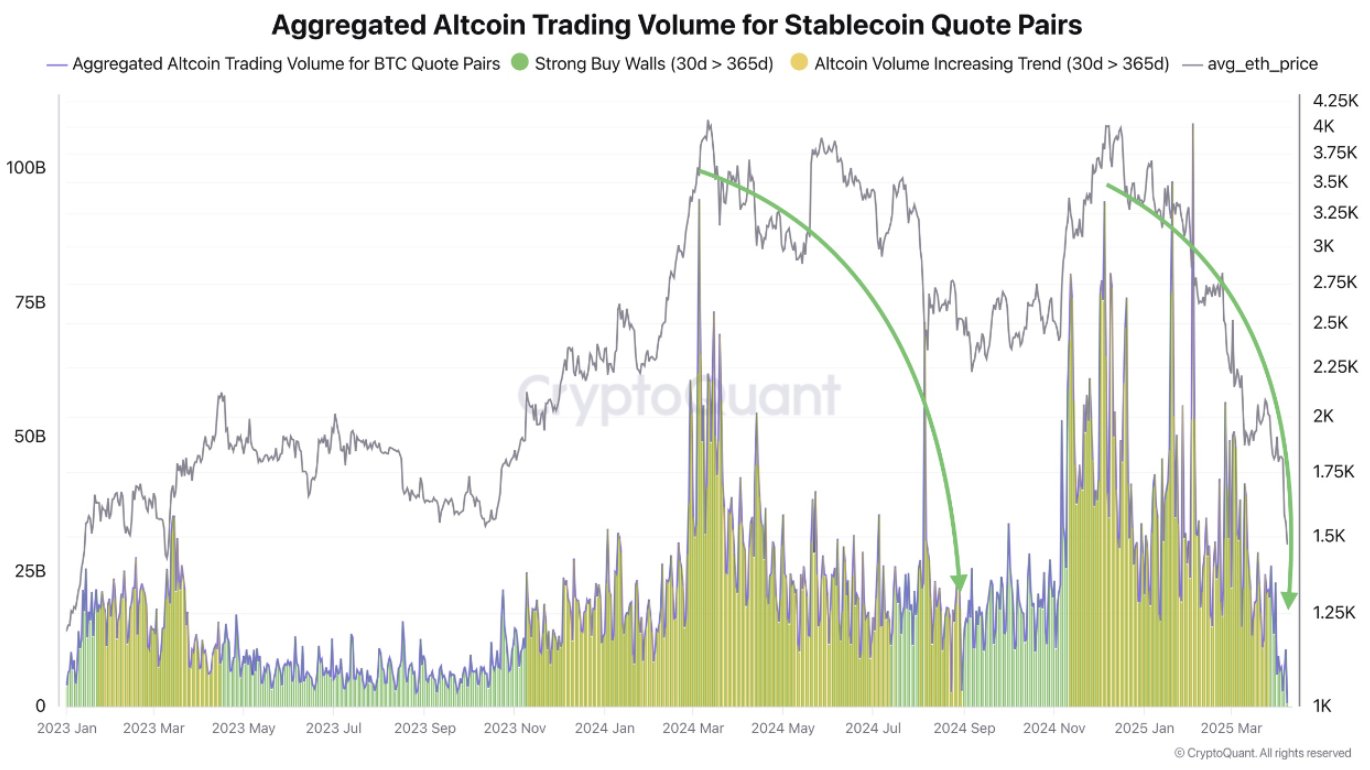

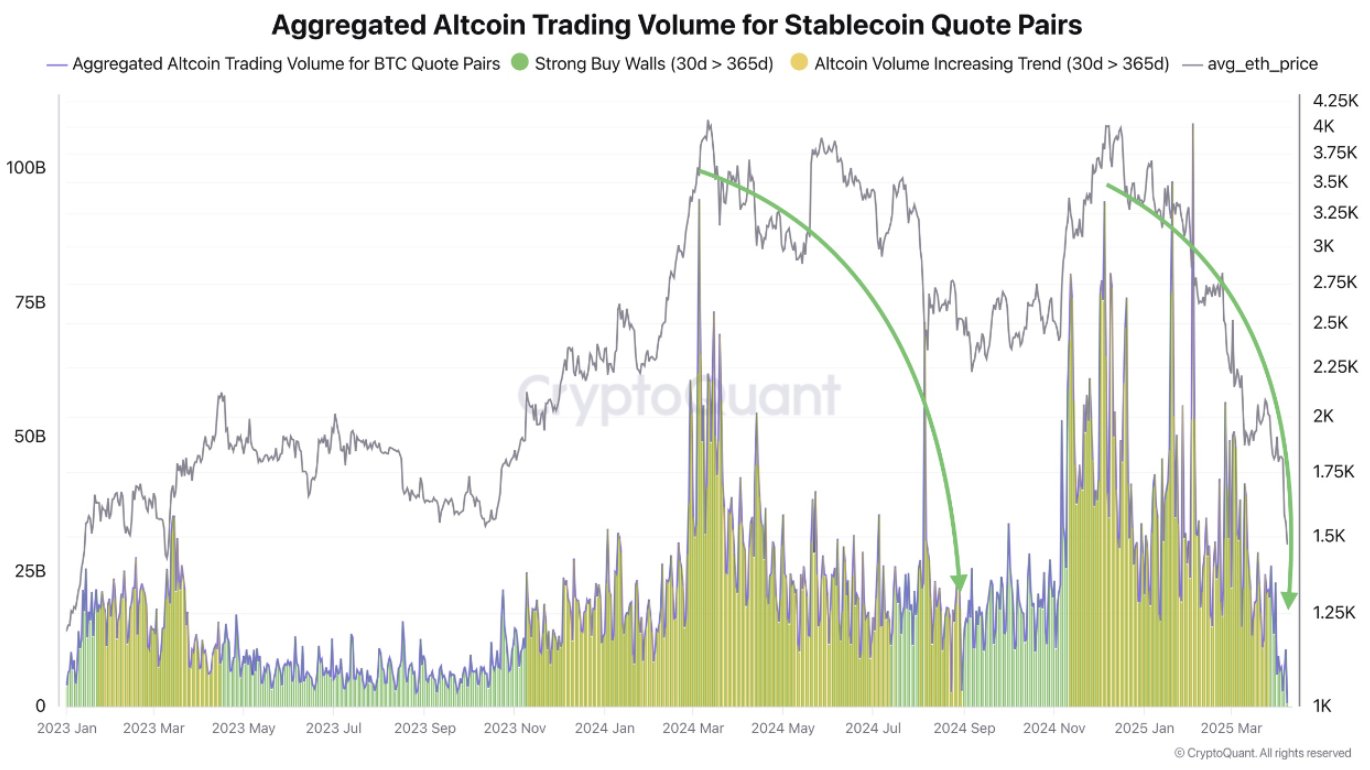

CryptoQuant analyst DarkFost revealed that it is likely to be a good time to slowly enter altcoin positions with a “mid-term” outlook. In doing so, he cited the mixture altcoin buying and selling quantity positioning.

“We’ve entered a shopping for zone, which is outlined by the 30-day transferring common falling under the annual common… final time we reached these ranges was in September 2023, proper after the bear market ended.”

Supply: CryptoQuant

Merely put, the indicator’s low readings mirrored the undervalued market situations simply earlier than the altcoin sector exploded in late 2023.

Therefore, the query – Do different altcoin momentum alerts agree with this specific outlook?

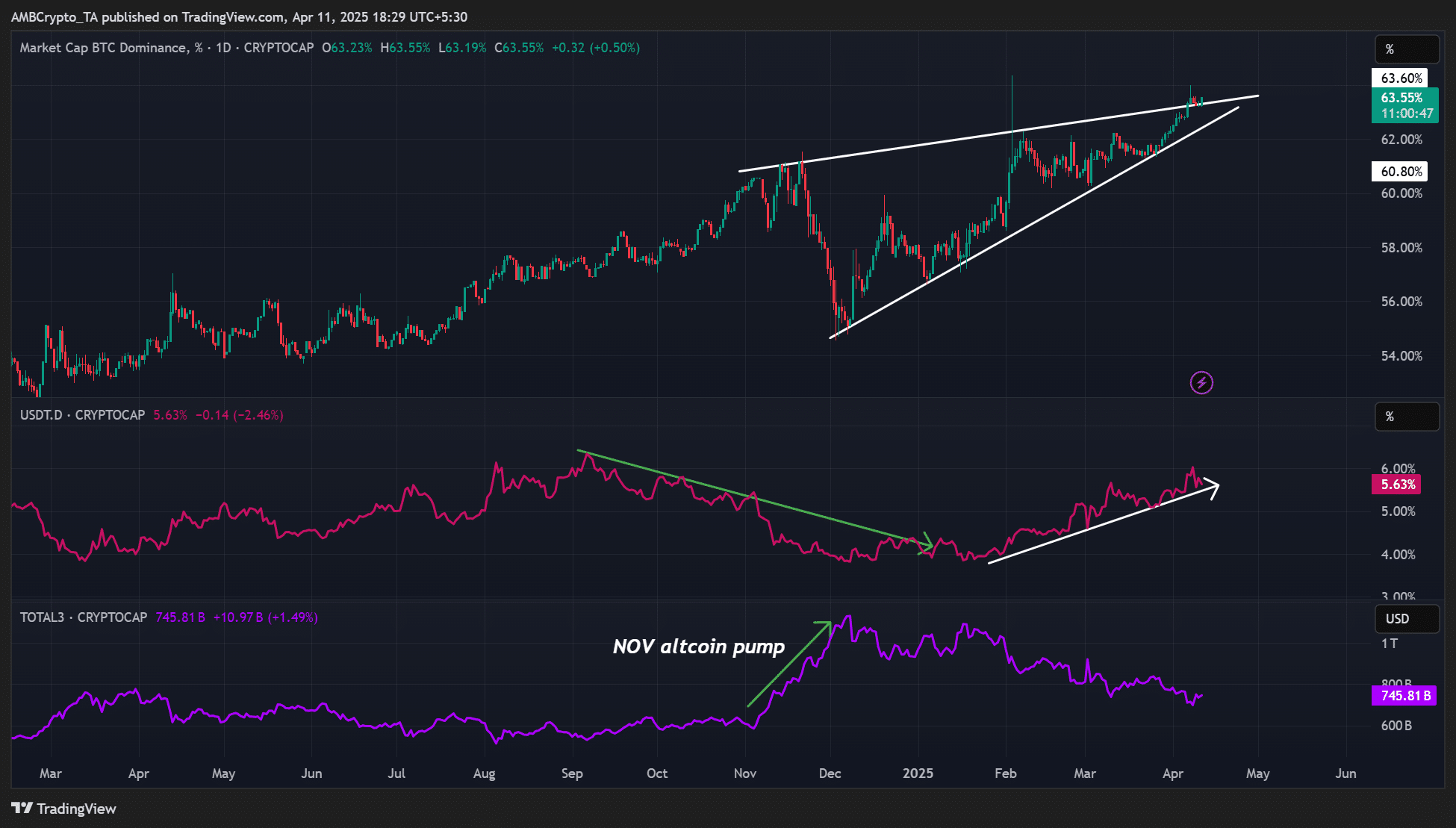

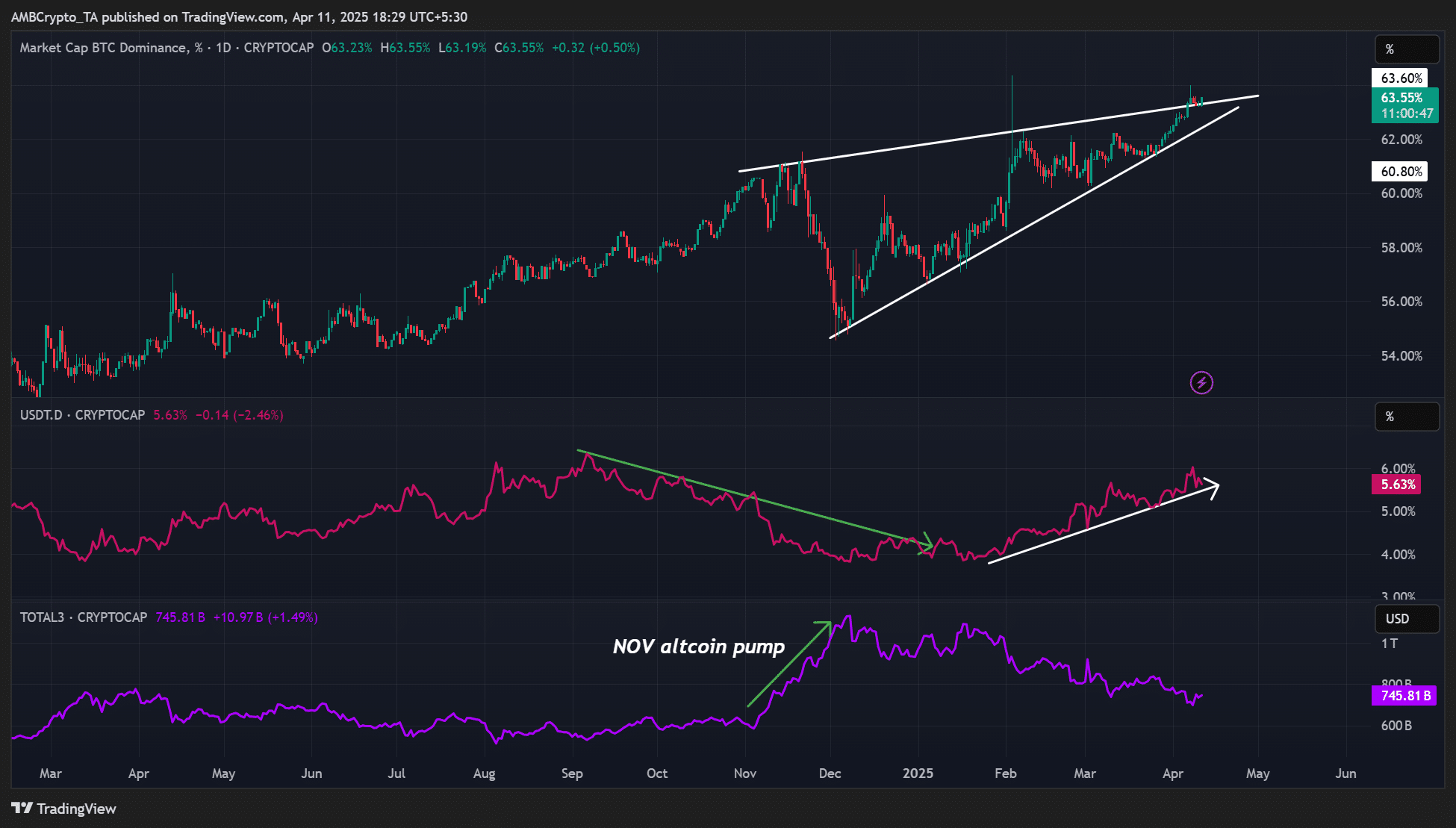

Assessing Bitcoin and USDT’s dominance

Some key indicators for altcoin momentum are BTC (BTC.D) and Tether USDT dominance (USDT.D).

In final November’s altcoin explosive run, USDT.D dropped, which means speculators swapped stablecoins for his or her favourite altcoin gems. On the identical time, this led to capital rotation from BTC to altcoins. Therefore, BTC.D fell.

Supply: BTC dominance vs Altcoin sector efficiency, TradingView

Nonetheless, in 2025, BTC.D climbed increased to 63.5%, suggesting that capital was parked in BTC from altcoins. Moreover, USDT.D rose from 4% to five.6%, underscoring cautious merchants fleeing to stablecoins to protect capital from Q1 drawdowns.

Primarily based on the press time readings, it will appear that speculators haven’t been eager to leap into the altcoin sector. Nonetheless, this might change in a good macro atmosphere.

That being mentioned, the RSI heatmap and funding charges revealed that the altcoin sector was undervalued and had much less froth (much less leverage). This gave the impression to be according to DarkFost’s outlook.

Supply: Coinglass

In late 2024, funding charges hit 50-80% (orange), signaling robust bullish sentiment and over-leverage. This typically results in sharp pullbacks in case of liquidations. Nonetheless, press time funding charges have been under 10% throughout a number of altcoins, hinting at a steady market that might rally increased beneath optimistic catalysts.

Price declaring although that some choose outliers outperformed BTC over the previous week and 30 days of buying and selling. Onyxcoin [XCN] and Fartcoin noticed over 100% beneficial properties previously week. Others, like Curve DAO [CRV], have surged by practically 50% over the previous month.