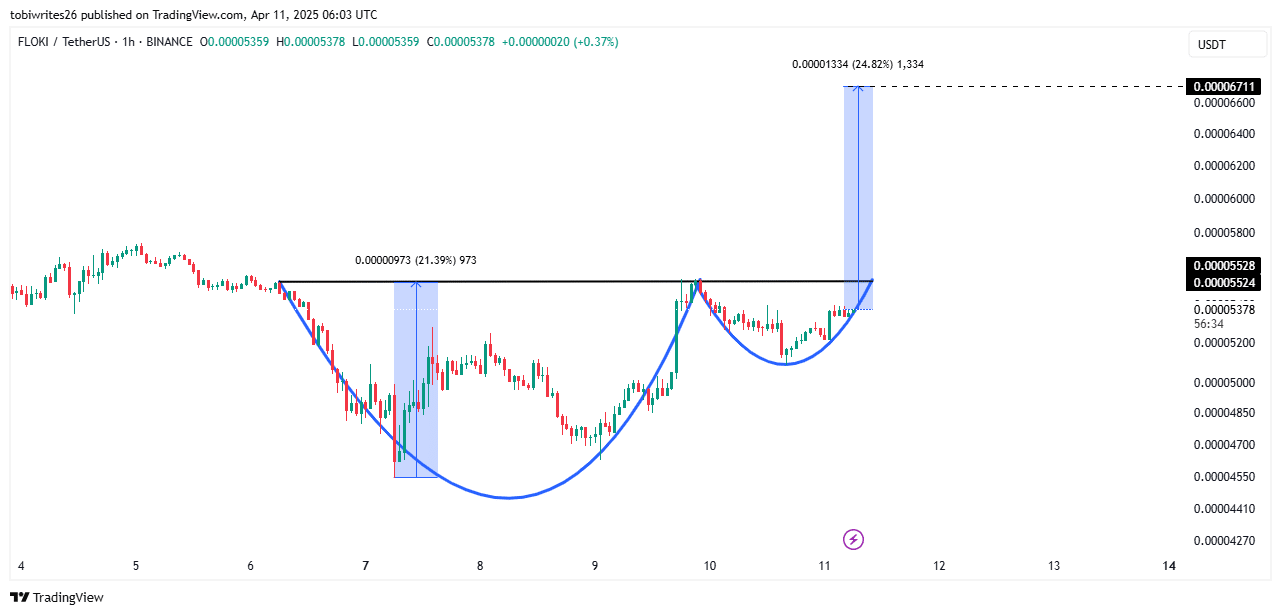

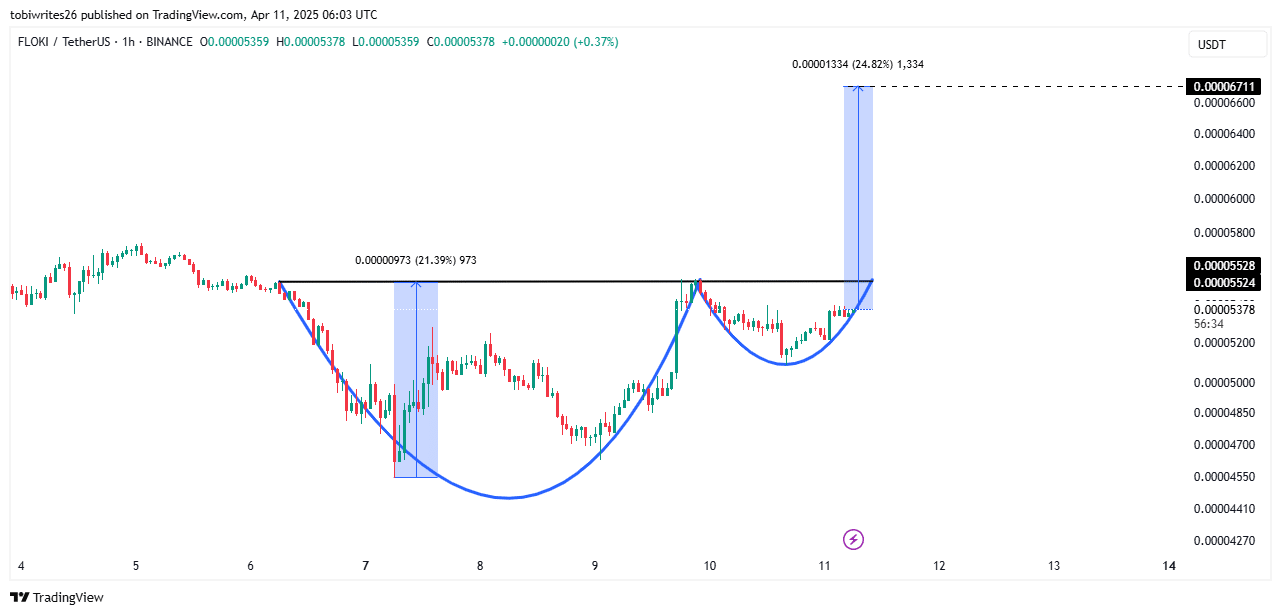

- FLOKI shaped a bullish technical sample often known as the cup and deal with sample – An indication of a rally

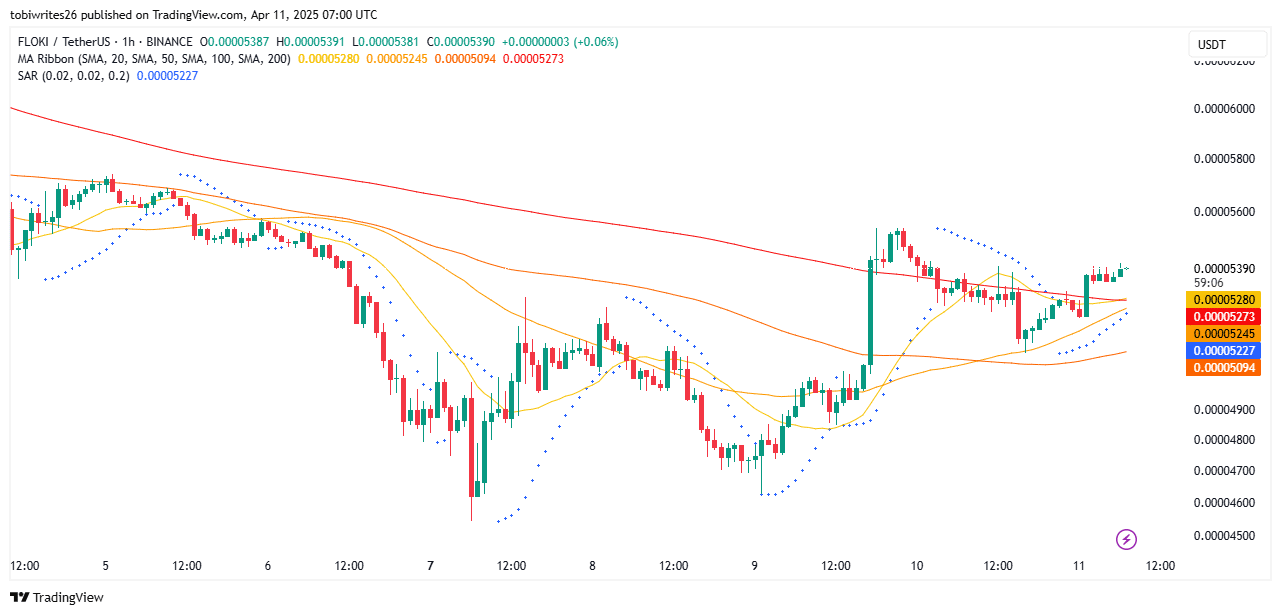

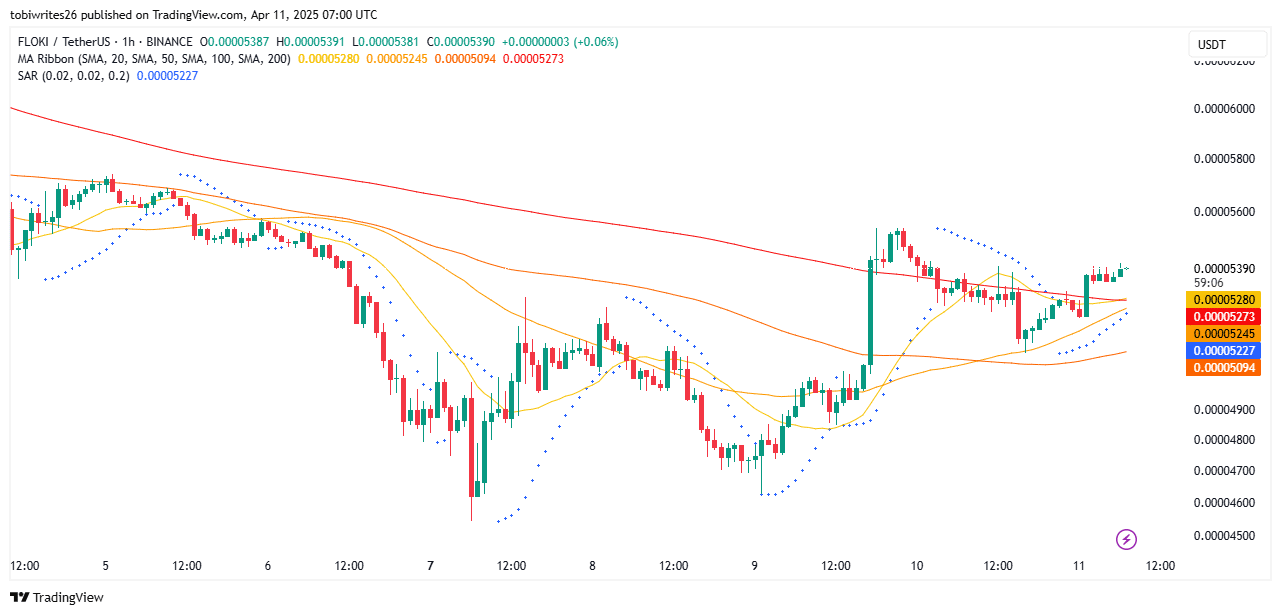

- A golden cross sample surfaced on the chart too, with accumulation of the asset rising throughout the spot market

Floki [FLOKI] has proven a stage of bullish sentiment available in the market currently, with a rally of two.42% progressively trying to defy its previoius month’s drop of 12.27%.

In actual fact, a number of bullish indicators have surfaced on the chart, revealing that the present leg up may lengthen additional as market contributors proceed to purchase FLOKI.

Bullish sample might be a rally launchpad

The press time formation of the cup and deal with sample on the chart gave the impression to be a sign of an incoming rally. Such a sample sometimes precedes a serious transfer to the upside.

In keeping with this evaluation, this rally might be a possible launchpad for main worth features of 24.82% to $0.00006711 from its press time worth stage.

Supply: TradingView

Nevertheless, the rally would absolutely ignite as soon as FLOKI breaches the black resistance line on the chart. As soon as it breaches the extent, it may hit the goal. Technical indicators pointed to a doable upside too. Two key instruments—Transferring Common (MA) Ribbon and Parabolic SAR—appeared to assist this view.

The MA Ribbon contains a number of Easy Transferring Averages (SMA) – 20, 50, 100, and 200. On the time of writing, it was reflecting a level of bullish sentiment.

This outlook was additional confirmed by a golden cross sample. The short-term SMA 20 additionally crossed above the long-term SMA 200. Such a crossover implies that short-term merchants have been overpowering the long-term bearish development.

Supply: TradingView

The Parabolic SAR additionally added to this bullish wave for FLOKI. This indicator makes use of dots to find out the development.

That is the case when these dotted markers seem above the worth. It means sellers are gaining energy available in the market. Quite the opposite, when under the worth, it implies that consumers are in management.

A take a look at the chart highlighted {that a} sequence of dotted markers shaped under FLOKI’s press time worth motion. This may be interpreted to trace at market confidence, with an extra transfer to the upside doable too.

Robust shopping for sentiment throughout the market

Spot market merchants over the previous week have been accumulating the asset progressively, contributing to the press time worth formation on the chart.

In keeping with trade netflows, which observe the motion of an asset out and in of exchanges, merchants within the spot market have bought $502,000 price of FLOKI. If this shopping for sample continues, these trades could be setting the stage for a gradual provide squeeze.

Supply: CoinGlass

Spinoff merchants have additionally been profiting from the bullish sentiment, putting lengthy bets as shopping for quantity surges.

The Taker Purchase Promote ratio revealed a hike in shopping for exercise, with a studying of 1.024. Any studying above 1 means there may be extra shopping for exercise available in the market, and that the asset tends to observe this path.

General, if market indicators and sentiment proceed to remain inside bullish territory, a doable worth push to the upside is probably going.