- LINK’s retest of its $12.5 breakout zone hinted at a potential bearish continuation

- On-chain and liquidation information supported additional draw back potential in the direction of the $10 and $7.5 ranges

After every week of constant decline, Chainlink [LINK] has been testing a key resistance zone round $12.5 — A degree that beforehand acted as a key assist. The altcoin’s worth motion gave the impression to be a retest of the breakout zone that may now flip into resistance. Actually, it additionally alluded to a scarcity of conviction on the bullish facet.

Nevertheless, LINK may even see a extra vital pullback if the bulls don’t keep this important worth degree. The broader market stays indecisive and Chainlink (LINK)’s latest retracement has been inside expectations.

![Will Chainlink’s [LINK] newest retest flip assist into resistance? Will Chainlink’s [LINK] newest retest flip assist into resistance?](https://ambcrypto.com/wp-content/uploads/2025/04/LINKUSD_2025-04-11_16-03-30_cd2ad.png)

Supply: TradingView

Moreover, the worth has not managed to put up a better excessive after topping close to $16.

Retesting the descending trendline at round $12.5 with out bouncing convincingly is an indication of a weakening construction.

LINK’s bearish setup bolstered by on-chain information

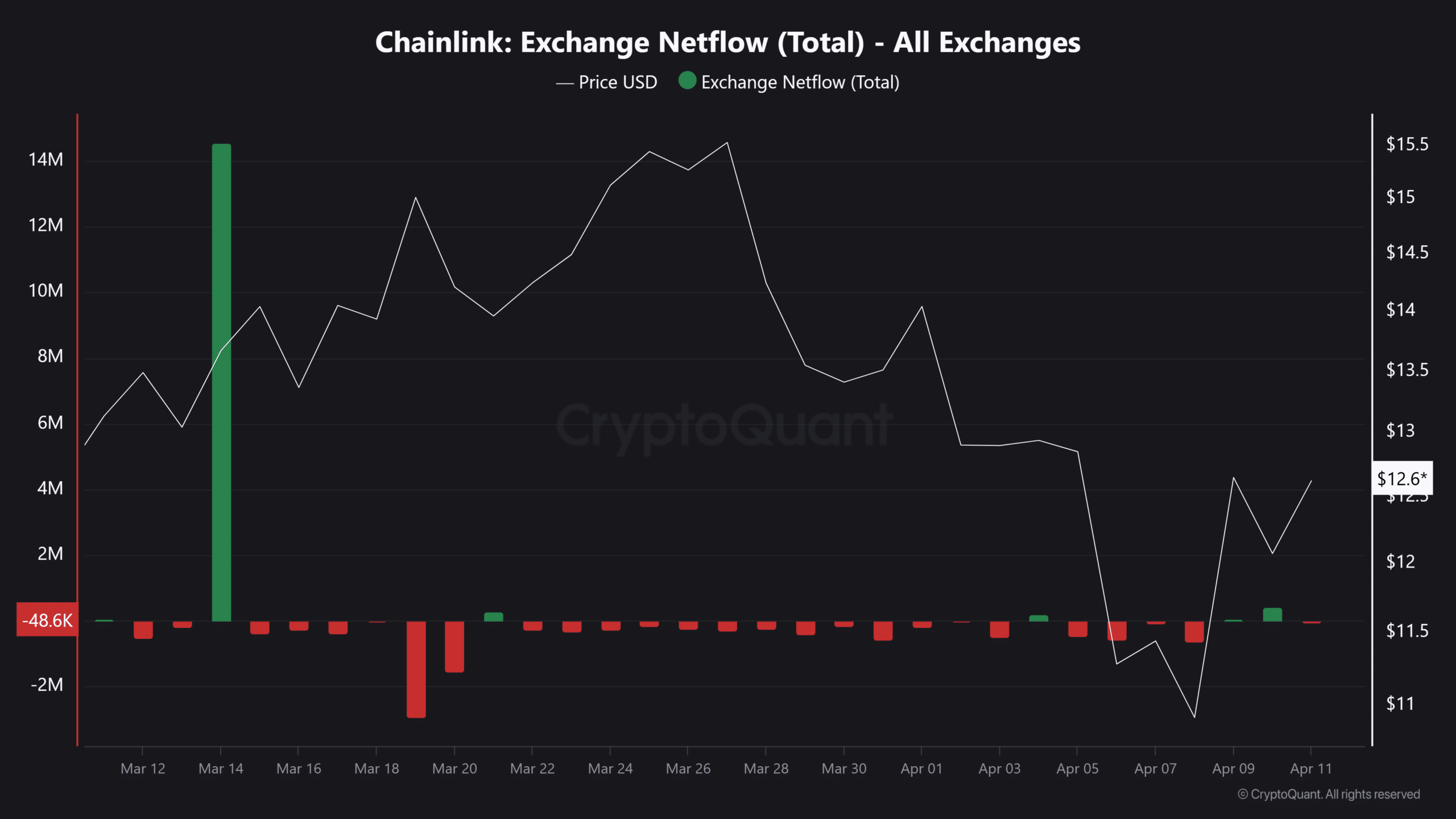

On the time of writing, on-chain information appeared to present little reassurance to LINK’s bulls.

In line with CryptoQuant, the web deposits for the altcoin on exchanges are solely barely above their 7-day common. That’s often an indication of heightened promoting strain.

Increased internet deposits typically characterize traders pulling funds from decentralized exchanges and sending them over to centralized exchanges with a view to promote.

Now, though the uptick didn’t exceed the bounds, it did coincide with a bearish technical outlook. This convergence might justify LINK’s bearish bias on the charts.

Supply: CryptoQuant

Liquidation clusters trace an extra drop previous $10

Lastly, leveraged merchants might additional affect LINK’s worth trajectory.

Liquidation heatmaps additionally revealed a cluster of lengthy liquidation ranges close to the $10-mark. Market makers wish to hunt these liquidity zones during times of uncertainty.

Supply: CoinGlass

If LINK strikes in the direction of $10, triggering liquidations, that promoting strain may set off a cascade of occasions. Then, one other push to $7.5 — This fall 2023’s earlier excessive — would turn out to be possible.

The $12.5 zone should maintain to keep away from deeper losses. With elevated change deposits and visual liquidation swimming pools under, the trail of least resistance is south for now.

![Will Chainlink’s [LINK] newest retest flip assist into resistance? Will Chainlink’s [LINK] newest retest flip assist into resistance?](https://i0.wp.com/ambcrypto.com/wp-content/uploads/2025/04/LINKUSD_2025-04-11_16-03-30_cd2ad.png?resize=1024,1024&ssl=1)