- ETH has gained 2.39% over the previous 24 hours.

- Ethereum’s demand aspect is strengthening, positioning the altcoin for sustained positive aspects.

For the reason that market recovered from the tariffs crash, Ethereum [ETH] has traded in an ascending sample. In truth, as of this writing, Ethereum was buying and selling at $1610.

This marked a 2.36% improve on every day charts.

Earlier than these positive aspects, the altcoin had been on a downward trajectory, dropping on weekly and month-to-month charts by 10.99% and 14.79%, respectively.

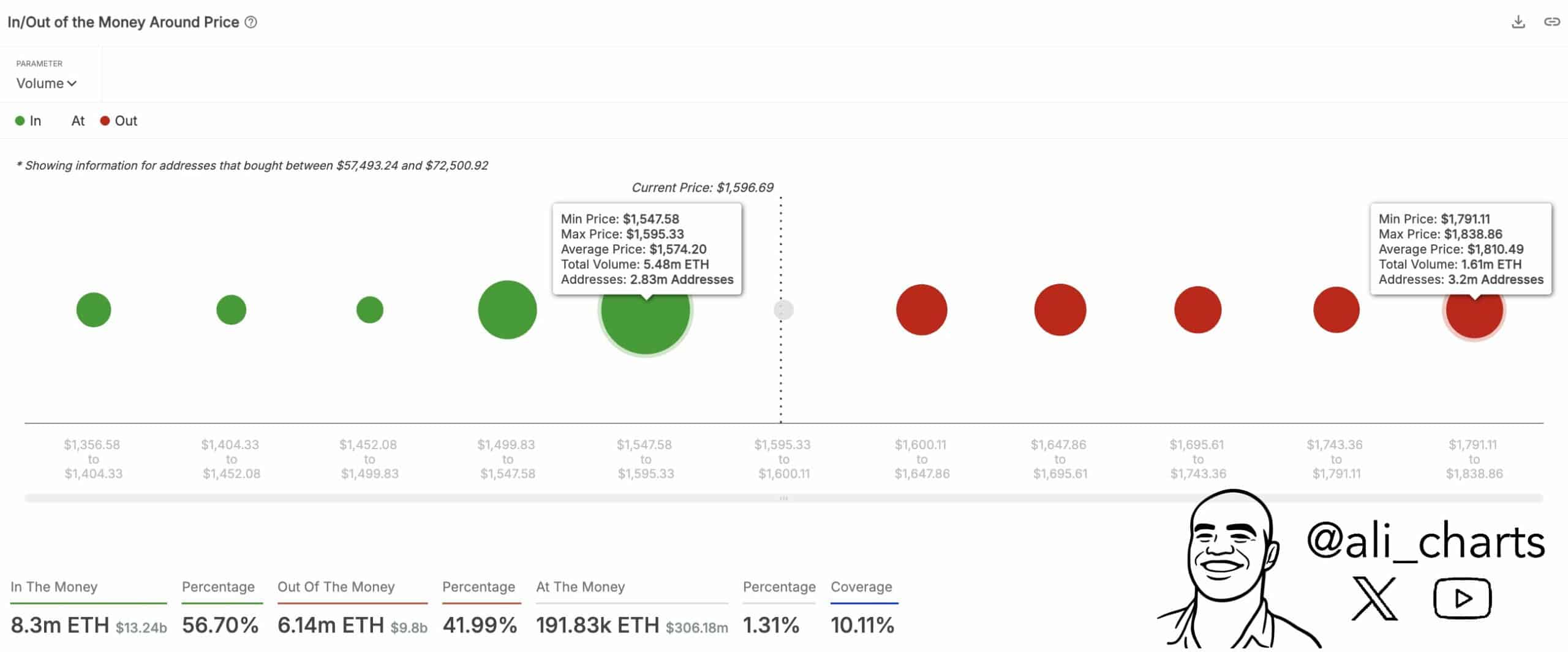

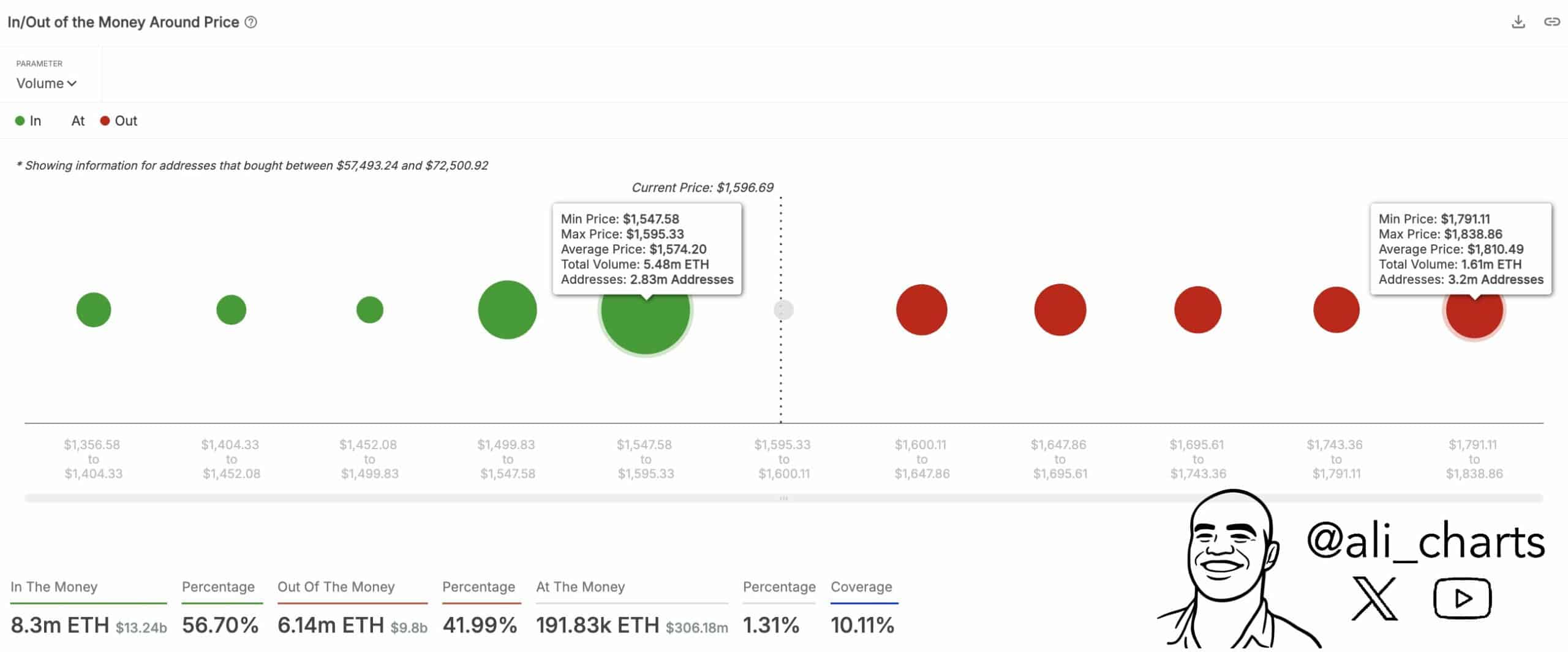

With the latest positive aspects, stakeholders are eyeing a extra sustained uptrend. Widespread crypto analyst, Ali Martinez, has urged a possible rally to $1,810.

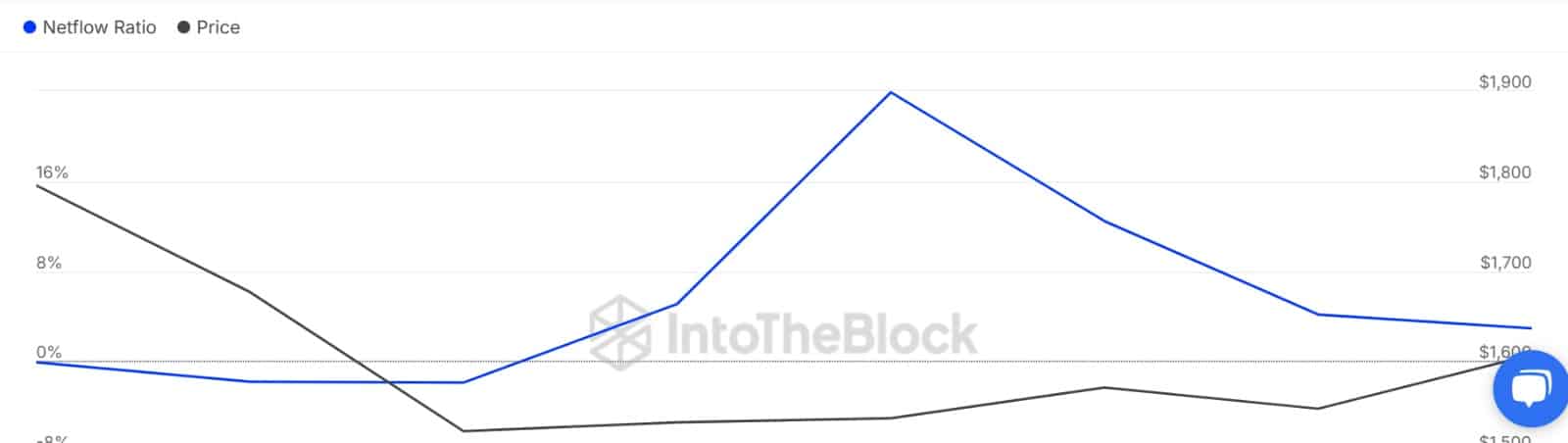

Supply: IntoTheBlock

In his evaluation, Martinez posited that since ETH has reclaimed its key help stage of $1574, the altcoin may rally if the demand zone holds. Thus, a maintain above this rally will see the altcoin reclaim the $1,810 resistance stage.

The query is, can Ethereum make sustained positive aspects to reclaim a better resistance stage?

Can Ethereum see a sustained uptrend?

In response to AMBCrypto’s evaluation, Ethereum is seeing a restoration on its demand aspect.

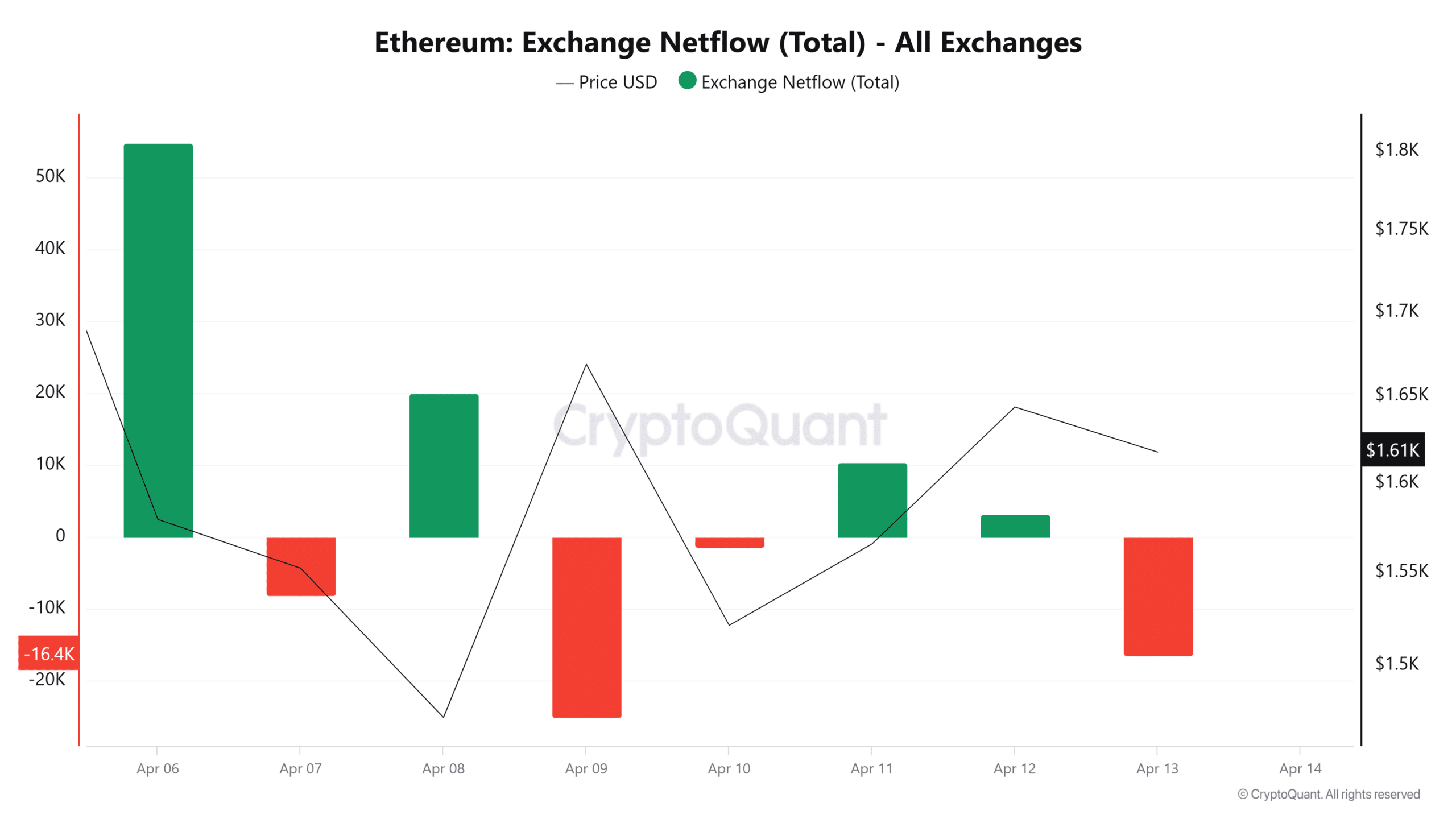

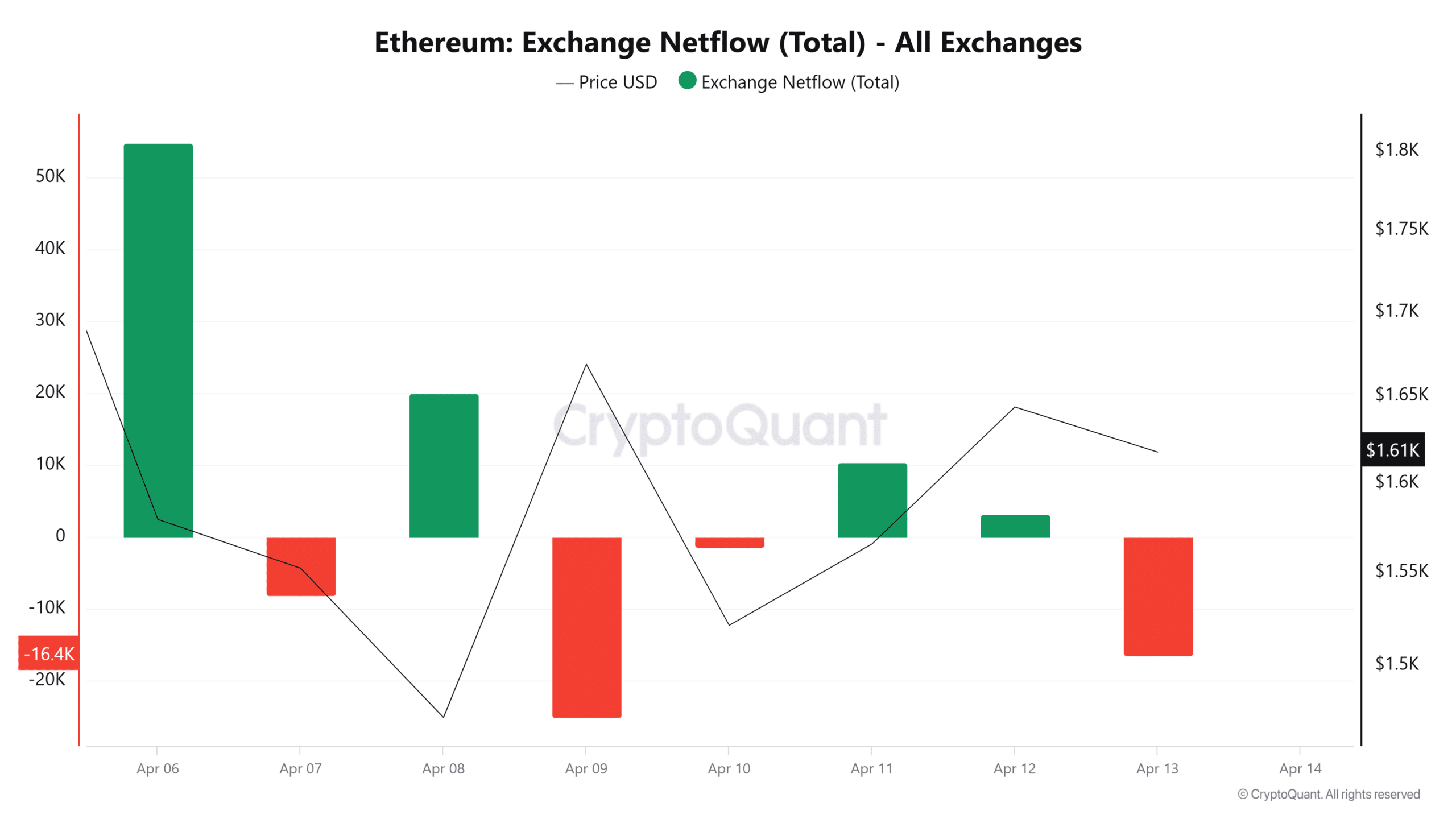

For starters, Ethereum’s Trade Netflow has turned unfavorable after two consecutive days of constructive flows. A shift into unfavorable means that buyers have turned to accumulating Ethereum.

As such, there are extra trade outflows than inflows, reflecting a rising demand.

Supply: CryptoQuant

Optimistic order imbalance additional validates this side. With a constructive order imbalance, it reveals that there are extra purchase orders executed than promote ones.

This implies that patrons are energetic out there, leading to extra trade outflows.

Supply: MobChat

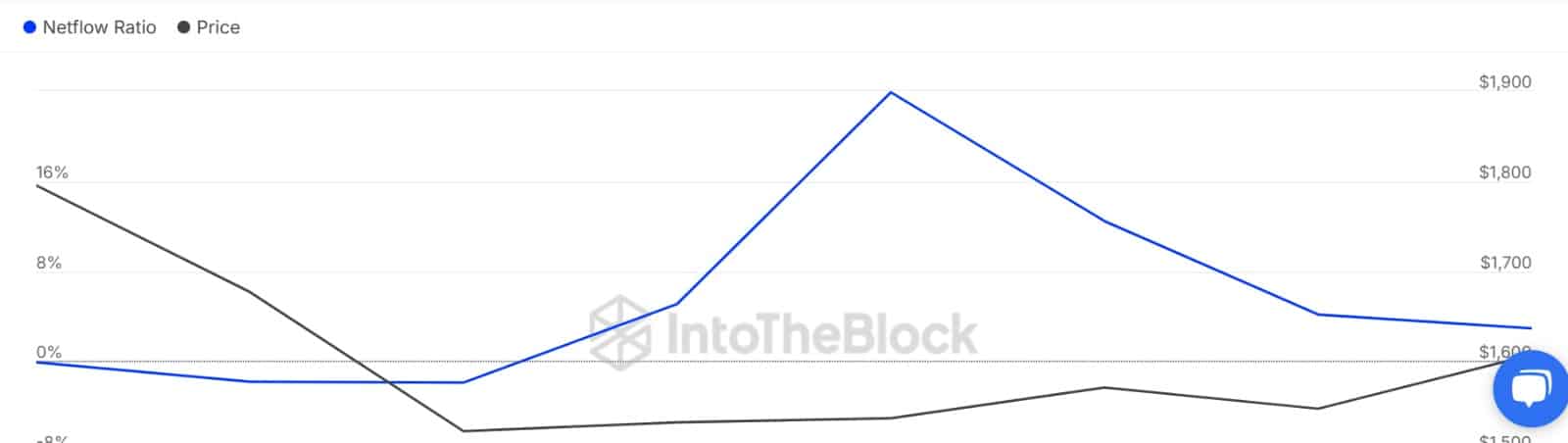

The rising demand is much more prevalent amongst whales. As such, Ethereum massive holders are making fewer transfers into exchanges.

Taking a look at massive holders’ netflow to trade netflow ratio, whales’ circulation to trade ratio has dropped from 23.9% to 2.92%.

This drop means that whales are shopping for greater than they’re promoting.

Supply: IntoTheBlock

With whales and retailers shopping for, it appears they’re shopping for the altcoin and taking lengthy positions. We are able to see this as Ethereum’s Aggregated Funding Price has turned constructive, reflecting a better demand for lengthy positions.

Thus, most buyers predict costs to rise even additional.

Supply: Coinalyze

Merely put, Ethereum is seeing a surge in demand. Traditionally, a better demand leads to larger costs. With ETH getting extra patrons than sellers, we may see the altcoin reclaim $1758.

If it rises to this stage, we may see a transfer in the direction of $1800. Conversely, if the try by bulls fails, we may see a correction with ETH retracing to $1465.