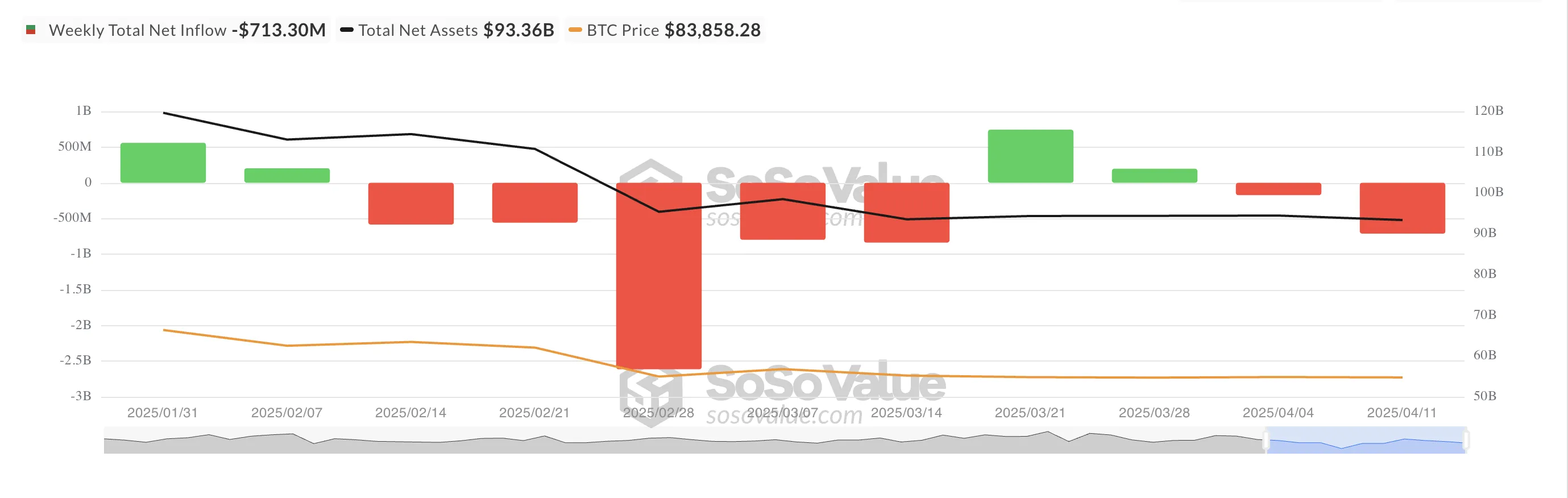

Final week, spot Bitcoin ETFs noticed day by day web outflows totaling $713 million, greater than threefold the $172.69 million outflows recorded the earlier week.

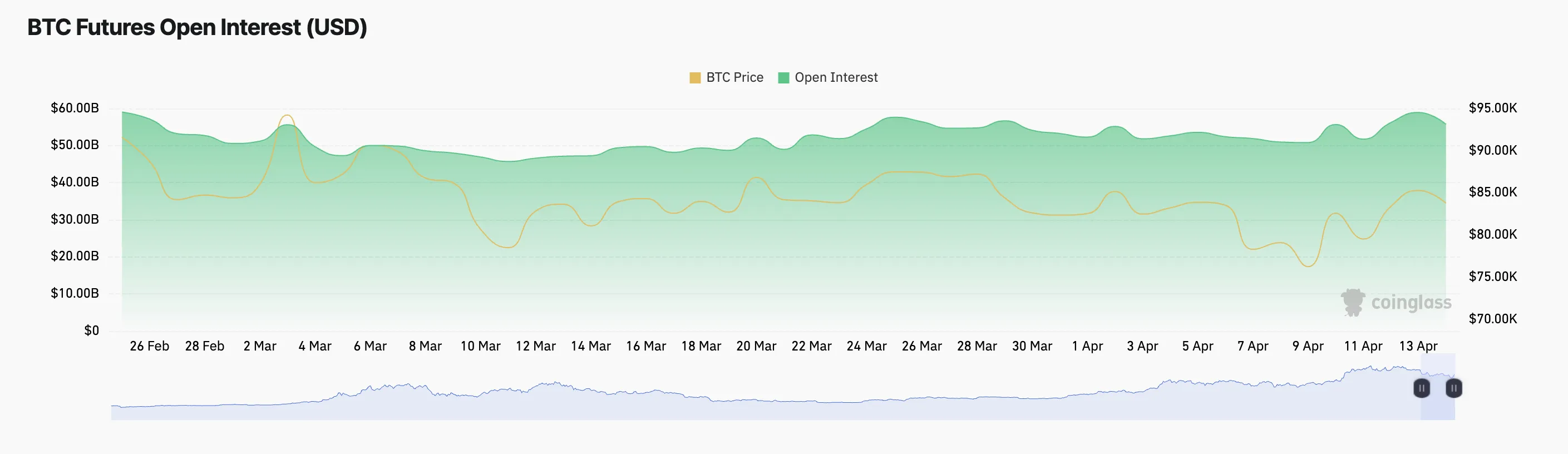

Within the derivatives market, BTC’s open curiosity has began the brand new week with a decline, though funding charges stay optimistic.

Bitcoin ETFs Bleed as Market Volatility Shakes Investor Confidence

Between April 7 and April 11, institutional traders pulled a portion of their capital from BTC funds. The transfer was largely pushed by broader market troubles, which stored BTC’s value beneath the extremely coveted $85,000 mark and dragged it all the way down to as little as $74,000 just a few instances.

Through the evaluation interval, complete web outflows reached $713 million, a 314% improve in comparison with the earlier week’s withdrawals of $172.69 million.

The biggest weekly outflow got here from BlackRock’s IBIT, which noticed $343 million in web outflows, marking 48% of all sums eliminated. Grayscale’s GBTC adopted with $161 million in outflows, bringing its complete web outflows to $22.78 billion.

Though the ETF market bled, some funds managed to file inflows final week. Per SosoValue, Grayscale’s Bitcoin Mini Belief noticed the best web influx amongst BTC spot ETFs final week, bringing in $2.39 million.

Bitcoin’s Derivatives Market Indicators Cautious Optimism

On the derivatives entrance, BTC’s futures open curiosity has begun the brand new week on a downward trajectory.

It at present stands at $55.73 billion at press time, noting a 5% dip over the previous day. That is occurring amid the broader market’s restoration try, which has seen BTC’s worth climb by a modest 1% over the previous day.

A decline in open curiosity whereas BTC‘s value rises indicators short-term warning amongst derivatives merchants. It means that merchants are closing out positions fairly than coming into new ones.

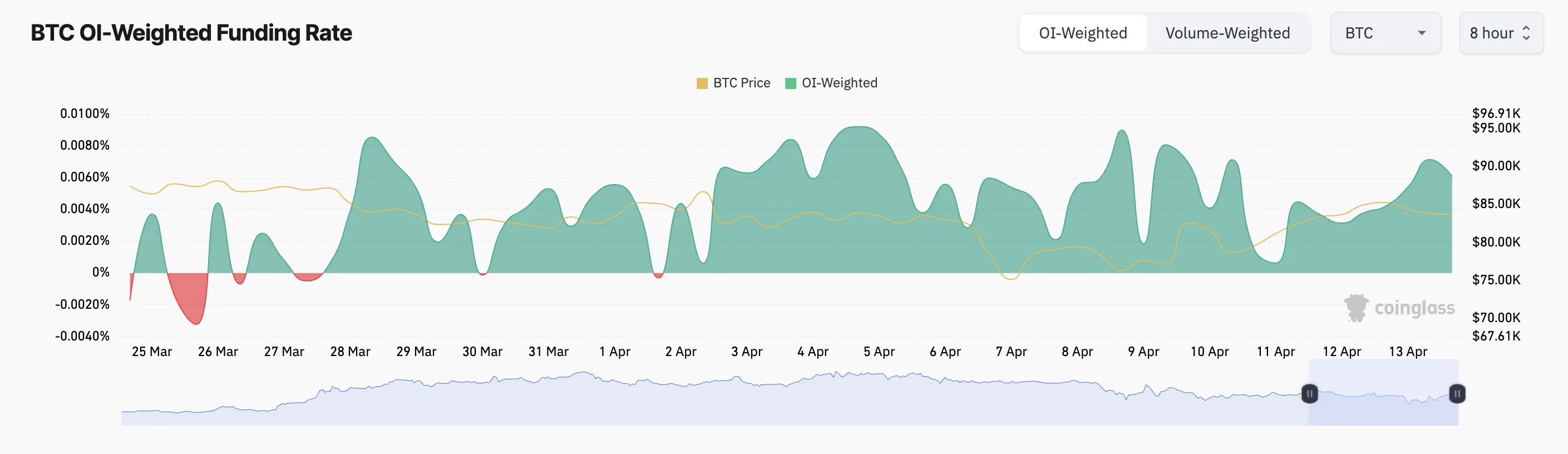

Regardless of this, funding charges stay optimistic, suggesting that lengthy positions nonetheless dominate amongst perpetual futures merchants, albeit with a extra cautious tone.

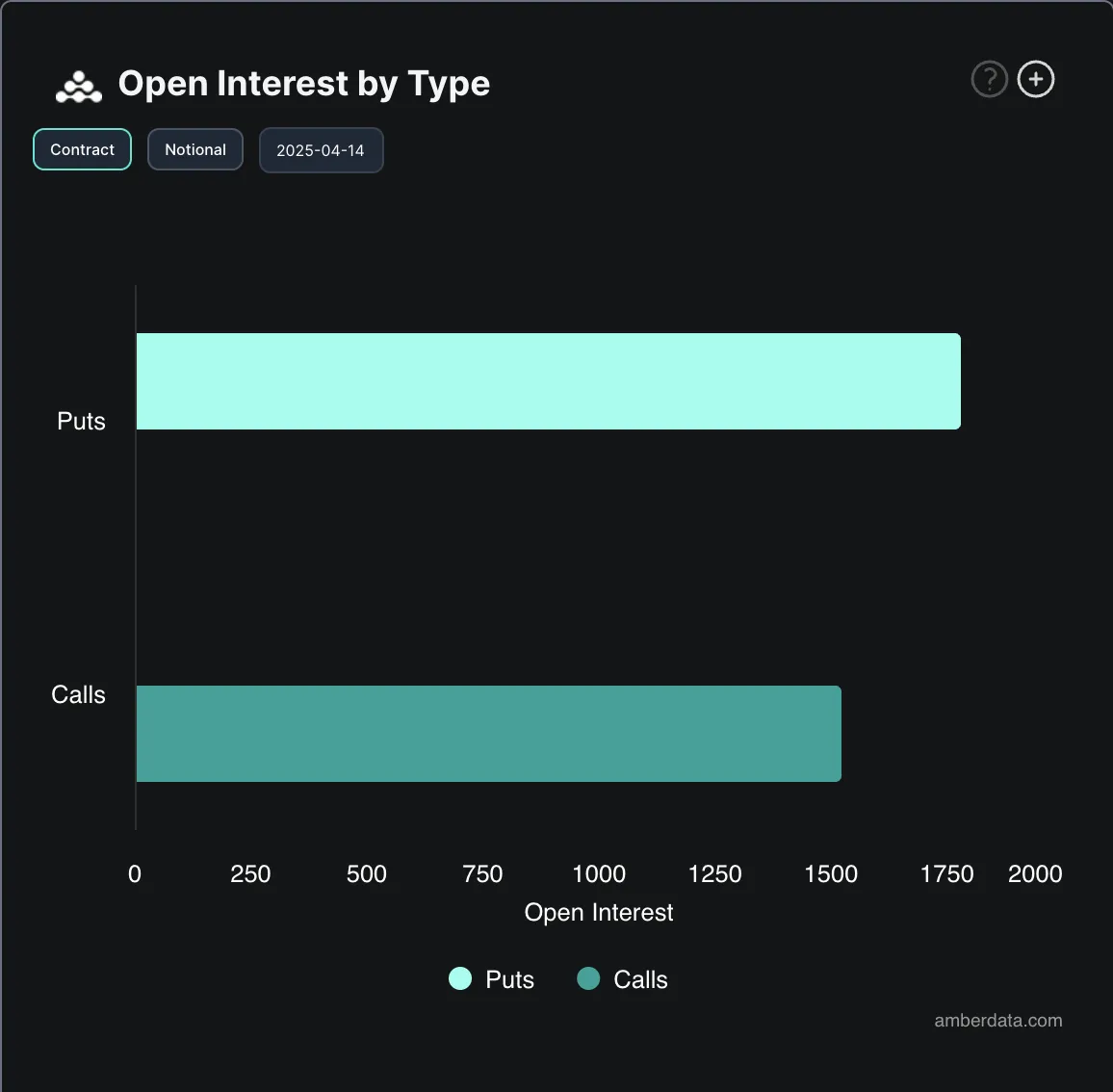

In the meantime, there are at present extra put contracts than name contracts within the choices market, signaling a bearish tilt in dealer sentiment. This larger put/name ratio indicators extra BTC merchants are betting on a possible draw back transfer for the coin or are actively hedging in opposition to near-term losses.

The ETF outflows, declining open curiosity, and bearish choices positioning counsel that sentiment within the broader BTC market is cautious.

Though the coin’s funding price hints that some optimism stays, merchants are nonetheless getting ready for elevated volatility within the coming days.

Disclaimer

According to the Belief Challenge tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.