Solana has surged by 40% since plummeting to a 12-month low of $95.23 on April 7, igniting renewed bullish sentiment within the derivatives market.

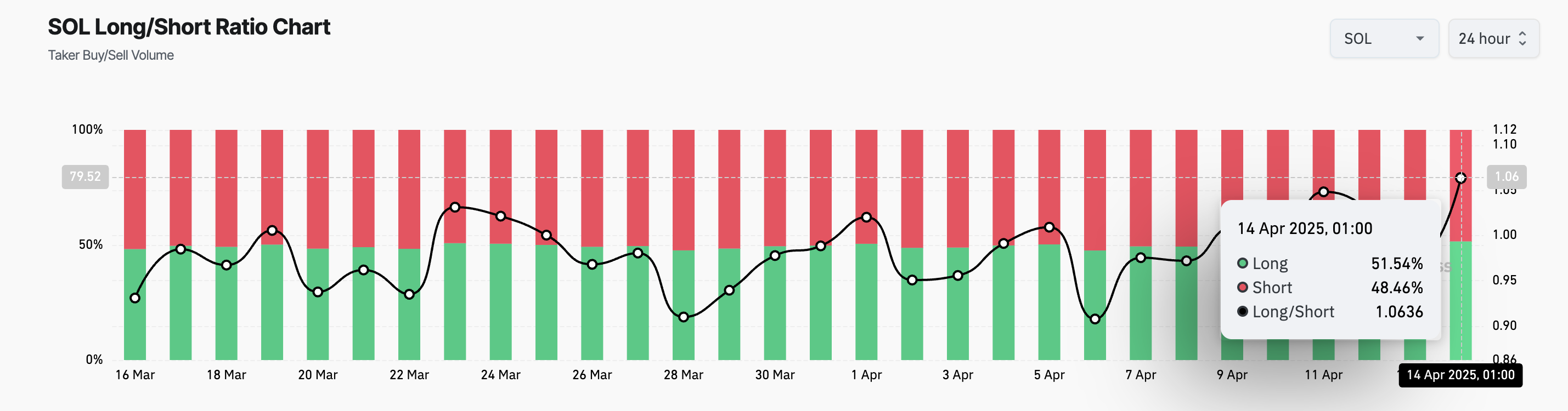

As of at present, this worth restoration has pushed SOL’s lengthy/brief ratio to a 30-day excessive, signaling a big uptick in demand for lengthy positions amongst futures merchants.

SOL Eyes Contemporary Rally as Lengthy/Quick Ratio Surges

In response to Coinglass, SOL’s lengthy/brief ratio at the moment sits at a 30-day excessive of 1.06, reflecting at present’s surge in demand for lengthy positions.

The lengthy/brief ratio measures the proportion of lengthy positions (bets on worth will increase) to brief positions (bets on worth declines) available in the market.

A ratio under 1 signifies extra merchants are betting on the asset’s worth falling. Conversely, as with SOL, a ratio above 1 suggests a bullish sentiment, with the bulk anticipating additional worth positive aspects.

The rising urge for food for longs suggests SOL merchants are more and more assured in additional upside potential. That is notable as a result of following the sharp rebound from its 12-month low, SOL seems to have entered a consolidation section, a typical cooling-off interval that always precedes the subsequent leg of a rally.

Therefore, if the demand for lengthy positions persists and shopping for strain strengthens, SOL might break above this slender vary and provoke the subsequent cycle of its rally.

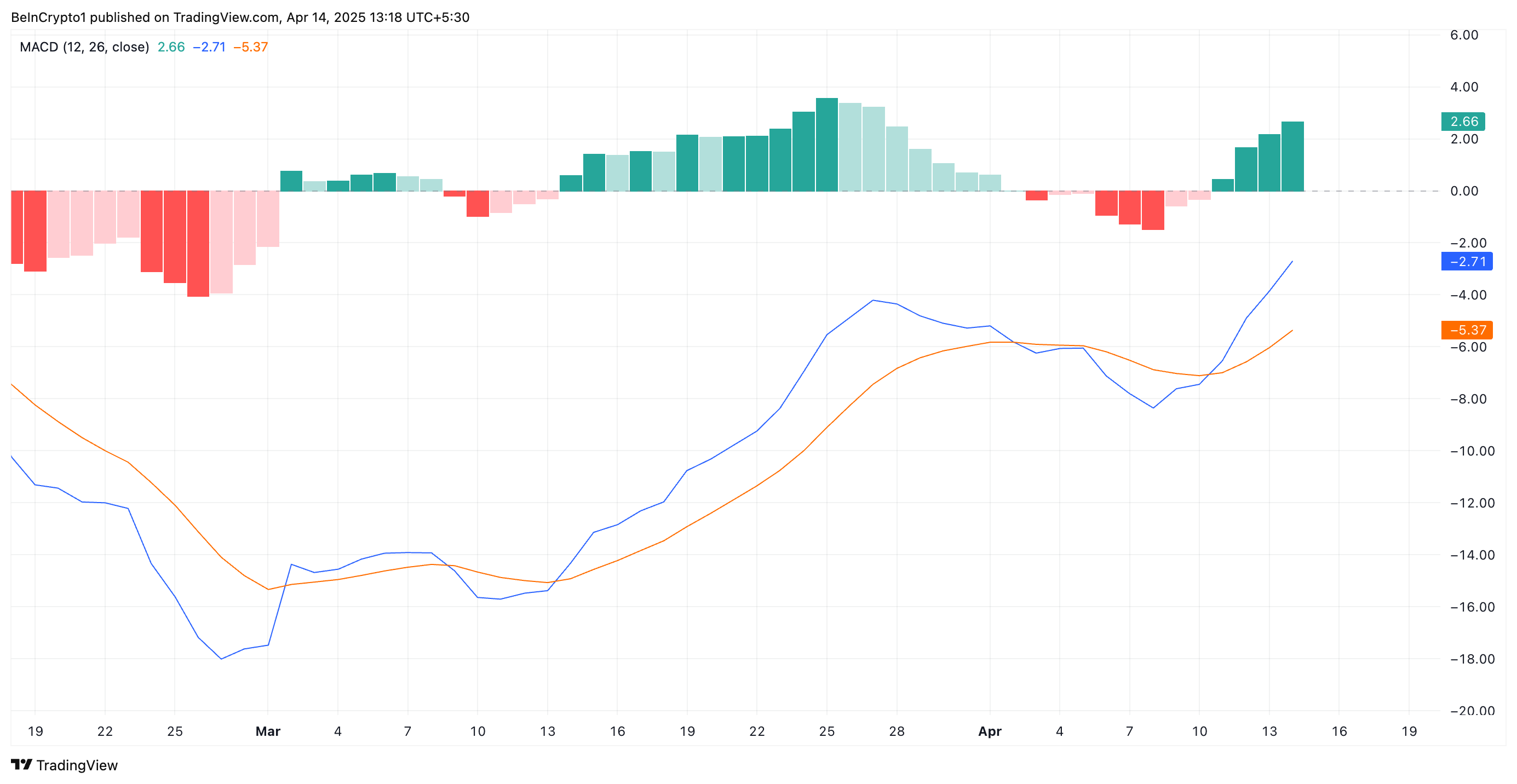

On the technical aspect of issues, the setup of the coin’s Transferring Common Convergence Divergence (MACD) confirms this bullish outlook. At press time, SOL’s MACD line (blue) rests atop its sign line (orange).

This development signifies rising bulling momentum within the SOL spot markets. The crossover suggests that purchasing strain is rising and gives affirmation that the current upward worth motion might proceed within the brief time period.

Solana Makes an attempt to Stabilize above $130, with $147 in Sight

SOL at the moment trades at $131.66, trying to stabilize above its new help ground fashioned at $130.17. If the demand for longs persists and bullish momentum stays robust, SOL might get away of its sideways actions and rally towards $147.59.

Then again, if bullish strain weakens and profit-taking resumes, SOL might slip under $130.17 and fall to $95.54.

Disclaimer

Consistent with the Belief Venture pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.