- BTC is experiencing robust demand throughout all market members.

- Whales on Binance aren’t promoting Bitcoin, reflecting rising market confidence.

Since dropping to an area low of $74k per week in the past, Bitcoin [BTC] has made a major restoration, hitting a excessive of $86k.

These important positive factors mirror the shift in market sentiments from market members, particularly whales.

As such, whales have cooled down and aren’t promoting as per CryptoQuant. This market habits amongst giant entities is extra evidenced by whale exercise on Binance.

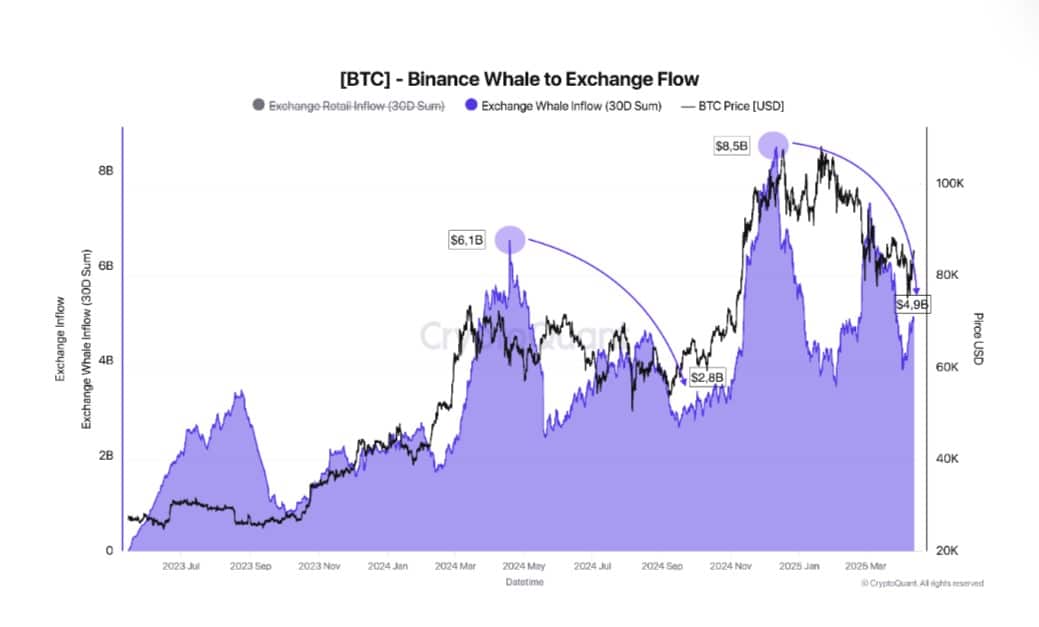

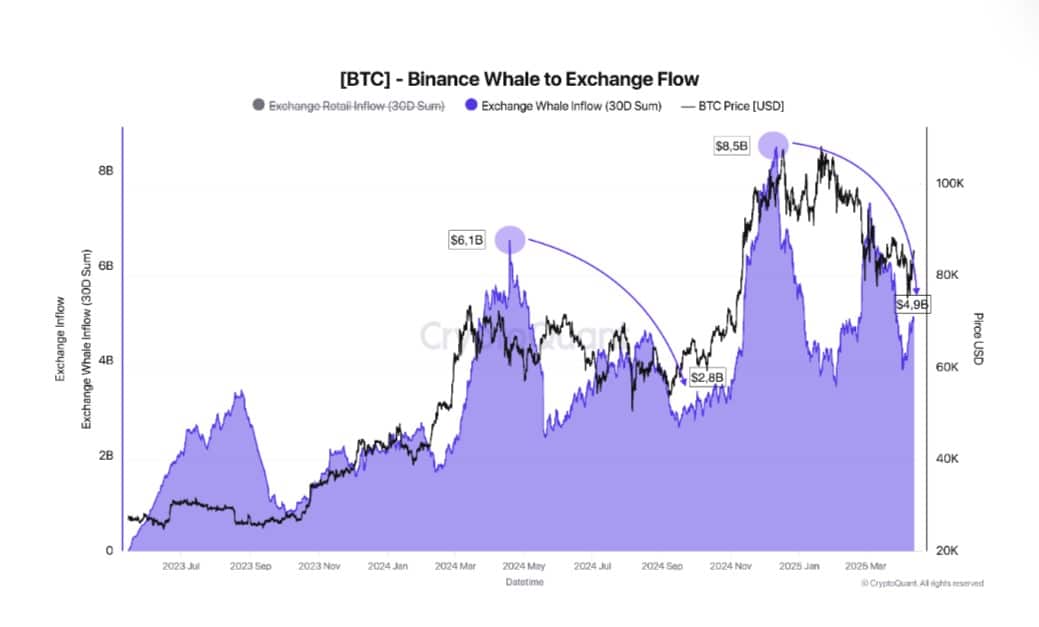

Supply: CryptoQuant

Over the previous thirty days, whale influx values have considerably declined, dropping by over $3 billion—just like the earlier correction in 2024. This means that Binance whales are sustaining composure and never displaying indicators of panic.

Moreover, each the Change Whale Ratio and whale inflows on Binance are reducing. This alteration in whale habits indicators a shift in market sentiment, with confidence amongst giant holders steadily recovering.

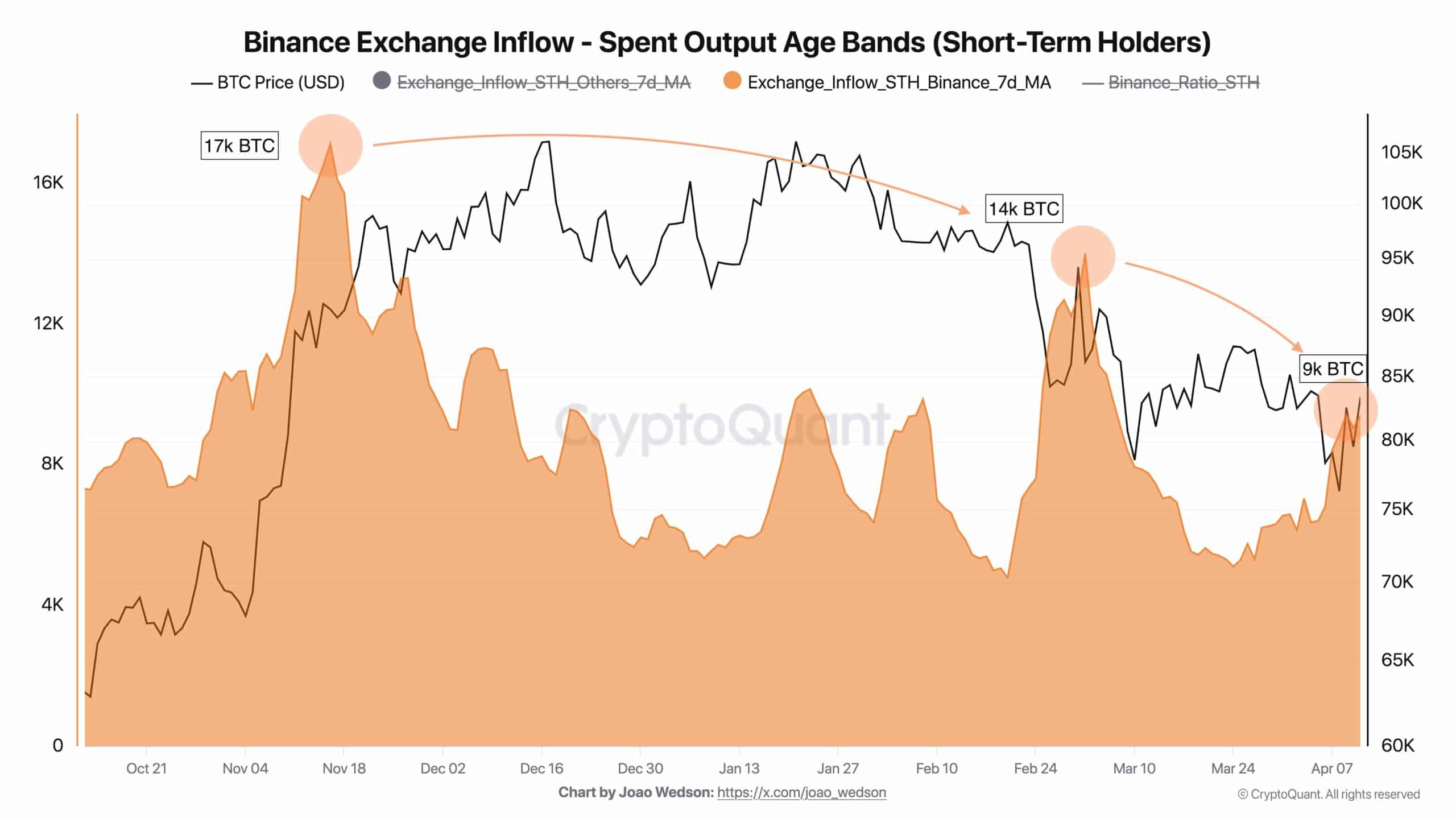

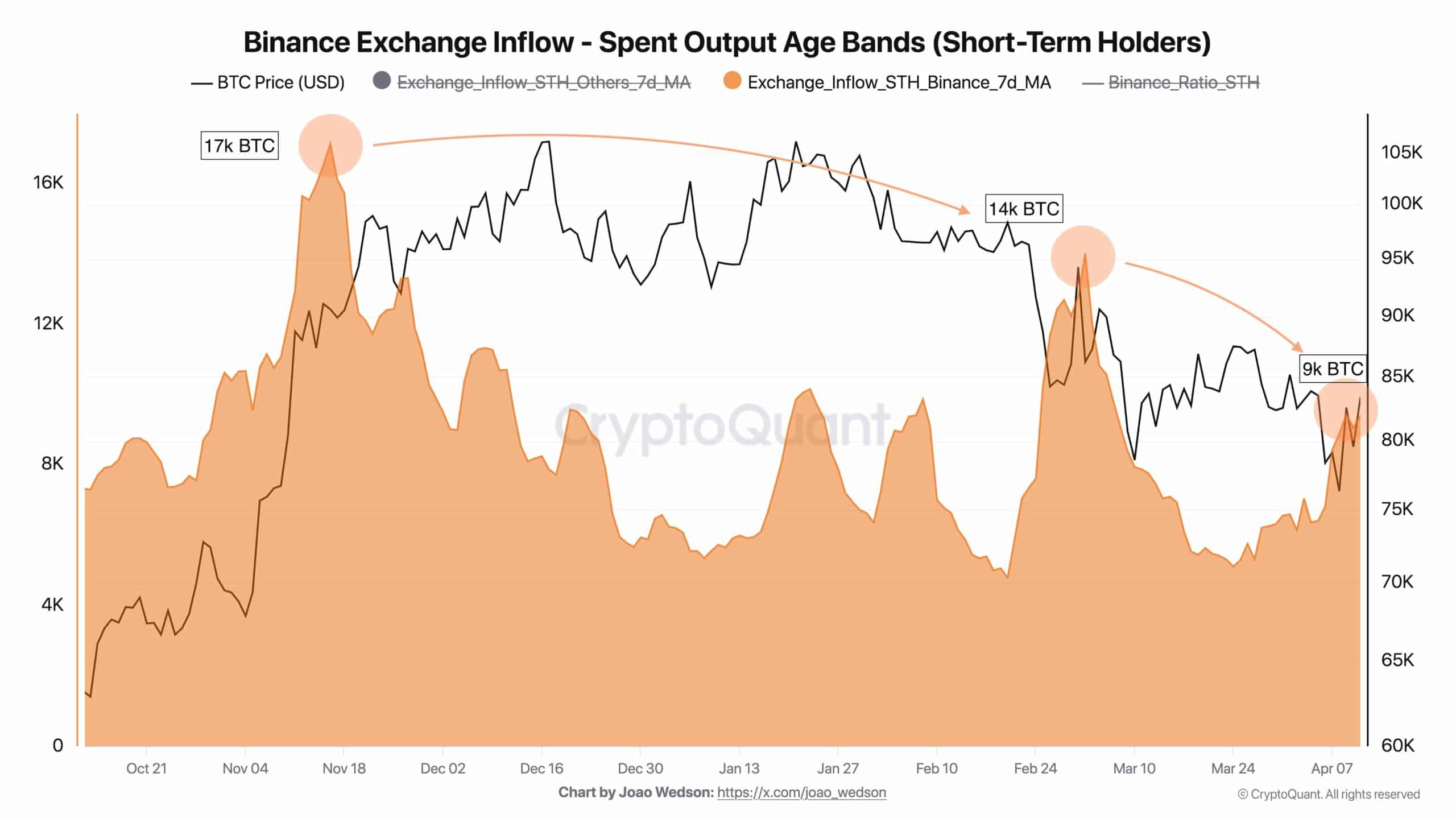

Supply: CryptoQuant

This shift in market habits is much more seen amongst short-term holders. As such, STH promoting strain on Binance is declining. BTC inflows (7DMA) from STHs to Binance have been steadily reducing.

They dropped from round 17,000 BTC inflows on the sixteenth of November to 14,000 on the third of March and are actually hovering round 9,000.

This means that promoting strain from short-term traders on Binance is easing, which is a constructive sign.

Supply: CryptoQuant

With whales and short-term holders on Binance decreasing promoting exercise, it displays the rising demand for Bitcoin.

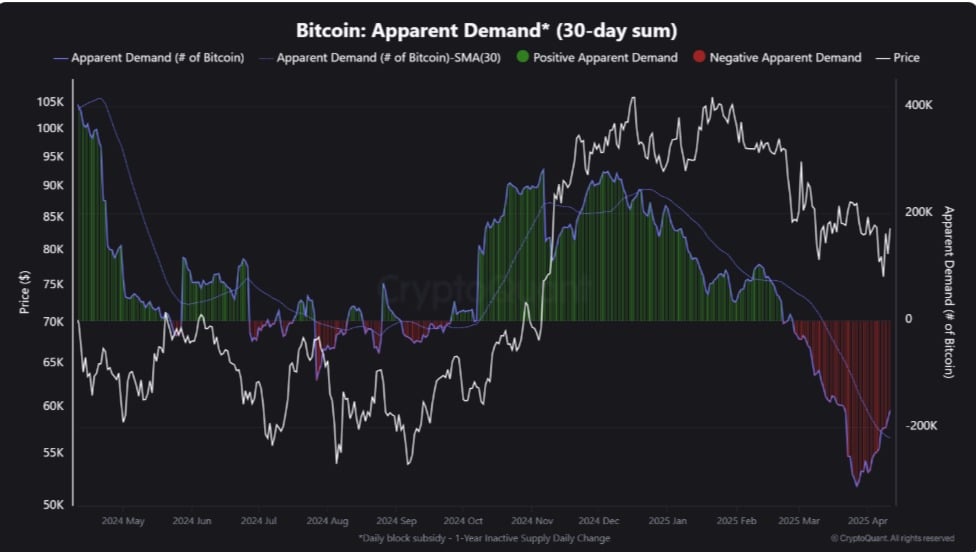

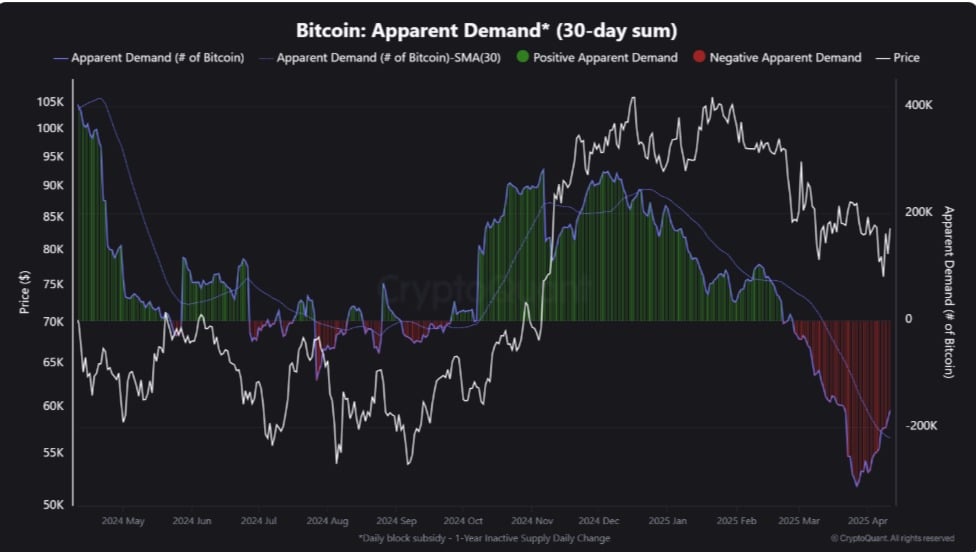

As such, Bitcoin’s Obvious Demand (30-day sum) has not too long ago began to bounce from deeply unfavorable territory, hinting at a attainable shift in market habits.

Supply: CryptoQuant

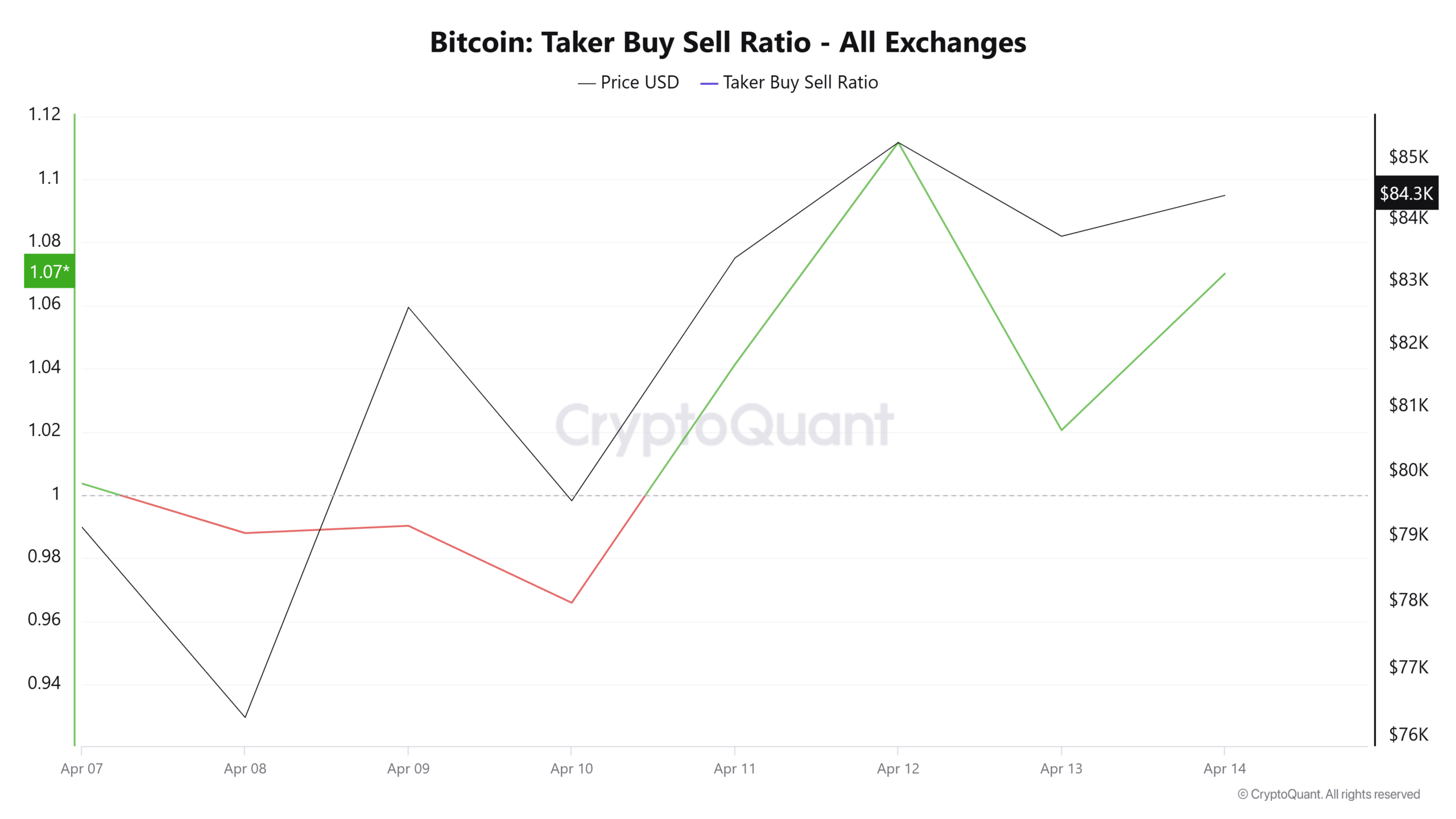

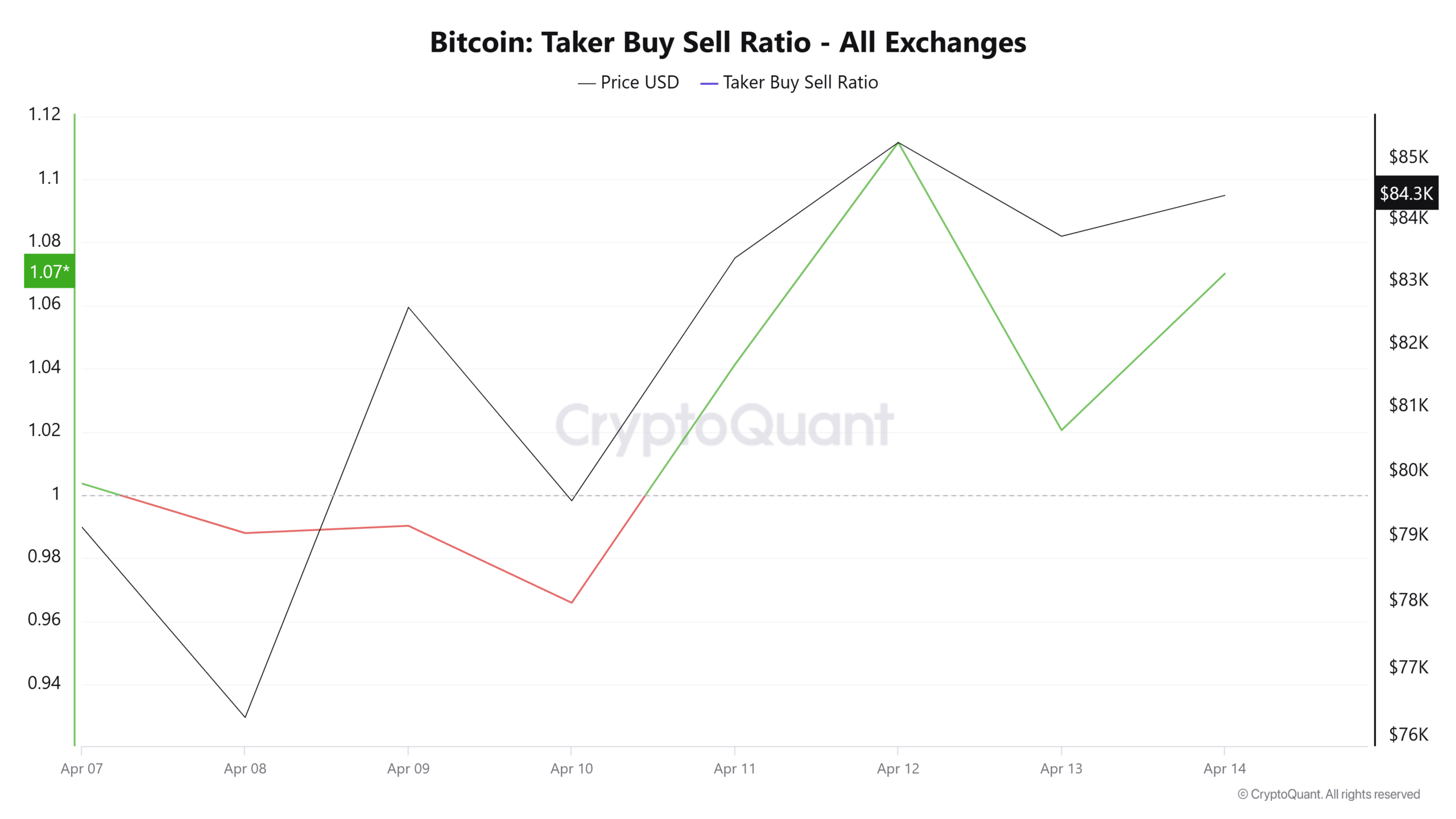

AMBCrypto noticed this shift in demand as consumers have taken the market again. This shift in dominance is evidenced by the current spike within the Taker Purchase Promote Ratio, which has reached 1.07.

When the Taker Purchase Promote Ratio surpasses 1, it means that consumers are actually dominant out there, reflecting greater demand as traders accumulate. The rise in demand means a pause in promoting strain, suggesting a possible shift in momentum.

What it means for BTC

A discount in short-term holder exercise and whale promoting suggests a shift in market path, with bulls gaining management.

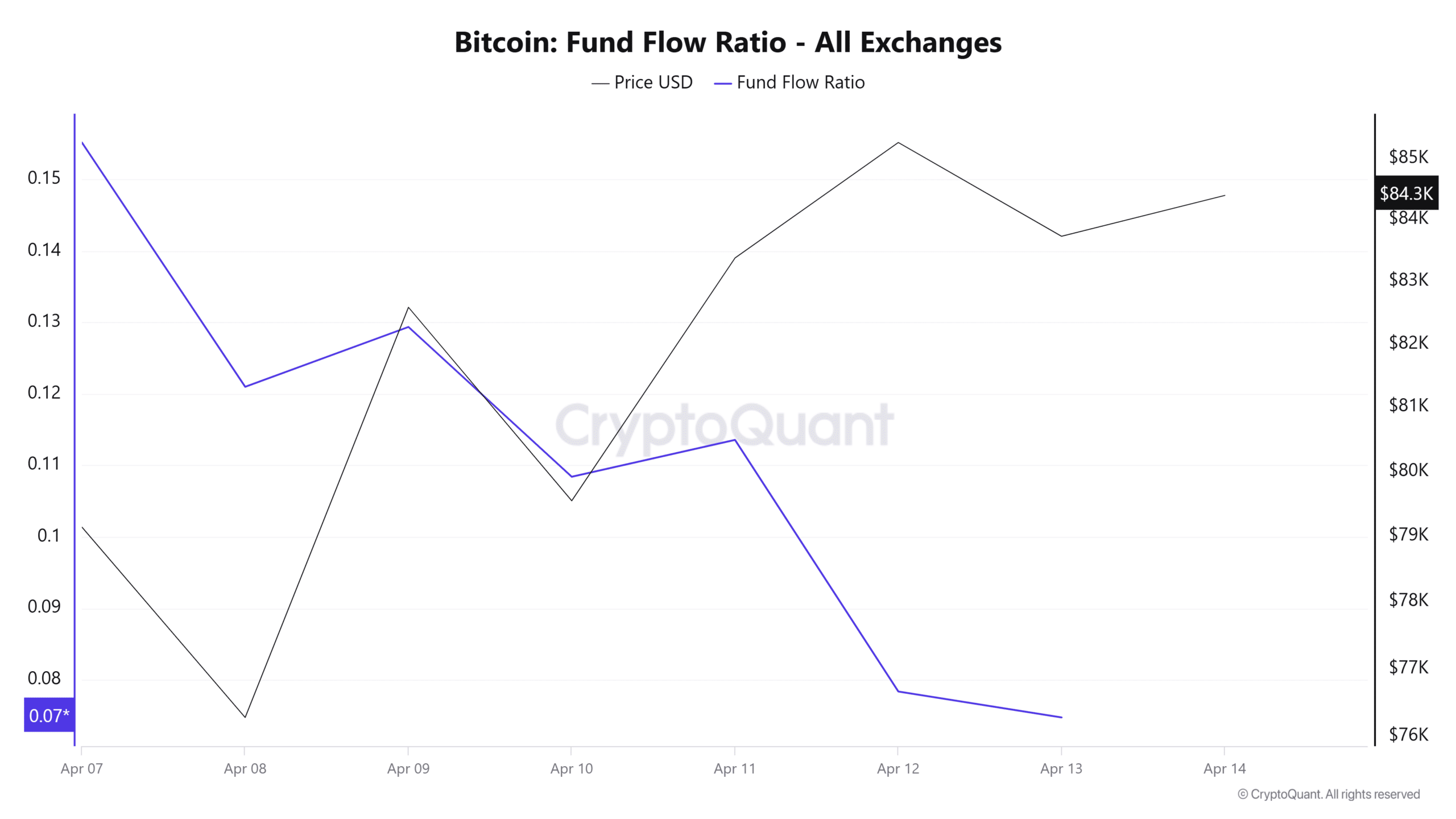

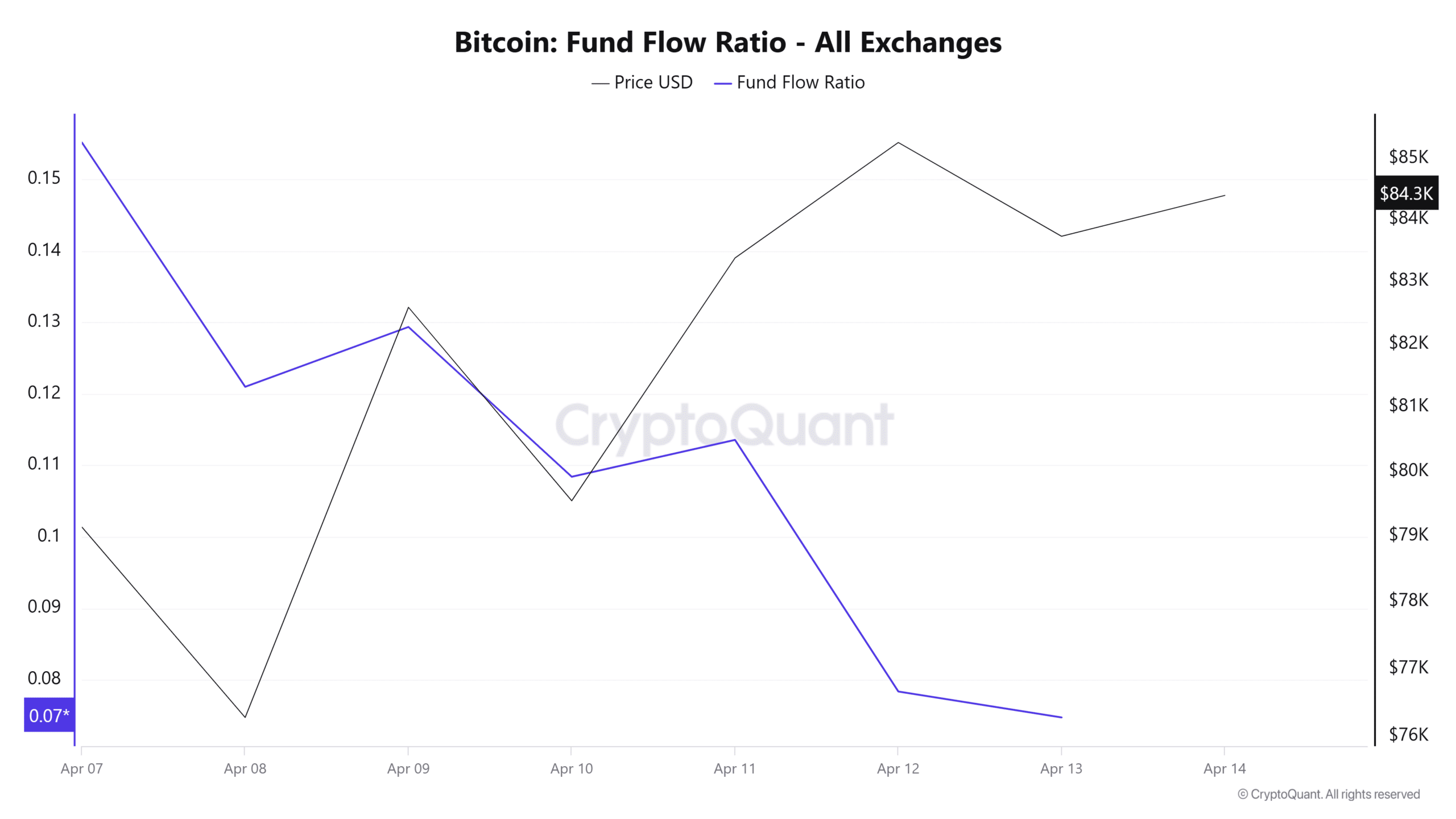

Bitcoin is displaying indicators of a possible development reversal, setting the stage for sustained positive factors. The Fund Circulation Ratio signifies restricted engagement with exchanges for promoting.

Over the previous week, the fund stream ratio has steadily decreased to 0.07, highlighting that holders are refraining from aggressive promoting.

Supply: CryptoQuant

With lowered promoting exercise and elevated demand, the outlook for BTC seems promising, positioning the cryptocurrency for sustained restoration. Traditionally, low promoting strain mixed with rising demand has usually led to cost will increase.

If present market circumstances stay secure, BTC might reclaim key resistance at $87,167 and probably purpose for $88,600. Nonetheless, if volatility intensifies and sellers regain management, BTC might face a correction, dropping to $82,460.