Este artículo también está disponible en español.

Bitcoin has skilled a whirlwind of volatility following its latest all-time excessive of $93,483 set on Wednesday. Over the previous few days, the value has oscillated between this report stage and a low of $85,100, indicating the potential onset of a consolidation section earlier than the subsequent main transfer. Merchants and buyers at the moment are carefully monitoring whether or not BTC will stabilize or proceed its upward trajectory.

Associated Studying

Key information from CryptoQuant means that promoting strain might improve rapidly, primarily pushed by speculative merchants trying to lock in fast income. Nevertheless, this doesn’t essentially spell bother for Bitcoin’s bullish momentum.

Analysts predict that a lot of the promoting strain can be absorbed by the rising demand for Bitcoin ETFs, which have gained important traction amongst institutional buyers.

This stability between short-term promoting and institutional accumulation may set the stage for Bitcoin’s subsequent transfer. With volatility anticipated to persist within the coming days, market members are eagerly looking ahead to alerts that may point out the route of BTC’s value motion. Whether or not this section results in a deeper correction or propels Bitcoin towards new highs, one factor is obvious—Bitcoin continues to dominate the monetary panorama with its dynamic efficiency.

Bitcoin Robust Demand Helps Bullish Worth Motion

Bitcoin’s value motion has been spectacular, surging by 38% over the previous ten days. This speedy rise has caught the eye of many buyers, reaffirming the rising energy of Bitcoin’s demand.

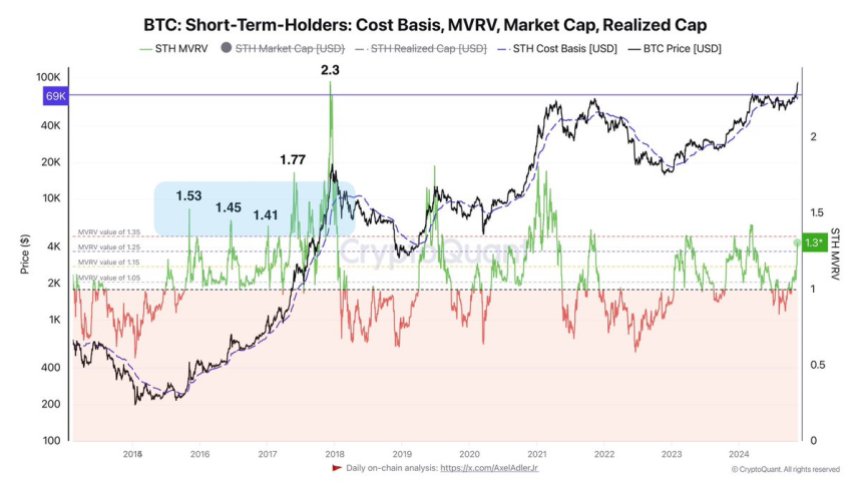

Key information from CryptoQuant analyst Axel Adler presents perception into the present market dynamics, highlighting that Bitcoin is buying and selling above its short-term holder (STH) value foundation of $69,000. This stage represents a vital help threshold for individuals who acquired Bitcoin previously few months, indicating strong demand above this value.

Moreover, the MVRV (Market Worth to Realized Worth) ratio stands at 1.3, suggesting that Bitcoin continues to be worthwhile. Nevertheless, Adler notes that if this ratio crosses the 1.35 mark, it may set off promoting strain from short-term speculators trying to lock in income.

Whereas this may occasionally immediate some market volatility, it’s vital to notice that the majority of those cash are anticipated to be absorbed by rising institutional demand, notably by means of Bitcoin exchange-traded funds (ETFs).

Associated Studying

This information factors to a major shift in Bitcoin’s rally—relatively than being fueled by speculative futures trades, the latest surge seems to be pushed by sturdy spot demand. Spot demand sometimes displays a extra sustainable, secure value transfer than the volatility usually seen in futures-driven rallies.

As Bitcoin continues to commerce above key help ranges, the outlook stays bullish, pushed by a wholesome stability between speculative buying and selling and long-term institutional curiosity.

BTC Technical View: Costs To Watch

Bitcoin is buying and selling at $89,240, reflecting a 7% retrace from its latest all-time excessive of $93,483. The value has consolidated under this stage following a interval of aggressive upward momentum that propelled it into value discovery territory.

This pause within the rally permits the market to stabilize and take a look at key help ranges earlier than figuring out its subsequent transfer.

Throughout this consolidation, the $85,000 mark has emerged as a vital help stage. If Bitcoin can maintain above this stage within the coming days, it could present the inspiration for one more surge, doubtlessly difficult the $90,000 resistance and retesting its all-time excessive. A profitable reclaim of $90,000 would sign renewed bullish momentum, paving the best way for additional value growth.

Associated Studying

Nevertheless, failure to keep up the $85,000 help may result in a deeper correction. On this situation, Bitcoin would seemingly search lower-level demand, with $82,000 rising as a major space of curiosity for patrons.

Because the market navigates this important section, merchants and buyers will carefully watch value motion for alerts of both a breakout or a pullback, with each situations carrying implications for Bitcoin’s short-term trajectory.

Featured picture from Dall-E, chart from TradingView