- LINK reclaimed its day by day trendline as bulls defended $12.25 amid gentle upside momentum

- On-chain exercise dropped sharply, however fundamentals and reserves hinted at restoration potential

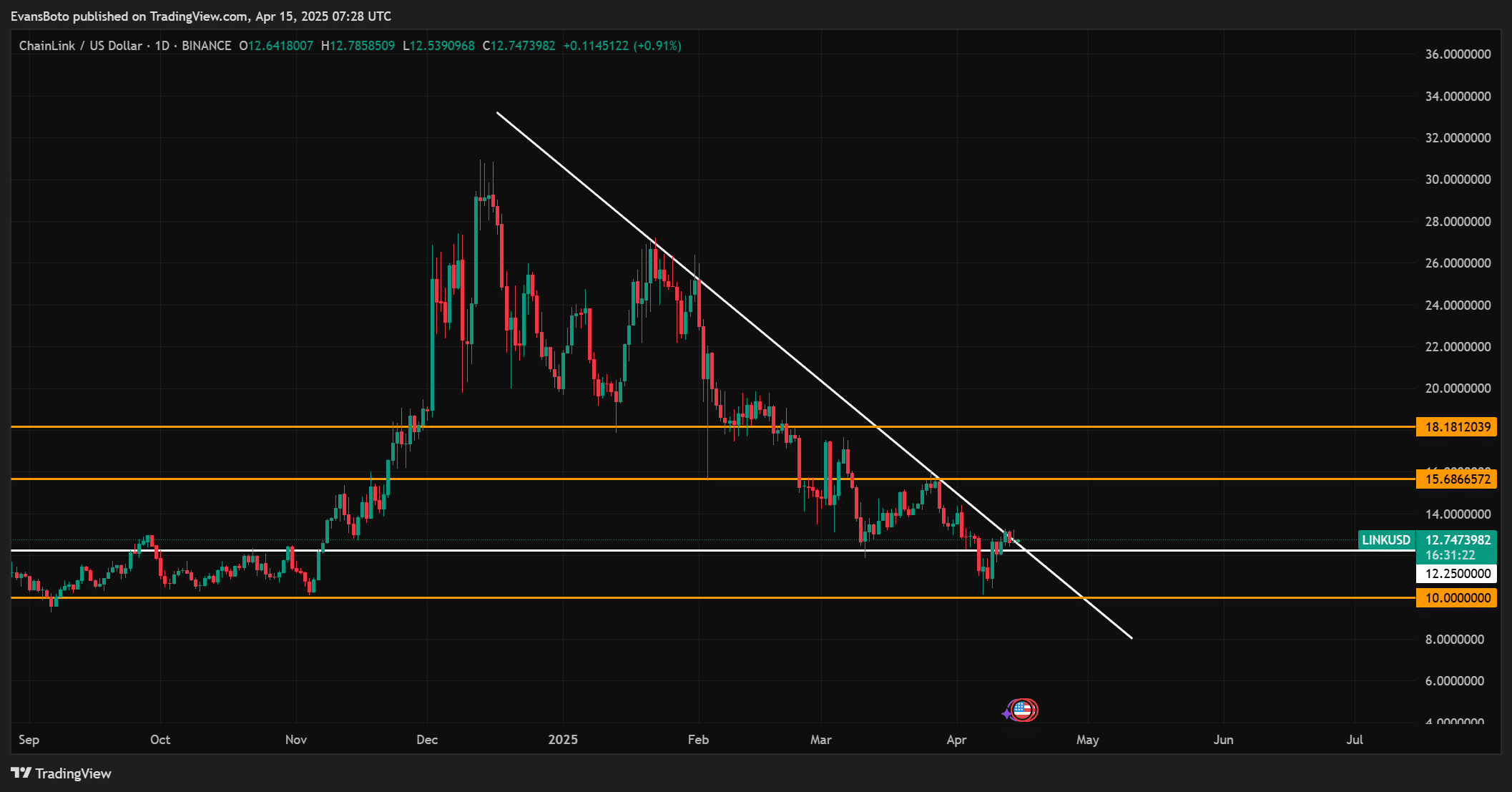

Chainlink [LINK], on the time of writing, was retesting an important breakdown zone after breaching a year-long ascending trendline. This appeared to allude to a decisive second for the altcoin’s short-term route.

In reality, regardless of a momentary rebound, the $12.25-level has emerged as a key battleground for bulls aiming to regain dominance. If this assist fails to carry, draw back targets at $10 and $7.50 might come into focus.

On the technical entrance, LINK just lately broke above a descending trendline on the day by day chart – Hinting at a possible shift in development. Nonetheless, momentum was weak, and the worth may nonetheless flirt with the important thing assist space.

At press time, LINK was buying and selling at $12.67 following positive aspects of 0.41% within the final 24 hours. Bulls should keep strain above $12.25 to verify a sustainable reversal.

![Chainlink [LINK] worth prediction – Be careful for a protection of THIS key degree! Chainlink [LINK] worth prediction – Be careful for a protection of THIS key degree!](https://ambcrypto.com/wp-content/uploads/2025/04/LINKUSD_2025-04-15_10-28-41.png)

Supply: TradingView

New partnerships and declining reserves – Will fundamentals spark a restoration?

Chainlink just lately introduced a strategic collaboration with Pi Community, aiming to boost decentralized functions by means of real-time knowledge integration. This transfer strengthens Chainlink’s sensible contract capabilities and will function a long-term bullish driver.

Nonetheless, the market response has been muted up to now, indicating that merchants could also be targeted extra on technical construction than fundamentals within the quick time period.

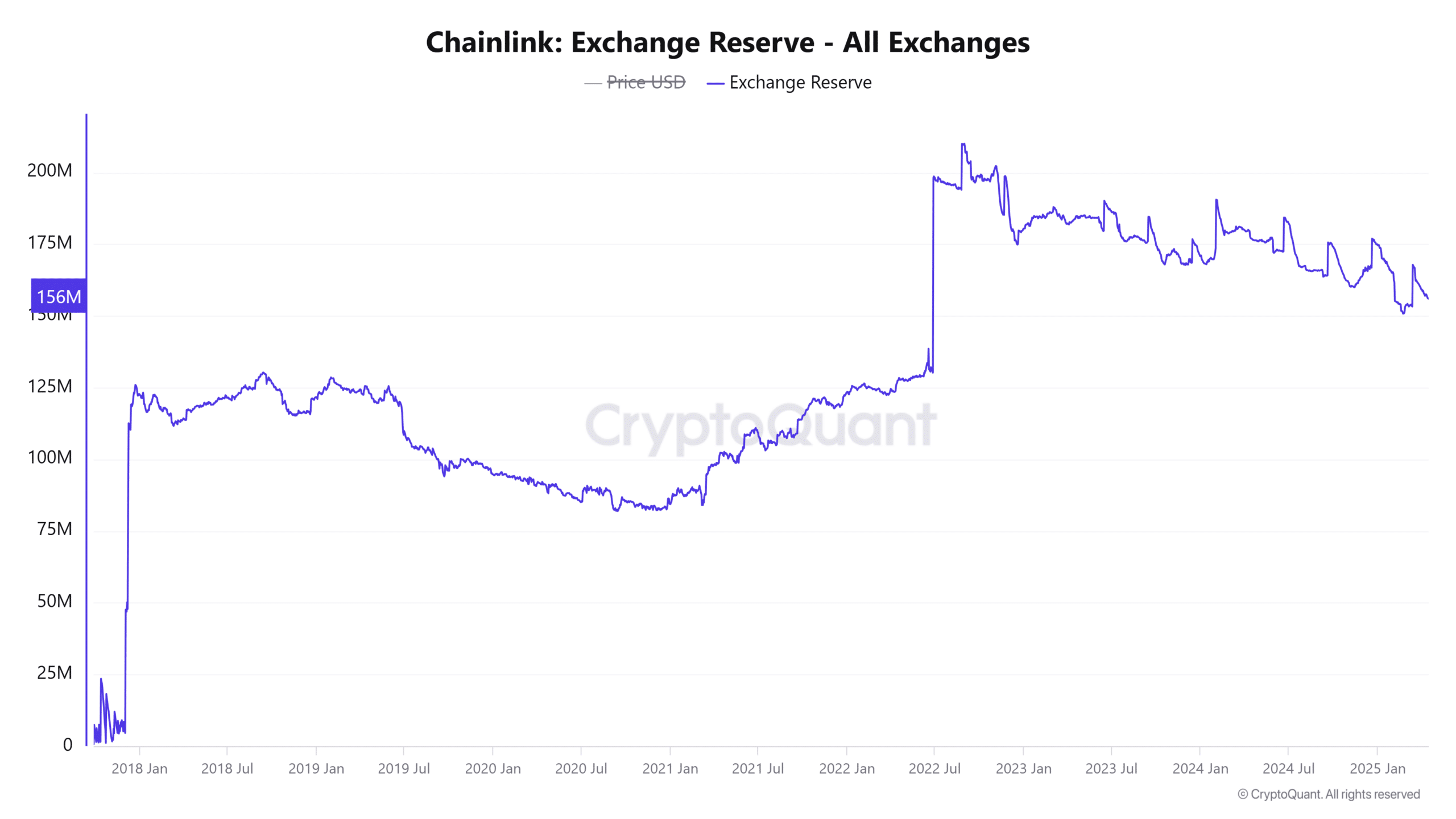

In the meantime, change reserve knowledge revealed a 0.2% drop during the last 24 hours, with whole LINK on exchanges now at 156 million. This fall in exchange-held provide hinted at declining sell-side strain, typically seen throughout accumulation phases. If sustained, this development may assist increased costs, particularly if demand begins to rise.

Supply: CryptoQuant

What does investor behaviour counsel?

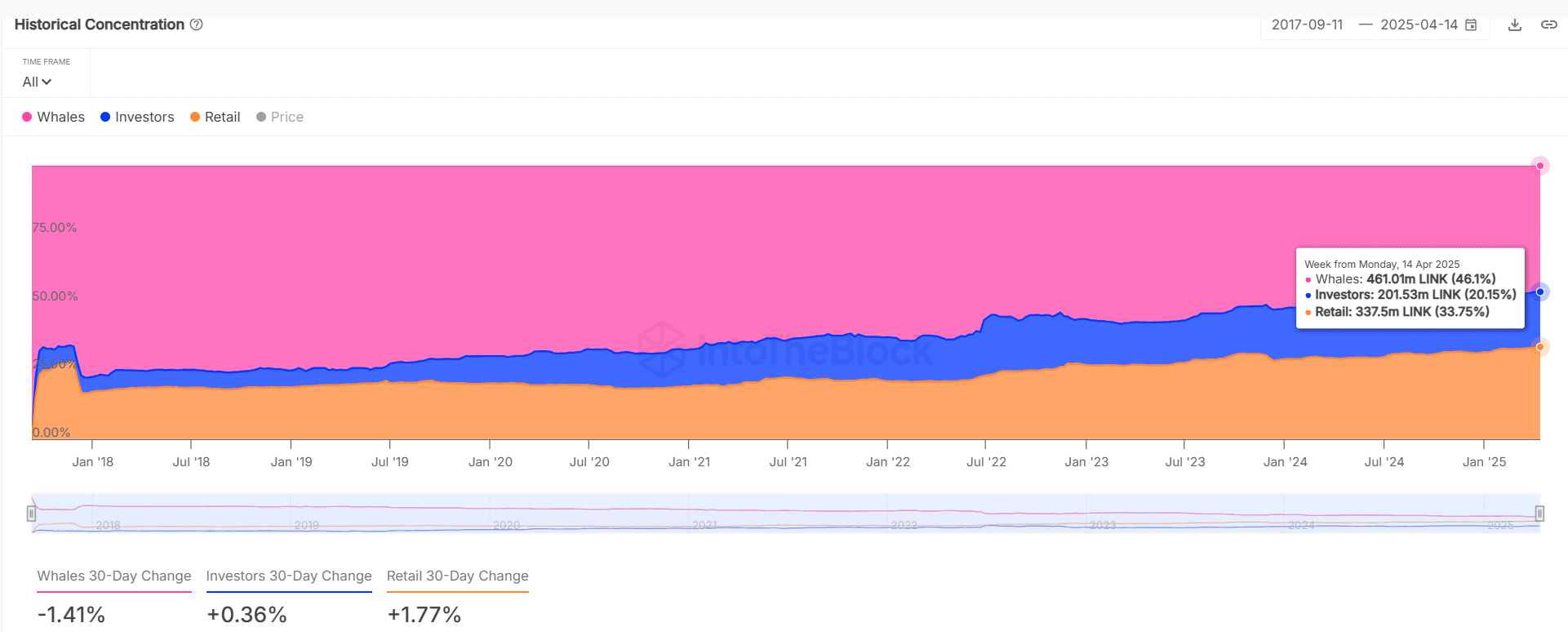

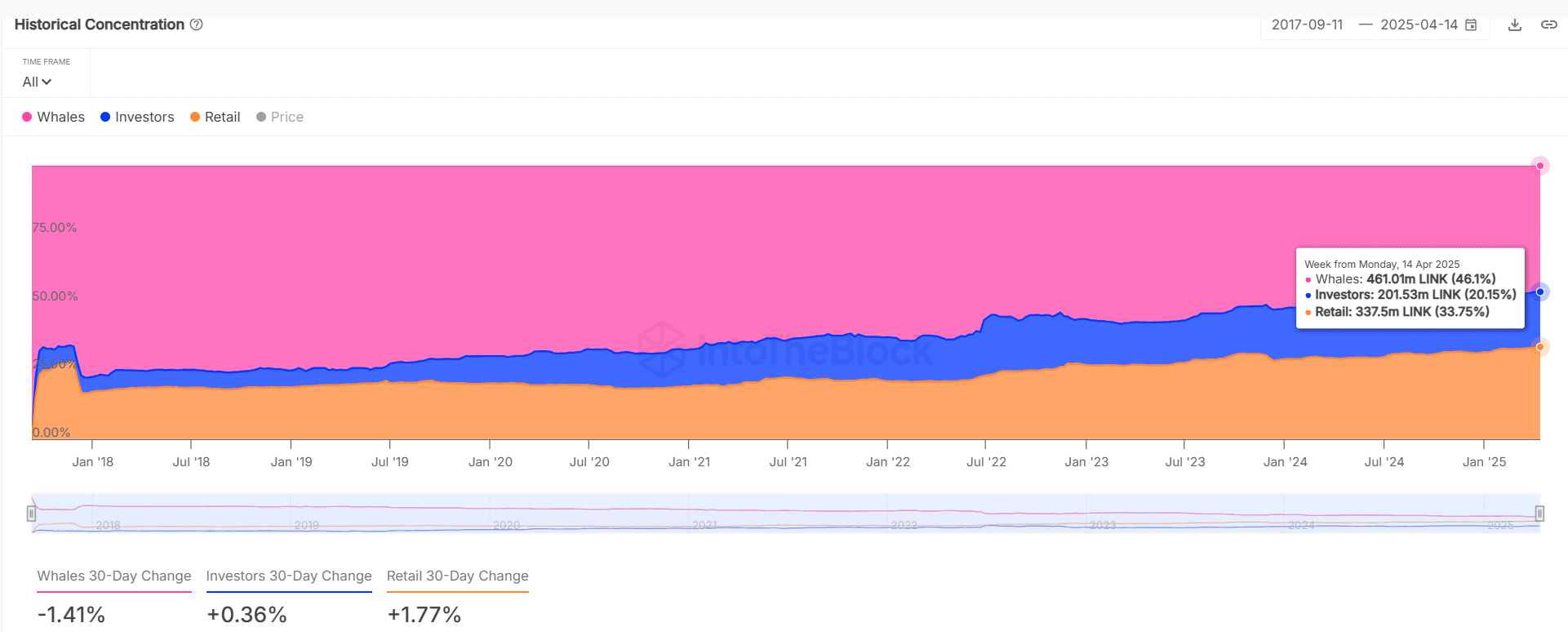

Proper now, whales management 46.1% of LINK’s provide. Nonetheless, their holdings dropped by 1.41% over the previous month.

Retail participation, alternatively, climbed by 1.77% and their investor holdings elevated marginally by 0.36%. This redistribution may level to rising curiosity from smaller market individuals, regardless of slight whale outflows.

Supply: IntoTheBlock

Quite the opposite, deal with exercise recommended that merchants are nonetheless on the sidelines. New addresses dropped by 44.25%, lively addresses by 49.5%, and zero-balance addresses by 56.62% over the previous week.

This slowdown in community exercise may restrict LINK’s upside potential within the quick time period. Until quantity and participation return throughout the market.

Conclusion

Chainlink’s present setup displays a market in limbo – Caught between promising structural shifts and declining on-chain engagement. The $12.25-level stays probably the most rapid line of protection for bulls, supported by decrease change reserves and constructive developments just like the Pi Community partnership.

Nonetheless, fading consumer exercise and a fall in whale involvement introduce warning. A decisive bounce above press time ranges may spark momentum, however failure to carry might drag LINK into deeper correction territory.

![Chainlink [LINK] worth prediction – Be careful for a protection of THIS key degree! Chainlink [LINK] worth prediction – Be careful for a protection of THIS key degree!](https://i0.wp.com/ambcrypto.com/wp-content/uploads/2025/04/LINKUSD_2025-04-15_10-28-41.png?resize=1024,1024&ssl=1)