Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

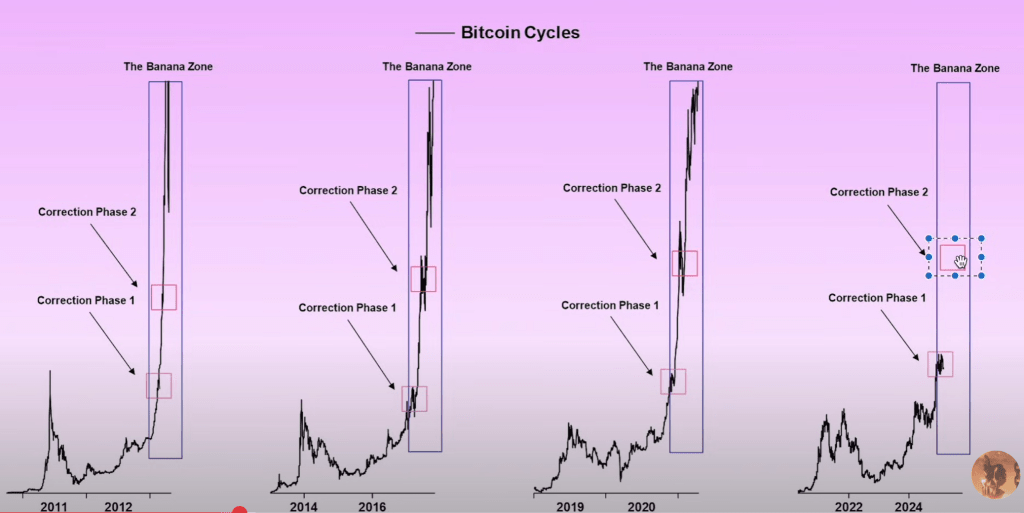

In a market replace, distinguished crypto commentator Rekt Capital examined Bitcoin’s newest dip via the lens of earlier bull cycles, asserting that it intently resembles the 2017 sample of a number of corrections en path to a parabolic prime. Talking in a video titled “The place’s The Bitcoin ‘Banana Zone’? – An Replace,” the analyst referred to the “banana zone” as “successfully a time period of endearment for the parabolic part of the cycle on the subject of Bitcoin’s value motion.” He described the present retracement as a pure however prolonged correction, emphasizing that it’s “nonetheless on monitor” regardless of many merchants feeling discouraged.

Will Bitcoin Enter ‘The Banana Zone’ Once more?

Rekt Capital drew parallels between the current dip and historic market conduct, spotlighting the cyclical tendency for Bitcoin to expertise two or extra corrective durations as soon as it breaks into new all-time highs. Citing the 2017 rally, he famous that there have been situations of “34% to 38% to 40%” pullbacks, not less than 4 in whole, earlier than the last word peak was reached.

He additionally referenced 2013’s bumpy ascents and traced them towards right this moment’s value motion, explaining that “once we break to new all-time highs, it may get a bit of bit bumpy” each round previous highs and instantly following new ones. Regardless of the present drawdown of 32% (max peak), he maintained that “we’re going to see extra upside after this corrective interval like we’ve seen prior to now” and categorized the market’s current place as a part of the primary of two possible corrections within the present value discovery part.

Associated Studying

All through his evaluation, Rekt Capital underscored the significance of endurance, noting that what may really feel like a protracted drawdown isn’t “out of the strange” for Bitcoin which traditionally endures a number of phases of uptrends and retracements on its strategy to a peak. “What’s out of the strange,” he stated, “is that it’s taking longer, but it surely’s going to allow that subsequent value discovery uptrend sooner or later.”

He supplied historic context by trying again at mid-2017 and different phases when Bitcoin underwent repeated downturns that ranged from round 30% to 40%. Based on him, these corrections usually deepen because the cycle progresses, though the ultimate one earlier than the following main transfer can generally be shallower.

The analyst additionally delved into technical indicators such because the 21-week and 50-week exponential transferring averages, suggesting that Bitcoin’s value has begun forming a triangular market construction because it turns into “sandwiched in between the 21-week EMA and the 50-week EMA.”

He drew comparisons to the mid-2021 interval, when an analogous formation preceded a 55% draw back transfer that finally broke out into one other bullish part. “We ended that interval with a weekly shut and post-breakout retest of the 21-week EMA into help,” he recounted, predicting {that a} comparable scenario may see Bitcoin rally towards the $93,500 degree if the transfer above the 21-week EMA holds.

Associated Studying

In addressing issues that the market is coming into a bear cycle, Rekt Capital asserted that “it’s not a bear market like all people is saying.” Whereas he acknowledged the emotional toll of huge pullbacks and the prevalence of conflicting alerts within the media, he suggested retaining a degree head and specializing in sturdy indications reminiscent of moving-average confluence, historic correction ranges, and the truth that “we’re on this first value discovery correction” relatively than any remaining downturn. Based on his outlook, the crypto’s value continues to be following the overarching blueprint set by earlier bull runs, even whether it is “a bit of little bit of a deep one” and has disenchanted merchants hoping for extra quick parabolic momentum.

Rekt Capital concluded his commentary by stressing reaccumulation phases are a part of an enduring bull-market framework relatively than the onset of a protracted downtrend.

At press time, BTC traded at $85,914.

Featured picture created with DALL.E, chart from TradingView.com