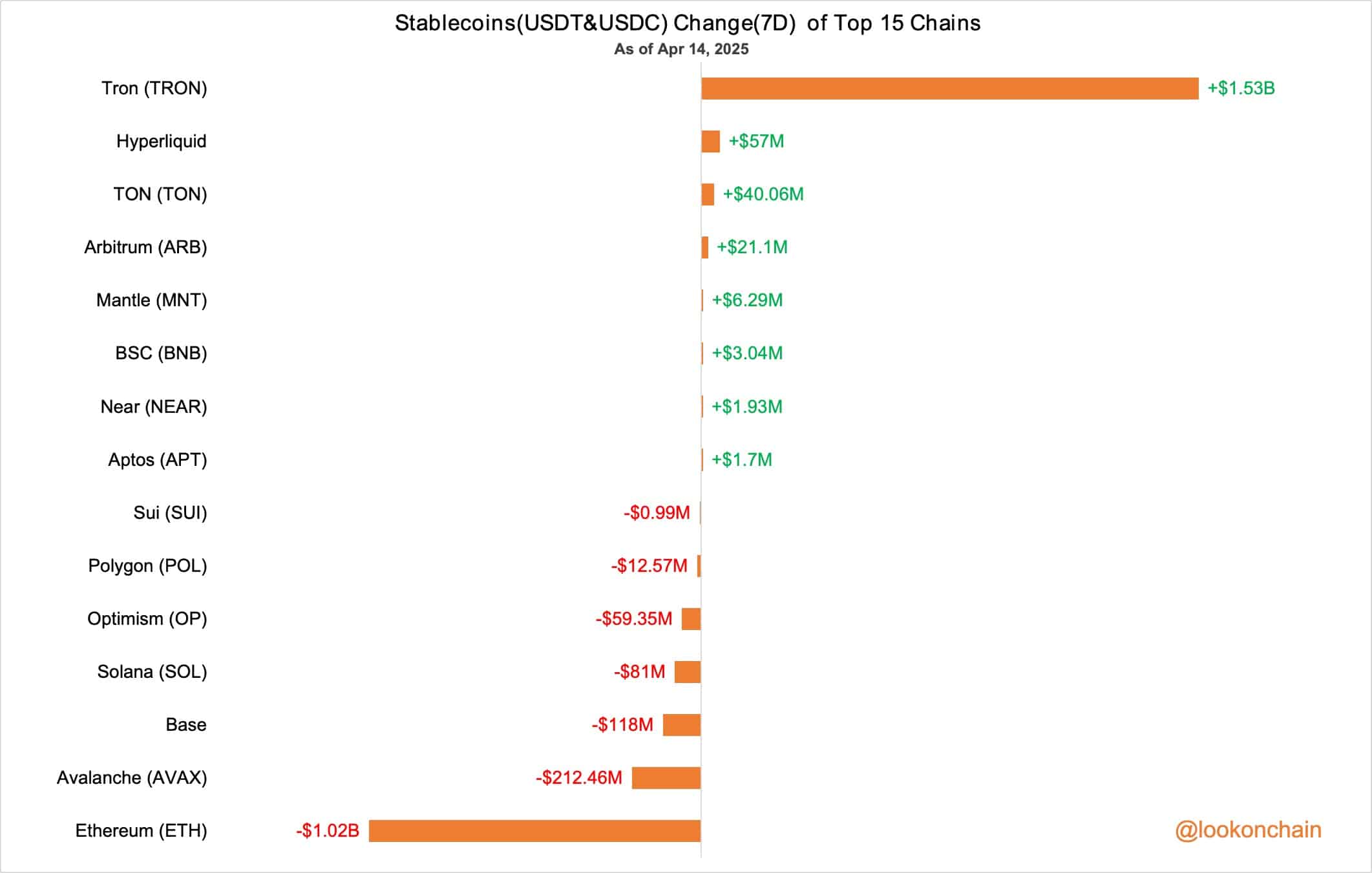

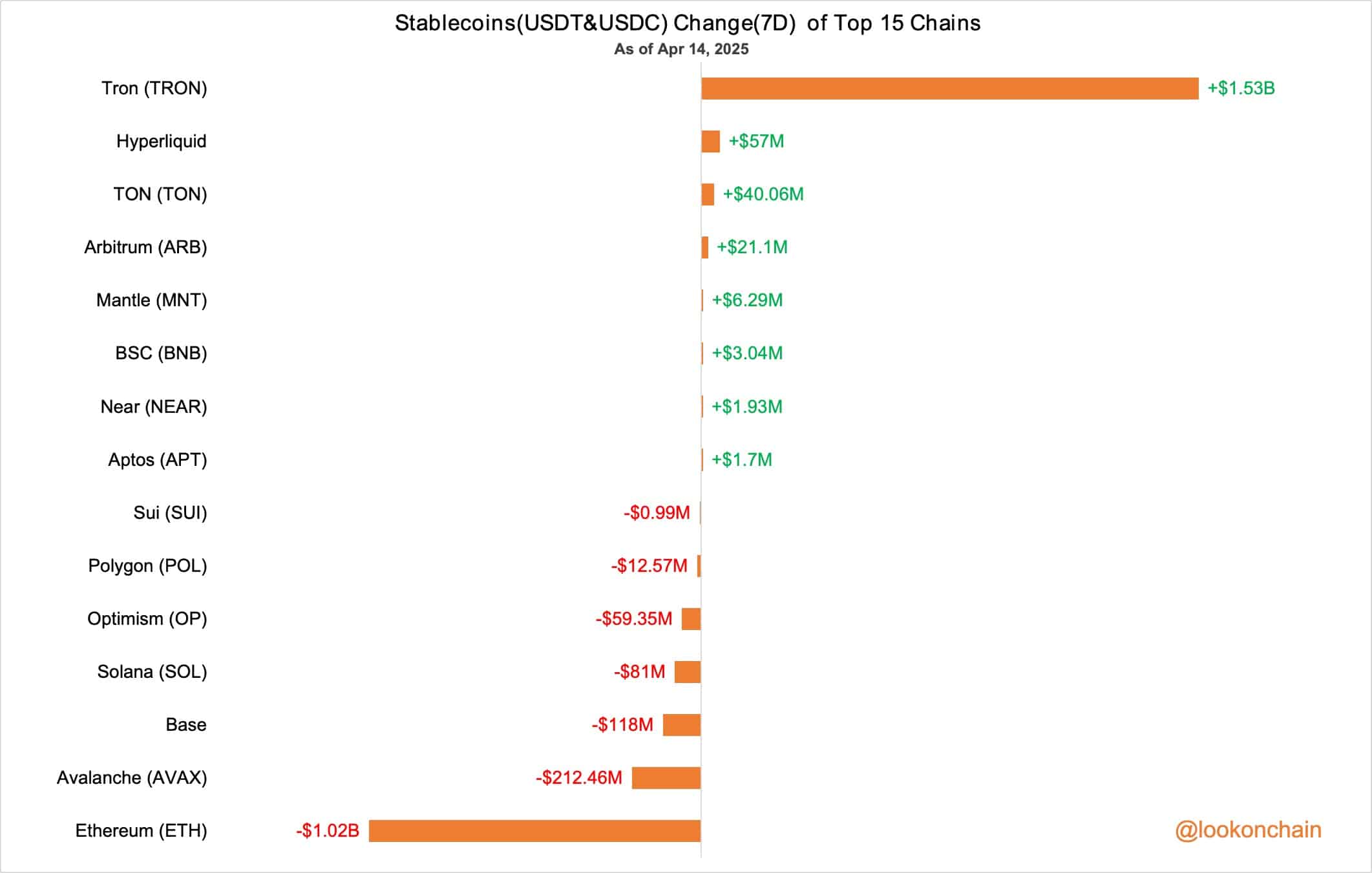

Over the previous seven days, Tron obtained a powerful $1.52 billion in stablecoins, primarily USDT and USDC.

This surge locations Tron properly forward of different blockchains in web stablecoin inflows. It additionally highlights a rising consumer choice for low-cost, high-efficiency networks.

In distinction, Ethereum skilled a web outflow of $1.02 billion, the sharpest decline among the many prime 15 chains.

Supply: X

The info suggests a major capital rotation as customers turn into extra cost-conscious attributable to Ethereum’s excessive gasoline charges and community congestion.

Benefiting from this pattern are Tron, Hyperliquid [HYPE], Toncoin [TON], and Arbitrum [ARB]. In the meantime, chains like Avalanche, Base, and Solana[SOL] are experiencing outflows.

These shifts replicate real-time adjustments in consumer conduct and capital allocation. Liquidity is more and more shifting towards platforms that supply streamlined, cost-efficient on-chain experiences, particularly for stablecoin-heavy transactions.

The rise of non-USD denominated cash

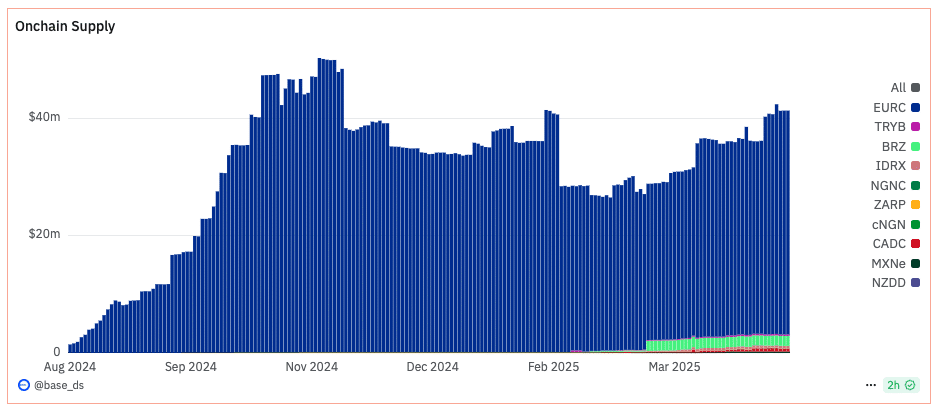

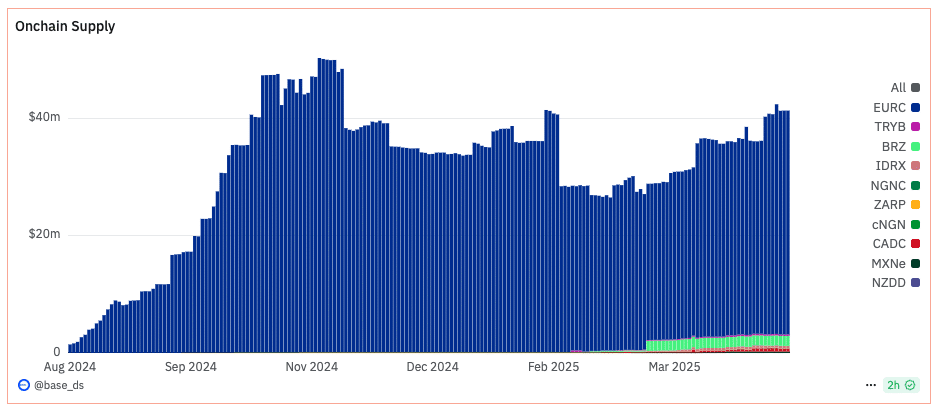

Alongside capital rotation to chains like Tron, the availability of non-USD stablecoins is quietly climbing — particularly on cost-efficient chains.

Information from Base exhibits a current uptick in stablecoins like NGNC, IDRX, and BRZ, with small however seen development in CADC and MXNe.

Supply: X

Whereas USD-backed cash nonetheless lead, regional stablecoins are rising for FX hedging, funds, and commerce. As demand for multi-currency publicity rises, chains providing sooner, cheaper execution have gotten the popular rails for stablecoin variety.

Capital is following utility. As customers diversify away from Ethereum, chains like Tron are setting the tone for crypto’s subsequent chapter.