In Q1 2025, Ethereum solidified its main place within the decentralized software (DApp) platform sector, producing $1.021 billion in charge income.

Different networks akin to Base (Coinbase’s Layer-2), BNB Chain, Arbitrum, and Avalanche C-Chain additionally recorded important income however lagged far behind Ethereum.

Charge Income Panorama Amongst Blockchains

In keeping with Token Terminal, Ethereum maintained its high place amongst DApp platforms, with DApp charge income reaching $1.021 billion in Q1 2025. This determine highlights Ethereum’s dominance and powerful development throughout the DApp ecosystem.

Base, a Coinbase Layer-2 community, ranked second with $193 million in DApp charge income, displaying notable development however nonetheless trailing Ethereum. BNB Chain adopted in third with $170 million, Arbitrum with $73.8 million, and Avalanche C-Chain in fifth with $27.68 million.

DApp charge income is a key metric for measuring a blockchain’s exercise and consumer worth. On Ethereum, well-liked DApps embody DeFi protocols like Uniswap and Aave, NFT platforms like OpenSea, blockchain video games, and social functions. The expansion in Ethereum’s DApp charge income signifies sustained excessive demand for these functions regardless of competitors from different networks and infrequently excessive transaction prices (gasoline charges) on the mainnet.

Why Ethereum Leads

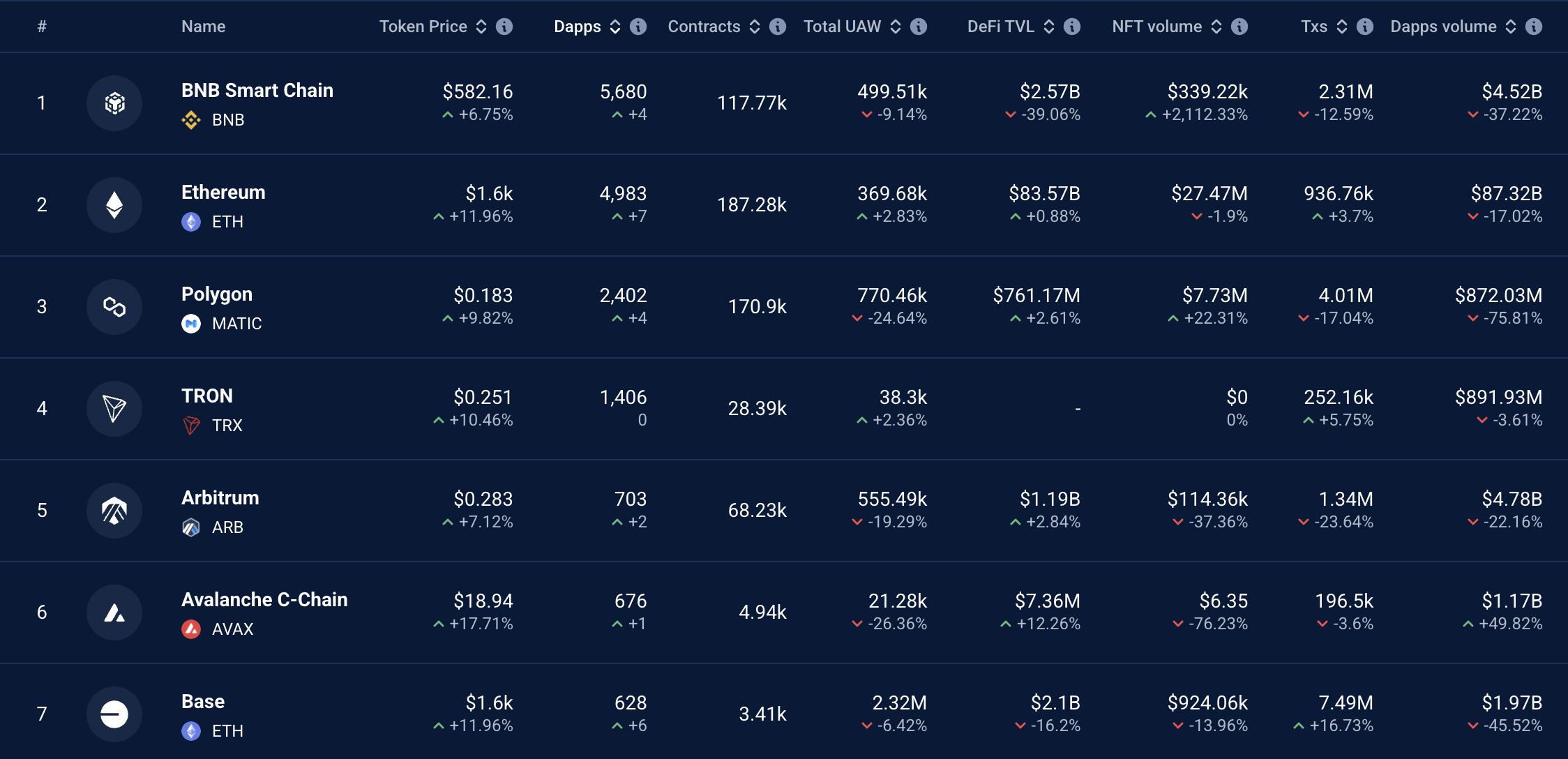

A number of components clarify Ethereum’s continued management in DApp charge income. Firstly, Ethereum was the primary blockchain to help good contracts, laying the inspiration for its DApp ecosystem. In keeping with DappRadar knowledge, Ethereum stays the blockchain with the most important DApps, internet hosting over 4,983 energetic DApps, under the BNB Chain.

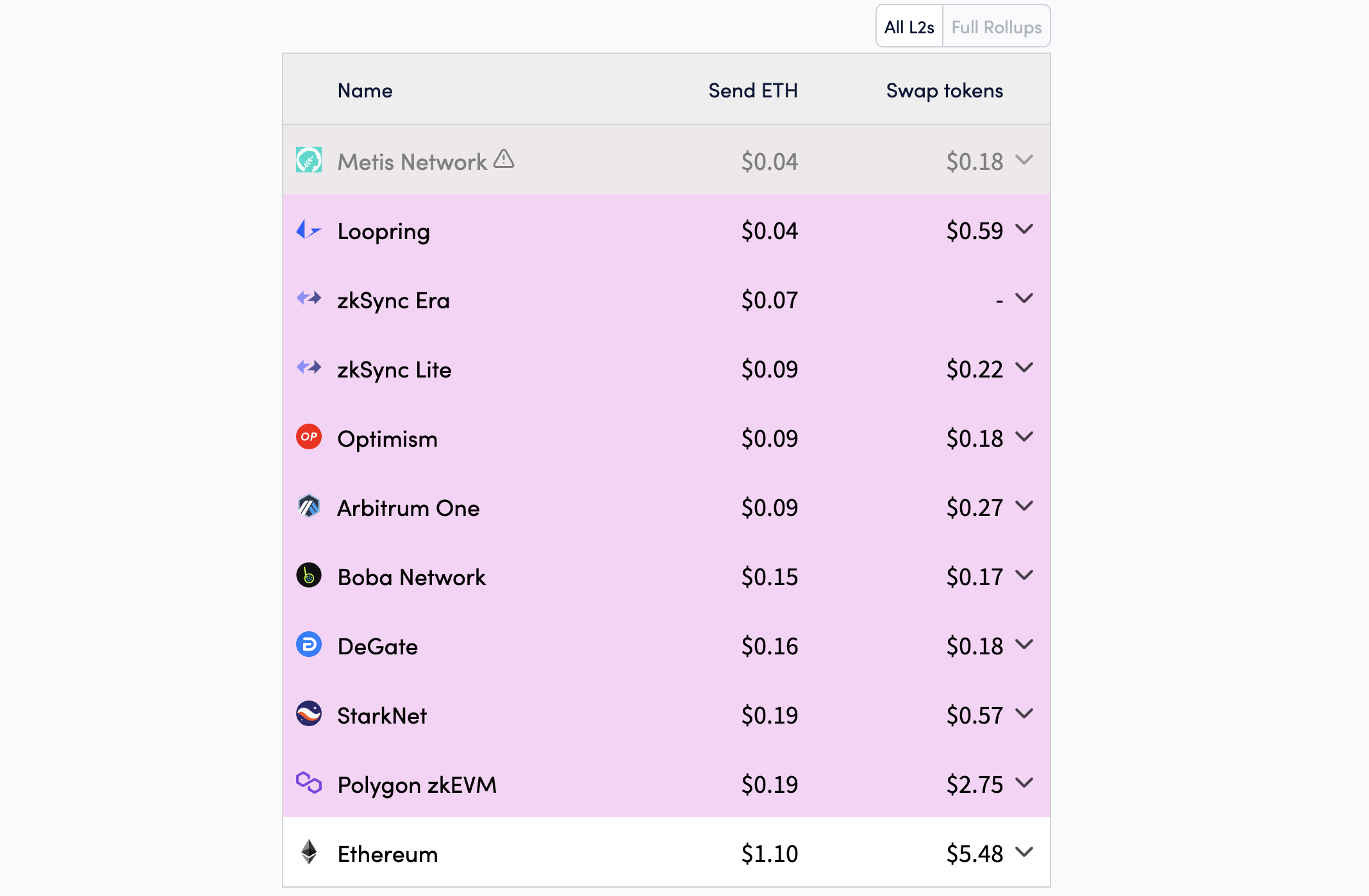

Second, Ethereum’s excessive safety and reliability make it the popular alternative for builders and customers. Regardless of excessive mainnet transaction prices, Ethereum has improved efficiency by upgrades like Dencun (carried out in 2024), which diminished prices on Layer-2 networks and enhanced scalability.

Third, Ethereum’s DeFi ecosystem stays a main driver of charge income. In keeping with DefiLlama, the Complete Worth Locked (TVL) in Ethereum’s DeFi protocols reached $46 billion, representing 51% of the entire TVL within the DeFi market.

Whereas Ethereum leads, different networks are additionally displaying important development. In keeping with Token Terminal, Base, Coinbase’s Layer-2, generated $193 million in DApp charge income, a forty five% enhance from This autumn 2024.

BNB Chain, with $170 million, stays a powerful competitor attributable to low prices and a various DApp ecosystem, together with platforms like PancakeSwap. Arbitrum, one other Ethereum Layer-2, recorded $73.8 million, pushed by the enlargement of DeFi and blockchain gaming DApps. With $27.68 million, Avalanche C-Chain excels in finance and NFTs however can’t match Ethereum’s scale.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.